Answered step by step

Verified Expert Solution

Question

1 Approved Answer

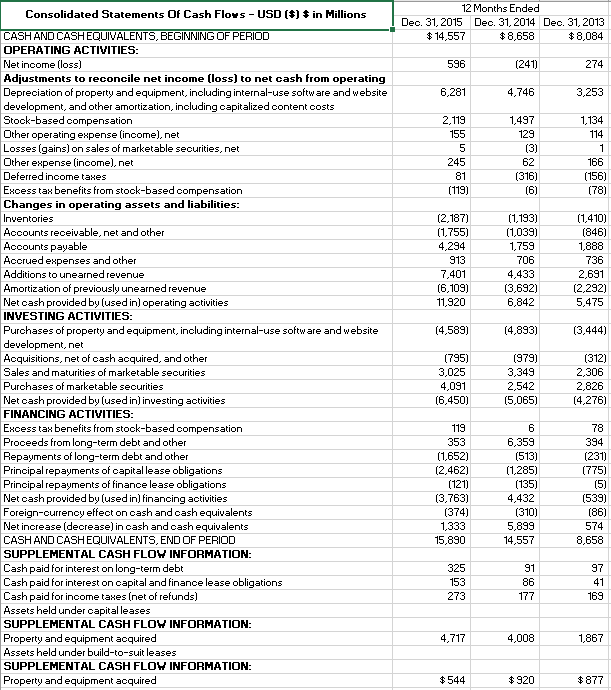

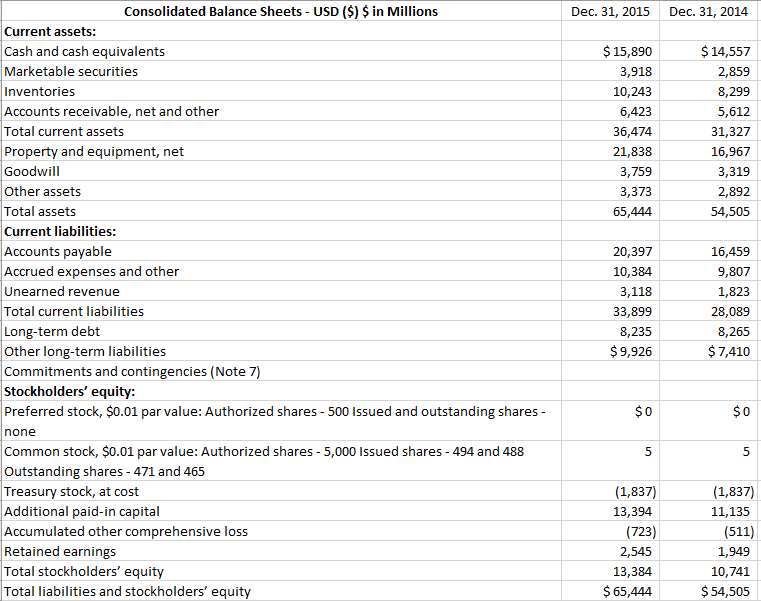

Refer to the attached Cash Flow Statements for Firm A and Firm B to answer the following questions. Financial statement information other than that provided

Refer to the attached Cash Flow Statements for Firm A and Firm B to answer the following questions. Financial statement information other than that provided is not necessary to answer the questions.

Basic Concepts:

- If possible, determine the net change in Accounts Receivable, Inventory, and Accounts Payable over the three-year period presented for each company (you should report only one number for each three-year period). What other working capital accounts have significant changes over the period? Briefly discuss what these changes might imply about working capital management for these firms.

- What are the significant non-cash or non-operating adjustments these firms made during the years presented?

- Identify the major investing and financing transactions for each firm for the three years presented. For each firm, indicate what the primary source of cash flows has been in the years presented.

Basic Analysis:

- For each firm, compute and interpret the interest coverage ratio and cash flow adequacy ratio for the most recent year (as defined in the Class 13 slides). (Interest Expense for Firm A is 459 and for Firm B is 437.)

- For each firm, compute and interpret the quality of earnings ratio for the most recent year (as defined in the Class 13 slides). Discuss any weaknesses of the ratio as a measure of the actual quality of earnings.

Extended Analysis:

- Indicate which, if any, of these firms are at risk of having inadequate cash flows to continue operations. Briefly discuss the factors you considered in your analysis.

- For each of the firms, indicate which phase of the companys life cycle you believe it is in (introduction, growth, maturity, or decline). Briefly discuss the reasons for your conclusion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started