Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to the following information from Capital Comet's Apparel Incorporated accounting books and records for the year ended December 31, 2022: pretax book income of

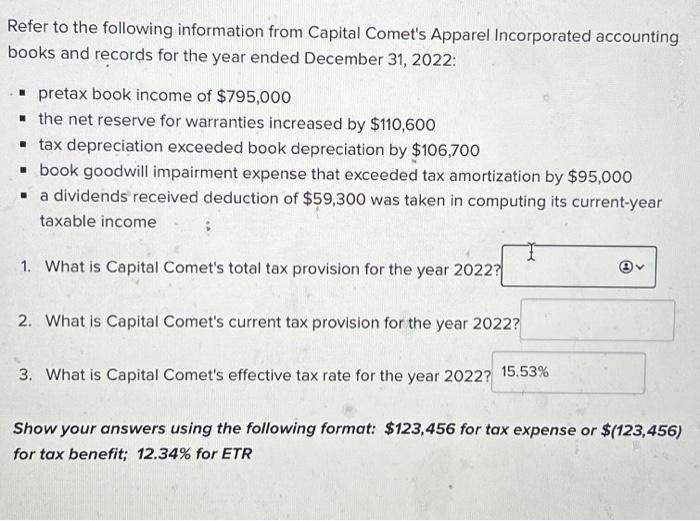

Refer to the following information from Capital Comet's Apparel Incorporated accounting books and records for the year ended December 31, 2022: pretax book income of $795,000 the net reserve for warranties increased by $110,600 tax depreciation exceeded book depreciation by $106,700 book goodwill impairment expense that exceeded tax amortization by $95,000 a dividends received deduction of $59,300 was taken in computing its current-year taxable income 1. What is Capital Comet's total tax provision for the year 2022? 2. What is Capital Comet's current tax provision for the year 2022? 3. What is Capital Comet's effective tax rate for the year 2022? 15.53% Show your answers using the following format: $123,456 for tax expense or $(123,456) for tax benefit; 12.34% for ETR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started