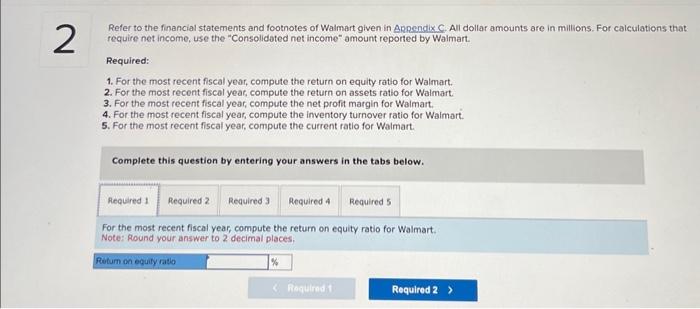

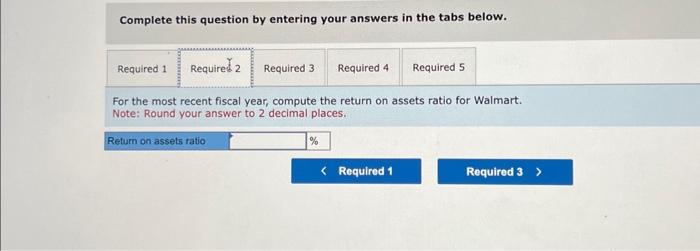

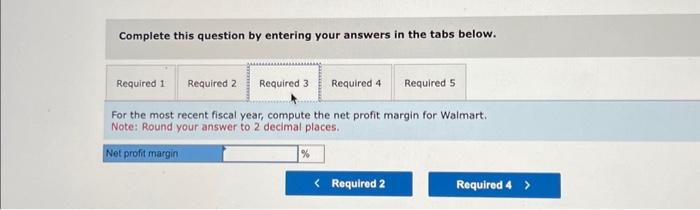

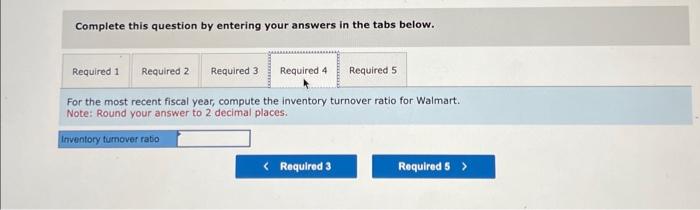

Refer to the financial statements and footnotes of Walmart given in Bppendix C. All dollar amounts are in millions. For calculations that require net income, use the "Consolidated net income" amount reported by Waimart. Required: 1. For the most recent fiscal year, compute the return on equity ratio for Walmart. 2. For the most recent fiscal year, compute the return on assets ratio for Walmart. 3. For the most recent fiscal year, compute the net profit margin for Waimart. 4. For the most recent fiscal year, compute the inventory turnover ratio for Waimart. 5. For the most recent fiscal year, compute the current ratio for Walmart. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the retum on equity ratio for Walmart. Note: found your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the return on assets ratio for Walmart. Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the net profit margin for Walmart. Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the inventory turnover ratio for Walmart. Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the current ratio for Walmart. Note: Round your answer to 2 decimal places. Refer to the financial statements and footnotes of Walmart given in Bppendix C. All dollar amounts are in millions. For calculations that require net income, use the "Consolidated net income" amount reported by Waimart. Required: 1. For the most recent fiscal year, compute the return on equity ratio for Walmart. 2. For the most recent fiscal year, compute the return on assets ratio for Walmart. 3. For the most recent fiscal year, compute the net profit margin for Waimart. 4. For the most recent fiscal year, compute the inventory turnover ratio for Waimart. 5. For the most recent fiscal year, compute the current ratio for Walmart. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the retum on equity ratio for Walmart. Note: found your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the return on assets ratio for Walmart. Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the net profit margin for Walmart. Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the inventory turnover ratio for Walmart. Note: Round your answer to 2 decimal places. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the current ratio for Walmart. Note: Round your answer to 2 decimal places