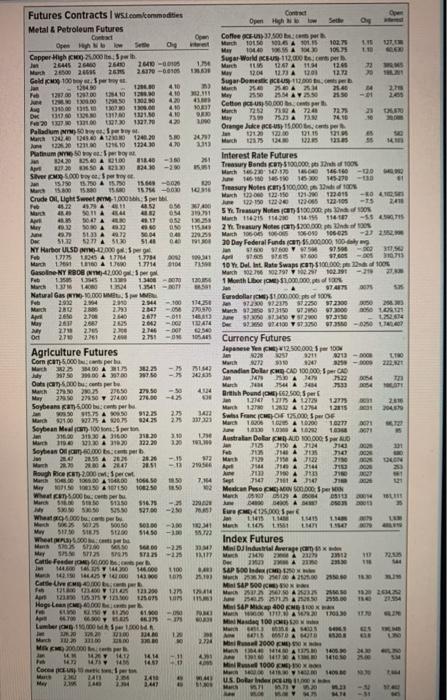

Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 11% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the March maturity contract? (Round your answer to the nearest whole dollar.) Required margin deposit b. If the March futures price increases to 2598.00, what percentage return will you earn on your investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment c. If the March futures price falis by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment do BE 8 !! RR15 8 i BE IK w DEN GE E SER 390 Futures Contracts wsi.com commodities Om. HANK Metal & Petroleum Futures Com Coffee 37.800 per 0 101566 A 101.15 102.7 11 May 10440 AM 1067 10 Capper High R. Swth 2.6445 26 Sugar World REUS 119,000 per 26410 20-0100 TES 12:57 A 1114 2500 24655 26 26170-00105 MI 12.04 123A 10 127 Gel 100 Sugar Domestik.com 131450 410 2 MOM 21.40 14 Feb 127.000 0 12. 410 My AV.50 2150 100.00 SONO 420 . A 230 100.00 410 Cetion S0.000.ph 16.11. 22 4.10 A 724 DK 72 May 101 73 F 20 10 753 A 7 7610 Palladium N. Orange Jake CESS.C.pl 10120 5. Mart 20.0 ALMO 124020 2012 10115 65 122.5 ne 201610174 40 13 Platinum 50 operboy. 300.00.00 Interest Rate Futures 16.40 Apr 20 SOA Treasury Bonde 100.000,00 124 10-20 Silver M.000 March 160 161 146.160-00 157503100 & 15. ( 16500 120 - 15.000 145.180 15150 5800 15.754-600 Tessury Notes 100.000,00 Max 90 2100922-015 -ROL Crude Oil, Light Sweet YM-1000: Sperbal re 45.12 192065 12210 228 122105 -15 241 M 11. 04 5 Y. Treasury Note 100.000 AM 135 000 02 March 1142151114114 -55 Mey SA es 2.50 2 treasury Note 100.000 S4272 30.04 04 22023 March 2010 1600 10602 Dw SR 27 500 51.4 00 1910 30 Day Federal Funds a $5.000.000, 100 g NY Harbor ULSD IN 10.000 peal 2005 9700 - 31, 1.7775 A 14 1.774 2.65 7500 37.608 16 & 10 17714 0104 10 Delint. Rate Swap a $100.000 1000 Gasoline NY RROBNYM-42.000 March 2796 297 102.9 -21 1 134000 1205 1 Month Liber 1.000.000 100 24 1.3541-071 50 9747 Natural Gas NTM 10.000 MM Erdollar) 100.000 per 100% Pub 2. 2.944 100 114,5 280 57.29721192230972300 02 2.790 2.04-058 Much 920 731 730 73000 A 26 060 R11 2.700 2671 -001 1483 701300120173430 LH4 May 25 2012 TATA DE 99 72100 730 730 -030 TALO MY 27 2. 2146 50 Oci 2.70 2761 21 2.750 ON 1000 Currency Futures Agriculture Futures Japanese Yen 12.500.000 SOST LTO Corn ICT 5.000 perlu 12 10 20-00 March 2015 3223 222221 750 100 Canadian Dollar CAD 100 000 30 MOS MAN 1122 Outlan.com 04 March MAN 272 7544 2650 22.50 -50 Mary O 250 214.00 British Pound 2.500 270.00 IN A 129 12 2016 Soybean 5.000 both perbu Man 131 12 1 2015 SO 2.5 91225 BA ON Swiss Franc CHF 1.000 per of March 2010092275 A 0.75 634.25 27 337323 March 120 10000 0021 Soybean Meal) 100 on Spo 103 WA 316.30 311 31600 16:30 310 UN 12.20 119. 10.30 Australian Dollar AUD 100.000 PRO 10 TL 1904 Seyran Olum.000 714 715 no 20.55 A 2011 2020 -15 12 M 9120 11. 122 27 20:51 21 Apuli 3144 10 A 1140 00 Rough 2.000 pero 773 1 MH 10.00 A 100 106. 1 fest 710 714 Mey 1050 10750 1082.50 Mexican Peso CHEM. SON WheT.000 Mart 51350 $16.95 - D BA N 050 SOS $21.00-21 What A DO Eure 125.000 11415 14 11415 00 300-200 141 Lan Me LIO 1951 317 50 51 st $14.50-1 Weat. Index Futures May Mini Din Average SS123 SAS STA -135 MARS 20 Cattle Feeder Dec 144.0 140 16000 100 MAS SAP LOM 143 3.103 wich 75 1.00 2. Case UCM Mia SAPO 0 21200 12 9414 March US 250 13.28 26 B SUR 25.00 Hags LC. MS&P M400 KN 4100 M 4.700 600 11933 LO1000M TROR Min Nan 100 SENS ES 0 ASTOA 5203 2011 2.724 M7000 CM MA M200.000 4 M14 1400 UM 14 1412 1414 11 san 11411 160 1457 Cocker 1000CM Mate 140 ZA SH 1.6 14 1 2014 2411 US Dole TI 151843 AN NE BCS INI 56 G W DE DO DO DIE DE 7. 