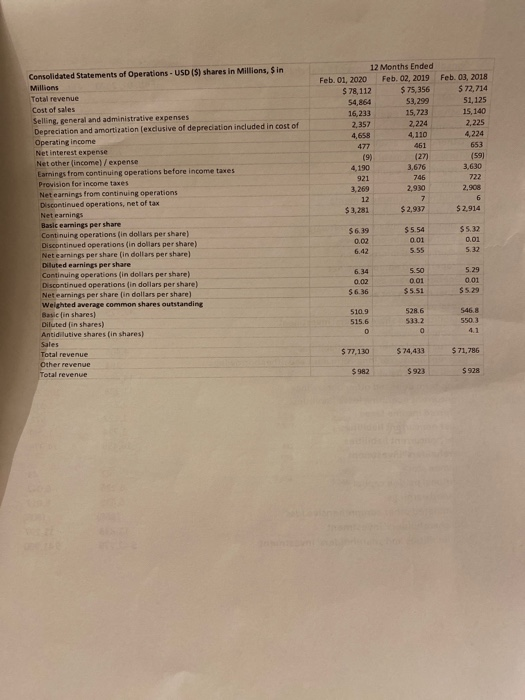

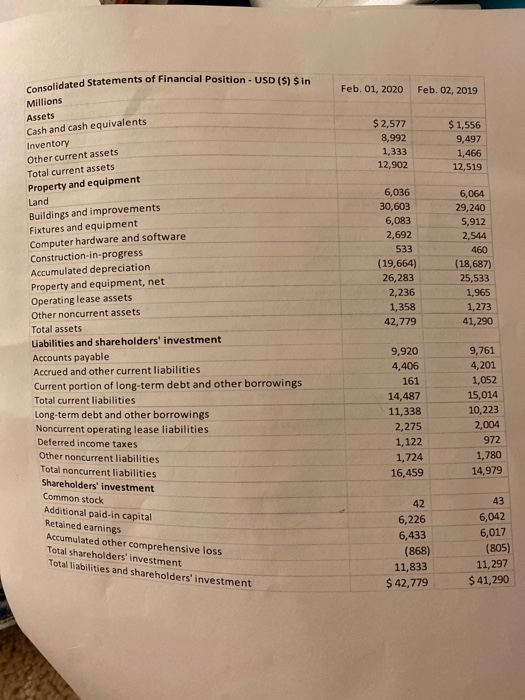

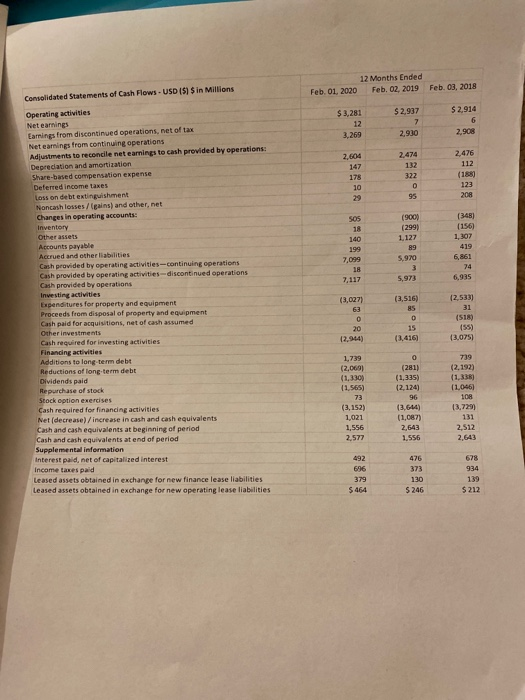

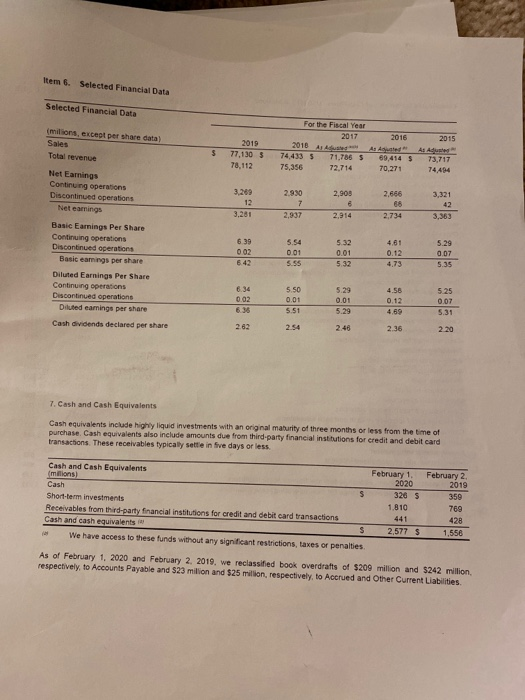

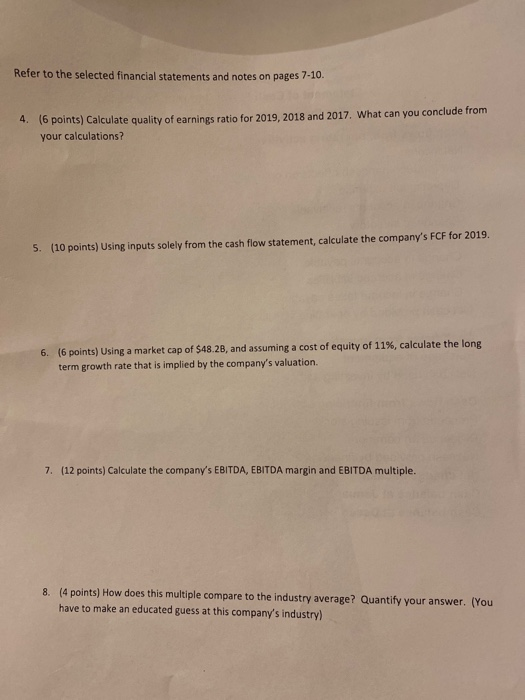

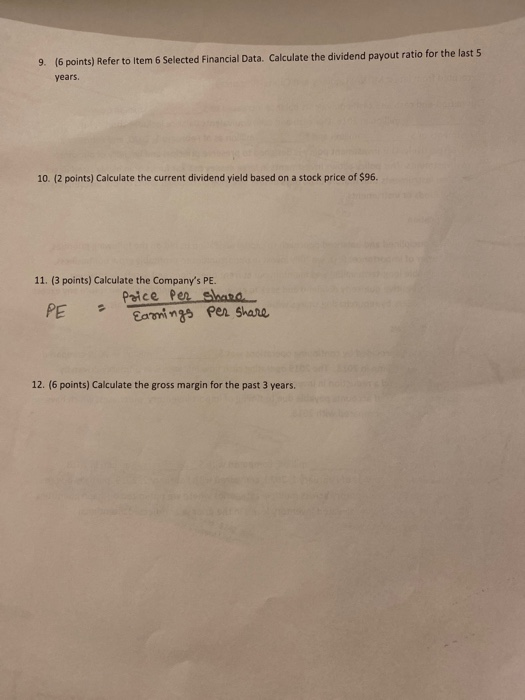

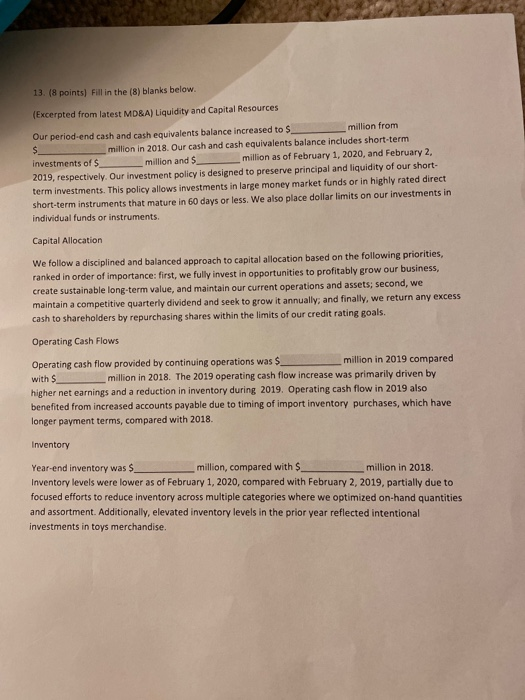

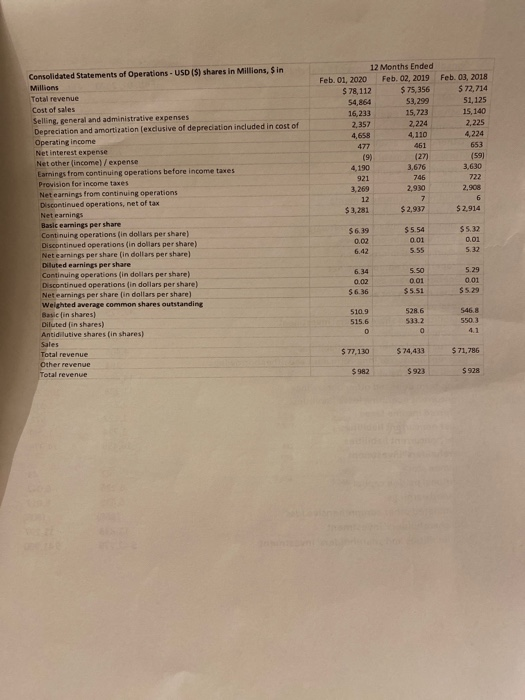

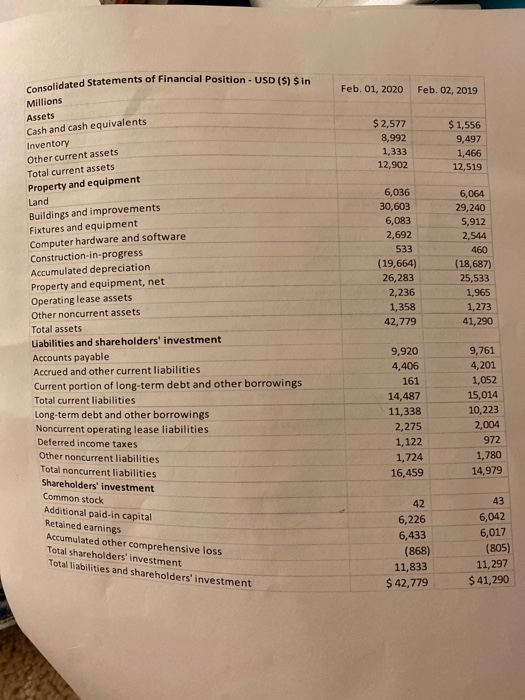

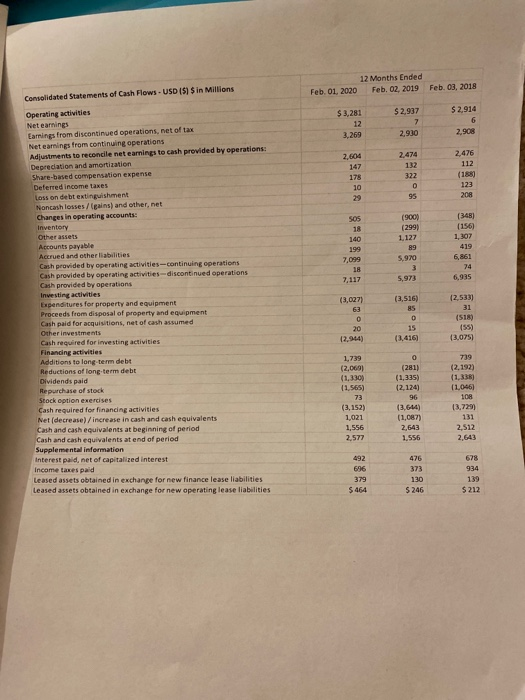

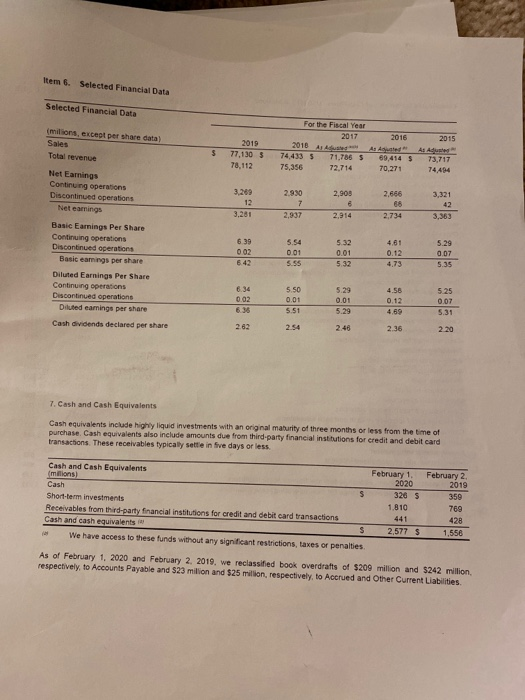

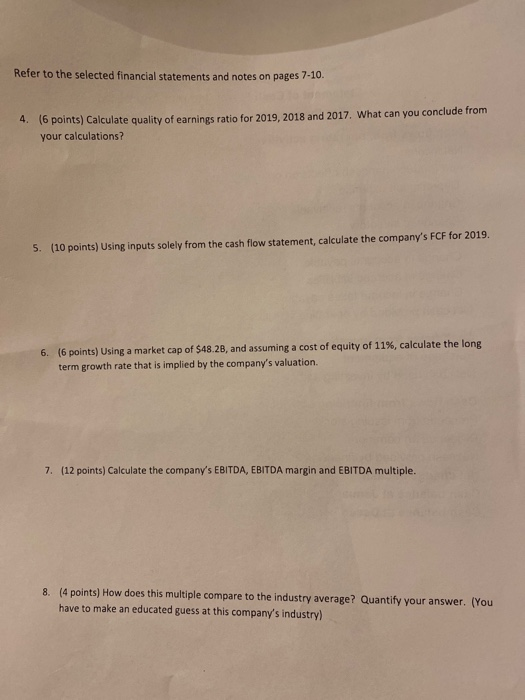

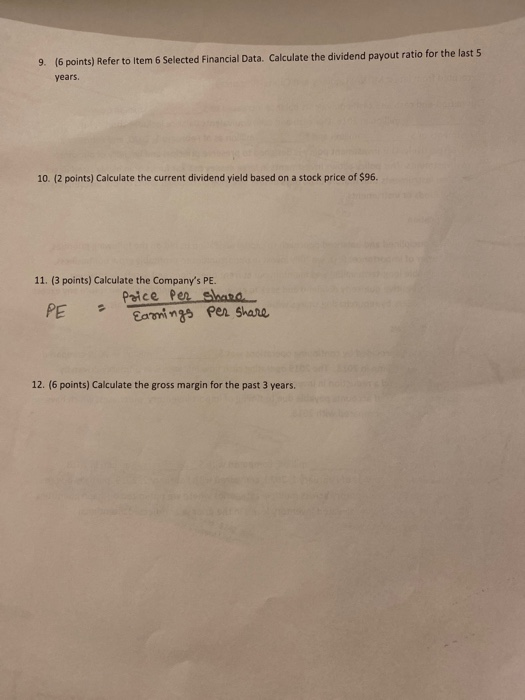

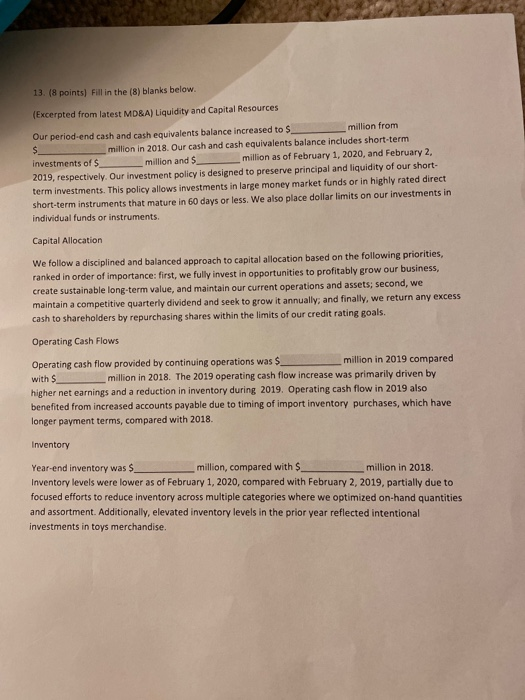

Refer to the selected financial statements and notes on pages 7-10. 4. (6 points) Calculate quality of earnings ratio for 2019, 2018 and 2017. What can you conclude from your calculations? 5. (10 points) Using inputs solely from the cash flow statement, calculate the company's FCF for 2019. 6. (6 points) Using a market cap of $48.2B, and assuming a cost of equity of 11%, calculate the long term growth rate that is implied by the company's valuation. 7. (12 points) Calculate the company's EBITDA, EBITDA margin and EBITDA multiple. 