Answered step by step

Verified Expert Solution

Question

1 Approved Answer

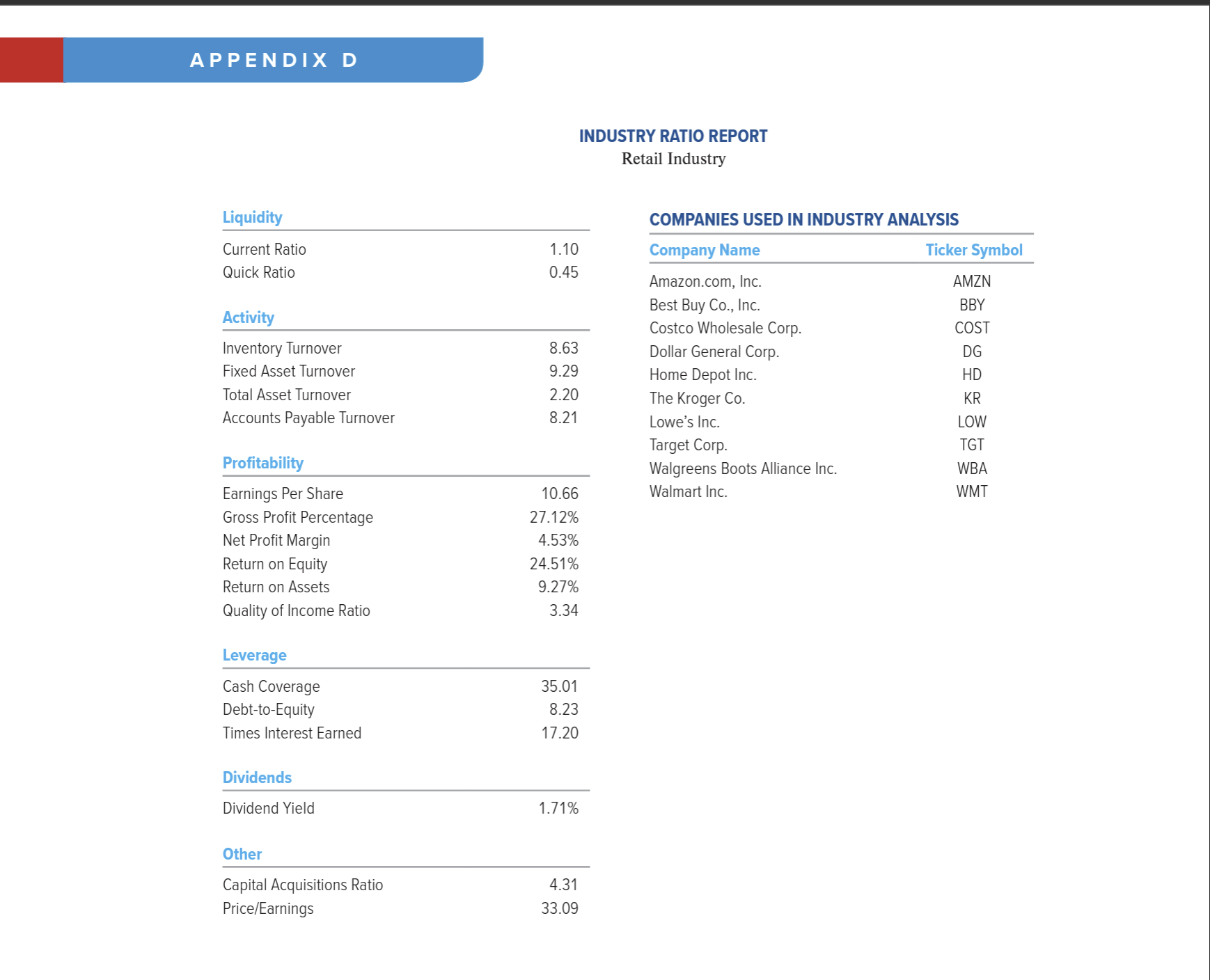

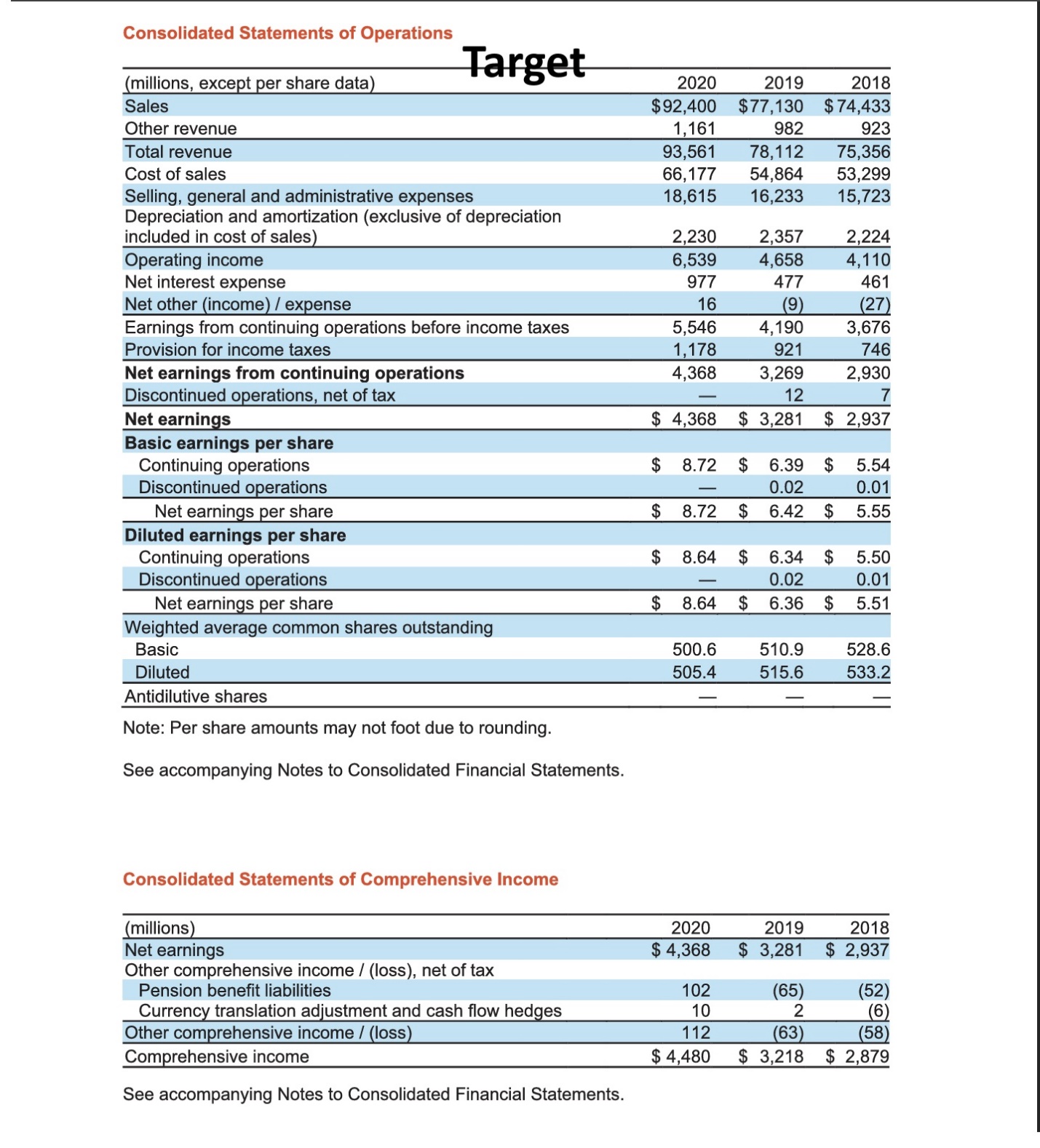

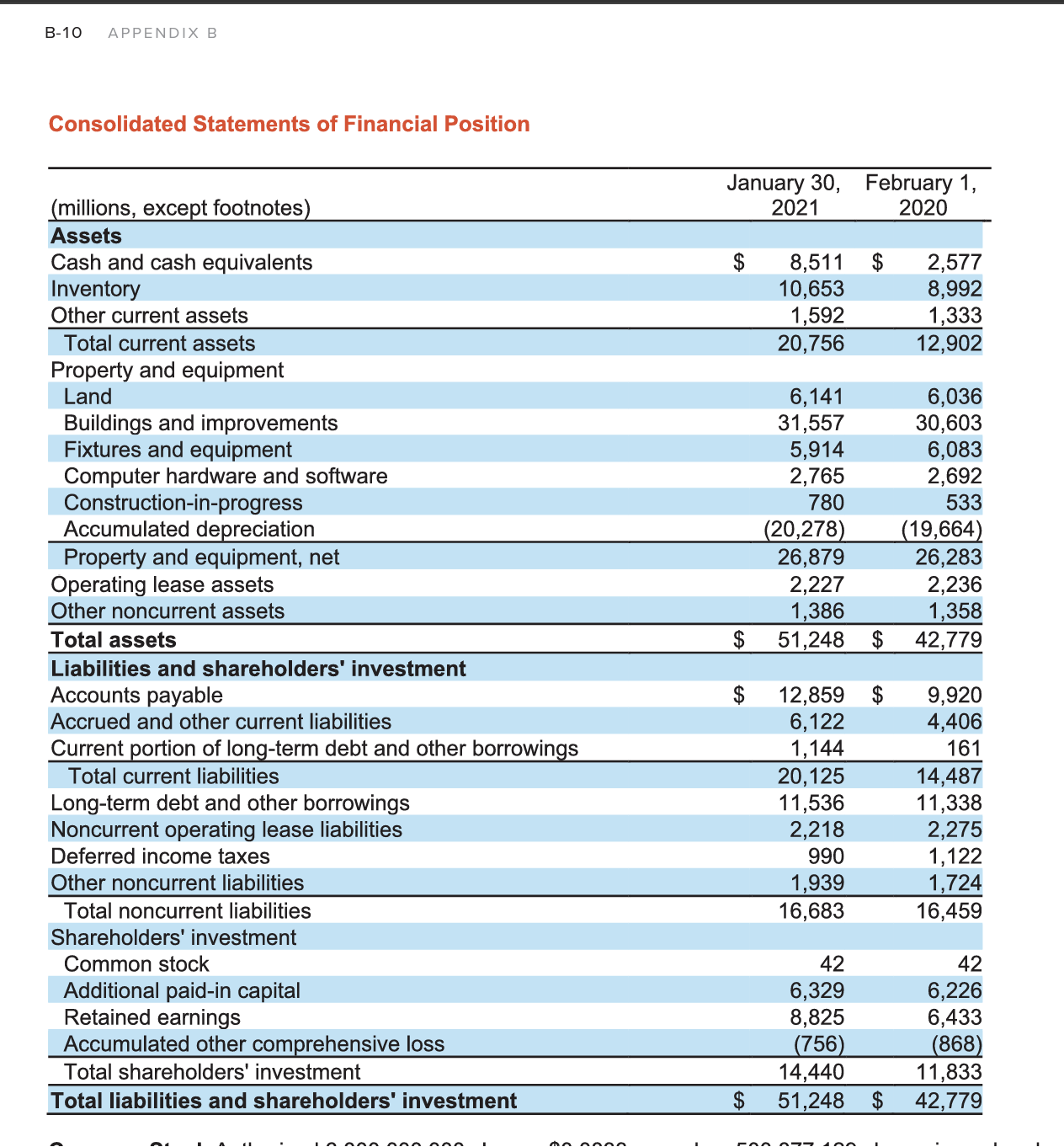

Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C), and the Industry Ratio Report (Appendix D). 1. Compute the quality of

Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C), and the Industry Ratio Report (Appendix D).