20 M ERTE TIME W curl EN SES ME BE WI Bi Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 11% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the March maturity contract? (Round your answer to the nearest whole dollar.) Required margin deposit b. If the March futures price increases to 2598.00, what percentage return will you earn on your investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment c. If the March futures price falis by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment do BE 8 !! RR15 8 i BE IK w DEN GE E SER 390 Futures Contracts wsi.com commodities Om. HANK Metal & Petroleum Futures Com Coffee 37.800 per 0 101566 A 101.15 102.7 11 May 10440 AM 1067 10 Capper High R. Swth 2.6445 26 Sugar World REUS 119,000 per 26410 20-0100 TES 12:57 A 1114 2500 24655 26 26170-00105 MI 12.04 123A 10 127 Gel 100 Sugar Domestik.com 131450 410 2 MOM 21.40 14 Feb 127.000 0 12. 410 My AV.50 2150 100.00 SONO 420 . A 230 100.00 410 Cetion S0.000.ph 16.11. 22 4.10 A 724 DK 72 May 101 73 F 20 10 753 A 7 7610 Palladium N. Orange Jake CESS.C.pl 10120 5. Mart 20.0 ALMO 124020 2012 10115 65 122.5 ne 201610174 40 13 Platinum 50 operboy. 300.00.00 Interest Rate Futures 16.40 Apr 20 SOA Treasury Bonde 100.000,00 124 10-20 Silver M.000 March 160 161 146.160-00 157503100 & 15. ( 16500 120 - 15.000 145.180 15150 5800 15.754-600 Tessury Notes 100.000,00 Max 90 2100922-015 -ROL Crude Oil, Light Sweet YM-1000: Sperbal re 45.12 192065 12210 228 122105 -15 241 M 11. 04 5 Y. Treasury Note 100.000 AM 135 000 02 March 1142151114114 -55 Mey SA es 2.50 2 treasury Note 100.000 S4272 30.04 04 22023 March 2010 1600 10602 Dw SR 27 500 51.4 00 1910 30 Day Federal Funds a $5.000.000, 100 g NY Harbor ULSD IN 10.000 peal 2005 9700 - 31, 1.7775 A 14 1.774 2.65 7500 37.608 16 & 10 17714 0104 10 Delint. Rate Swap a $100.000 1000 Gasoline NY RROBNYM-42.000 March 2796 297 102.9 -21 1 134000 1205 1 Month Liber 1.000.000 100 24 1.3541-071 50 9747 Natural Gas NTM 10.000 MM Erdollar) 100.000 per 100% Pub 2. 2.944 100 114,5 280 57.29721192230972300 02 2.790 2.04-058 Much 920 731 730 73000 A 26 060 R11 2.700 2671 -001 1483 701300120173430 LH4 May 25 2012 TATA DE 99 72100 730 730 -030 TALO MY 27 2. 2146 50 Oci 2.70 2761 21 2.750 ON 1000 Currency Futures Agriculture Futures Japanese Yen 12.500.000 SOST LTO Corn ICT 5.000 perlu 12 10 20-00 March 2015 3223 222221 750 100 Canadian Dollar CAD 100 000 30 MOS MAN 1122 Outlan.com 04 March MAN 272 7544 2650 22.50 -50 Mary O 250 214.00 British Pound 2.500 270.00 IN A 129 12 2016 Soybean 5.000 both perbu Man 131 12 1 2015 SO 2.5 91225 BA ON Swiss Franc CHF 1.000 per of March 2010092275 A 0.75 634.25 27 337323 March 120 10000 0021 Soybean Meal) 100 on Spo 103 WA 316.30 311 31600 16:30 310 UN 12.20 119. 10.30 Australian Dollar AUD 100.000 PRO 10 TL 1904 Seyran Olum.000 714 715 no 20.55 A 2011 2020 -15 12 M 9120 11. 122 27 20:51 21 Apuli 3144 10 A 1140 00 Rough 2.000 pero 773 1 MH 10.00 A 100 106. 1 fest 710 714 Mey 1050 10750 1082.50 Mexican Peso CHEM. SON WheT.000 Mart 51350 $16.95 - D BA N 050 SOS $21.00-21 What A DO Eure 125.000 11415 14 11415 00 300-200 141 Lan Me LIO 1951 317 50 51 st $14.50-1 Weat. Index Futures May Mini Din Average SS123 SAS STA -135 MARS 20 Cattle Feeder Dec 144.0 140 16000 100 MAS SAP LOM 143 3.103 wich 75 1.00 2. Case UCM Mia SAPO 0 21200 12 9414 March US 250 13.28 26 B SUR 25.00 Hags LC. MS&P M400 KN 4100 M 4.700 600 11933 LO1000M TROR Min Nan 100 SENS ES 0 ASTOA 5203 2011 2.724 M7000 CM MA M200.000 4 M14 1400 UM 14 1412 1414 11 san 11411 160 1457 Cocker 1000CM Mate 140 ZA SH 1.6 14 1 2014 2411 US Dole TI 151843 AN NE BCS INI 56 G W DE DO DO DIE DE 7. 20 M ERTE TIME W curl EN SES ME BE WI Bi