Answered step by step

Verified Expert Solution

Question

1 Approved Answer

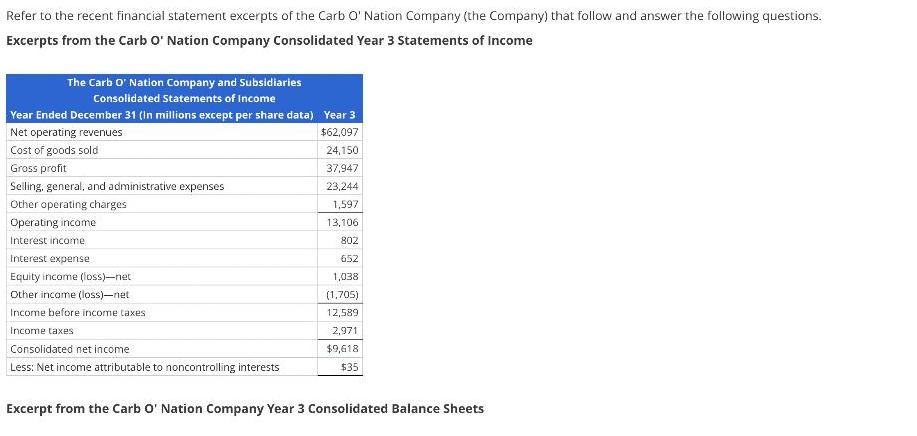

Refer to the recent financial statement excerpts of the Carb O' Nation Company (the Company) that follow and answer the following questions. Excerpts from

