Refer to the same notes as in the previous question (i.e., the 5.30% notes due 2025). Calculate the total cash that would be paid at maturity (Use semi-annual calculations).

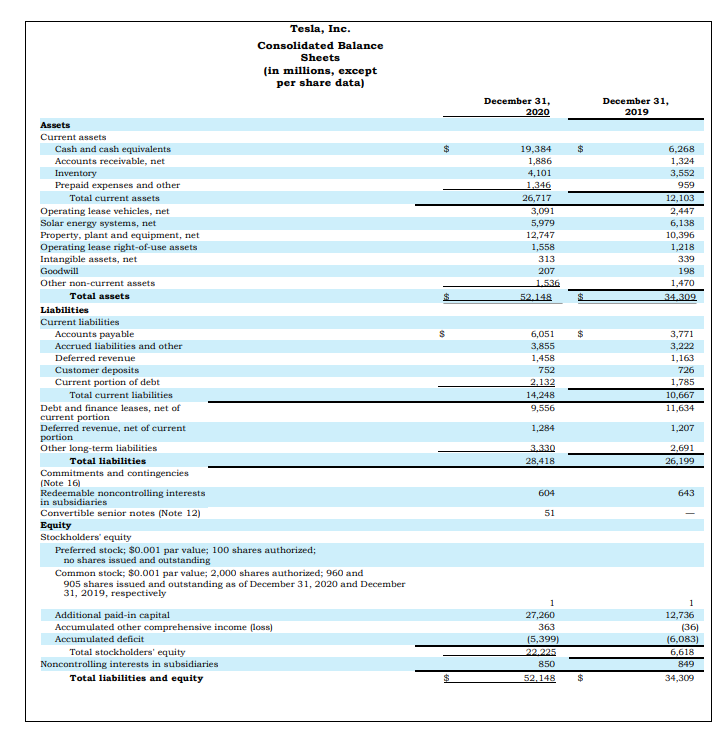

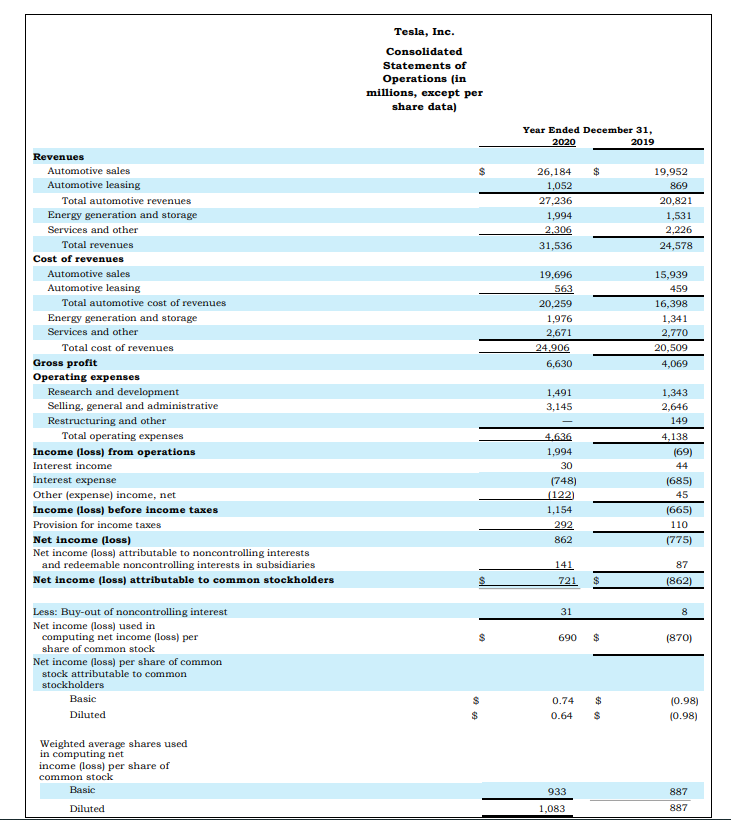

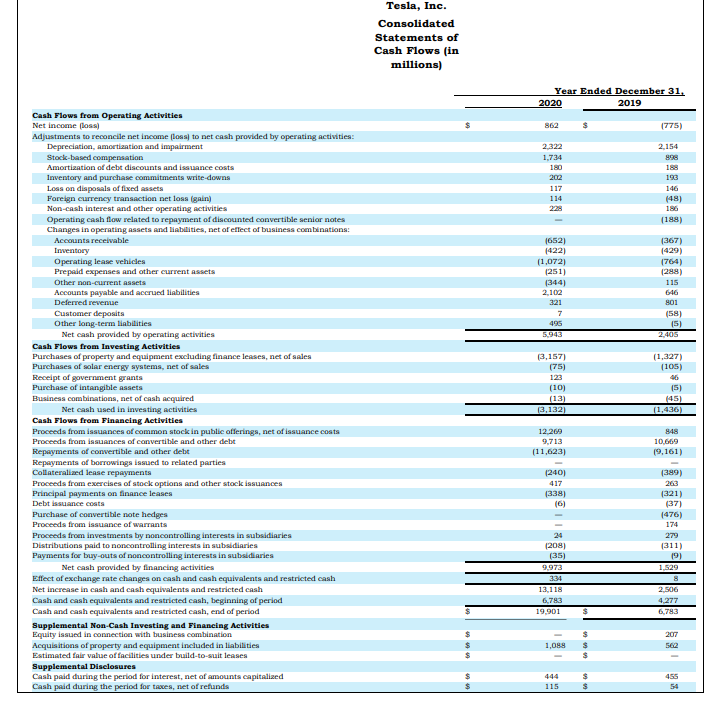

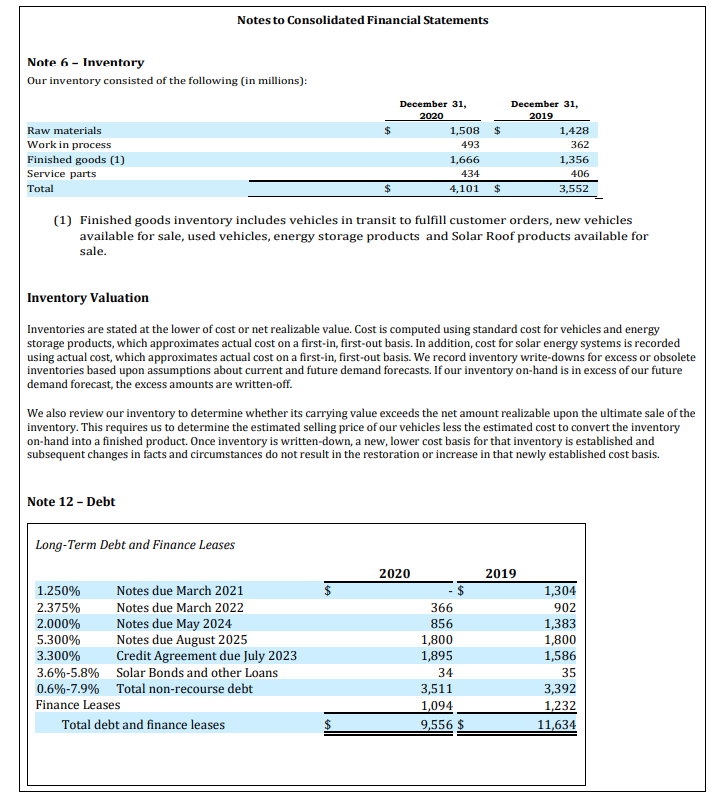

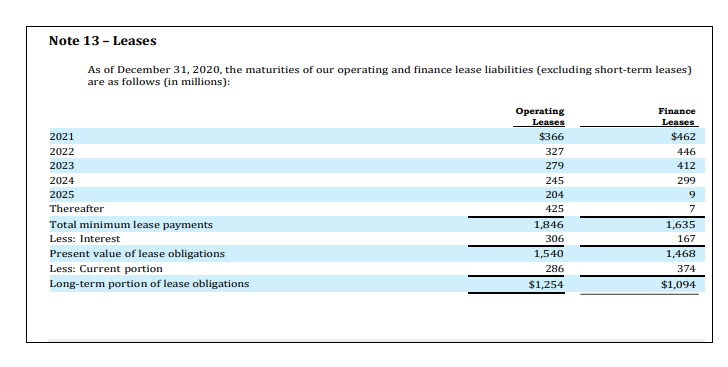

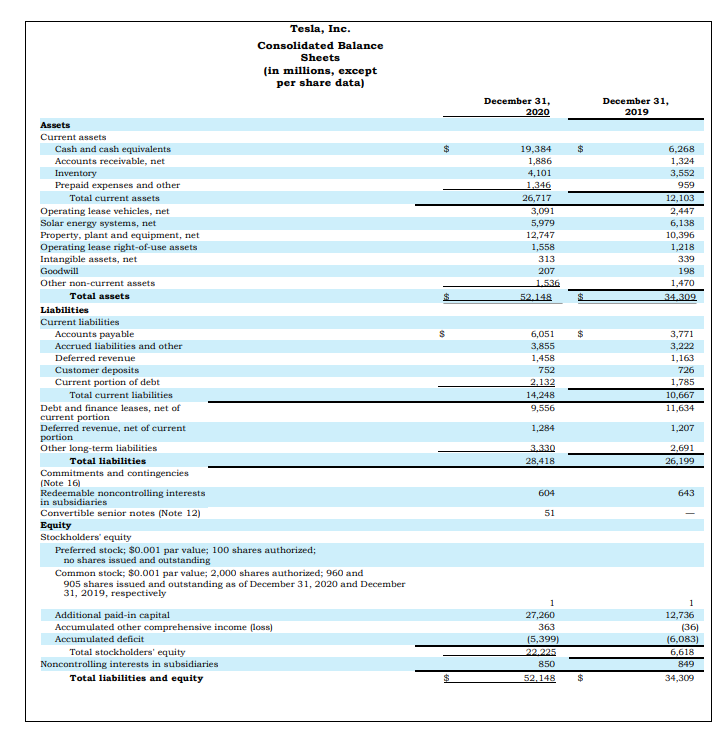

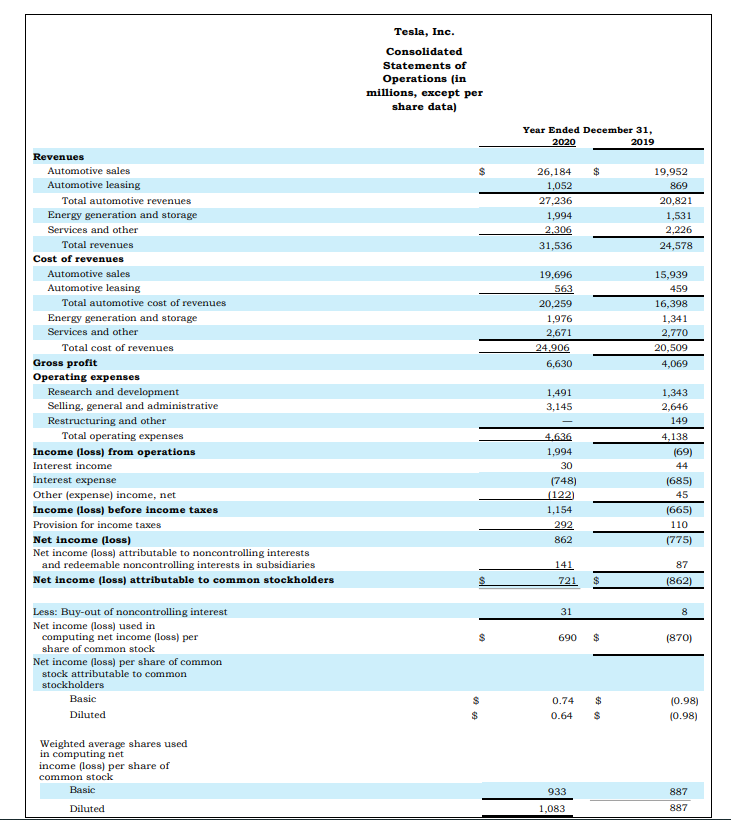

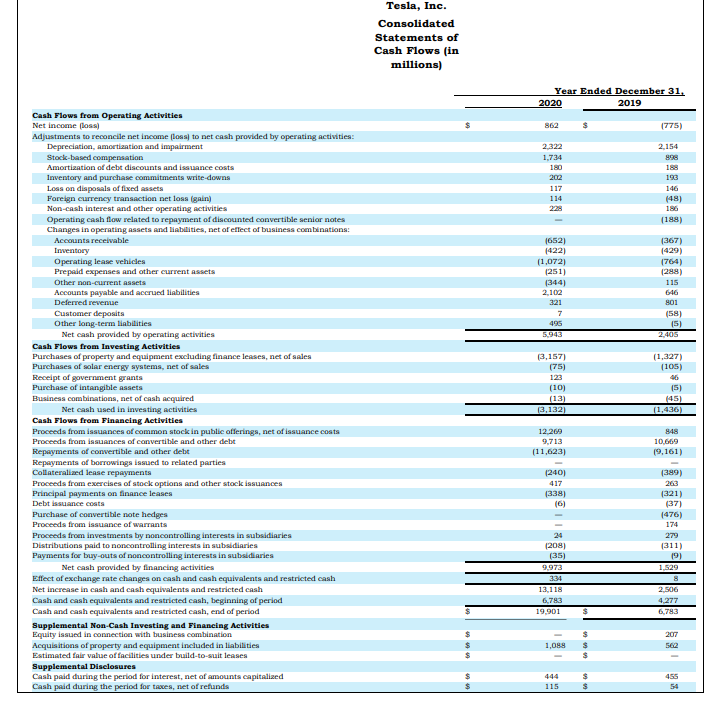

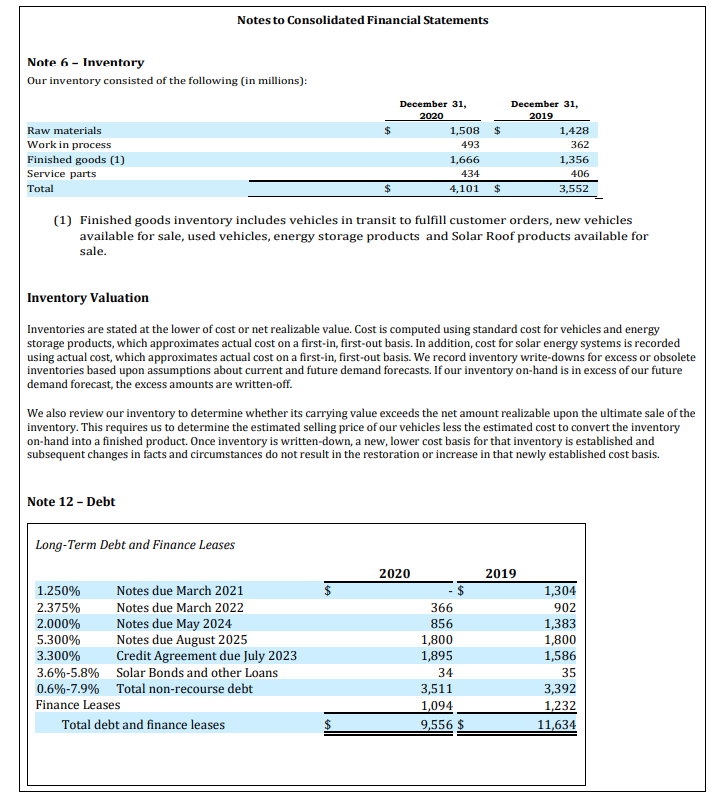

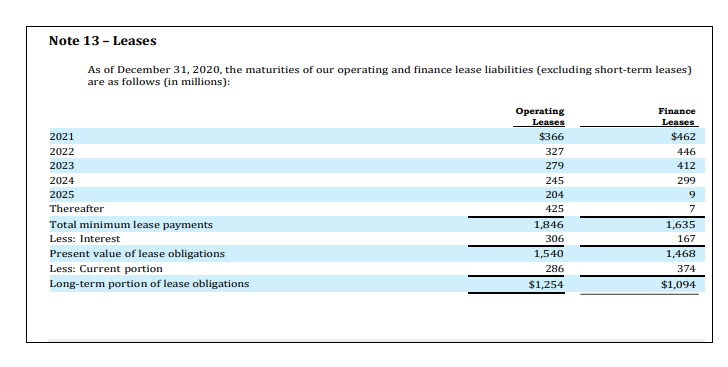

Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Tesla, Inc. Consolidated Statements of Cash Flows (in millions) Notes to Consolidated Financial Statements Note 6 - Inventory Our inventory consisted of the