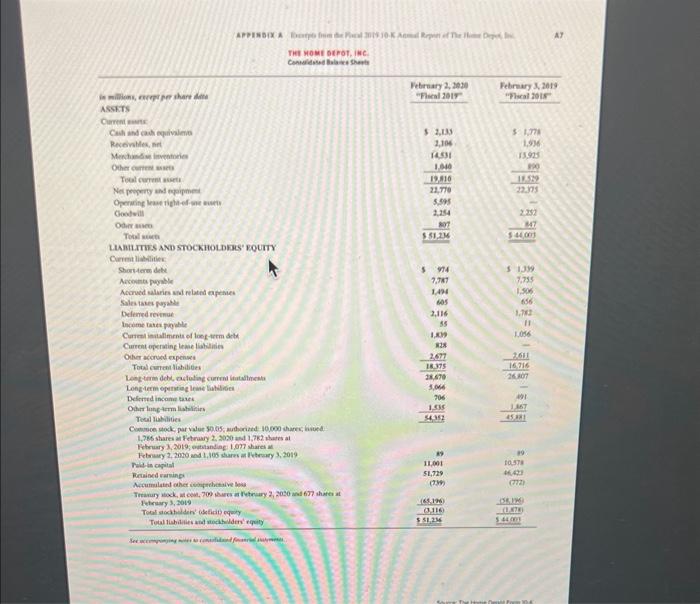

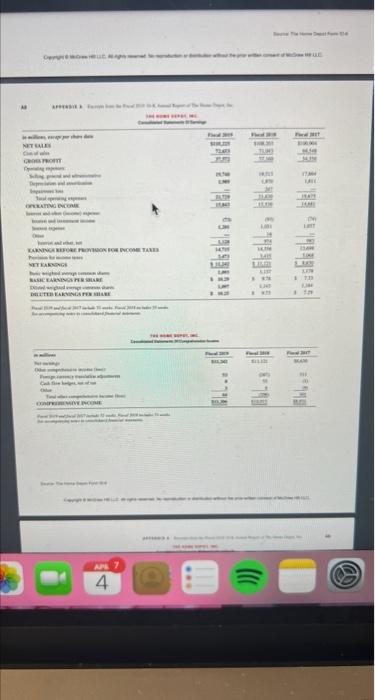

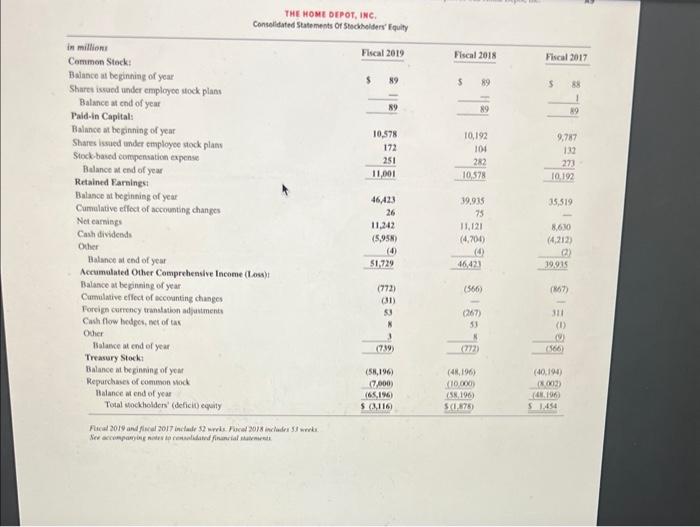

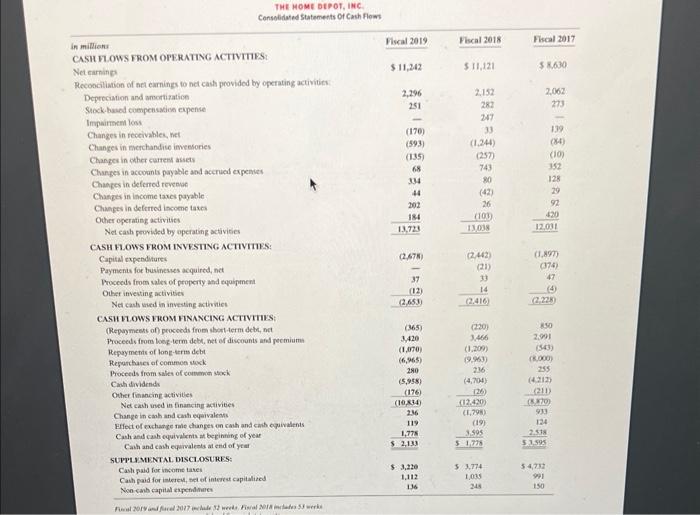

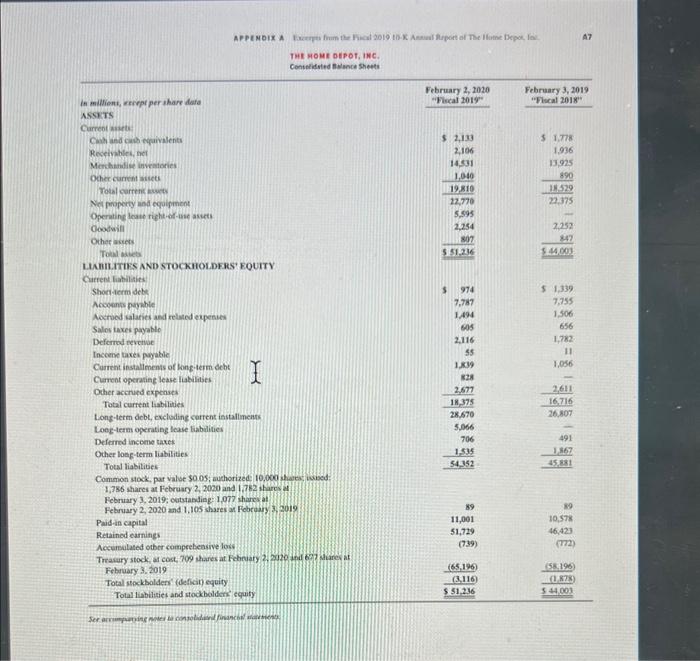

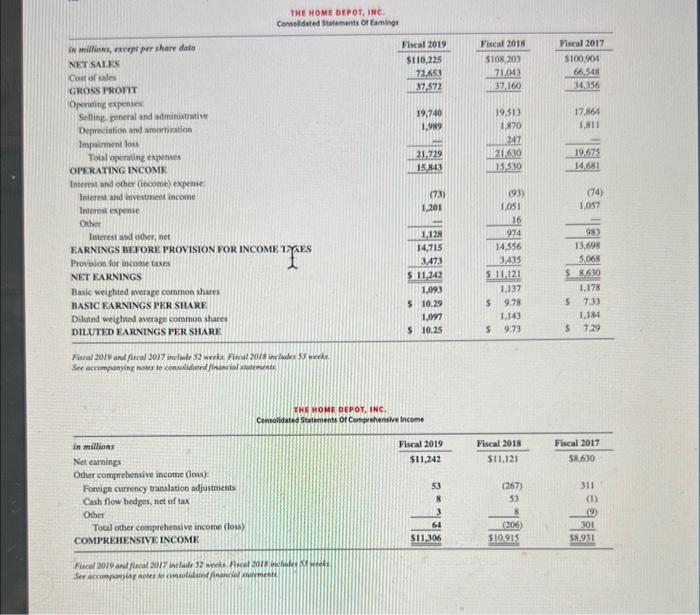

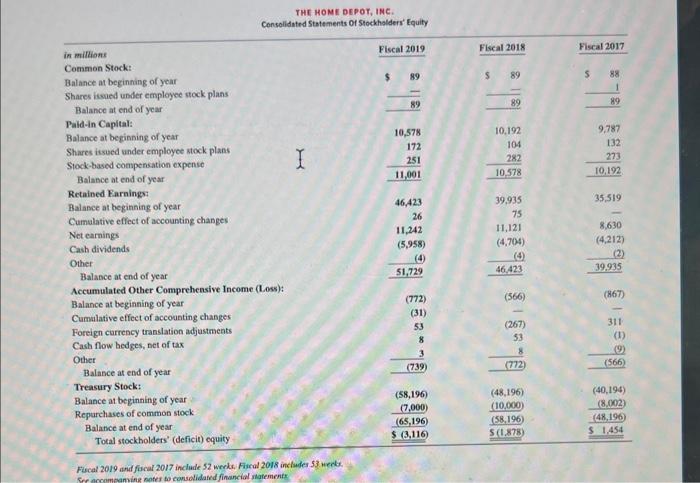

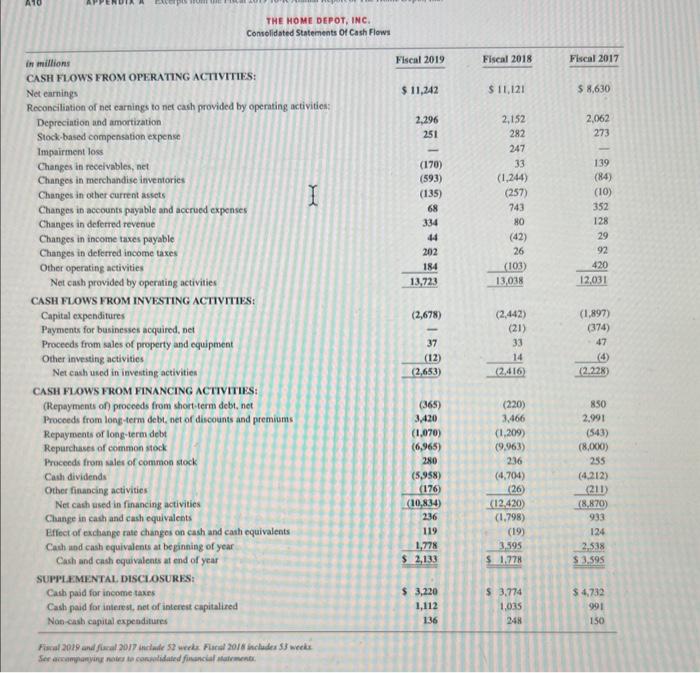

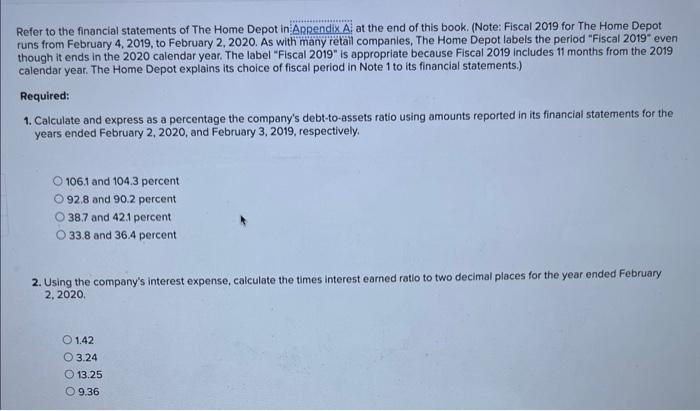

Refer to the financial statements of The Home Depot in ARRendix.A at the end of this book. (Note: Fiscal 2019 for The Home Depot runs from February 4, 2019, to February 2, 2020. As with many retall companies, The Home Depot labels the period "Fiscal 2019" even though it ends in the 2020 calendar year. The label "Fiscal 2019 " is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. Calculate and express as a percentage the company's debt-to-assets ratio using amounts reported in its financial statements for the years ended February 2, 2020, and February 3, 2019, respectively. \begin{tabular}{|l|} \hline 106.1 and 104.3 percent \\ \hline 92.8 and 90.2 percent \\ \hline 387 and 421 percent \\ \hline 33.8 and 36.4 percent \end{tabular} 2. Using the company's interest expense, calculate the times interest earned ratio to two decimal places for the year ended february 2,2020 \begin{tabular}{|} \hline 1.42 \\ \hline 3.24 \\ 13.25 \\ \hline 9.36 \\ \hline \end{tabular} Thit yout strot. ine TML Momt ofPot, inc. Consclidated State ments or Steckbelders' Fault TME MOME BEPOT, INC Consoldared Statements of Cach flow in mildians