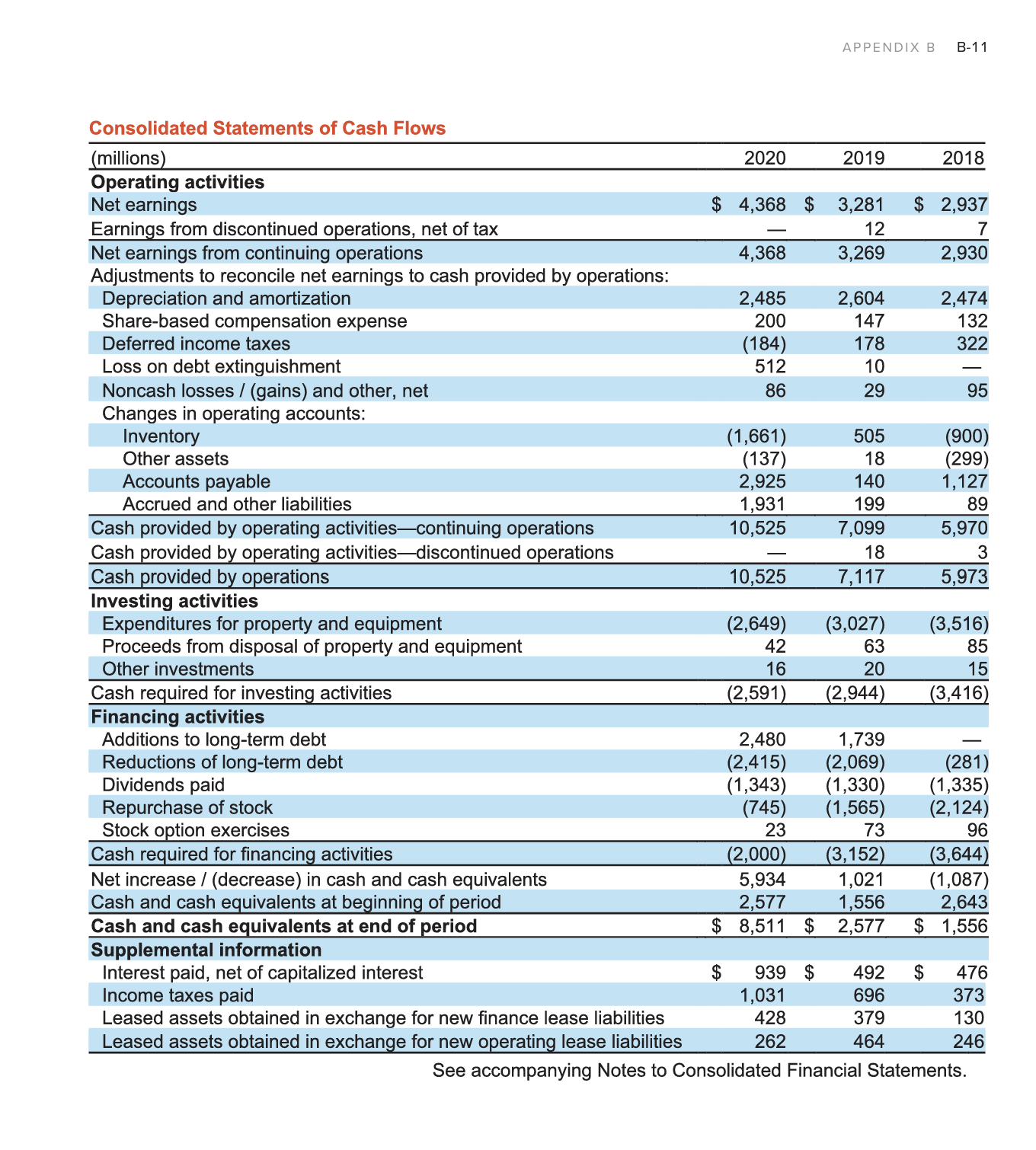

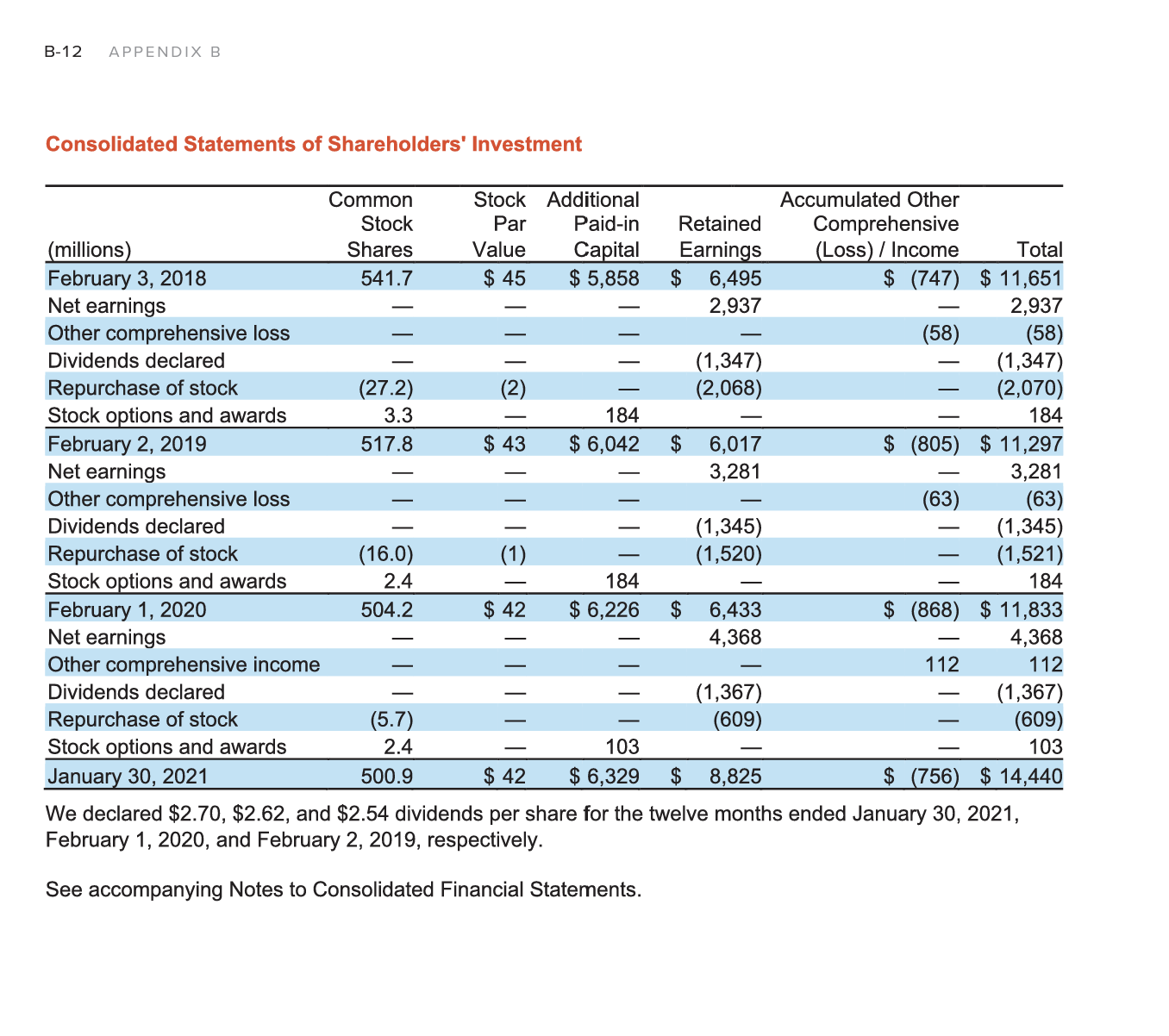

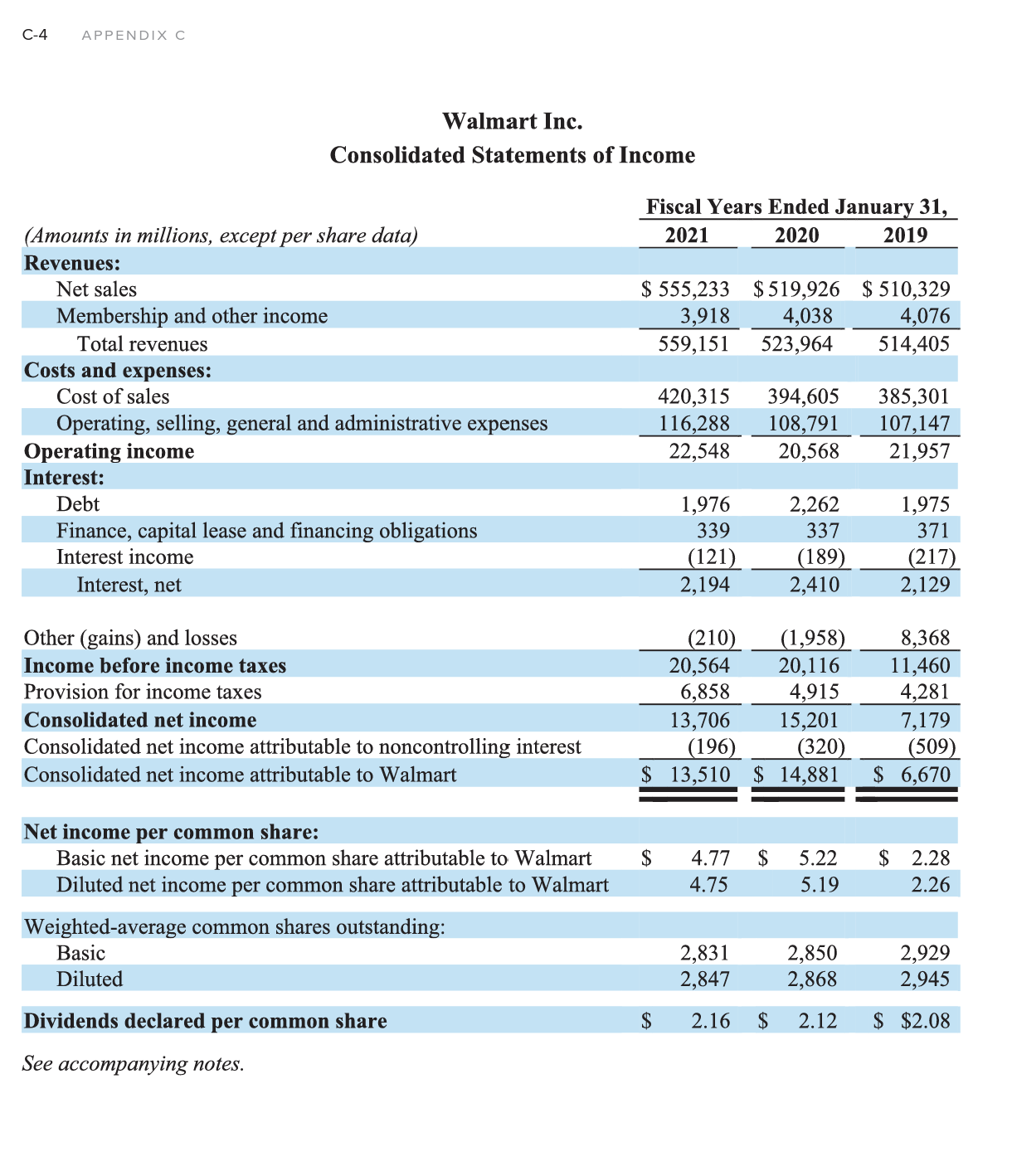

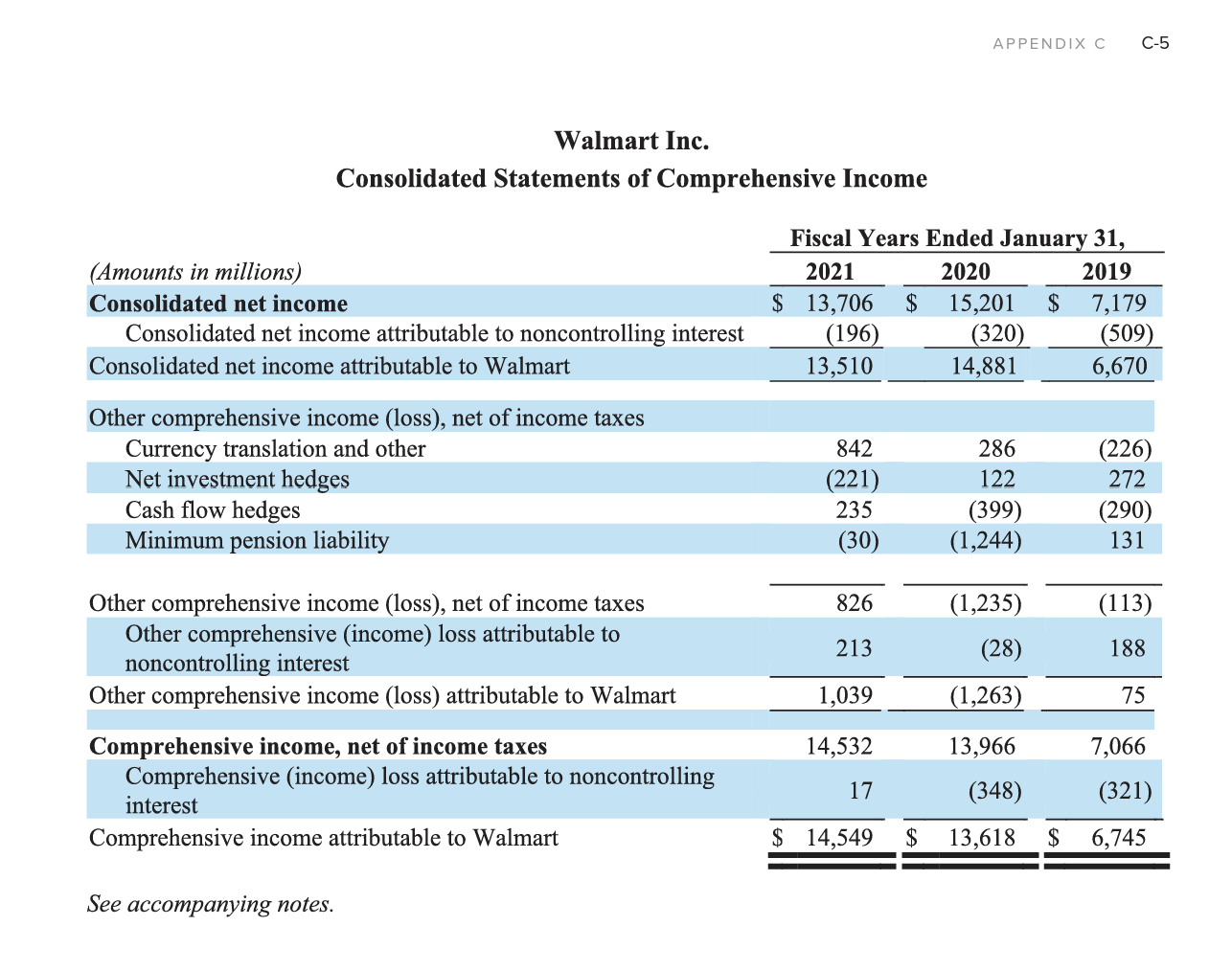

1. Compute the quality of income ratio for both companies for the most recent reporting year.

2. Compute the capital acquisitions ratio for both companies for the most recent reporting year.

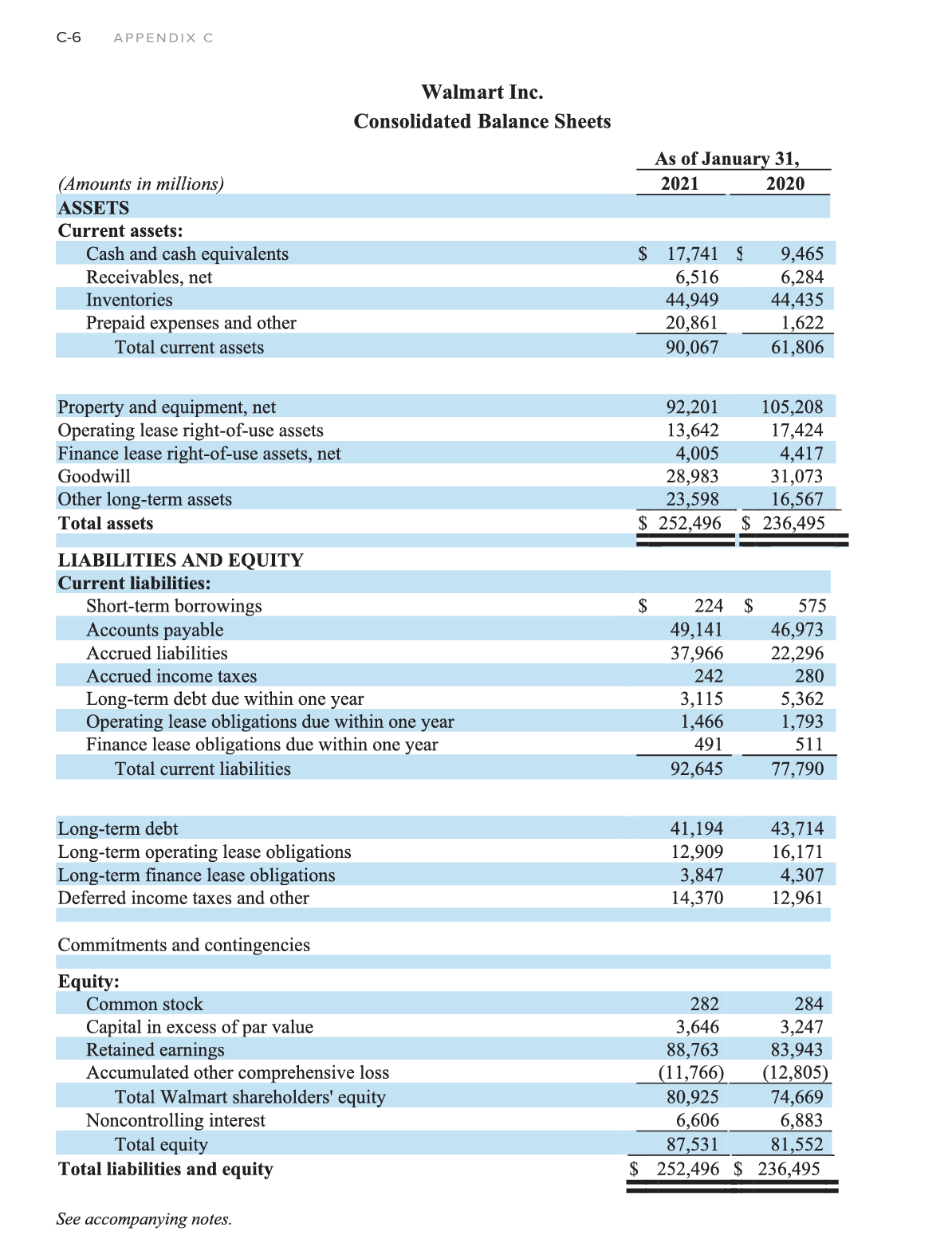

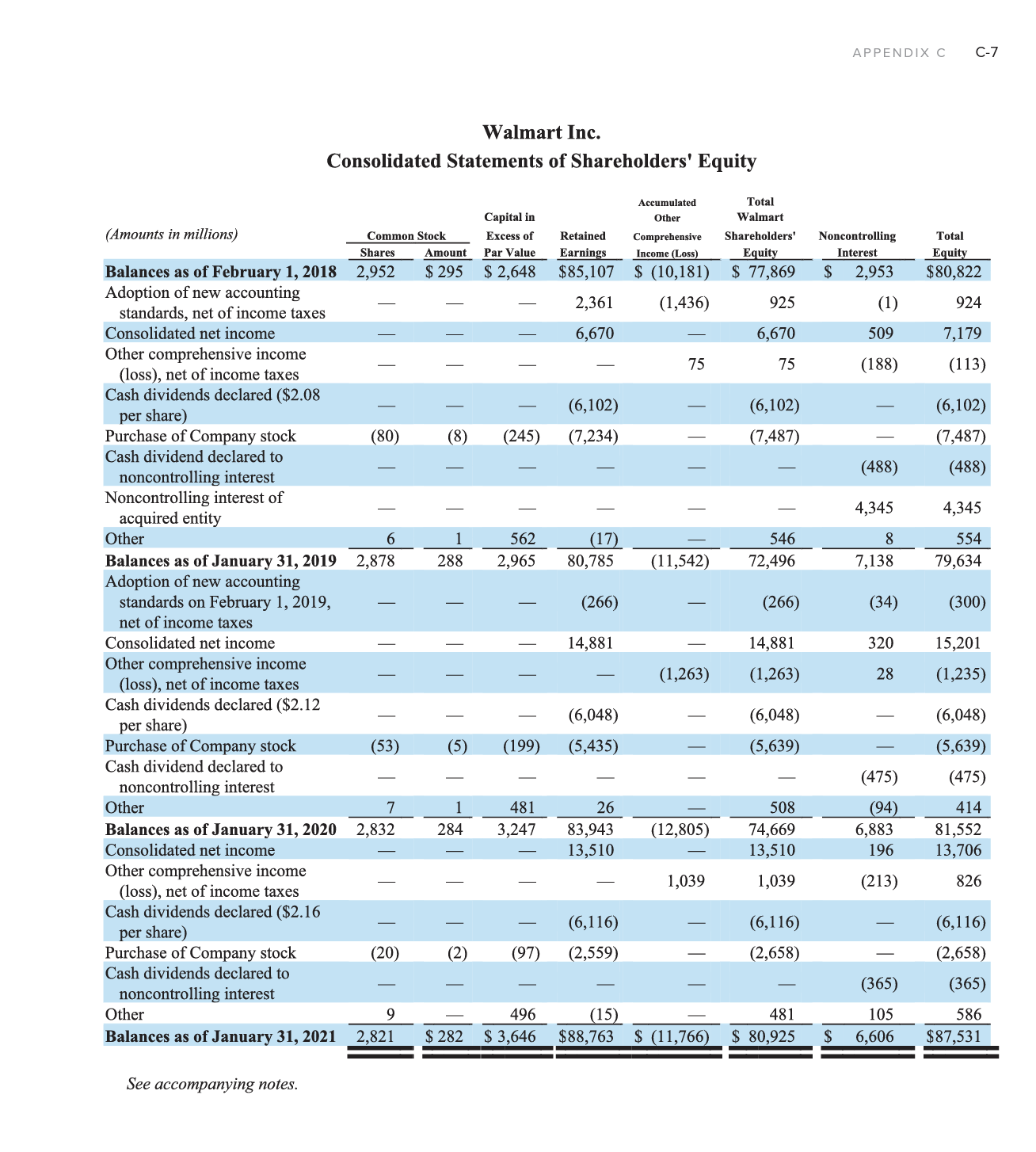

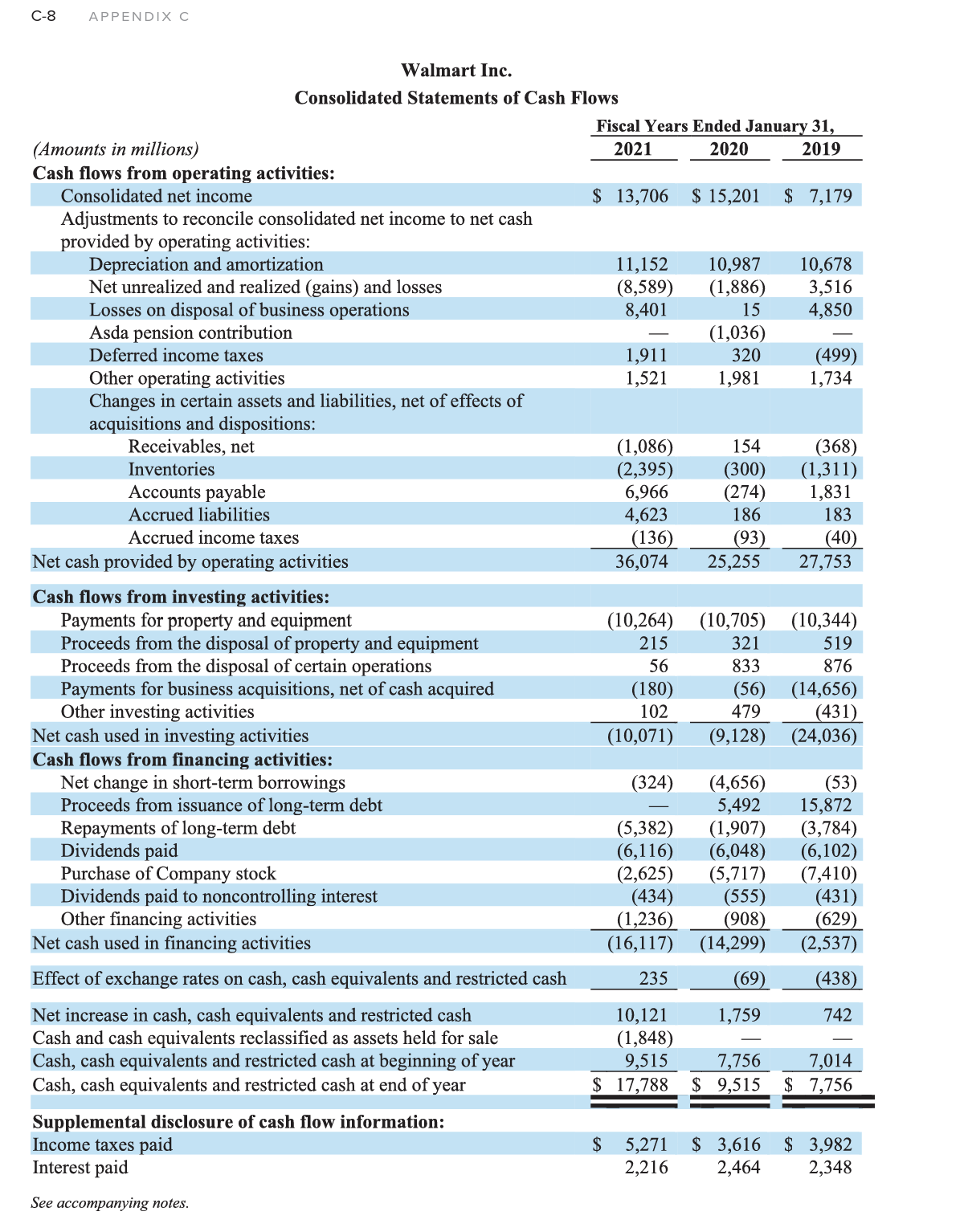

Walmart Inc. Consolidated Statements of Comprehensive Income Walmart Inc. Consolidated Statements of Income Walmart Inc. Canonlidatnd Ctatamnnte af Einannial Donoitinn INDUSTRY RATIO REPORT Retail Industry Consolidated Statements of Shareholders' Investment We declared $2.70,$2.62, and $2.54 dividends per share for the twelve months ended January 30,2021 , February 1, 2020, and February 2, 2019, respectively. See accompanying Notes to Consolidated Financial Statements. Walmart Inc. Consolidated Statements of Shareholders' Equity APPENDIX B B-11 Consolidated Statements of Cash Flows \begin{tabular}{|c|c|c|c|c|c|c|} \hline (millions) & & 2020 & & 2019 & & 2018 \\ \hline \multicolumn{7}{|l|}{ Operating activities } \\ \hline Net earnings & $ & 4,368 & $ & 3,281 & $ & 2,937 \\ \hline Earnings from discontinued operations, net of tax & & - & & 12 & & \\ \hline Net earnings from continuing operations & & 4,368 & & 3,269 & & 2,930 \\ \hline \multicolumn{7}{|l|}{ Adjustments to reconcile net earnings to cash provided by operations: } \\ \hline Depreciation and amortization & & 2,485 & & 2,604 & & 2,474 \\ \hline Share-based compensation expense & & 200 & & 147 & & 132 \\ \hline Deferred income taxes & & (184) & & 178 & & 322 \\ \hline Loss on debt extinguishment & & 512 & & 10 & & - \\ \hline Noncash losses / (gains) and other, net & & 86 & & 29 & & 