Question

Refer to the Racquetball Racket case. From the corresponding exercise in Chapter 3, review the design of a spreadsheet for this problem. a. Develop a

Refer to the Racquetball Racket case. From the corresponding exercise in Chapter 3, review the design of a spreadsheet for this problem.

a. Develop a base case. You may create any data you need for this purpose. Why is this base case appropriate for this situation?

b. Perform appropriate sensitivity analysis. Which parameters have the most significant impact on the results? Can you find applications for the Parametric Sensitivity, Tornado

Chart, and Scenario Manager tools?

c. Identify applications of Goal Seek in this situation. (For example, what percentage of the market must they achieve to break even on their investment?)

d. Identify potential applications of optimization in this case.

e. Identify potential applications of simulation in this case.

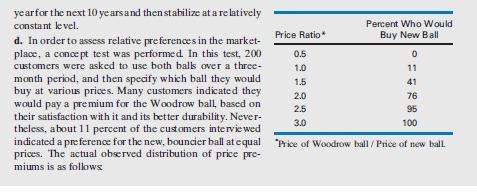

THE RACQUETBALL RACKET It is early in 2000, and a friend of yours has invented a new manufacturing process for producing racquetballs. The rate and start producing racquetballs in a year. resulting high-quality ball has more bounce, but slightly less durability, than the currently popular high-quality ball, which is manufactured by Woodrow, Ltd. The better the analysis for him. He has already hired a well-known market players, the more they tend to prefer a lively ball. The research fim, Market Analysis, Ltd., to do some data primary advantage of the new ball is that it can be manu- gathering and preliminary market analysis. The key factured much more inexpensively than the existing ball. bank, he can borrow the capital at about a 10 percent interest Your frie nd has offered to make you a partner in the business and has asked you in return to perform a market elements of their final report are given below. Your problem is to determine how the new balls should Current estimates are that full variablecostsfor the new ball are $0.52 per ball as compared to $0.95 for the existing ball. be priced, what the resultant market shares will be, and (Variable costs include all costs of production, marketing, whether the manufacturing plant is a good investment. Your and distribution that varywith output. It excludes the cost of friend is especially concerned about the risks involved and plant and equipment, overhead, etc.) Because the new process is unlike well-known production appears to be. He would like you to make a formal processes, the only reasonable alternative is to build a man- presentation of your analysis. ufacturing plant specifically for producing these balk. Your friend has cakulated that this would require $4-6 million of "Adapted from a class assi gnment de veloped by Dick Smallwood initial capital. He figuresthat if he can make a goodcase to the would like some measures of bow solid the investment and Peter Morris. RACQUETBALL MARKET ANALYSIS Market Analysis, Ltd. January 20, 2000 a. The market forthistype of high-quality balliscurrently 1987 dominated by a single major competitor, Woodrow, Ltd. Woodrow specializes in manuf acturing balls for all types of 1989 sports. It has been the only seller of high-quality racquet- balk since the late 1970s. Itscurrent price to ret ail outlets is $1.25 perball (theretail mark up istypically 100 percent, so these bals retail around $2.50 cach, or $5.00for the typical pack of two). b. Historical data on the number of people playing the sport, the average retail price of balls, and the (esti- mated) total sales of balls is given in the folowing table: 655 $1.80 6.506 1988 700 $1.90 6.820 730 $1.90 7.161 1990 762 $1.90 7.895 1991 812 $2.00 7.895 1992 831 $2.20 8.224 1993 877 $2.45 8.584 1994 931 $2.45 9.026 1995 967 $2.60 9.491 1996 1,020 $2.55 9.996 1997 1,077 $2.50 10.465 1998 1,139 $2.50 10.981 Number Players (Thousands) Retail Price (per ball) Balls Sold (millions) Year a According to industry trade association projections the total number of players will grow about 10 percent a 1986 600 $1.75 5.932 1986 635 $1.75 6.229

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

New Microsoft Excel Worksheet Microsoft Excel Product Activation Failed File Home Insert Page Layout ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started