following (in millions): (1) Finished goods inventory includes vehicles in transit to fulfill customer orders, new vehicles available for sale, used vehicles, energy storage products and Solar Roof products available for sale. Inventory Valuation Inventories are stated at the lower of cost or net realizable value. Cost is computed using standard cost for vehicles and energy storage products, which approximates actual cost on a first-in, first-out basis. In addition, cost for solar energy systems is recorded using actual cost, which approximates actual cost on a first-in, first-out basis. We record inventory write-downs for excess or obsolete inventories based upon assumptions about current and future demand forecasts. If our inventory on-hand is in excess of our future demand forecast, the excess amounts are written-off. We also review our inventory to determine whether its carrying value exceeds the net amount realizable upon the ultimate sale of the inventory. This requires us to determine the estimated selling price of our vehicles less the estimated cost to convert the inventory on-hand into a finished product. Once inventory is written-down, a new, lower cost basis for that inventory is established and subsequent changes in facts and circumstances do not result in the restoration or increase in that newly established cost basis. As of December 31, 2020, the maturities of our operating and finance lease liabilities (excluding short-term leases) are as follows (in millions): Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Tesla, Inc. Consolidated Statements of Cash Flows (in millions) Notes to Consolidated Financial Statements Note 6 - Inventory Our inventory consisted of the following (in millions): (1) Finished goods inventory includes vehicles in transit to fulfill customer orders, new vehicles available for sale, used vehicles, energy storage products and Solar Roof products available for sale. Inventory Valuation Inventories are stated at the lower of cost or net realizable value. Cost is computed using standard cost for vehicles and energy storage products, which approximates actual cost on a first-in, first-out basis. In addition, cost for solar energy systems is recorded using actual cost, which approximates actual cost on a first-in, first-out basis. We record inventory write-downs for excess or obsolete inventories based upon assumptions about current and future demand forecasts. If our inventory on-hand is in excess of our future demand forecast, the excess amounts are written-off. We also review our inventory to determine whether its carrying value exceeds the net amount realizable upon the ultimate sale of the inventory. This requires us to determine the estimated selling price of our vehicles less the estimated cost to convert the inventory on-hand into a finished product. Once inventory is written-down, a new, lower cost basis for that inventory is established and subsequent changes in facts and circumstances do not result in the restoration or increase in that newly established cost basis. As of December 31, 2020, the maturities of our operating and finance lease liabilities (excluding short-term leases) are as follows (in millions)