Question

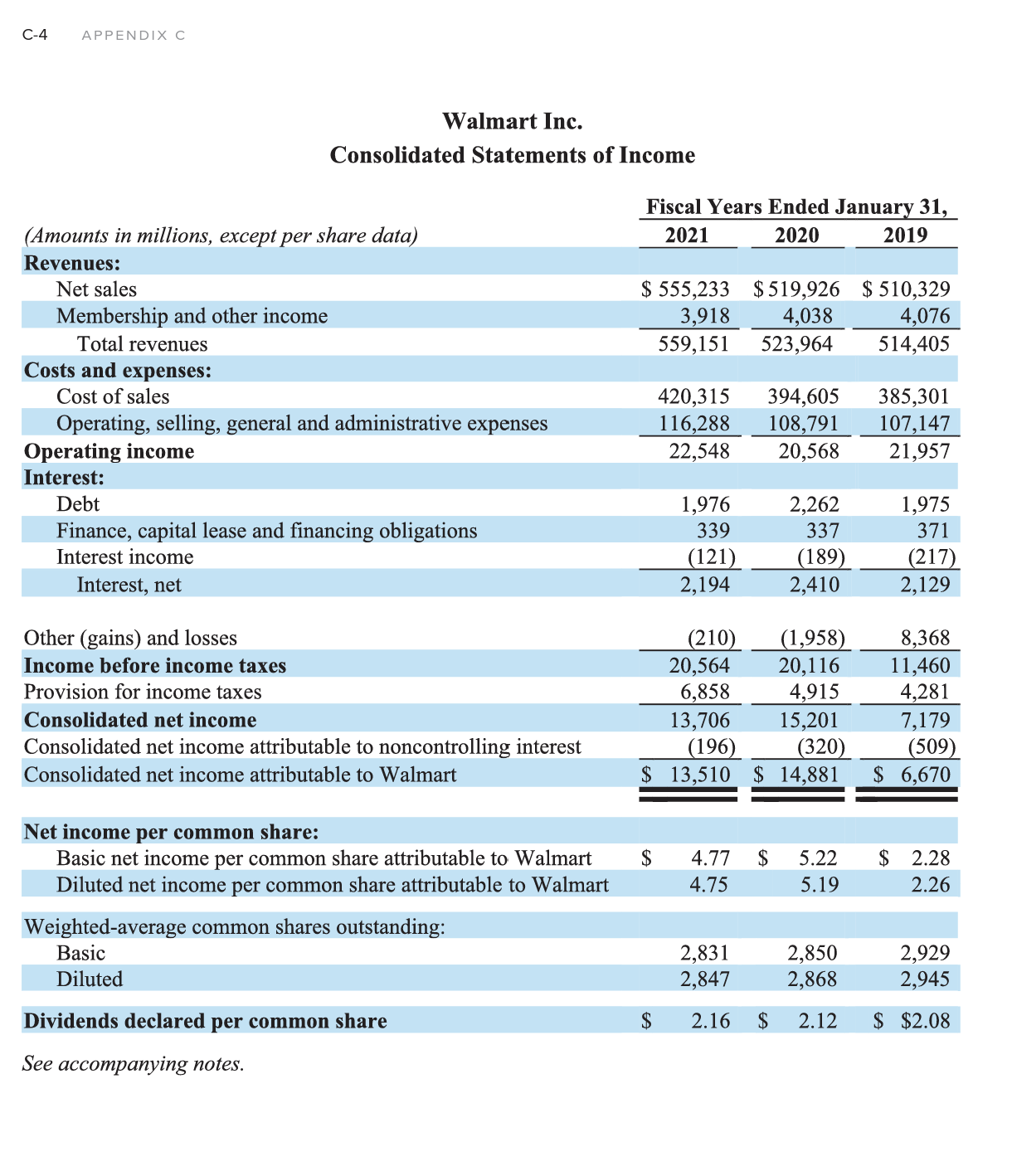

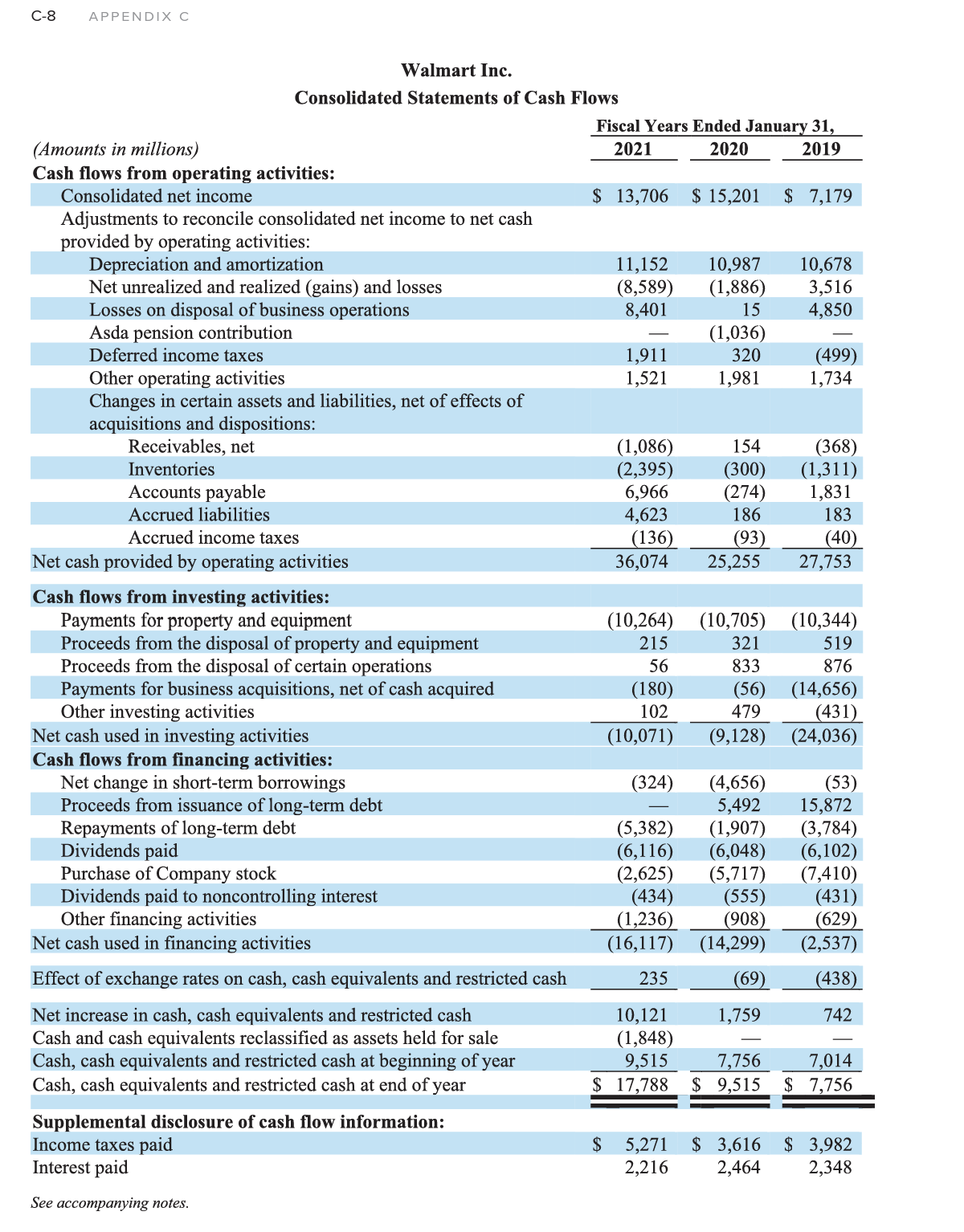

Refer to the financial statements of Walmart given in Appendix C. All dollar amounts in the statements are in millions. Required: 1. (a) How much

Refer to the financial statements of Walmart given in Appendix C. All dollar amounts in the statements are in millions.

Required:

