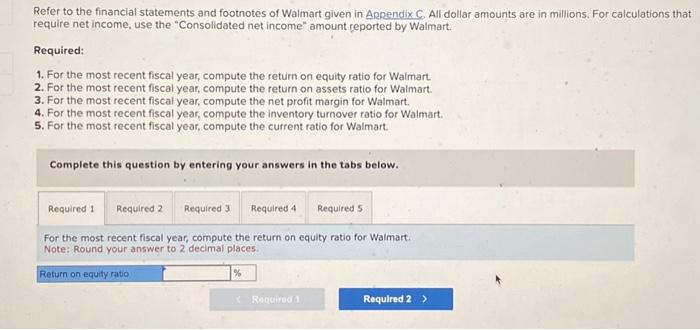

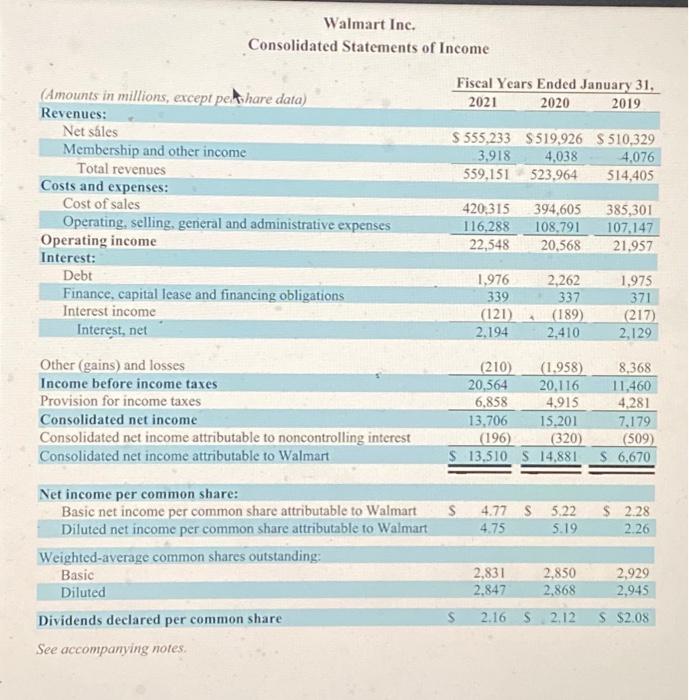

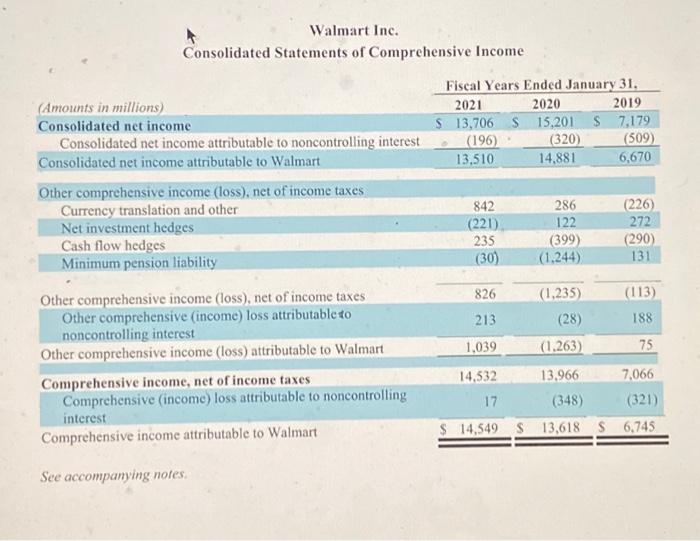

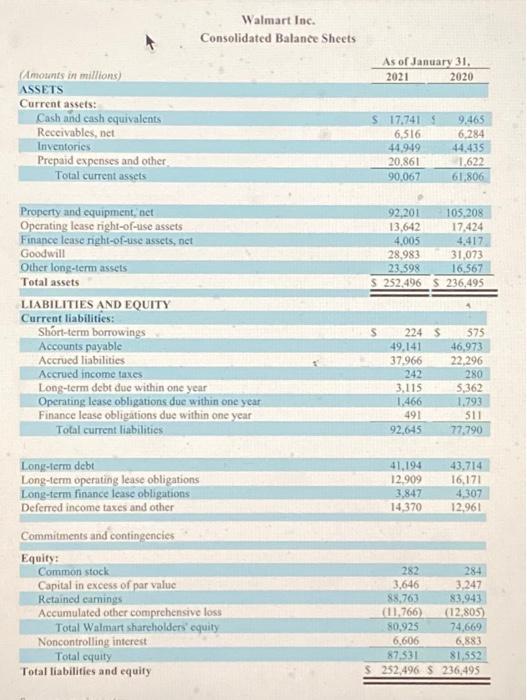

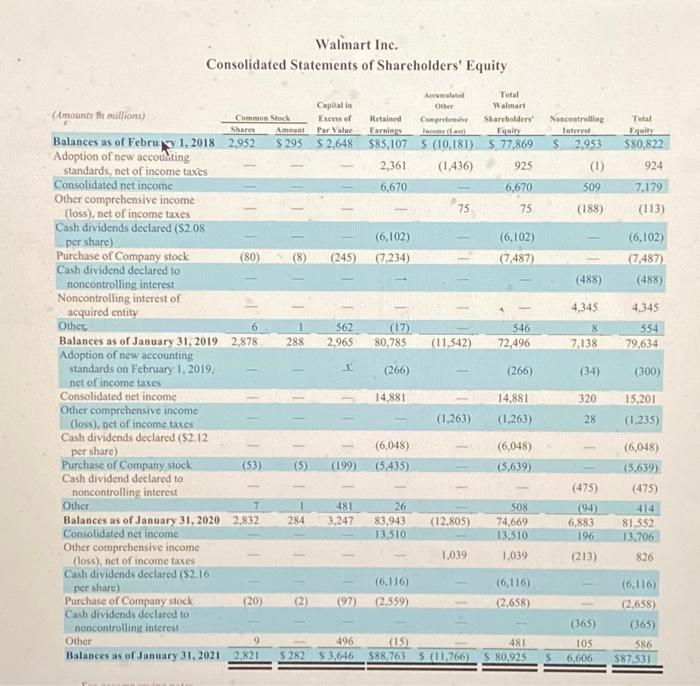

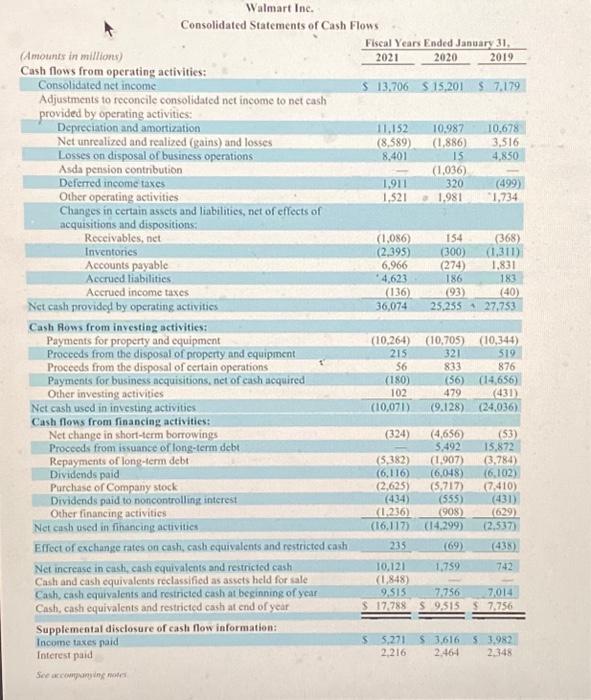

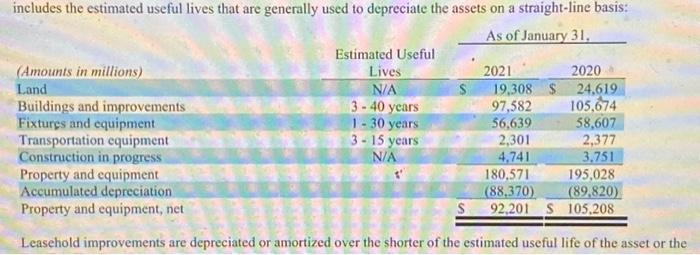

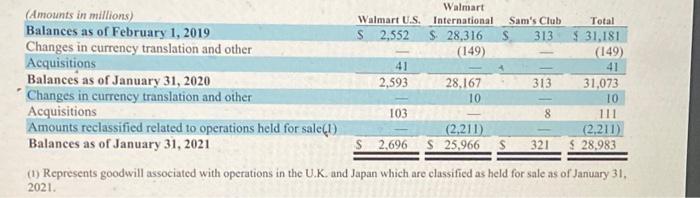

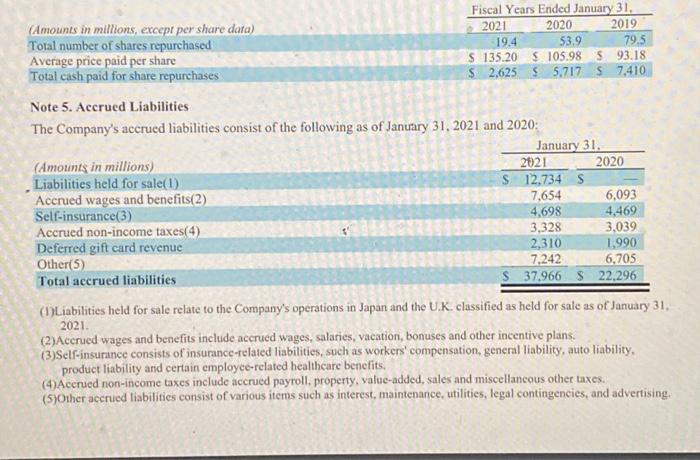

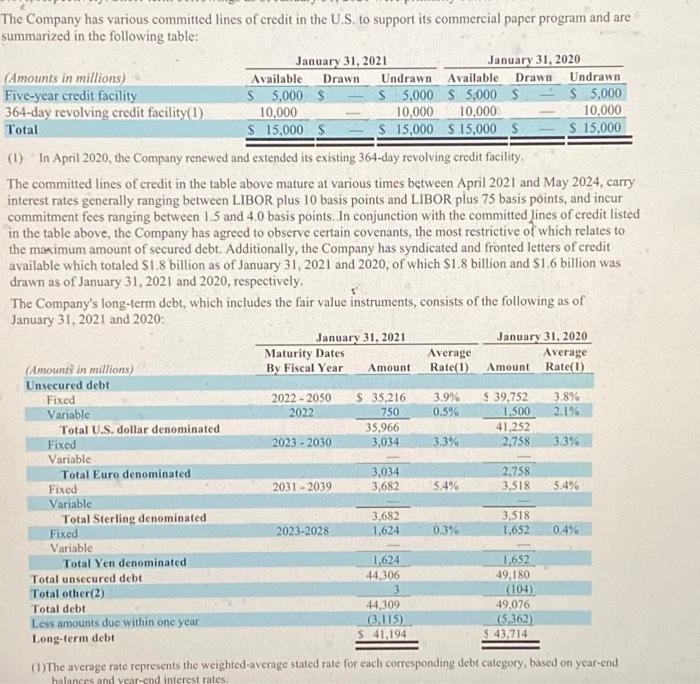

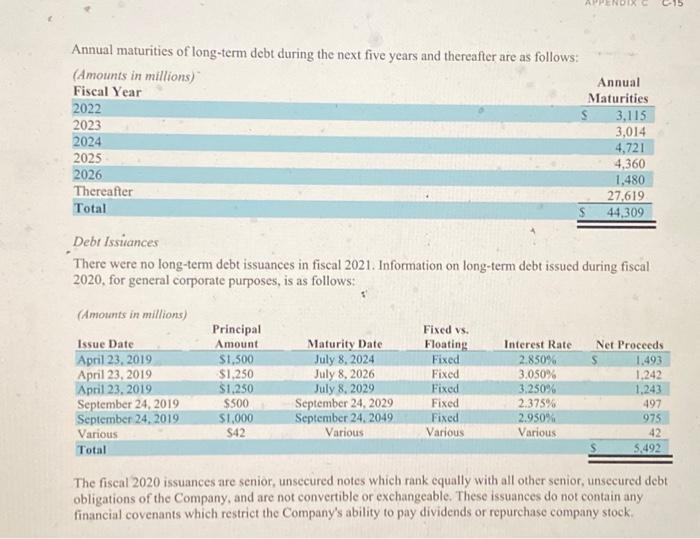

Refer to the financial statements and footnotes of Walmart given in Appendix C. All dollar amounts are in millions. For calculations that require net income, use the "Consolidated net income" amount reported by Walmart. Required: 1. For the most recent fiscal year, compute the return on equity ratio for Walmart. 2. For the most recent fiscal year, compute the return on assets ratio for Walmart. 3. For the most recent fiscal year, compute the net profit margin for Walmart. 4. For the most recent fiscal year, compute the inventory turnover ratio for Walmart. 