Answered step by step

Verified Expert Solution

Question

1 Approved Answer

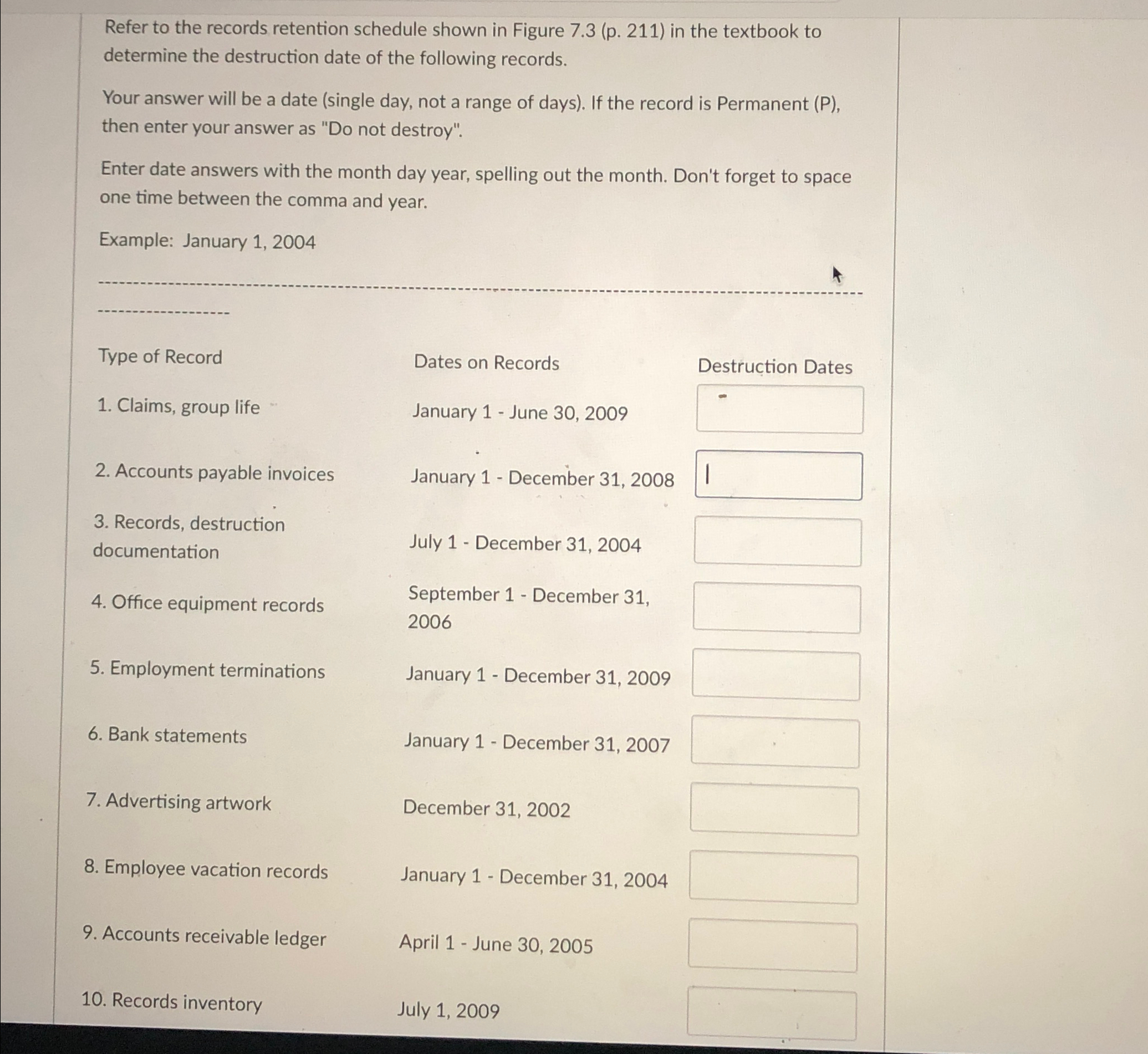

Refer to the records retention schedule shown in Figure 7.3 (p. 211) in the textbook to determine the destruction date of the following records.

Refer to the records retention schedule shown in Figure 7.3 (p. 211) in the textbook to determine the destruction date of the following records. Your answer will be a date (single day, not a range of days). If the record is Permanent (P), then enter your answer as "Do not destroy". Enter date answers with the month day year, spelling out the month. Don't forget to space one time between the comma and year. Example: January 1, 2004 Type of Record 1. Claims, group life Dates on Records Destruction Dates January 1 - June 30, 2009 2. Accounts payable invoices 3. Records, destruction documentation 4. Office equipment records 5. Employment terminations January 1 - December 31, 2008 July 1 December 31, 2004 September 1 - December 31, 2006 January 1 - December 31, 2009 6. Bank statements 7. Advertising artwork 8. Employee vacation records 9. Accounts receivable ledger January 1 - December 31, 2007 December 31, 2002 January 1 - December 31, 2004 April 1 - June 30, 2005 10. Records inventory July 1, 2009

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Claims group life January 1June 30 22009 June 30 2014 2 Accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started