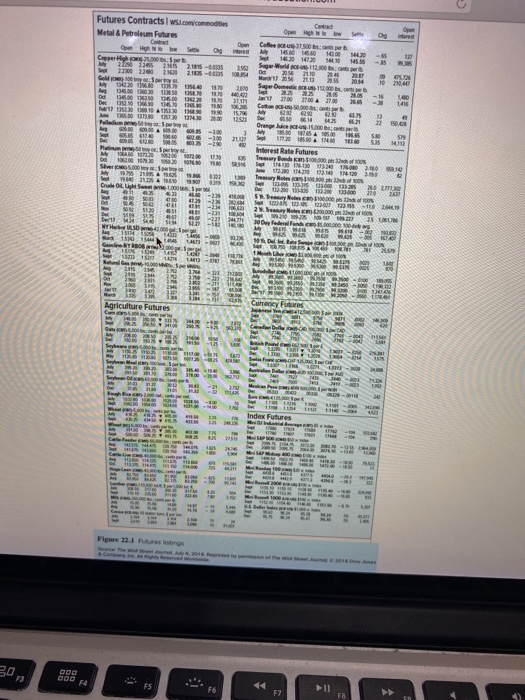

Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 30% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the September maturity contract? (Round your answer to 2 decimal places.) Required margin deposit b. If the September futures price were to increase to 2,089.73. what percentage return would you earn on your net investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment 1 % c. If the September futures price fails by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return on not investment Futures Contracts wi.com/commodities Metal & Petroleum Futures Group - -15 Calle 31 500 16800 Set 130 10 SegWorld 12.00 2015 Sarome 270000 - IN 23 De Orange 50 . ** * -100 2001 10 INGO Interest Rate Futures und 400 nh em 13 Try Dec 13 200 TL by of 135 13301 1238510141 * 0.00 30 Day Federal Fund ur lo ja titulu ts que hi ha !!!! S SS SS 38 ! " Flowers Futures Contracts wi.com/commodities Metal & Petroleum Futures Hi HAN, I AM 5.1 Nika, = = = = HEA Cafe 3500 HAT I HA , = = == - 11. It H. , AtEHIn , we HTTum MI liki lu ! Wi Oy_NA Luis Kom Hi Hi er , EE 553333 s - 11 W IN II Interest Rate Futures The = = = . If HT, THE == = H IN # 1 NA Mak TA IDO III IM- W-MA. all iNo = = = = E A IMAL SE. RFI | sin sis IE 5, IT IS ! - R? == 1 5 !! !!! ,,, 2, Flowe 231 Pres Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 30% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the September maturity contract? (Round your answer to 2 decimal places.) Required margin deposit b. If the September futures price were to increase to 2,089.73. what percentage return would you earn on your net investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment 1 % c. If the September futures price fails by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return on not investment Futures Contracts wi.com/commodities Metal & Petroleum Futures Group - -15 Calle 31 500 16800 Set 130 10 SegWorld 12.00 2015 Sarome 270000 - IN 23 De Orange 50 . ** * -100 2001 10 INGO Interest Rate Futures und 400 nh em 13 Try Dec 13 200 TL by of 135 13301 1238510141 * 0.00 30 Day Federal Fund ur lo ja titulu ts que hi ha !!!! S SS SS 38 ! " Flowers Futures Contracts wi.com/commodities Metal & Petroleum Futures Hi HAN, I AM 5.1 Nika, = = = = HEA Cafe 3500 HAT I HA , = = == - 11. It H. , AtEHIn , we HTTum MI liki lu ! Wi Oy_NA Luis Kom Hi Hi er , EE 553333 s - 11 W IN II Interest Rate Futures The = = = . If HT, THE == = H IN # 1 NA Mak TA IDO III IM- W-MA. all iNo = = = = E A IMAL SE. RFI | sin sis IE 5, IT IS ! - R? == 1 5 !! !!! ,,, 2, Flowe 231 Pres