CASH RT.OWS FKOM OPERATING ACTTVTTES? Net earning Recoociliation of net earnings to net cast provided by operating activities. Depreciabon and amortization Suok basod compensadis expense Impairsem los Changes in receivables, thet Chaness in ekerchandise imestories Chanpes in other cwarten ases Changes in accornts payable and acerued expenses Chages in deferted revenoe Changes in income taxes payable Chinges in defrred income tasea Other ogerating activitien Net cash peorided by operating activities \begin{tabular}{rrr} 2,296 & 2,152 & 2,062 \\ 251 & 282 & 273 \\ - & 247 & 139 \\ (170) & 33 & (84) \\ (593) & (1,24) & (10) \\ (135) & (257) & 152 \\ 68 & 743 & 128 \\ 134 & 80 & 29 \\ 44 & (42) & 92 \\ 202 & 26 & 430 \\ 184 & (109 & 12.031 \\ \hline 13,723 & 13.038 & \\ \hline \end{tabular} CASH HLOWS FROM INVESTTV ACTVITES: Capital expenditure Payments foe businesies acquired, nd Proceeds from sales of property and equipeneni Oher invexing activitie: Net canb wised in investing actionict CASH RLOWS FKOM HINANCING ACTIVTTES: (Repunments of) procods from ibort Aerm deth, nd Thoceads from loeg-term debt, bet of dispounts and pecmiuma Repryments of long-tern debt Regarthasei of commoe twik Procecels from sales of coument stakk Cahh dividends Outer financing activites Ne cash red in financing activite! Change in canh and cant equivaless Elfoct of eachasge nate chunges on cath and canh equivalents Cahh and cach cquivilents at bepinting of year Cahh and cash equivaleets a end of your SUPPUMENTAL