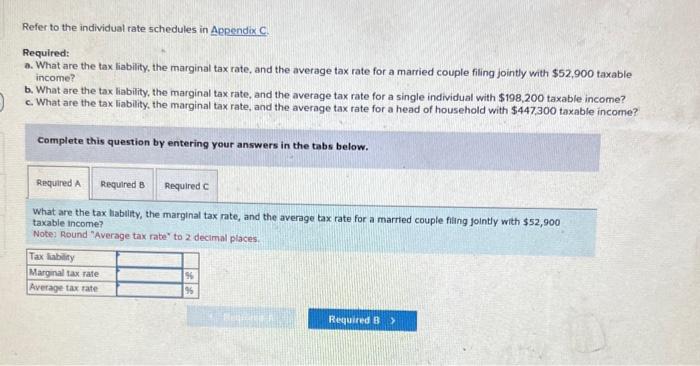

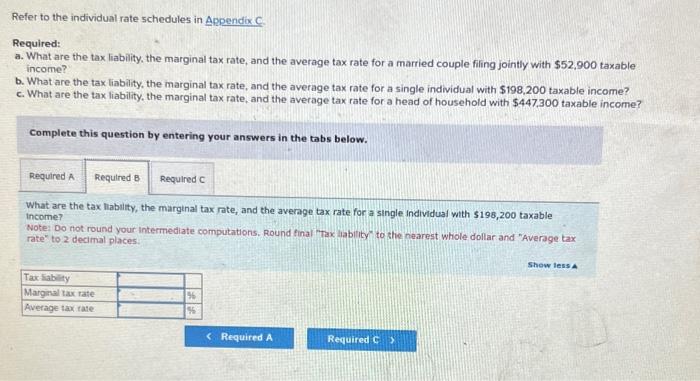

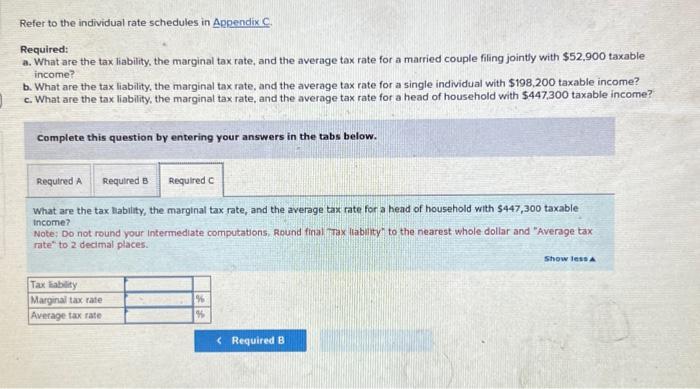

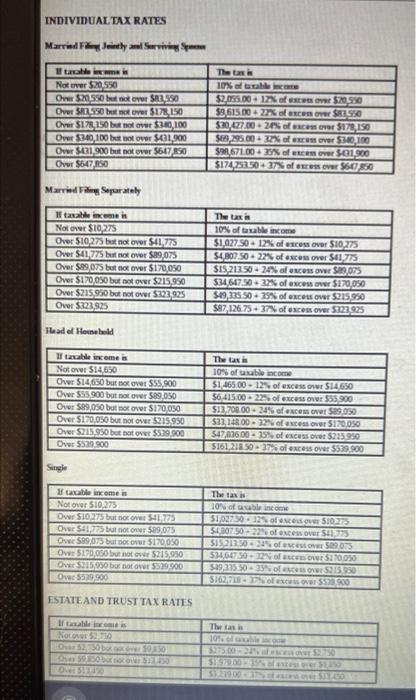

Refer to the individual rate schedules in ppendix. Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $52,900 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $198,200 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $447,300 taxable income? Complete this question by entering your answers in the tabs below. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filling jointly with $52,900 taxable income? Note] Round "Average tax rate" to 2 decimal places. Refer to the individual rate schedules in ppendix.C. Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $52,900 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $198,200 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $447,300 taxable income? Complete this question by entering your answers in the tabs below. What are the tax liability, the marginal tax rate, and the average tax rate for a single individuaf with $198,200 taxable income? Note: Do not round your intermediate computations. Round final "Tax lability" to the nearest whole dollar and "Average tax rate" to 2 decimal places. Refer to the individual rate schedules in Appendix 0 . Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $52,900 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $198,200 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $447,300 taxable income Complete this question by entering your answers in the tabs below. What are the tax lability, the marginal tax rate, and the average tax rate for a head of household with 5447,300 taxable income? Note; Do not round your intermediate computations, Round final Tax llability" to the nearest whole dollar and "Average tax rate" to 2 decimal places. INDIVIDUAL DAX RATES Married Finy Jeachy and Sarwies Syemen Married Frite Soparately Fhead of Henselowd Single FSTATEAND TRUSI TAXRATES