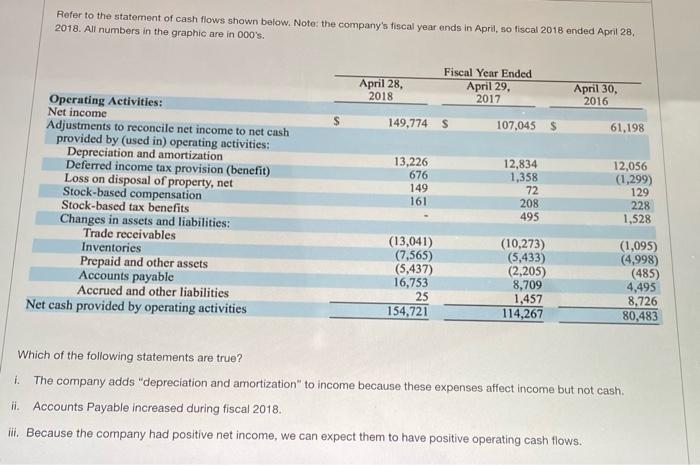

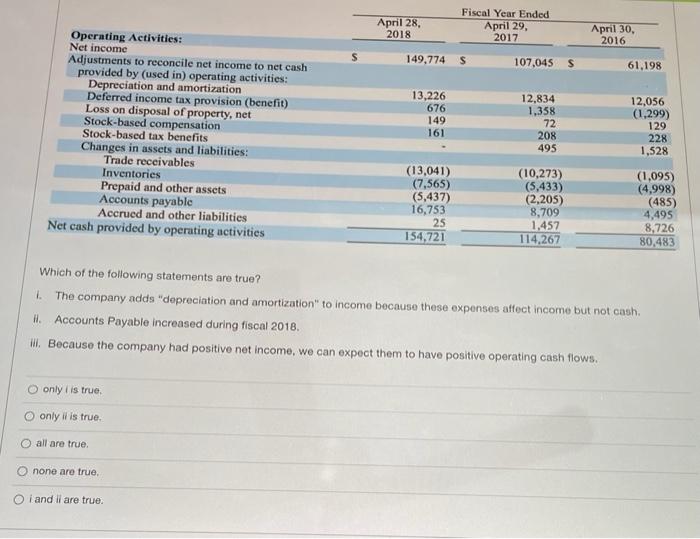

Refer to the statement of cash flows shown below. Note: the company's fiscal year ends in April, so fiscal 2018 ended April 28, 2018. All numbers in the graphic are in 000's. April 28, 2018 Fiscal Year Ended April 29, 2017 April 30, 2016 149,774 S 107,045 $ 61,198 Operating Activities: Net income Adjustments to reconcile net income to net cash provided by (used in) operating activities: Depreciation and amortization Deferred income tax provision (benefit) Loss on disposal of property, net Stock-based compensation Stock-based tax benefits Changes in assets and liabilities: Trade receivables Inventories Prepaid and other assets Accounts payable Accrued and other liabilities Net cash provided by operating activities 13,226 676 149 161 12,834 1,358 72 208 495 12,056 (1,299) 129 228 1,528 (13,041) (7,565) (5,437) 16,753 25 154,721 (10,273) (5,433) (2,205) 8,709 1,457 114,267 (1,095) (4,998) (485) 4,495 8,726 80,483 Which of the following statements are true? The company adds "depreciation and amortization to income because these expenses affect income but not cash. ii. Accounts Payable increased during fiscal 2018. iii. Because the company had positive net income, we can expect them to have positive operating cash flows. April 28, 2018 Fiscal Year Ended April 29, 2017 April 30, 2016 149,774 S 107,045 s 61,198 Operating Activities: Net income Adjustments to reconcile net income to net cash provided by (used in) operating activities: Depreciation and amortization Deferred income tax provision (benefit) Loss on disposal of property, net Stock-based compensation Stock-based tax benefits Changes in assets and liabilities: Trade receivables Inventories Prepaid and other assets Accounts payable Accrued and other liabilities Net cash provided by operating activities 13,226 676 149 161 12,834 1,358 72 208 495 12,056 (1.299) 129 228 1,528 (13,041) (7,565) (5,437) 16,753 25 154,721 (10,273) (5,433) (2,205) 8,709 1,457 114.267 (1,095) (4,998) (485) 4,495 8,726 80,483 Which of the following statements are true? 1. The company adds "depreciation and amortization to income because these expenses attect income but not cash. Accounts Payable increased during fiscal 2018. ill. Because the company had positive net income, we can expect them to have positive operating cash flows. O only iis true only is true all are true nono are true. O i and il are true