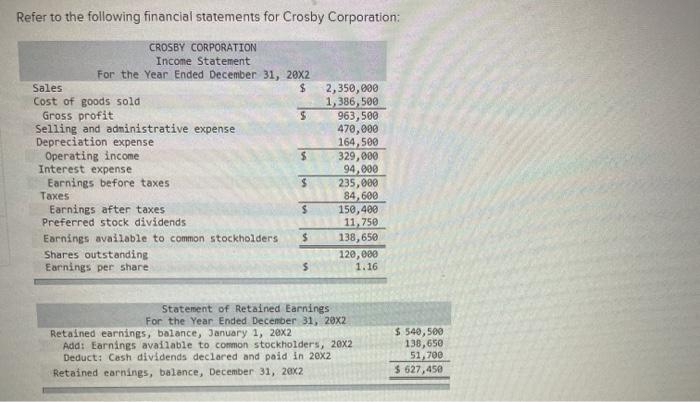

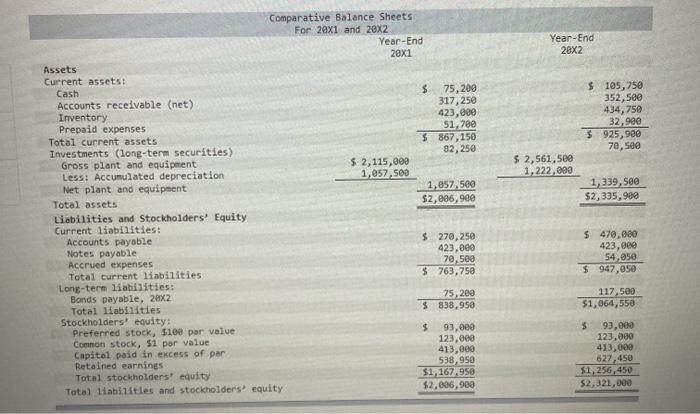

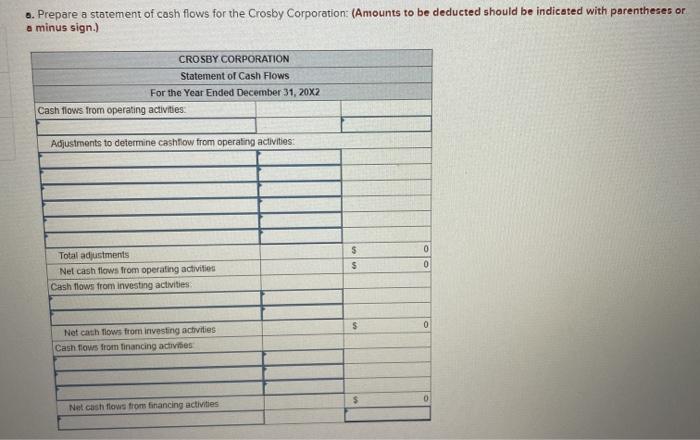

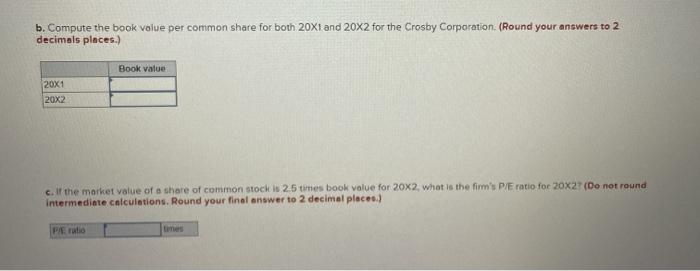

Refer to the following financial statements for Crosby Corporation: CROSBY CORPORATION Income Statement For the Year Ended December 31, 20X2 Sales $ Cost of goods sold Gross profit $ Selling and administrative expense Depreciation expense Operating income $ Interest expense Earnings before taxes $ Taxes Earnings after taxes $ Preferred stock dividends Earnings available to common stockholders $ Shares outstanding Earnings per share $ 2,350,000 1,386,500 963,500 470,000 164,500 329,000 94,800 235,000 84,600 150,400 11,750 138,650 120,000 1.16 Statement of Retained Earnings For the Year Ended December 31, 20X2 Retained earnings, balance, January 1, 20x2 Add: Earnings available to common stockholders, 20x2 Deduct: Cash dividends declared and paid in 20x2 Retained earnings, balance, December 31, 20x2 $ 540, 500 138,650 51,700 $ 627,450 Year-End 28x2 $ 105,758 352,500 434,750 32,980 $ 925,900 70,500 $ 2,561,500 1,222,888 1,339,5ee $2,335,900 Comparative Balance Sheets For 20x1 and 20X2 Year-End 20x1 Assets Current assets: Cash $ 75,200 Accounts receivable (net) 317,250 Inventory 423,000 Prepaid expenses 51,700 Total current assets $ 867,150 Investments (long-term securities) 82,250 Gross plant and equipment $ 2,115,000 Less: Accumulated depreciation 1,057,500 Net plant and equipment 1,057,500 Total assets $2,006,900 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 270,250 Notes payable 423,000 Accrued expenses 70,500 Total current liabilities $763, 750 Long-term liabilities: Bonds payable, 20x2 75,200 Total Habilities $ 838,950 Stockholdersequity: Preferred stock, 5100 per value $ 93,000 Common stock, 51 por value 123,000 Capital paid in excess of per 413,000 Retained earnings 538,950 Total stockholders equity $1,167.950 Total liabilities and stockholders equity $2,006,900 $ 470,000 423,000 54,050 $947,050 117,500 $1,064,550 $ 93,000 123,000 413,000 627,450 $1,256,450 $2,321,000 .. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with parentheses or a minus sign.) CROSBY CORPORATION Statement of Cash Flows For the Year Ended December 31, 20X2 Cash flows from operating activities Adjustments to determine cashflow from operating activities: $ $ 0 0 Total adjustments Nel cash flows from operating activities Cash flows from investing activities $ 0 Net cath flows from investing activities Cash flows from inancing activities $ Net cash flows from financing activities b. Compute the book value per common share for both 20X1 and 20x2 for the Crosby Corporation (Round your answers to 2 decimals places.) Book value 20X1 20x2 c. If the market value of a share of common stock is 25 umes book value for 20x2, what is the firm's P/E ratio for 20x2? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Prati