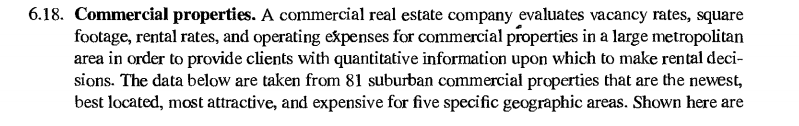

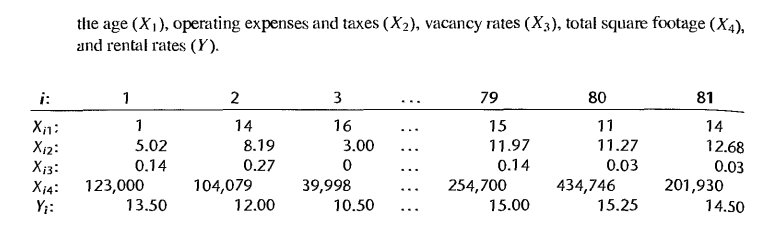

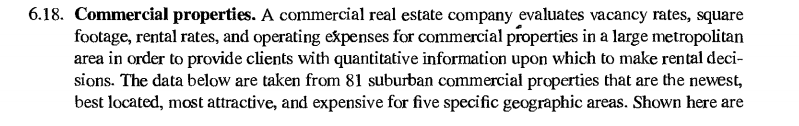

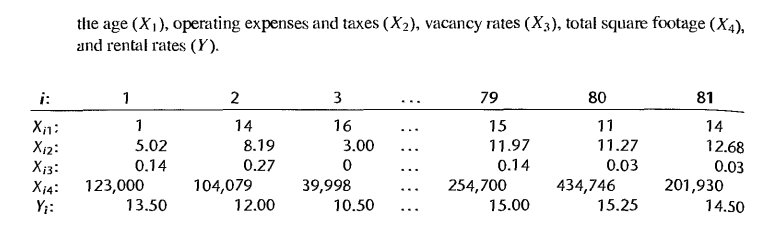

Refer to the Commercial Properties Problem 6.18. Can the model be used to estimate the rental rate if the property in question has (X1, X2, X3, X4) = (10, 12.00, 0.05, 350,000), or is extrapolation required? Justify your answer. (This means the property is 10 years old, the operating expenses and taxes are 12.00, the occupancy rate is 0.05, and the square footage is 350,000.) 6.18. Commercial properties. A commercial real estate company evaluates vacancy rates, square footage, rental rates, and operating expenses for commercial properties in a large metropolitan area in order to provide clients with quantitative information upon which to make rental deci- sions. The data below are taken from 81 suburban commercial properties that are the newest, best located, most attractive, and expensive for five specific geographic areas. Shown here are the age (X1), operating expenses and taxes (X2), vacancy rates (X3), total square footage (X4), and rental rates (Y). 2 81 X1 Xiz: Xiz: X4: Y: 1 1 5.02 0.14 123,000 13.50 14 8.19 0.27 104,079 12.00 3 16 3.00 0 39,998 10.50 79 15 11.97 0.14 254,700 15.00 80 11 11.27 0.03 434,746 15.25 14 12.68 0.03 201,930 14.50 Refer to the Commercial Properties Problem 6.18. Can the model be used to estimate the rental rate if the property in question has (X1, X2, X3, X4) = (10, 12.00, 0.05, 350,000), or is extrapolation required? Justify your answer. (This means the property is 10 years old, the operating expenses and taxes are 12.00, the occupancy rate is 0.05, and the square footage is 350,000.) 6.18. Commercial properties. A commercial real estate company evaluates vacancy rates, square footage, rental rates, and operating expenses for commercial properties in a large metropolitan area in order to provide clients with quantitative information upon which to make rental deci- sions. The data below are taken from 81 suburban commercial properties that are the newest, best located, most attractive, and expensive for five specific geographic areas. Shown here are the age (X1), operating expenses and taxes (X2), vacancy rates (X3), total square footage (X4), and rental rates (Y). 2 81 X1 Xiz: Xiz: X4: Y: 1 1 5.02 0.14 123,000 13.50 14 8.19 0.27 104,079 12.00 3 16 3.00 0 39,998 10.50 79 15 11.97 0.14 254,700 15.00 80 11 11.27 0.03 434,746 15.25 14 12.68 0.03 201,930 14.50