5. For the most recent fiscal year, compute the current ratio for Walmart. Complete this question by entering your answers in the tabs below. For the most recent fiscal year, compute the return on equity ratio for Walmart. Note: Round your answer to 2 decimal places. Walmart Inc. Consolidated Statements of Income Walmart Inc. Consolidated Statements of Comprehensive Income Walmart Inc. Consolidated Balance Sheets Walmart Inc. Walmart Inc. Consolidated Statements of Cash Flows includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: (1) Represents goodwill associated with operations in the U.K. and Japan which are classified as held for sale as of January 31 . 2021. Note 5. Accrued Liabilities The Company's accrued liabilities consist of the following as of January 31, 2021 and 2020: (1) Liabilities held for sale relate to the Company's operations in Japan and the U.K. classified as held for sale as of January 31. 2021. (2)Acerued wages and benefits include acerued wages, salaries, vacation, bonuses and other incentive plans. (3)Self-insurance consists of insurance-telated liabilities, such as workers' compensation, general liability, auto liability, product liability and certain employee-related healtheare benefits. (4) Acerued non-income taxes include accrued payroll, property, value-added, sales and miscellancous other taxes. (5)Oiher acerued liabilitics consist of various items such as interest, maintenance, utilities, legal contingencies, and advertising. The Company has various committed lines of credit in the U.S. to support its commercial paper program and are summarized in the following table: (1) 'In April 2020, the Company renewed and extended its existing 364-day revolving credit facility, The committed lines of credit in the table above mature at various times between April 2021 and May 2024, carry interest rates generally ranging between LIBOR plus 10 basis points and LIBOR plus 75 basis points, and incur commitment fees ranging between 1.5 and 4.0 basis points. In conjunction with the committed lines of credit listed in the table above, the Company has agreed to observe certain covenants, the most restrictive of which relates to the maximum amount of secured debt. Additionally, the Company has syndicated and fronted letters of credit available which totaled $1.8 billion as of January 31,2021 and 2020 , of which $1.8 billion and $1.6 billion was drawn as of January 31,2021 and 2020 , respectively. The Company's long-term debt, which includes the fair value instruments, consists of the following as of January 31.2021 and 2020 : (1)The average rate represents the weighted-average stated rate for each corresponding debt category, based on year-end Annual maturities of long-term debt during the next five years and thereafter are as follows: (Amounts in millions) Debr Issiances There were no long-term debt issuances in fiscal 2021. Information on long-term debt issued during fiscal 2020 , for general corporate purposes, is as follows: The fiscal 2020 issuances are senior, unsecured notes which rank equally with all other senior, unsecured debt obligations of the Company, and are not convertible or exchangeable. These issuances do not contain any financial covenants which restrict the Company's ability to pay dividends or repurchase company stock