DISCZOSURES: Cash paid for insome tanei Cash paid for isieted, sel of inerict capialized Noocab capital esendales: The nome odpot, lme. THE MOME DEPOT, INC Fiscal 2019 and ficcal 2017 include 52 werk. Fincul 2018 inchedes 53 Heede. Soe accompanine noter to covsdidated financial inatements. THE HOME DEPOT. INC. Conolidsted statements ot Cash Flows in millions Fiscal 2019 Fiscal 2018 Fiscal 2017 CASH FLOWS FROM OPERATING ACTIVTIIES: Net earnings $11,242$11,121$8,630 Reconciliation of net earnings to net cach provided by operating activitien: Depreciation and amortization Slock-based compensation expense Impairment loss Changes in recelvables, net Changes in merchandise inventories Changes in other current asvets Changes in aceounts payable and accrued expenses Changes in deferred revenue Changes in income taxes payable Changes in deferred income taxes Other operating activities Net cash provided by operatiog activities \begin{tabular}{rrr} 2,296 & 2,152 & 2,062 \\ 251 & 282 & 273 \\ - & 247 & - \\ (170) & 33 & 139 \\ (593) & (1,244) & (84) \\ (135) & (257) & (10) \\ 68 & 743 & 352 \\ 334 & 80 & 128 \\ 44 & (42) & 29 \\ 202 & 26 & 92 \\ 184 & (103) & 420 \\ \hline 13,723 & 13,038 & 12,031 \\ \hline \end{tabular} CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Payments for businesses acquired, net Proceeds from sales of property and equipment Other investing activities Net cash used in inventing activitien \begin{tabular}{rr} (2,678) & (2,442) \\ - & (21) \\ 37 & 33 \\ (12) & 14 \\ \hline(2,653) & (2,416) \\ \hline \end{tabular} (1,897) CASH FLOWS FROM FINANCING ACTTVITIES: (Repayments of) proceeds from short-term debt, net Procoeds from long-term debt, net of discounts and premiums Repayments of long-term debt Reparchases of commen stock Pruceeds from sales of common stock Cash dividends Other financing activities Net cash ssed in financing activities Change in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at be ginning of year Cash and cash equivalents at end of year SUPII.FMENTAL. DISCIOSURKS: Final 2019 and fixcal 2017 inciale 53 wrekx fural 20/8 includes 53 wreis Refer to the financial statements of The Home Depot in:ARpendix A) at the end of this book, (Note: Fiscal 2019 for The Home Depot runs from February 4, 2019, to February 2, 2020. As with many reetail companles, The Home Depot labels the period "Fiscal 2019" even though it ends in the 2020 calendar year. The label "Fiscal 2019" is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. Calculate and express as a percentage the company's debt-to-assets ratio using amounts reported in its financial statements for the years ended February 2, 2020, and February 3, 2019, respectively. 106.1 and 104.3 percent 92.8 and 90.2 percent 38.7 and 42.1 percent 33.8 and 36.4 percent 2. Using the company's interest expense, calculate the times interest earned ratio to two decimal places for the year ended February 2,2020 \begin{tabular}{|c|} \hline 1.42 \\ \hline 3.24 \\ \hline 13.25 \\ \hline 9.36 \\ \hline \end{tabular}