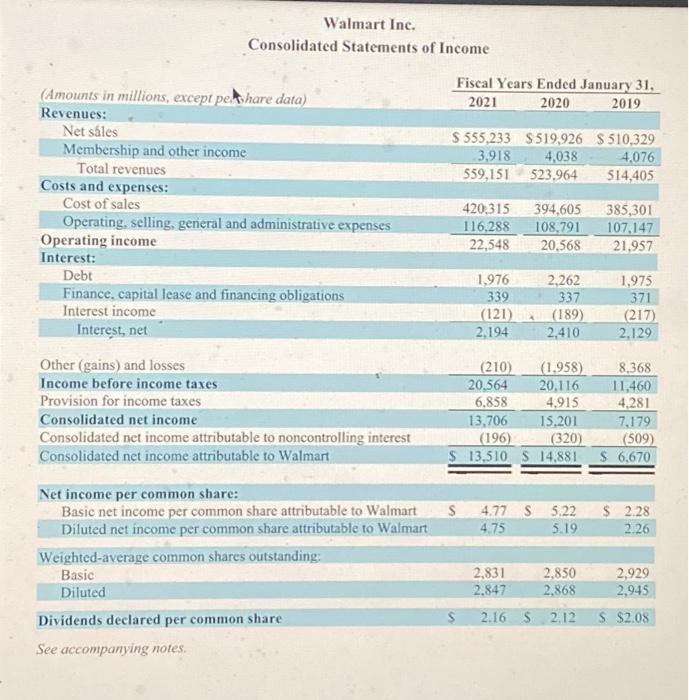

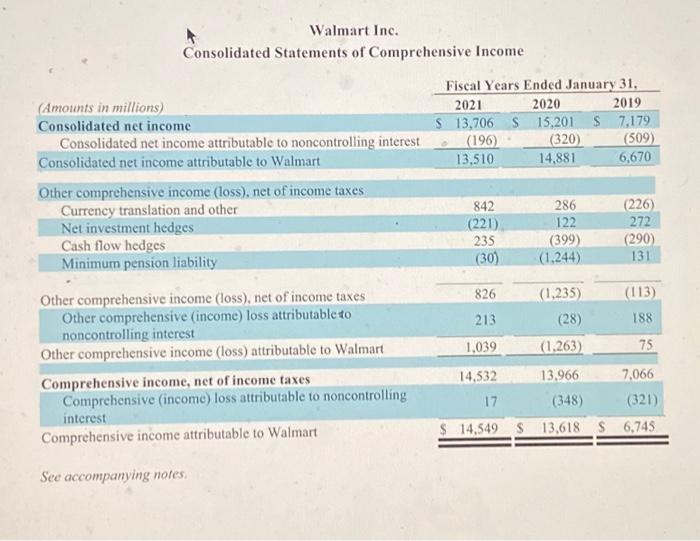

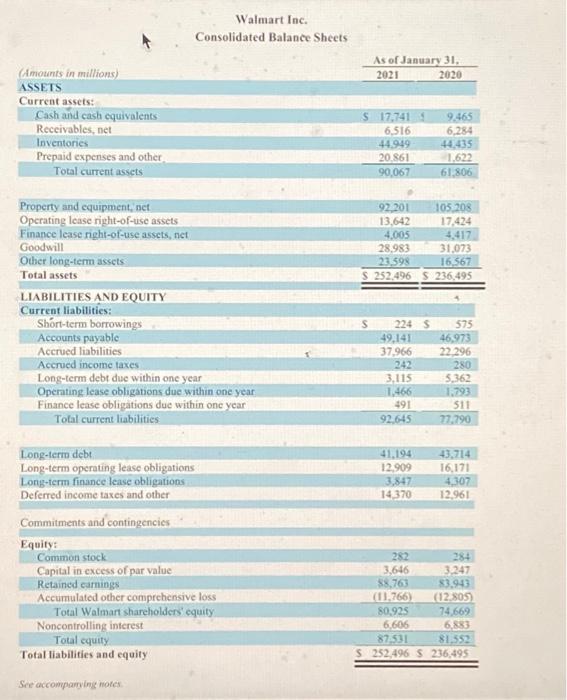

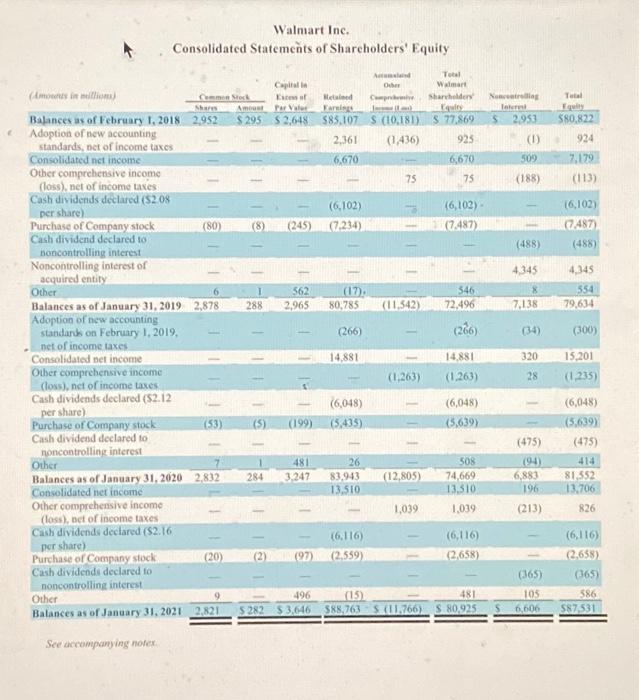

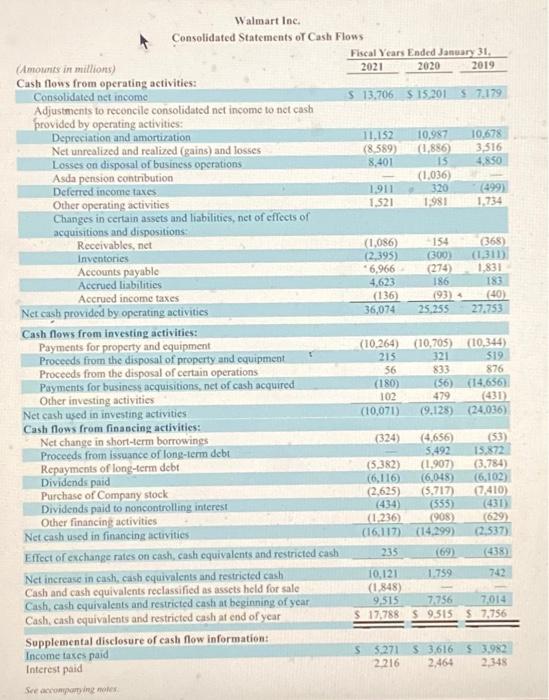

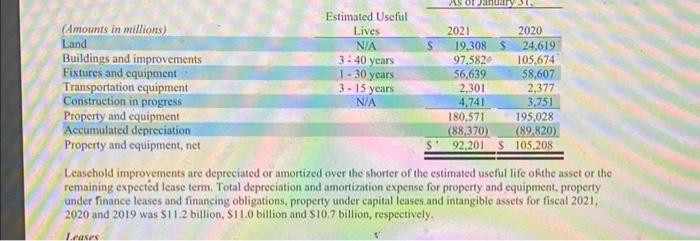

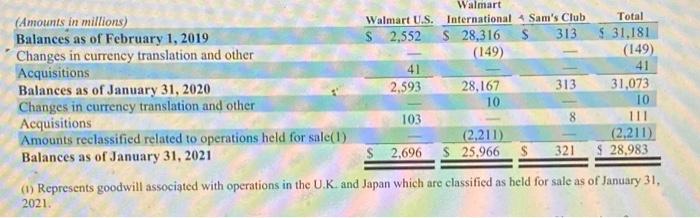

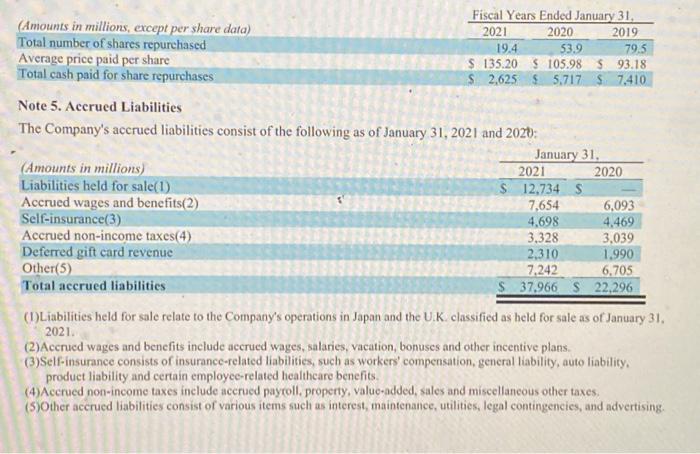

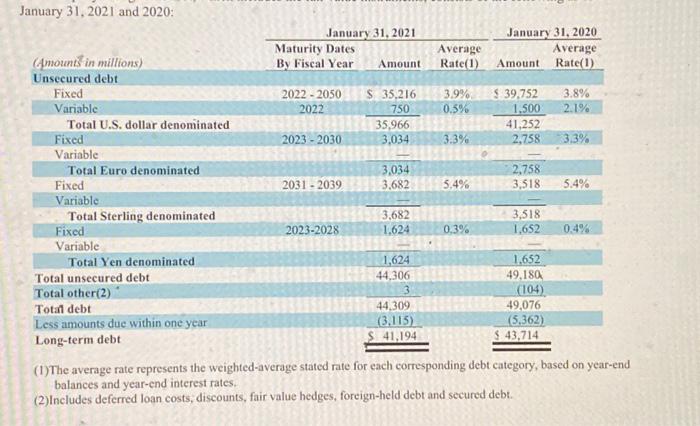

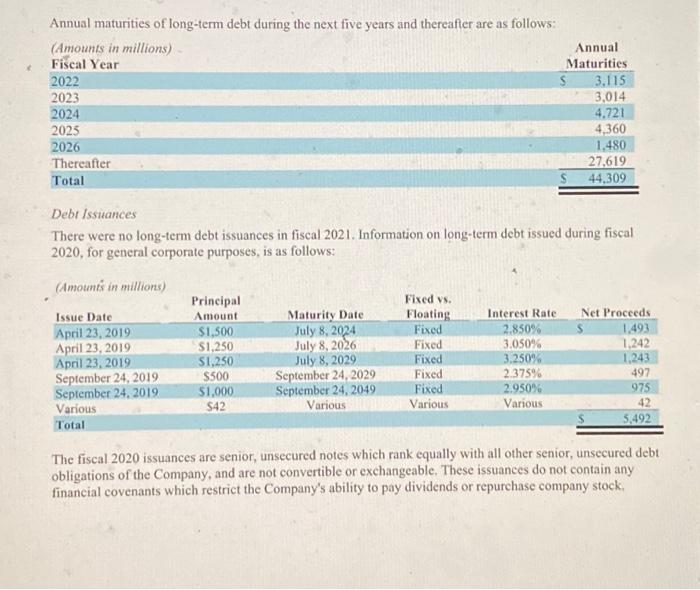

Refer to the financial statements and footnotes of Walmart given in Appendix C at the end of this book. All doliar amounts are in millions. Required: 1. What is the amount of cash Walmart paid to repurchase shares of their own stock during the most recent fiscal year? 2. What is the total par value (not par value per share) of the common stock Walmart reported at the end of the most recent fiscal year? 3. How many shares of common stock did Walmart have outstanding at the end of the most recent fiscal year? 4. What is the amount of shareholders' equity Walmart reported at the end of the most recent fiscal year? 5. What is the amount of dividends per share Walmart declared during the most recent fiscal year? Complete this question by entering your answers in the tabs below. What is the amount