Refer to the attachment for the questions

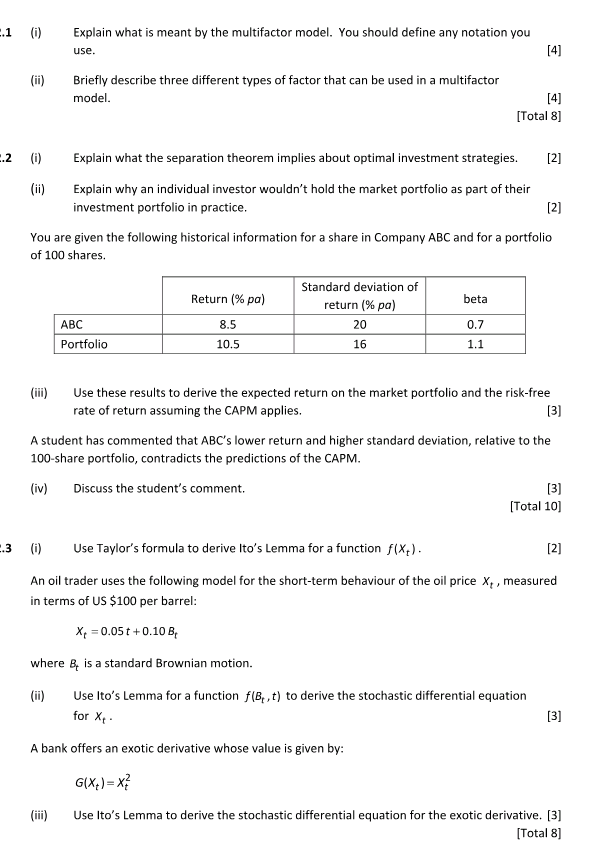

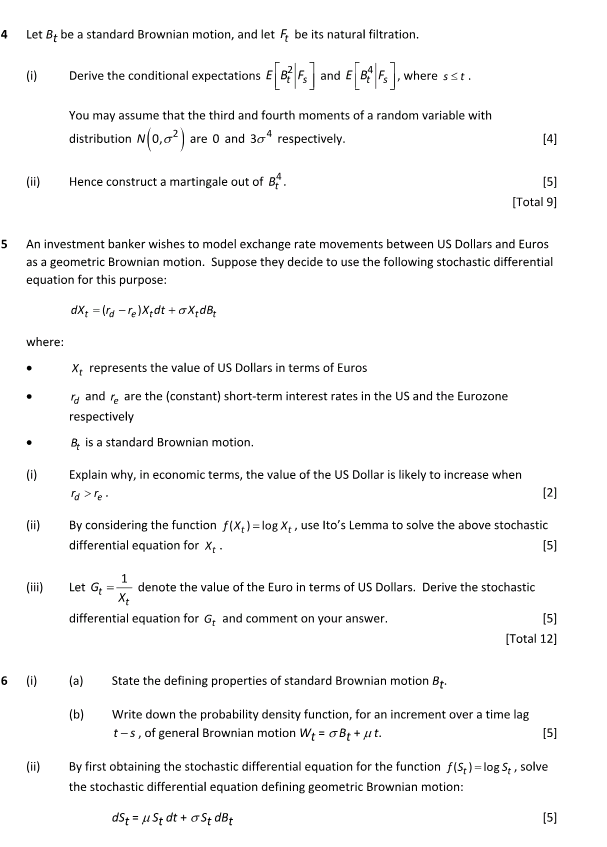

L1 lil Explain what is meant by the multifactor model. You should define an? notation you use. [41 [ii] Enriefl'iir describe three different types of factor that can be used in a rnultifactor model. [4] [Total 3] [i] Explain what the separation theorem Implies about optimal Investment strategies. [2] {iii Explain why an individual investor wouldn't hold the market portfolio as part of their investment portfolio in practice. [2] You are given the following historical information for a share in Company ABC and for a portfolio Standard deviation of Return {'56 pa} return ['35 pa] of 111] shares. [iii] Use these results to derive the expected return on the market po rtfollo and the risk-free rate of return assuming the CAPM applies. [3] A student has commented that ABtfs lower return and higher standard deviationr relative to the l-share portfolio. contradicts the predictions of the EAPM. [iv] Discuss the student's comment. [3] [Total 10] [ii Use Tavlor's formula to derive lto's Lemma for a function net]: . [2] An oil trader uses the following model for the short-term behaviour of the oil price Ir J measured in terms of U5 51m per barrel: x, = cos I + on: e; where iElr is a standard Brownian motion. [ii] Use Ito's Lemma for a function f[3,,t] to derive the stochastic differential equation for It. [3] A bank offers an exotic derivative whose value is given by: _ 2 six}: _ it} [iii] Use Ito's Lemma to derive the stochastic differential equation for the exotic derivative. [3] [Total 3] 4 Let Bt be a standard Brownian motion, and let A be its natural filtration. (1) Derive the conditional expectations 6 87 Fs and 8 8 Fs . where sst . You may assume that the third and fourth moments of a random variable with distribution N(0,2 ) are 0 and 304 respectively. [4] (ii) Hence construct a martingale out of Bi. [5] [Total 9] 5 An investment banker wishes to model exchange rate movements between US Dollars and Euros as a geometric Brownian motion. Suppose they decide to use the following stochastic differential equation for this purpose: dXt = (d -re)X,dt + aX,dB, where: *, represents the value of US Dollars in terms of Euros ra and re are the (constant) short-term interest rates in the US and the Eurozone respectively B is a standard Brownian motion. Explain why, in economic terms, the value of the US Dollar is likely to increase when [2] (ii) By considering the function f(X,)=log X, , use Ito's Lemma to solve the above stochastic differential equation for Xt - [5] (iii) Let G= denote the value of the Euro in terms of US Dollars. Derive the stochastic Xt differential equation for G, and comment on your answer. [5] [Total 12] 6 (a) State the defining properties of standard Brownian motion By. (b) Write down the probability density function, for an increment over a time lag t -s , of general Brownian motion Wt = GB + wit. [5] (ii) By first obtaining the stochastic differential equation for the function f(5,) = log S, , solve the stochastic differential equation defining geometric Brownian motion: dSt = /St dt + 05+ dBy [5]