95 \\ \hline \multicolumn{7}{|l|}{ Changes in operating accounts: } \\ \hline Inventory & & (1,661) & & 505 & & (900) \\ \hline Other assets & & (137) & & 18 & & (299) \\ \hline Accounts payable & & 2,925 & & 140 & & 1,127 \\ \hline Accrued and other liabilities & & 1,931 & & 199 & & 89 \\ \hline Cash provided by operating activities - continuing operations & & 10,525 & & 7,099 & & 5,970 \\ \hline Cash provided by operating activities-discontinued operations & & - & & 18 & & 3 \\ \hline Cash provided by operations & & 10,525 & & 7,117 & & 5,973 \\ \hline \multicolumn{7}{|l|}{ Investing activities } \\ \hline Expenditures for property and equipment & & (2,649) & & (3,027) & & (3,516) \\ \hline Proceeds from disposal of property and equipment & & 42 & & 63 & & 85 \\ \hline Other investments & & 16 & & 20 & & 15 \\ \hline Cash required for investing activities & & (2,591) & & (2,944) & & (3,416) \\ \hline \multicolumn{7}{|l|}{ Financing activities } \\ \hline Additions to long-term debt & & 2,480 & & 1,739 & & - \\ \hline Reductions of long-term debt & & (2,415) & & (2,069) & & (281) \\ \hline Dividends paid & & (1,343) & & (1,330) & & (1,335) \\ \hline Repurchase of stock & & (745) & & (1,565) & & (2,124) \\ \hline Stock option exercises & & 23 & & 73 & & 96 \\ \hline Cash required for financing activities & & (2,000) & & (3,152) & & (3,644) \\ \hline Net increase / (decrease) in cash and cash equivalents & & 5,934 & & 1,021 & & (1,087) \\ \hline Cash and cash equivalents at beginning of period & & 2,577 & & 1,556 & & 2,643 \\ \hline Cash and cash equivalents at end of period & $ & 8,511 & $ & 2,577 & $ & 1,556 \\ \hline \multicolumn{7}{|l|}{ Supplemental information } \\ \hline Interest paid, net of capitalized interest & $ & 939 & $ & 492 & $ & 476 \\ \hline Income taxes paid & & 1,031 & & 696 & & 373 \\ \hline Leased