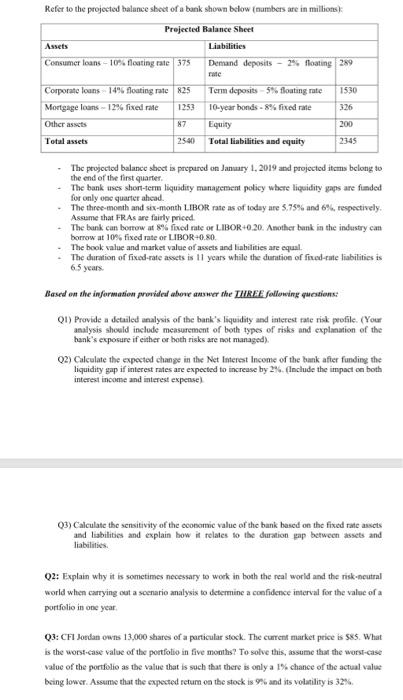

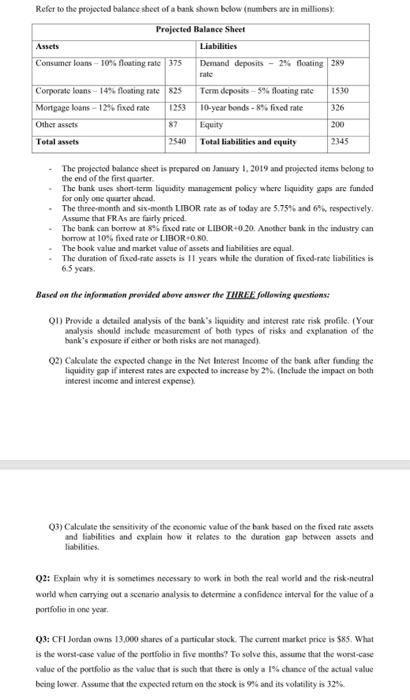

Refer to the projected balance sheet of a bank shown below (numbers are in millions): Prejected Balance Sheet Assets Liabilities Consumer loans -10% floating rate 375 Demand deposits - 2% floating 289 rate Corporate loans 14% floating rate 825 Term deposits 5% floating rate 1530 Mortgage loans12% fixed rate 1253 10-year bonds - 8% fixed rate 326 Other assets Equity 200 Total assets 2540 Total liabilities and equity 2145 The projected balance sheet is prepared on January 1, 2019 and projected items belong so the end of the first quarter. The bank uses short-term liquidity management policy where liquidity gaps are funded for only one quarter ahead. The three month and six-month LIBOR rate as of today are 5,75% and 6%, respectively. Assume that FRAs are fairly priced. The bank can borrow at 8% fixed rate or LIBOR+0:20. Another bank in the industry can borrow at 10% fixed rate or LIBOR-0.80. The book value and market value of assets and liabilities are equal The duration of fixed-rate assets is 11 years while the duration of fixed-rate liabilities is 65 years Based on the information provided above answer the THREE following questions: QI) Provide a detailed analysis of the bank's liquidity and interest rate risk profile. (Your analysis should include measurement of both types of risks and explanation of the hank's exposure if either or both risks are not managed). 02) Calculate the expected change in the Net Interest Income of the bank after funding the liquidity gap if interest rates are expected to increase by 2% (Include the impact on both interest income and interest expense) 03) Calculate the sensitivity of the cometnic value of the bank based on the fixed rate assets and liabilities and explain how it relates to the duration gap between assets and liabilities Q2: Explain why it is sometimes necessary to work in both the real world and the risk-neutral world when carrying out a scenario analysis to determine a confidence interval for the value of a portfolio in one year 03: CFI Jordan owns 13,000 shares of a particular stock. The current market price is $85. What is the worst-case value of the portfolio in five months? To solve this, assume that the worst-case value of the portfolio as the value that is such that there is only a % chance of the actual value being lower. Assume that the expected retum on the stock is 9% and its volatility is 32% Refer to the projected balance sheet of a bank shown below (numbers are in millions): Projected Balance Sheet Assets Liabilities Consumer loans--10% floating rate 375 Demand deposits - 2% floating 289 rate 1530 Term deposits -5% floating rate 10-year bonds - 8% fixed rate 326 Corporate loans -14% floating rate 825 Mortgage loans -12% fixed rate 1253 Other assets 87 Total assets 2540 Equity 200 Total liabilities and equity 2345 . The projected balance sheet is prepared on January 1, 2019 and projected items belong to the end of the first quarter The bank uses short-term liquidity management policy where liquidity gaps are funded for only one quarter acad. The three-month and six-month LIBOR rate as of today are 5.759 and 6%, respectively Assume that FR As are fairly priced The bank can borrow a fixed rate or LIBOR-0.20. Another bank in the industry can borrow at 10% fixed rate or LIBOR+0.80. The book value and market value of assets and liabilities are equal The duration of fixed-rate assets is 11 years while the duration of fixed-rate liabilities is 6.5 years Based on the information provided above answer the THREE following questions OD) Provide a detailed analysis of the bank's liquidity and interest rate risk profile. (Your analysis should include measurement of both types of risks and explanation of the bank's exposure if either or both risks are not managed) Q2) Calculate the expected change in the Net Interest Income of the bank after funding the liquidity gap if interest rates are expected to increase by 2% (Include the impact on both interest income and interest expense) 03) Calculate the sensitivity of the conomic value of the bank based on the fired rate assets and lisbilities and explain how it relates to the duration gap between assets and liabilities Q2: Explain why it is sometimes necessary to work in both the real world and the risk-neutral world when carrying out a scenario analysis to determine a confidence interval for the value of a portfolio in one year Q3: CFI Jordan owns 13,000 shares of a particular stock. The current market price is $85. What is the worst-case value of the portfolio in five months? To solve this, assume that the worst case value of the portfolio as the value that is such that there is only a 1% chance of the actual value being lower. Assume that the expected retum en