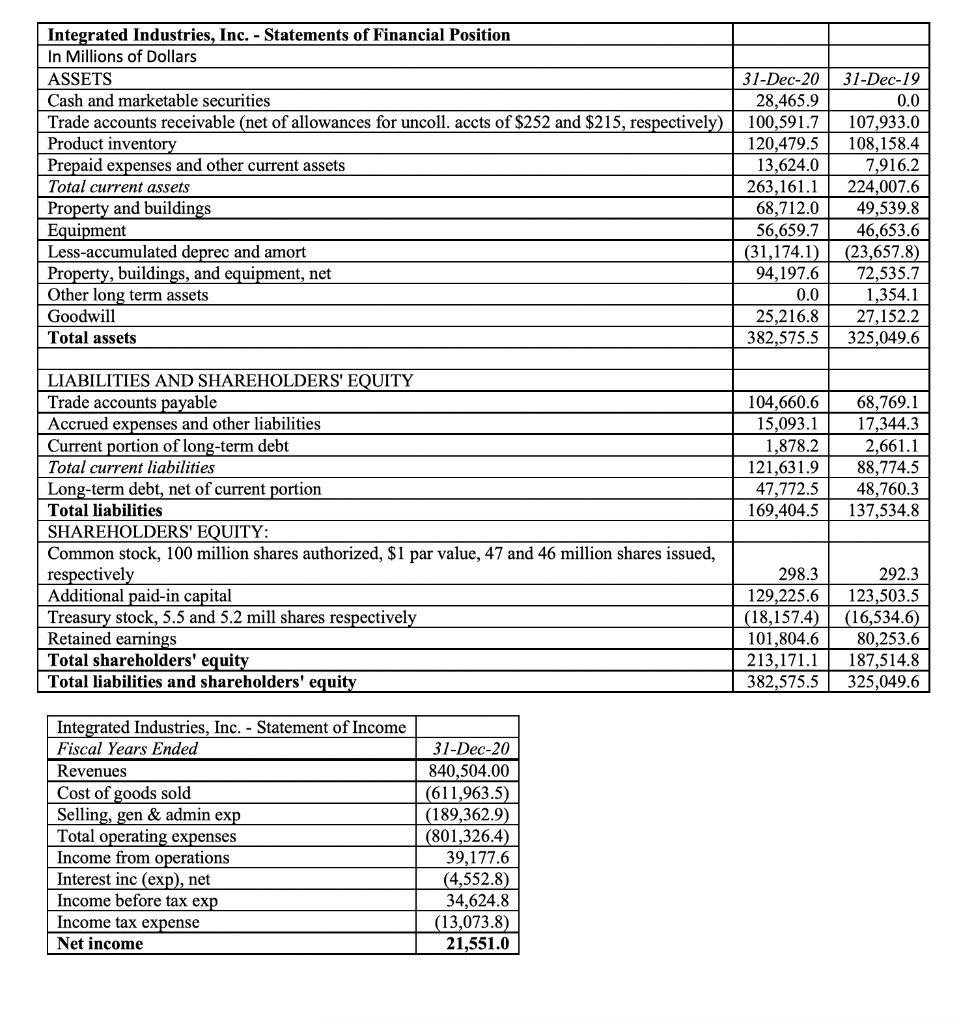

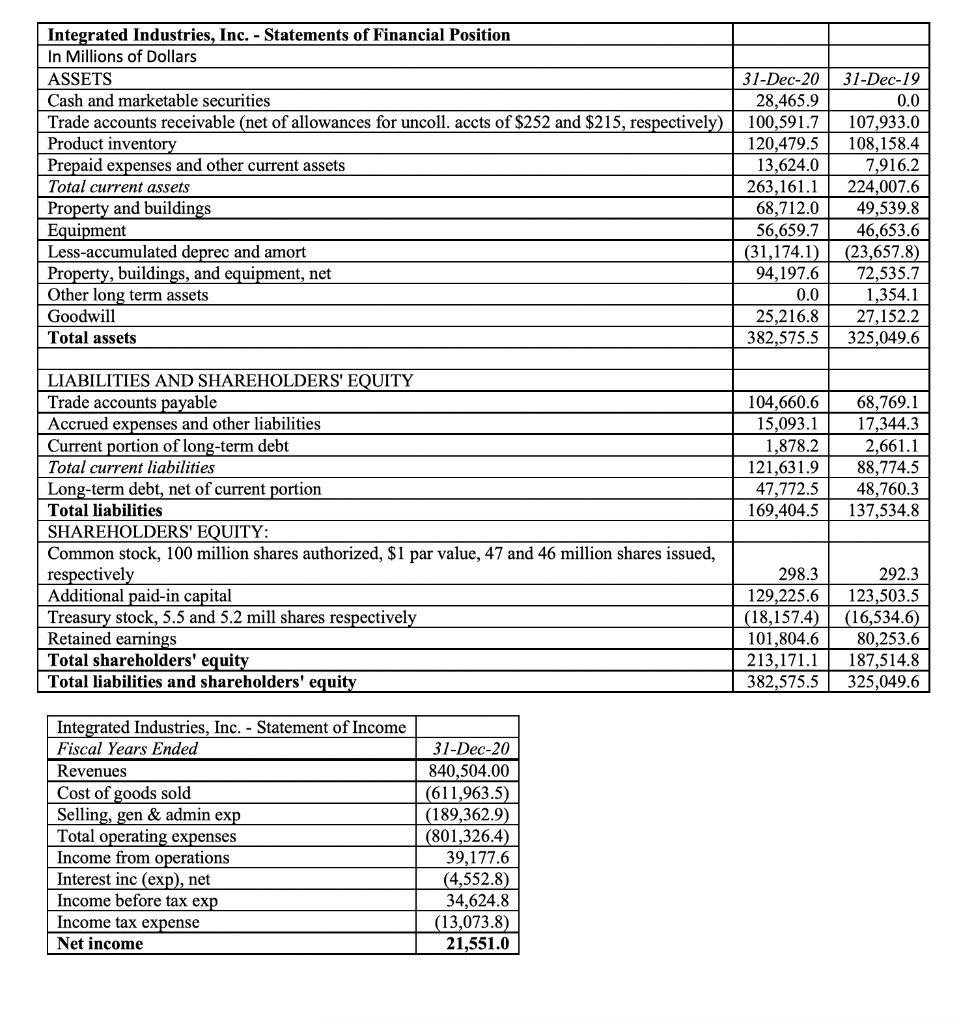

Refer to the information regarding Integrated Industries. Based on the financial statements presented, we can conclude that: a) Integrated Ind recognized no depreciation expense during the year ended December 31, 2020. b) Integrated Ind's property and equipment has a market value of $94,197.6 at December 31, 2020. Integrated Ind purchased equipment costing $10,006.1 during the year ended December 31, 2020. d) The original cost of the property, buildings, and equipment Integrated Ind had in service at December 31, 2020 was $125,371.7. e) None of these answers are correct. Integrated Industries, Inc. - Statements of Financial Position In Millions of Dollars ASSETS Cash and marketable securities Trade accounts receivable (net of allowances for uncoll. accts of $252 and $215, respectively) Product inventory Prepaid expenses and other current assets Total current assets Property and buildings Equipment Less-accumulated deprec and amort Property, buildings, and equipment, net Other long term assets Goodwill Total assets 31-Dec-20 28,465.9 100,591.7 120,479.5 13,624.0 263,161.1 68,712.0 56,659.7 (31,174.1) 