8. (4 points) How does this multiple compare to the industry average? Quantify your answer. (You have to make an educated guess at this company's industry) 9. (6 points) Refer to item 6 Selected Financial Data. Calculate the dividend payout ratio for the last 5 years. 11. (3 points) Calculate the Company's PE. Poice Per Share PE = Carmings per share 12. (6 points) Calculate the gross margin for the past 3 years. 13. (8 points) Fill in the (8) blanks below. (Excerpted from latest MD&A) Liquidity and Capital Resources Our period end cash and cash equivalents balance increased to s million from investments of million and $ _million as of February 1, 2020, and February 2, 2019, respectively. Our investment policy is designed to preserve principal and liquidity of our short term investments. This policy allows investments in large money market funds or in highly rated direct short-term instruments that mature in 60 days or less. We also place dollar limits on our investments in individual funds or instruments Capital Allocation We follow a disciplined and balanced approach to capital allocation based on the following priorities, ranked in order of importance: first, we fully invest in opportunities to profitably grow our business, create sustainable long-term value, and maintain our current operations and assets; second, we maintain a competitive quarterly dividend and seek to grow it annually, and finally, we return any excess cash to shareholders by repurchasing shares within the limits of our credit rating goals. Operating Cash Flows Operating cash flow provided by continuing operations was $_ _million in 2019 compared higher net earnings and a reduction in inventory during 2019. Operating cash flow in 2019 also benefited from increased accounts payable due to timing of import inventory purchases, which have longer payment terms, compared with 2018 Inventory Year-end inventory was $_ million, compared with $ million in 2018 Inventory levels were lower as of February 1, 2020, compared with February 2, 2019, partially due to focused efforts to reduce inventory across multiple categories where we optimized on-hand quantities and assortment. Additionally, elevated inventory levels in the prior year reflected intentional investments in toys merchandise. Refer to the selected financial statements and notes on pages 7-10. 4. (6 points) Calculate quality of earnings ratio for 2019, 2018 and 2017. What can you conclude from your calculations? 5. (10 points) Using inputs solely from the cash flow statement, calculate the company's FCF for 2019. 