of cash Waimart paid to repurchase shares of their own stock during the most recent fiscal year? Walmart Inc. Consolidated Statements of Income Walmart Inc. Consolidated Statements of Comprehensive Income Walmart Inc. 18/alwaw 1 ana Walmart Inc. Consolidated Statements of Cash Flows Leasehold improvements are depreciated or amortized over the shorter of the estimated useful life ofthe asset or the remaining expected lease term. Total depreciation and amortization expense for property and equipment, property under finance leases and financing obligations, property under capital leases and intangible assets for fiscal 2021 . 2020 and 2019 was \$11.2 billion, \$11.0 billion and \$10.7 billion, respectively. (1) Represents goodwill associated with operations in the U.K. and Japan which are classified as held for sale as of January 31 , 2021. Note 5. Accrued Liabilities The Company's accrued liabilities consist of the following as of January 31,2021 and 202t: (1) Liabilities held for sale relate to the Company's operations in Japan and the U.K. classified as held for sale as of January 31 . 2021. (2) Acerued wages and benefits include acerued wages, salaries, vacation, bonuses and other incentive plans. (3) Self-insurance consists of insurance-related liabilities, such as worker' compensation, general liability, auto liability, product liability and certain employee-related healtheare benefits. (4)Aecrued non-income taxes include accrued payroll, property, value-added, sales and miscellaneous other taxes. (5)Other accrued liabilities consist of various items such as interest, maintenance, utilities, legal contingencies, and advertising. January 31,2021 and 2020 : (1) ne average rawe apromas an neng: balances and year-end interest rates. (2)Includes deferred loan costs, discounts, fair value hedges, foreign-held debt and secured debt. Annual maturities of long-term debt during the next five years and thereafter are as follows: Debt Issuances There were no long-term debt issuances in fiscal 2021. Information on long-term debt issued during fiscal 2020, for general corporate purposes, is as follows: The fiscal 2020 issuances are senior, unsecured notes which rank equally with all other senior, unsecured debt obligations of the Company, and are not convertible or exchangeable. These issuances do not contain any financial covenants which restrict the Company's ability to pay dividends or repurchase company stock