94,197.6 0.0 25,216.8 382,575.5 31-Dec-19 0.0 107,933.0 108,158.4 7,916.2 224,007.6 49,539.8 46,653.6 (23,657.8) 72,535.7 1,354.1 27,152.2 325,049.6 104,660.6 15,093.1 1,878.2 121,631.9 47,772.5 169,404.5 68,769.1 17,344.3 2,661.1 88,774.5 48,760.3 137,534.8 LIABILITIES AND SHAREHOLDERS' EQUITY Trade accounts payable Accrued expenses and other liabilities Current portion of long-term debt Total current liabilities Long-term debt, net of current portion Total liabilities SHAREHOLDERS' EQUITY: Common stock, 100 million shares authorized, $1 par value, 47 and 46 million shares issued, respectively Additional paid-in capital Treasury stock, 5.5 and 5.2 mill shares respectively Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 298.3 129,225.6 (18,157.4) 101,804.6 213,171.1 382,575.5 292.3 123,503.5 (16,534.6) 80,253.6 187,514.8 325,049.6 Integrated Industries, Inc. - Statement of Income Fiscal Years Ended Revenues Cost of goods sold Selling, gen & admin exp Total operating expenses Income from operations Interest inc (exp), net Income before tax exp Income tax expense Net income 31-Dec-20 840,504.00 (611,963.5) (189,362.9) (801,326.4) 39,177.6 (4,552.8) 34,624.8 (13,073.8) 21,551.0