6. (6 points) Using a market cap of $48.2B, and assuming a cost of equity of 11%, calculate the long term growth rate that is implied by the company's valuation. 7. (12 points) Calculate the company's EBITDA, EBITDA margin and EBITDA multiple. 8. (4 points) How does this multiple compare to the industry average? Quantify your answer. (You have to make an educated guess at this company's industry) 9. (6 points) Refer to item 6 Selected Financial Data. Calculate the dividend payout ratio for the last 5 years. 11. (3 points) Calculate the Company's PE. Poice Per Share PE = Carmings per share 12. (6 points) Calculate the gross margin for the past 3 years. 13. (8 points) Fill in the (8) blanks below. (Excerpted from latest MD&A) Liquidity and Capital Resources Our period end cash and cash equivalents balance increased to s million from investments of million and $ _million as of February 1, 2020, and February 2, 2019, respectively. Our investment policy is designed to preserve principal and liquidity of our short term investments. This policy allows investments in large money market funds or in highly rated direct short-term instruments that mature in 60 days or less. We also place dollar limits on our investments in individual funds or instruments Capital Allocation We follow a disciplined and balanced approach to capital allocation based on the following priorities, ranked in order of importance: first, we fully invest in opportunities to profitably grow our business, create sustainable long-term value, and maintain our current operations and assets; second, we maintain a competitive quarterly dividend and seek to grow it annually, and finally, we return any excess cash to shareholders by repurchasing shares within the limits of our credit rating goals. Operating Cash Flows Operating cash flow provided by continuing operations was $_ _million in 2019 compared higher net earnings and a reduction in inventory during 2019. Operating cash flow in 2019 also benefited from increased accounts payable due to timing of import inventory purchases, which have longer payment terms, compared with 2018 Inventory Year-end inventory was $_ million, compared with $ million in 2018 Inventory levels were lower as of February 1, 2020, compared with February 2, 2019, partially due to focused efforts to reduce inventory across multiple categories where we optimized on-hand quantities and assortment. Additionally, elevated inventory levels in the prior year reflected intentional investments in toys merchandise