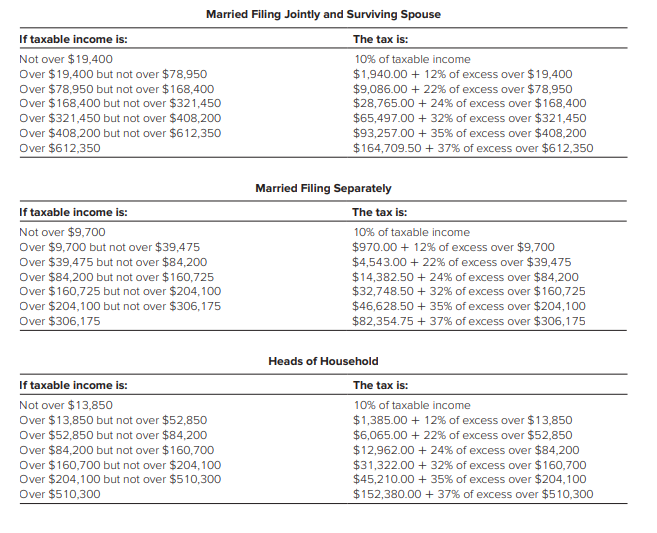

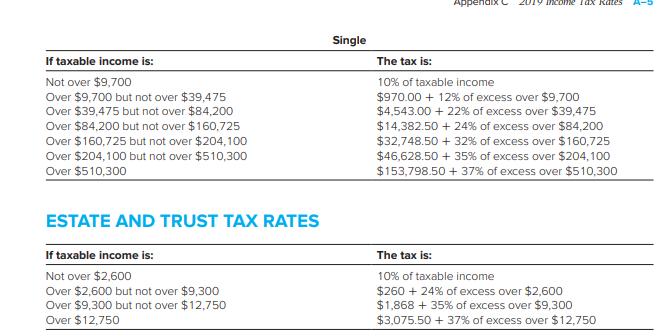

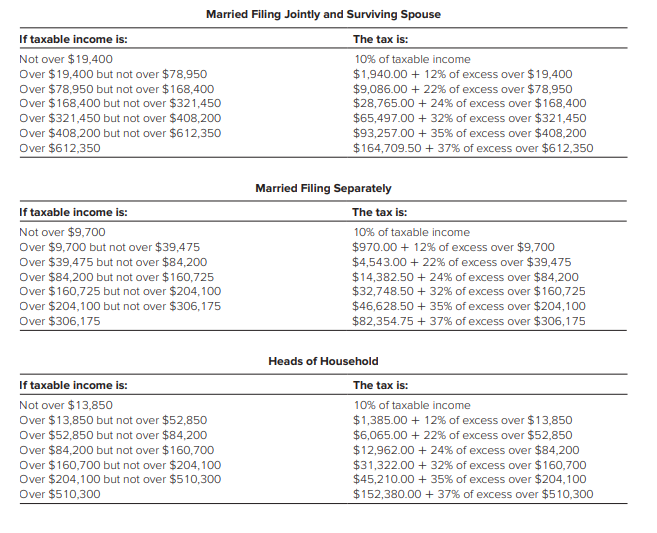

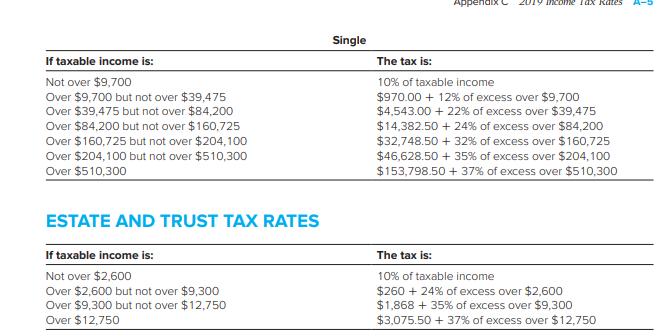

Refer to the individual rate schedules in Appendix C.

A.What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $51,900 taxable income?

B.What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $197,200 taxable income?

C.What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $446,300 taxable income?