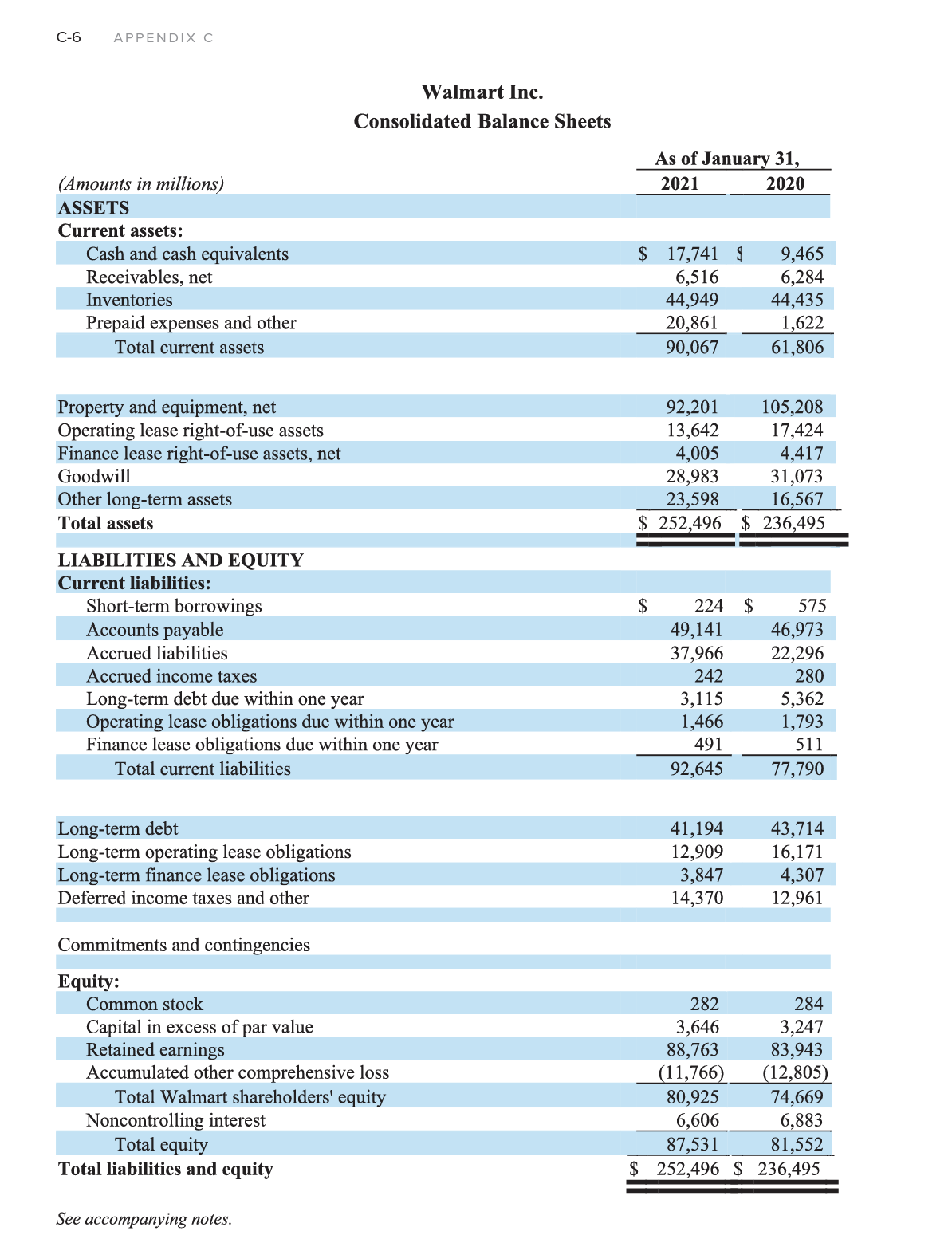

1. (a) How much cash and cash equivalents does the company report at the end of the current year?

(b) Walmart is a large international company. What amount (in billions) of its cash and cash equivalents may not be freely transferable to the United States?

2. What was the change in receivables, net (in millions) between last year and the current year?

3. Walmart's total receivables, net were $6.5 billion at the end of the current year. What amount (in billions) were receivables from transactions with customers?