assets obtained in exchange for new finance lease liabilities & & 428 & & 379 & & 130 \\ \hline Leased assets obtained in exchange for new operating lease liabilities & & 262 & & 464 & & 246 \\ \hline \end{tabular} See accompanying Notes to Consolidated Financial Statements. Note: Per share amounts may not toot due to roundng. See accompanying Notes to Consolidated Financial Statements. Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements. C-6 APPENDIX C Walmart Inc. Consolidated Balance Sheets (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets \begin{tabular}{cr} As of January 31, \\ \hline 2021 & 2020 \\ \hline \end{tabular} \begin{tabular}{rrrr} $17,741 & $ & 9,465 \\ 6,516 & & 6,284 \\ 44,949 & & 44,435 \\ 20,861 & & 1,622 \\ \hline 9nn & & 61,806 \end{tabular} \begin{tabular}{lrr} Property and equipment, net & 92,201 & 105,208 \\ Operating lease right-of-use assets & 13,642 & 17,424 \\ Finance lease right-of-use assets, net & 4,005 & 4,417 \\ Goodwill & 28,983 & 31,073 \\ Other long-term assets & 23,598 & 16,567 \\ \hline Total assets & $252,496 & $236,495 \\ \hline \end{tabular} LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities \$ 224$575 49,14146,973 37,96622,296 280 2423,1152805,362 \begin{tabular}{rr} 242 & 5,362 \\ 1,466 & 1,793 \end{tabular} \begin{tabular}{rr} 491 & 511 \\ & 77,645 \end{tabular} \begin{tabular}{lrr} Long-term debt & 41,194 & 43,714 \\ Long-term operating lease obligations & 12,909 & 16,171 \\ Long-term finance lease obligations & 3,847 & 4,307 \\ Deferred income taxes and other & 14,370 & 12,961 \end{tabular} Commitments and contingencies Equity: \begin{tabular}{lrr} Common stock & 282 & 284 \\ Capital in excess of par value & 3,646 & 3,247 \\ Retained earnings & 88,763 & 83,943 \\ Accumulated other comprehensive loss & (11,766) & (12,805) \\ Total Walmart