Married Filing Jointly and Surviving Spouse If taxable income is: Not over $19,400 Over $19,400 but not over $78,950 Over $78,950 but not over $168,400 Over $ 168,400 but not over $321,450 Over $321,450 but not over $408,200 Over $408,200 but not over $612,350 Over $612,350 The tax is: 10% of taxable income $1,940.00 + 12% of excess over $19,400 $9,086.00 + 22% of excess over $78,950 $28,765.00 + 24% of excess over $168,400 $65,497.00 + 32% of excess over $321,450 $93,257.00 + 35% of excess over $408,200 $164,709.50 + 37% of excess over $612,350 Married Filing Separately If taxable income is: Not over $9,700 Over $9.700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160.725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 The tax is: 10% of taxable income $970.00 + 12% of excess over $9,700 $4,543.00 + 22% of excess over $39,475 $14,382.50 +24% of excess over $84,200 $32,748.50 + 32% of excess over $160,725 $46,628.50 + 35% of excess over $204,100 $82,354.75 + 37% of excess over $306,175 Heads of Household The tax is: If taxable income is: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84,200 Over $84,200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of taxable income $1,385.00 + 12% of excess over $13,850 $6,065.00 + 22% of excess over $52,850 $12,962.00 +24% of excess over $84,200 $31,322.00 + 32% of excess over $160,700 $45,210.00 + 35% of excess over $204,100 $152,380.00 + 37% of excess over $510,300 Appendix L 2019 come Tax Rates A-5 Single The tax is: If taxable income is: Not over $9,700 Over $9,700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of taxable income $970.00 + 12% of excess over $9,700 $4,543.00 + 22% of excess over $39,475 $14,382.50 +24% of excess over $84,200 $32,748.50 + 32% of excess over $160,725 $46,628.50 + 35% of excess over $204,100 $153,798.50 + 37% of excess over $510,300 ESTATE AND TRUST TAX RATES If taxable income is: The tax is: Not over $2,600 Over $2,600 but not over $9,300 Over $9,300 but not over $12,750 Over $12,750 10% of taxable income $260 + 24% of excess over $2,600 $1,868 + 35% of excess over $9,300 $3,075.50 + 37% of excess over $12,750 Married Filing Jointly and Surviving Spouse If taxable income is: Not over $19,400 Over $19,400 but not over $78,950 Over $78,950 but not over $168,400 Over $ 168,400 but not over $321,450 Over $321,450 but not over $408,200 Over $408,200 but not over $612,350 Over $612,350 The tax is: 10% of taxable income $1,940.00 + 12% of excess over $19,400 $9,086.00 + 22% of excess over $78,950 $28,765.00 + 24% of excess over $168,400 $65,497.00 + 32% of excess over $321,450 $93,257.00 + 35% of excess over $408,200 $164,709.50 + 37% of excess over $612,350 Married Filing Separately If taxable income is: Not over $9,700 Over $9.700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160.725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 The tax is: 10% of taxable income $970.00 + 12% of excess over $9,700 $4,543.00 + 22% of excess over $39,475 $14,382.50 +24% of excess over $84,200 $32,748.50 + 32% of excess over $160,725 $46,628.50 + 35% of excess over $204,100 $82,354.75 + 37% of excess over $306,175 Heads of Household The tax is: If taxable income is: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84,200 Over $84,200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of taxable income $1,385.00 + 12% of excess over $13,850 $6,065.00 + 22% of excess over $52,850 $12,962.00 +24% of excess over $84,200 $31,322.00 + 32% of excess over $160,700 $45,210.00 + 35% of excess over $204,100 $152,380.00 + 37% of excess over $510,300 Appendix L 2019 come Tax Rates A-5 Single The tax is: If taxable income is: Not over $9,700 Over $9,700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of taxable income $970.00 + 12% of excess over $9,700 $4,543.00 + 22% of excess over $39,475 $14,382.50 +24% of excess over $84,200 $32,748.50 + 32% of excess over $160,725 $46,628.50 + 35% of excess over $204,100 $153,798.50 + 37% of excess over $510,300 ESTATE AND TRUST TAX RATES If taxable income is: The tax is: Not over $2,600 Over $2,600 but not over $9,300 Over $9,300 but not over $12,750 Over $12,750 10% of taxable income $260 + 24% of excess over $2,600 $1,868 + 35% of excess over $9,300 $3,075.50 + 37% of excess over $12,750