Answered step by step

Verified Expert Solution

Question

1 Approved Answer

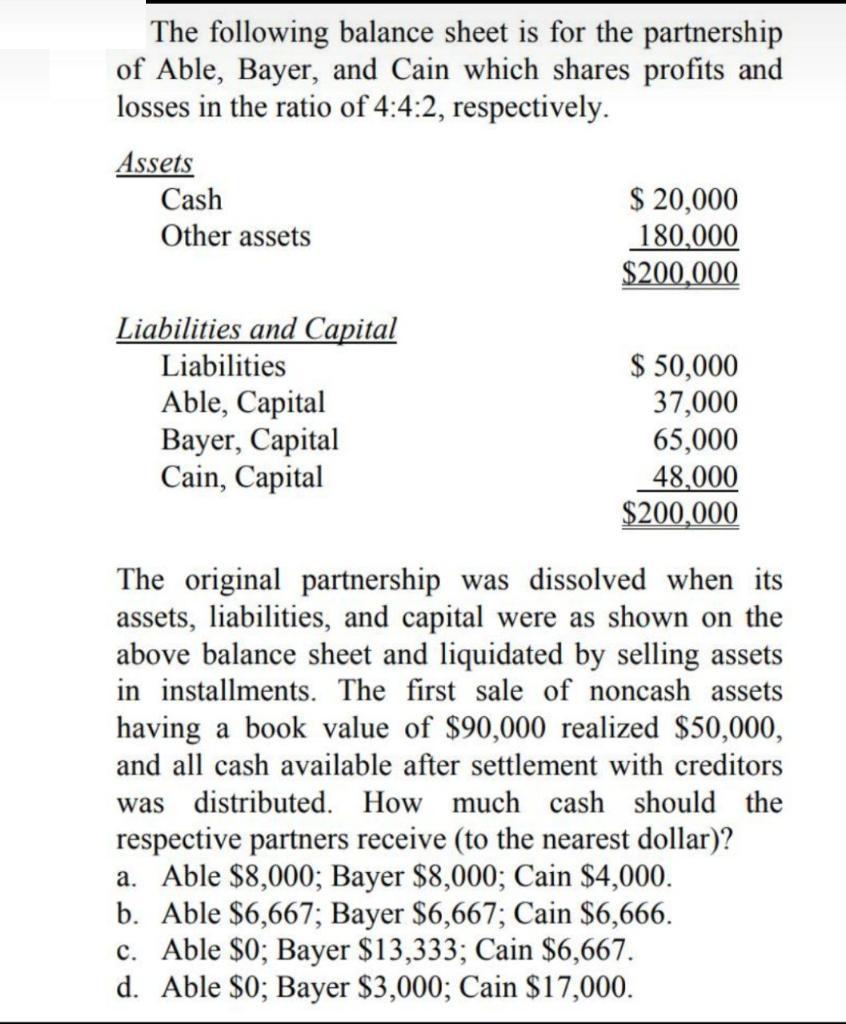

The following balance sheet is for the partnership of Able, Bayer, and Cain which shares profits and losses in the ratio of 4:4:2, respectively.

The following balance sheet is for the partnership of Able, Bayer, and Cain which shares profits and losses in the ratio of 4:4:2, respectively. Assets Cash Other assets Liabilities and Capital Liabilities Able, Capital Bayer, Capital Cain, Capital $ 20,000 180,000 $200,000 $50,000 37,000 65,000 48,000 $200,000 The original partnership was dissolved when its assets, liabilities, and capital were as shown on the above balance sheet and liquidated by selling assets in installments. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How much cash should the respective partners receive (to the nearest dollar)? a. Able $8,000; Bayer $8,000; Cain $4,000. b. Able $6,667; Bayer $6,667; Cain $6,666. c. Able $0; Bayer $13,333; Cain $6,667. d. Able $0; Bayer $3,000; Cain $17,000.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started