shareholders' equity & 80,925 & 74,669 \\ Noncontrolling interest & 6,606 & 6,883 \\ Total equity & 87,531 & 81,552 \\ \hline otal liabilities and equity & $252,496 & $236,495 \\ \hline \end{tabular} See accompanying notes. Walmart Inc. Consolidated Statements of Comprehensive Income Walmart Inc. Consolidated Statements of Income Walmart Inc. Canonlidatnd Ctatamnnte af Einannial Donoitinn INDUSTRY RATIO REPORT Retail Industry Consolidated Statements of Shareholders' Investment We declared $2.70,$2.62, and $2.54 dividends per share for the twelve months ended January 30,2021 , February 1, 2020, and February 2, 2019, respectively. See accompanying Notes to Consolidated Financial Statements. Walmart Inc. Consolidated Statements of Shareholders' Equity APPENDIX B B-11 Consolidated Statements of Cash Flows \begin{tabular}{|c|c|c|c|c|c|c|} \hline (millions) & & 2020 & & 2019 & & 2018 \\ \hline \multicolumn{7}{|l|}{ Operating activities } \\ \hline Net earnings & $ & 4,368 & $ & 3,281 & $ & 2,937 \\ \hline Earnings from discontinued operations, net of tax & & - & & 12 & & \\ \hline Net earnings from continuing operations & & 4,368 & & 3,269 & & 2,930 \\ \hline \multicolumn{7}{|l|}{ Adjustments to reconcile net earnings to cash provided by operations: } \\ \hline Depreciation and amortization & & 2,485 & & 2,604 & & 2,474 \\ \hline Share-based compensation expense & & 200 & & 147 & & 132 \\ \hline Deferred income taxes & & (184) & & 178 & & 322 \\ \hline Loss on debt extinguishment & & 512 & & 10 & & - \\ \hline Noncash losses / (gains) and other, net & & 86 & & 29 & & 95 \\ \hline \multicolumn{7}{|l|}{ Changes in operating accounts: } \\ \hline Inventory & & (1,661) & & 505 & & (900) \\ \hline Other assets & & (137) & & 18 & & (299) \\ \hline Accounts payable & & 2,925 & & 140 & & 1,127 \\ \hline Accrued and other liabilities & & 