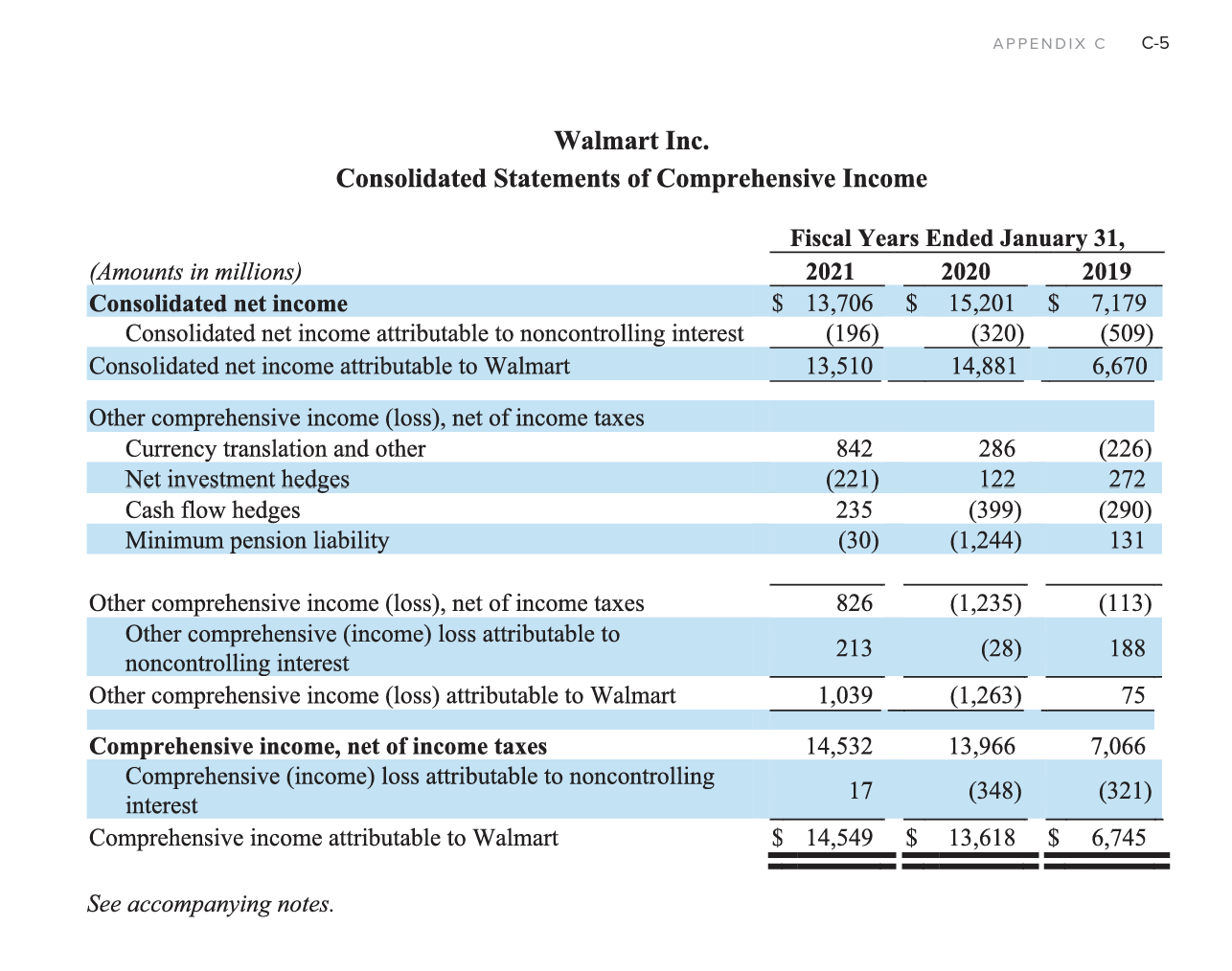

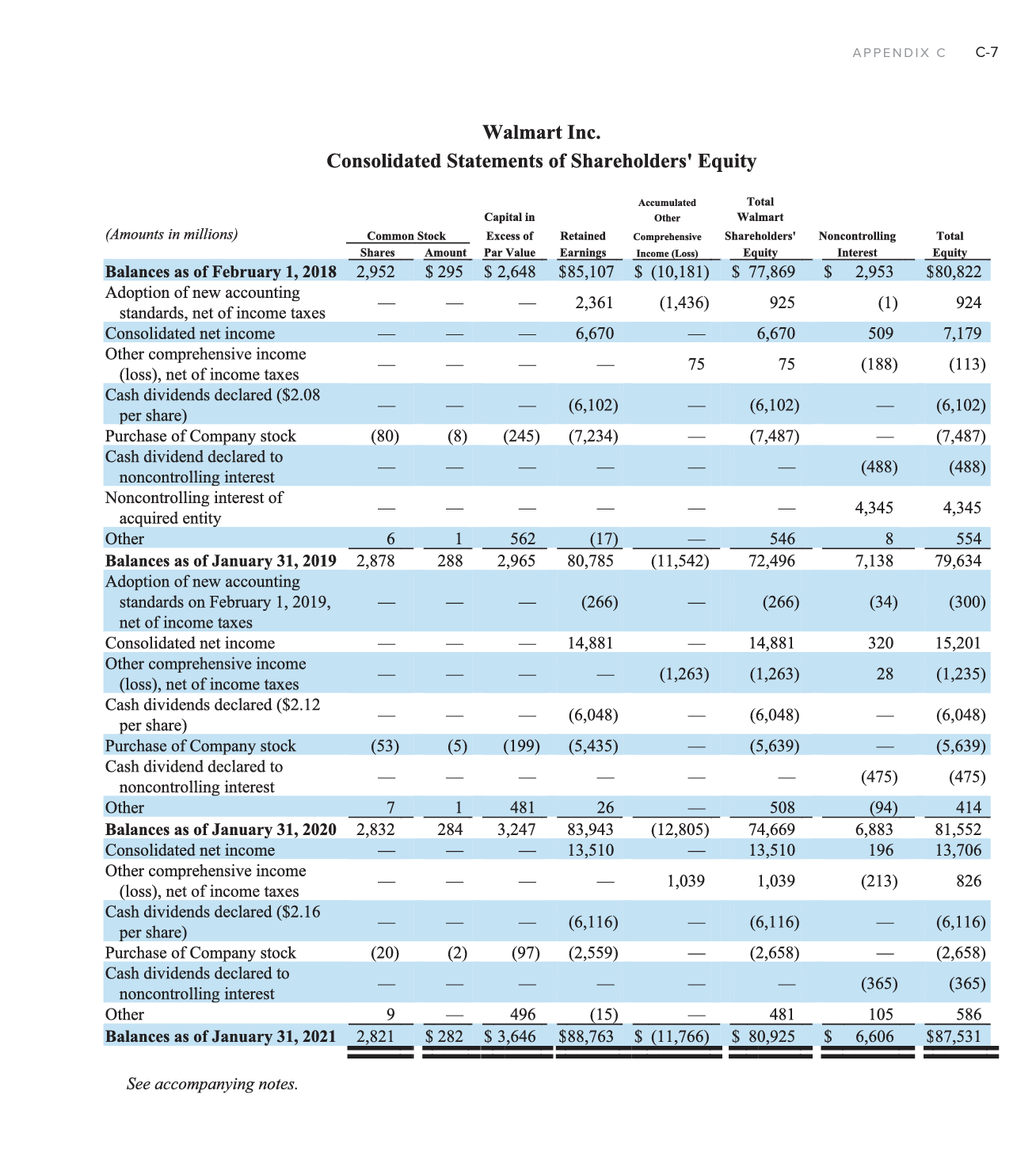

Walmart Inc. Consolidated Statements of Shareholders' Equity Walmart Inc. C-6 APPENDIX C Walmart Inc. Consolidated Balance Sheets (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets \begin{tabular}{cr} As of January 31, \\ \hline 2021 & 2020 \\ \hline \end{tabular} \begin{tabular}{rrrr} $17,741 & $ & 9,465 \\ 6,516 & & 6,284 \\ 44,949 & & 44,435 \\ 20,861 & & 1,622 \\ \hline 9nn & & 61,806 \end{tabular} \begin{tabular}{lrr} Property and equipment, net & 92,201 & 105,208 \\ Operating lease right-of-use assets & 13,642 & 17,424 \\ Finance lease right-of-use assets, net & 4,005 & 4,417 \\ Goodwill & 28,983 & 31,073 \\ Other long-term assets & 23,598 & 16,567 \\ \hline Total assets & $252,496 & $236,495 \\ \hline \end{tabular} LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Operating lease obligations due within one year Finance lease obligations due within one year Total current liabilities \$ 224$575 49,14146,973 37,96622,296 280 2423,1152805,362 \begin{tabular}{rr} 242 & 5,362 \\ 1,466 & 1,793 \end{tabular} \begin{tabular}{rr} 491 & 511 \\ & 77,645 \end{tabular} \begin{tabular}{lrr} Long-term debt & 41,194 & 43,714 \\ Long-term operating lease obligations & 12,909 & 16,171 \\ Long-term finance lease obligations & 3,847 & 4,307 \\ Deferred income taxes and other & 14,370 & 12,961 \end{tabular} Commitments and contingencies Equity: \begin{tabular}{lrr} Common stock & 282 & 284 \\ Capital in excess of par value & 3,646 & 3,247 \\ Retained earnings & 88,763 & 83,943 \\ Accumulated other comprehensive loss & (11,766) & (12,805) \\ Total Walmart shareholders' equity & 80,925 & 74,669 \\ Noncontrolling interest & 6,606 & 6,883 \\ Total equity & 87,531 & 81,552 \\ \hline otal liabilities and equity & $252,496 & $236,495 \\ \hline \end{tabular} See accompanying notes. Walmart Inc. Consolidated Statements of Income Walmart Inc. Consolidated Statements of Comprehensive Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started