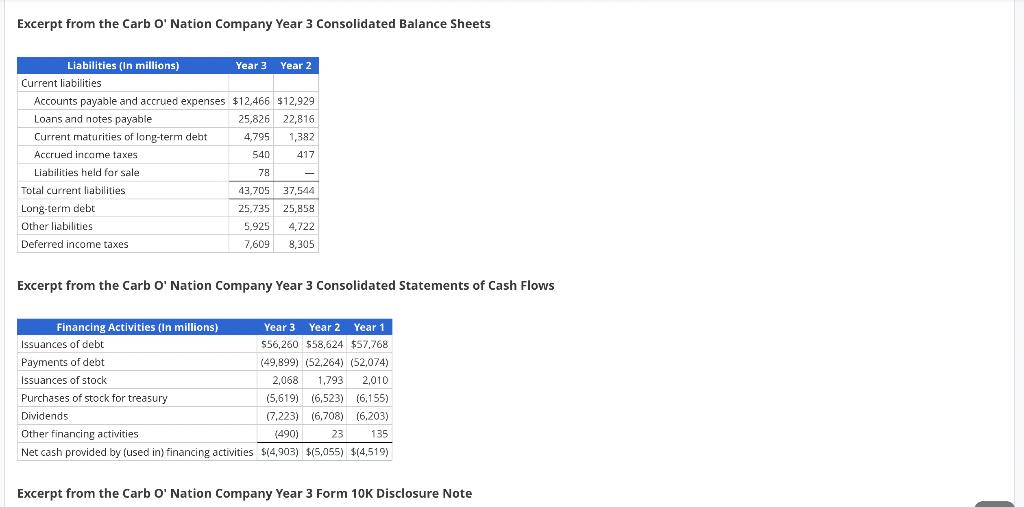

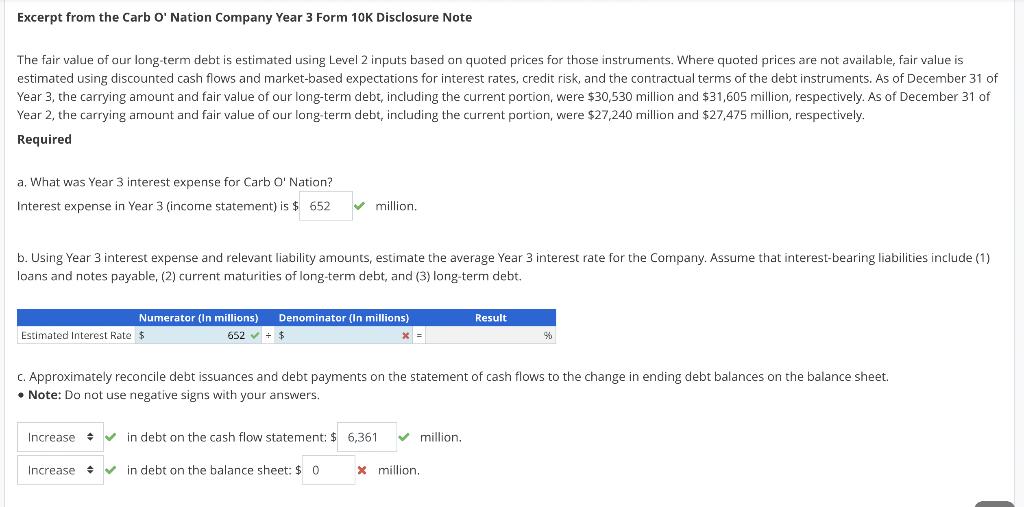

Refer to the recent financial statement excerpts of the Carb O' Nation Company (the Company) that follow and answer the following questions. Excerpts from the Carb O' Nation Company Consolidated Year 3 Statements of Income The Carb O' Nation Company and Subsidiaries Consolidated Statements of Income Year Ended December 31 (In millions except per share data) Net operating revenues Cost of goods sold Gross profit Selling, general, and administrative expenses Other operating charges Operating income Interest income Interest expense Equity income (loss)-net Other income (loss)-net Income before income taxes Income taxes Consolidated net income Less: Net income attributable to noncontrolling interests Year 3 $62,097 24,150 37,947 23,244 1,597 13,106 802 652 1,038 (1,705) 12,589 2,971 $9,618 $35 Excerpt from the Carb O' Nation Company Year 3 Consolidated Balance Sheets Excerpt from the Carb O' Nation Company Year 3 Consolidated Balance Sheets Liabilities (In millions) Current liabilities Accounts payable and accrued expenses $12,466 $12,929 Loans and notes payable 25,826 22,816 Current maturities of long-term debt 4,795 1,382 540 417 78 Accrued income taxes Liabilities held for sale Total current liabilities. Long-term debt Other liabilities Deferred income taxes Year 3 Year 2 Financing Activities (In millions) 43,705 37,544 25,735 25,858 Excerpt from the Carb O' Nation Company Year 3 Consolidated Statements of Cash Flows Issuances of debt Payments of debt. Issuances of stock Purchases of stock for treasury Dividends 5,925 4,722 7,609 8,305 Year 3 Year 2 Year 1 $56,250 $58,624 $57,768 (49,899) (52,264) (52,074) 2,068 1,793 2,010 (5,619) (6,523) (6,155) (7,223) (6,708) (6,203) (490) 23 135 Other financing activities Net cash provided by (used in) financing activities $(4,903) $(5,055) $(4,519) Excerpt from the Carb O' Nation Company Year 3 Form 10K Disclosure Note Excerpt from the Carb O' Nation Company Year 3 Form 10K Disclosure Note The fair value of our long-term debt is estimated using Level 2 inputs based on quoted prices for those instruments. Where quoted prices are not available, fair value is estimated using discounted cash flows and market-based expectations for interest rates, credit risk, and the contractual terms of the debt instruments. As of December 31 of Year 3, the carrying amount and fair value of our long-term debt, including the current portion, were $30,530 million and $31,605 million, respectively. As of December 31 of Year 2, the carrying amount and fair value of our long-term debt, including the current portion, were $27,240 million and $27,475 million, respectively. Required a. What was Year 3 interest expense for Carb O' Nation? Interest expense in Year 3 (income statement) is $ 652 b. Using Year 3 interest expense and relevant liability amounts, estimate the average Year 3 interest rate for the Company. Assume that interest-bearing liabilities include (1) loans and notes payable, (2) current maturities of long-term debt, and (3) long-term debt. Numerator (In millions) Denominator (In millions) Estimated Interest Rate $ 652 $ + million. Increase Increase x = c. Approximately reconcile debt issuances and debt payments on the statement of cash flows to the change in ending debt balances on the balance sheet. Note: Do not use negative signs with your answers. in debt on the balance sheet: $ 0 in debt on the cash flow statement: $ 6,361 million. Result x million. 96

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Interest rate An interest rate is usually represented in percentage form is a factor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started