1,931 & & 199 & & 89 \\ \hline Cash provided by operating activities - continuing operations & & 10,525 & & 7,099 & & 5,970 \\ \hline Cash provided by operating activities-discontinued operations & & - & & 18 & & 3 \\ \hline Cash provided by operations & & 10,525 & & 7,117 & & 5,973 \\ \hline \multicolumn{7}{|l|}{ Investing activities } \\ \hline Expenditures for property and equipment & & (2,649) & & (3,027) & & (3,516) \\ \hline Proceeds from disposal of property and equipment & & 42 & & 63 & & 85 \\ \hline Other investments & & 16 & & 20 & & 15 \\ \hline Cash required for investing activities & & (2,591) & & (2,944) & & (3,416) \\ \hline \multicolumn{7}{|l|}{ Financing activities } \\ \hline Additions to long-term debt & & 2,480 & & 1,739 & & - \\ \hline Reductions of long-term debt & & (2,415) & & (2,069) & & (281) \\ \hline Dividends paid & & (1,343) & & (1,330) & & (1,335) \\ \hline Repurchase of stock & & (745) & & (1,565) & & (2,124) \\ \hline Stock option exercises & & 23 & & 73 & & 96 \\ \hline Cash required for financing activities & & (2,000) & & (3,152) & & (3,644) \\ \hline Net increase / (decrease) in cash and cash equivalents & & 5,934 & & 1,021 & & (1,087) \\ \hline Cash and cash equivalents at beginning of period & & 2,577 & & 1,556 & & 2,643 \\ \hline Cash and cash equivalents at end of period & $ & 8,511 & $ & 2,577 & $ & 1,556 \\ \hline \multicolumn{7}{|l|}{ Supplemental information } \\ \hline Interest paid, net of capitalized interest & $ & 939 & $ & 492 & $ & 476 \\ \hline Income taxes paid & & 1,031 & & 696 & & 373 \\ \hline Leased assets obtained in exchange for new finance lease liabilities & & 428 & & 379 & & 130 \\ \hline Leased assets obtained in exchange for new operating lease liabilities & & 262 & & 464 & & 246 \\ \hline \end{tabular} See accompanying Notes to Consolidated Financial Statements. Note: Per share amounts may not toot due to roundng. See accompanying Notes to Consolidated Financial Statements. Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements. C-6 APPENDIX C Walmart Inc. Consolidated Balance Sheets (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets \begin{tabular}{cr} As of January 31, \\ \hline 2021 & 2020 \\ \hline \end{tabular} \begin{tabular}{rrrr} $17,741 & $ & 9,465 \\ 6,516 & & 6,284 \\ 44,949 & & 44,435 \\ 20,861 & & 1,622 \\ \hline 9nn & & 61,806 \end{tabular} \begin{tabular}{lrr} Property and equipment, net & 92,201 & 105,208 \\ Operating lease right-of-use assets & 13,642 & 17,424 \\ Finance lease right-of-use assets, net & 4,005 & 4,417 \\ Goodwill & 28,983 & 31,073 \\ Other long-term assets & 23,598 & 16,567 \\ \hline Total assets & $252,496 & $236,495 \\ \hline \end{tabular} LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities \$ 224$575 49,14146,973 37,96622,296 280 2423,1152805,362 \begin{tabular}{rr} 242 & 5,362 \\ 1,466 & 1,793 \end{tabular} \begin{tabular}{rr} 491 & 511 \\ & 77,645 \end{tabular} \begin{tabular}{lrr} Long-term debt & 41,194 & 43,714 \\ Long-term operating lease obligations & 12,909 & 16,171 \\ Long-term finance lease obligations & 3,847 & 4,307 \\ Deferred income taxes and other & 14,370 & 12,961 \end{tabular} Commitments and contingencies Equity: \begin{tabular}{lrr} Common stock & 282 & 284 \\ Capital in excess of par value & 3,646 & 3,247 \\ Retained earnings & 88,763 & 83,943 \\ Accumulated other comprehensive loss & (11,766) & (12,805) \\ Total Walmart shareholders' equity & 80,925 & 74,669 \\ Noncontrolling interest & 6,606 & 6,883 \\ Total equity & 87,531 & 81,552 \\ \hline otal liabilities and equity & $252,496 & $236,495 \\ \hline \end{tabular} See accompanying notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started