Answered step by step

Verified Expert Solution

Question

1 Approved Answer

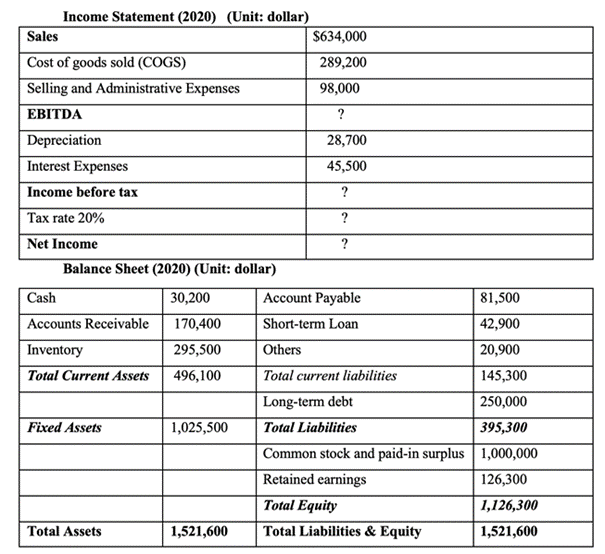

Refer to the financial statements of Violet Company. Complete the information in Income Statement Calculate: Current ratio, Acid-test ratio, Average collection period, Asset turnover ratio,

Refer to the financial statements of Violet Company.

- Complete the information in Income Statement

- Calculate: Current ratio, Acid-test ratio, Average collection period, Asset turnover ratio, ROA, ROE

- Construct the Du Pont identity for Violet Company?

- Violet Company has 51000 shares of common stock outstanding and the market price for a share of stock at the end of 2020 is 15 USD. What is the price-earning ratio? What are the dividends per share if the company decided to keep 20% of its Net Income as Addition to Retained earnings?

Thanh you so much. Can you explain for me please.

Income Statement (2020) (Unit: dollar) Sales $634,000 Cost of goods sold (COGS) 289,200 Selling and Administrative Expenses 98,000 EBITDA ? Depreciation 28,700 Interest Expenses 45,500 Income before tax ? Tax rate 20% ? Net Income ? Balance Sheet (2020) (Unit: dollar) Cash 30,200 Account Payable 81,500 Accounts Receivable 170,400 Short-term Loan 42,900 Inventory 295,500 Others 20,900 Total Current Assets 496,100 Total current liabilities 145,300 Long-term debt 250,000 Fixed Assets 1,025,500 Total Liabilities 395,300 Common stock and paid-in surplus 1,000,000 Retained earnings 126,300 Total Equity 1,126,300 Total Assets 1,521,600 Total Liabilities & Equity 1,521,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started