Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is five years into the future. It is time to buy your first home, using a budget based approach. As it turns out,

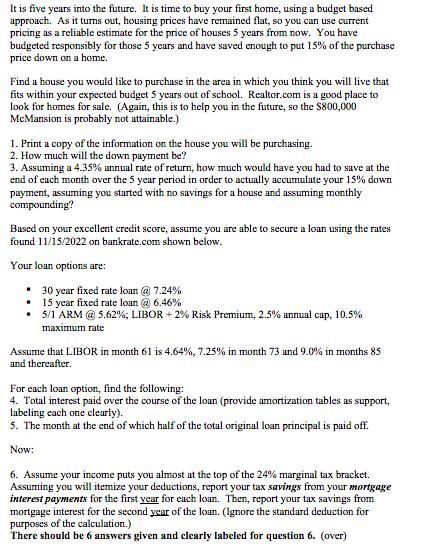

It is five years into the future. It is time to buy your first home, using a budget based approach. As it turns out, housing prices have remained flat, so you can use current pricing as a reliable estimate for the price of houses 5 years from now. You have budgeted responsibly for those 5 years and have saved enough to put 15% of the purchase price down on a home. Find a house you would like to purchase in the area in which you think you will live that fits within your expected budget 5 years out of school. Realtor.com is a good place to look for homes for sale. (Again, this is to help you in the future, so the $800,000 McMansion is probably not attainable.) 1. Print a copy of the information on the house you will be purchasing. 2. How much will the down payment be? 3. Assuming a 4.35% annual rate of return, how much would have you had to save at the end of each month over the 5 year period in order to actually accumulate your 15% down payment, assuming you started with no savings for a house and assuming monthly compounding? Based on your excellent credit score, assume you are able to secure a loan using the rates found 11/15/2022 on bankrate.com shown below. Your loan options are: 30 year fixed rate loan @ 7.24% 15 year fixed rate loan @ 6.46% 5/1 ARM @ 5.62%; LIBOR + 2% Risk Premium, 2.5% annual cap, 10.5% maximum rate Assume that LIBOR in month 61 is 4.64%, 7.25% in month 73 and 9.0% in months 85 and thereafter. For each loan option, find the following: 4. Total interest paid over the course of the loan (provide amortization tables as support, labeling each one clearly). 5. The month at the end of which half of the total original loan principal is paid off. Now: 6. Assume your income puts you almost at the top of the 24% marginal tax bracket. Assuming you will itemize your deductions, report your tax savings from your mortgage interest payments for the first year for each loan. Then, report your tax savings from mortgage interest for the second year of the loan. (Ignore the standard deduction for purposes of the calculation.) There should be 6 answers given and clearly labeled for question 6. (over)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

03153 Raising this to pwer of 12 100315 10385 Correct Dividing 385 by 12 and then interpolating 03153 Raising this to pwer of 12 1003153 10385 1 1003153 2267753858 2274904086 2 1006315941 2267753858 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started