the stock is 9% and its volatility is 32% Refer to the projected balance sheet of a bank shown below (numbers are in millions): Prejected Balance Sheet Assets Liabilities Consumer loans -10% floating rate 375 Demand deposits - 2% floating 289 rate Corporate loans 14% floating rate 825 Term deposits 5% floating rate 1530 Mortgage loans12% fixed rate 1253 10-year bonds - 8% fixed rate 326 Other assets Equity 200 Total assets 2540 Total liabilities and equity 2145 The projected balance sheet is prepared on January 1, 2019 and projected items belong so the end of the first quarter. The bank uses short-term liquidity management policy where liquidity gaps are funded for only one quarter ahead. The three month and six-month LIBOR rate as of today are 5,75% and 6%, respectively. Assume that FRAs are fairly priced. The bank can borrow at 8% fixed rate or LIBOR+0:20. Another bank in the industry can borrow at 10% fixed rate or LIBOR-0.80. The book value and market value of assets and liabilities are equal The duration of fixed-rate assets is 11 years while the duration of fixed-rate liabilities is 65 years Based on the information provided above answer the THREE following questions: QI) Provide a detailed analysis of the bank's liquidity and interest rate risk profile. (Your analysis should include measurement of both types of risks and explanation of the hank's exposure if either or both risks are not managed). 02) Calculate the expected change in the Net Interest Income of the bank after funding the liquidity gap if interest rates are expected to increase by 2% (Include the impact on both interest income and interest expense) 03) Calculate the sensitivity of the cometnic value of the bank based on the fixed rate assets and liabilities and explain how it relates to the duration gap between assets and liabilities Q2: Explain why it is sometimes necessary to work in both the real world and the risk-neutral world when carrying out a scenario analysis to determine a confidence interval for the value of a portfolio in one year 03: CFI Jordan owns 13,000 shares of a particular stock. The current market price is $85. What is the worst-case value of the portfolio in five months? To solve this, assume that the worst-case value of the portfolio as the value that is such that there is only a % chance of the actual value being lower. Assume that the expected retum on the stock is 9% and its volatility is 32% Refer to the projected balance sheet of a bank shown below (numbers are in millions): Projected Balance Sheet Assets Liabilities Consumer loans--10% floating rate 375 Demand deposits - 2% floating 289 rate 1530 Term deposits -5% floating rate 10-year bonds - 8% fixed rate 326 Corporate loans -14% floating rate 825 Mortgage loans -12% fixed rate 1253 Other assets 87 Total assets 2540 Equity 200 Total liabilities and equity 2345 . The projected balance sheet is prepared on January 1, 2019 and projected items belong to the end of the first quarter The bank uses short-term liquidity management policy where liquidity gaps are funded for only one quarter acad. The three-month and six-month LIBOR rate as of today are 5.759 and 6%, respectively Assume that FR As are fairly priced The bank can borrow a fixed rate or LIBOR-0.20. Another bank in the industry can borrow at 10% fixed rate or LIBOR+0.80. The book value and market value of assets and liabilities are equal The duration of fixed-rate assets is 11 years while the duration of fixed-rate liabilities is 6.5 years Based on the information provided above answer the THREE following questions OD) Provide a detailed analysis of the bank's liquidity and interest rate risk profile. (Your analysis should include measurement of both types of risks and explanation of the bank's exposure if either or both risks are not managed) Q2) Calculate the expected change in the Net Interest Income of the bank after funding the liquidity gap if interest rates are expected to increase by 2% (Include the impact on both interest income and interest expense) 03) Calculate the sensitivity of the conomic value of the bank based on the fired rate assets and lisbilities and explain how it relates to the duration gap between assets and liabilities Q2: Explain why it is sometimes necessary to work in both the real world and the risk-neutral world when carrying out a scenario analysis to determine a confidence interval for the value of a portfolio in one year Q3: CFI Jordan owns 13,000 shares of a particular stock. The current market price is $85. What is the worst-case value of the portfolio in five months? To solve this, assume that the worst case value of the portfolio as the value that is such that there is only a 1% chance of the actual value being lower. Assume that the expected retum en the stock is 9% and its volatility is 32%