Question

Refer to the attached excerpts from the Wall Street Journal , to answer the following questions: (the excerpts show the closing prices as of Thursday

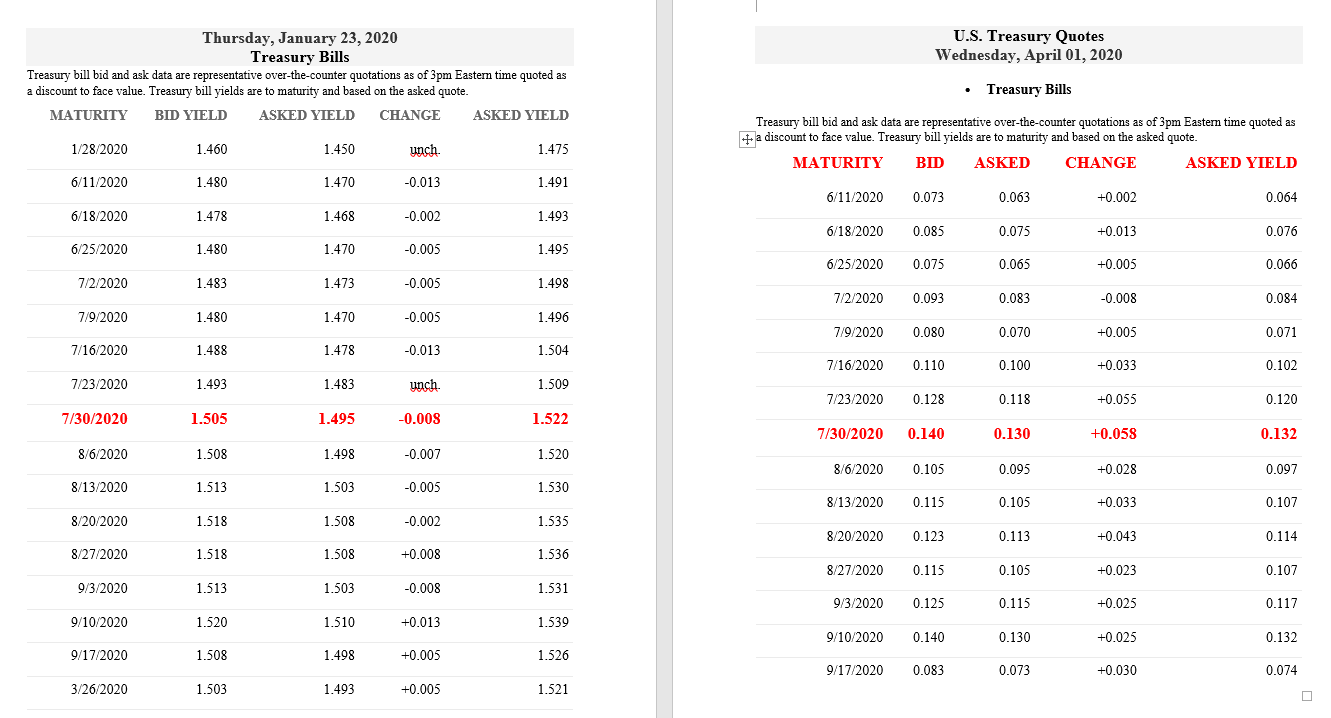

Refer to the attached excerpts from the Wall Street Journal, to answer the following questions: (the excerpts show the closing prices as of Thursday January 23, 2020 and Wednesday April 1, 2020).

- You purchased a T-bill on Thursday January 23, 2020 which matures on July 30, 2020.

Determine the purchase price of the T-bill (how much you paid for it). Use the excerpt of January 23 to get the price

- On Wednesday April 1, 2020, you sold the same T-bill (which has the same maturity on July 30). Use the excerpt of April 1, 2020 to get the price

a. Determine the selling price of the T-bill (how much you received for it).

b. Determine the holding period rate of return (HPR) on this investment.

c. Determine the Annual Percentage rate of Return (APR) on this investment.

d. Determine the Effective Annual Rate of Return (EAR) on this investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started