Question

Refer to the textbook case study Pan-Europa Foods SA. a. Consider the project proposal 11 - Strategic Acquisition. What is its initial investment capital in

Refer to the textbook case study "Pan-Europa Foods SA".

a. Consider the project proposal 11 - Strategic Acquisition. What is its initial investment capital in million euros in the year zero? (Note: enter a number with no sign and no decimal figure, e.g. 123)

b. Consider the project proposal 11 - Strategic Acquisition. What is its inflow cash in million euros in Year 1 as expected from the normal course of business ? (Note: enter a number with no sign and no decimal figure, e.g. 123)

c. Which project proposals have non-quantitative benefits that should be considered in an evaluation? Which project proposal should be selected even though it is not profitable? Explain why?

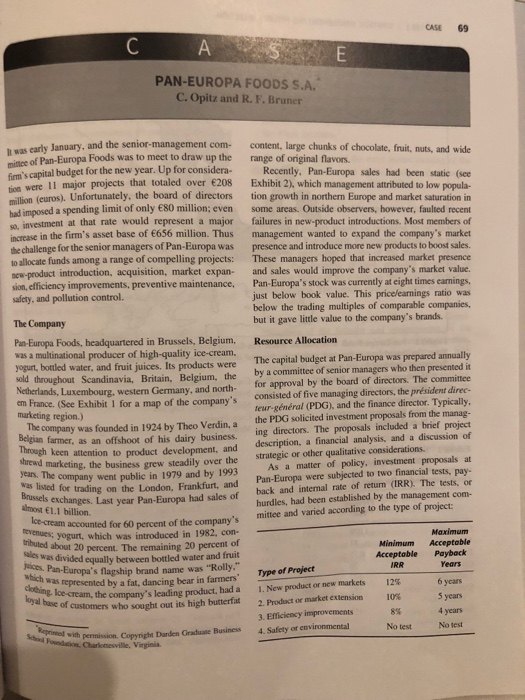

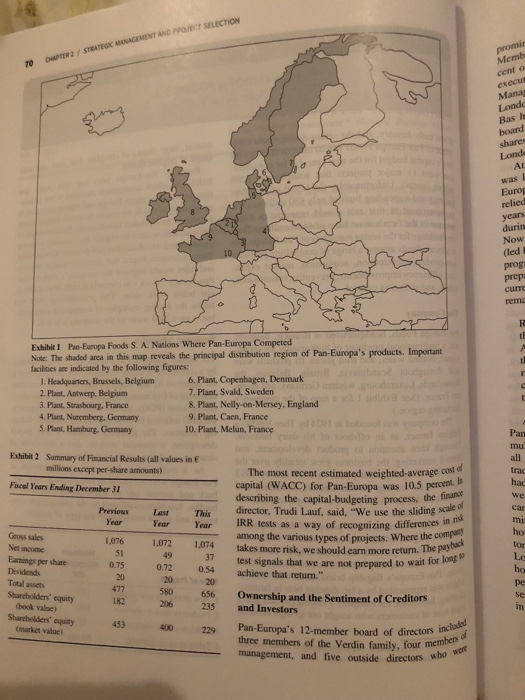

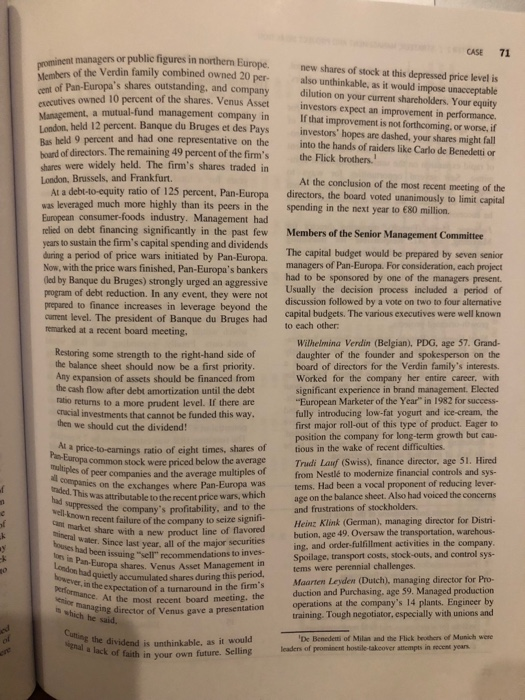

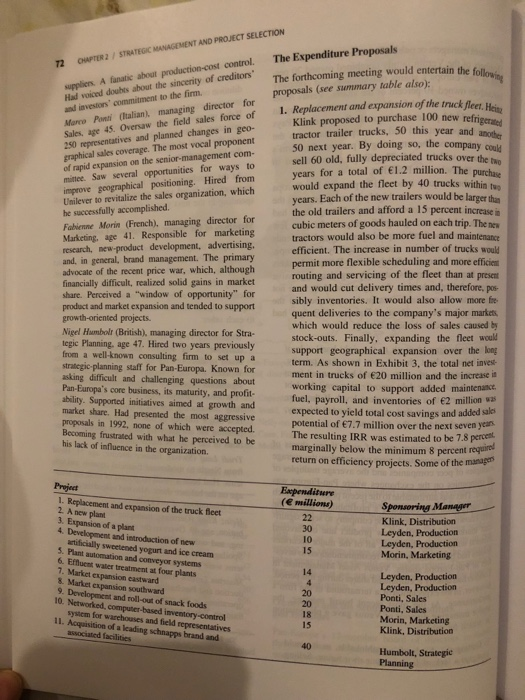

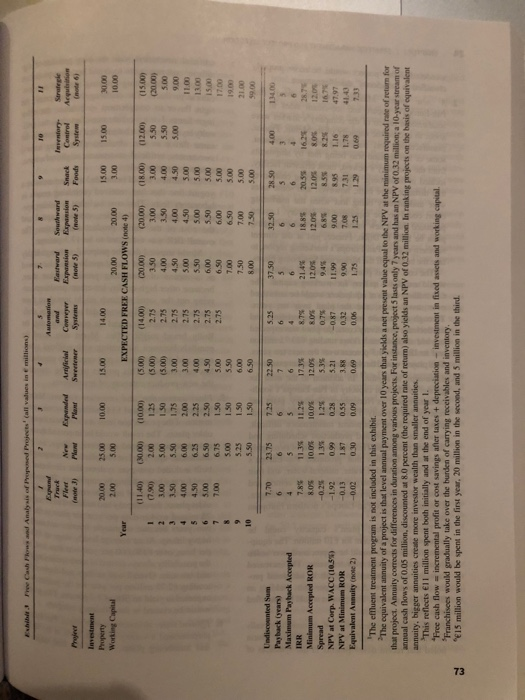

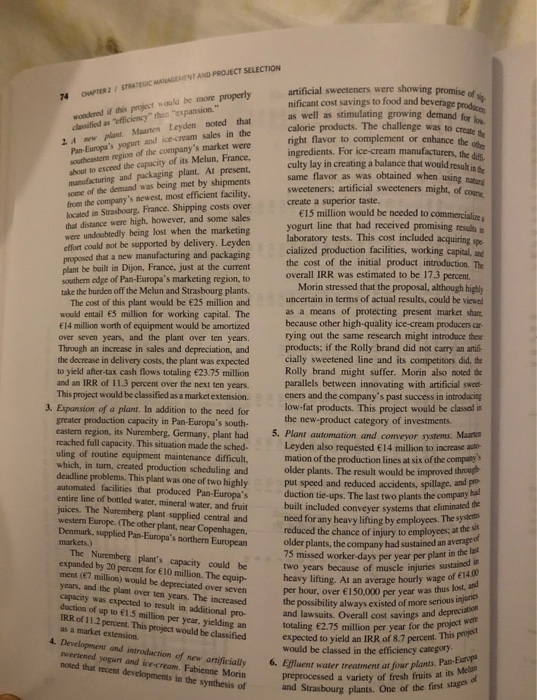

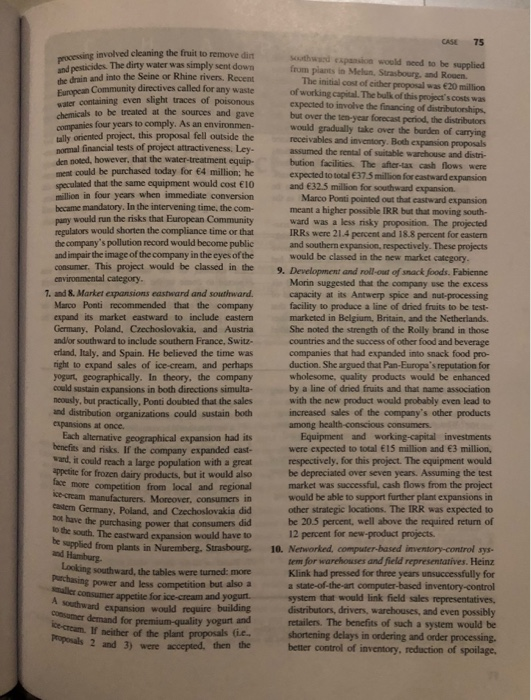

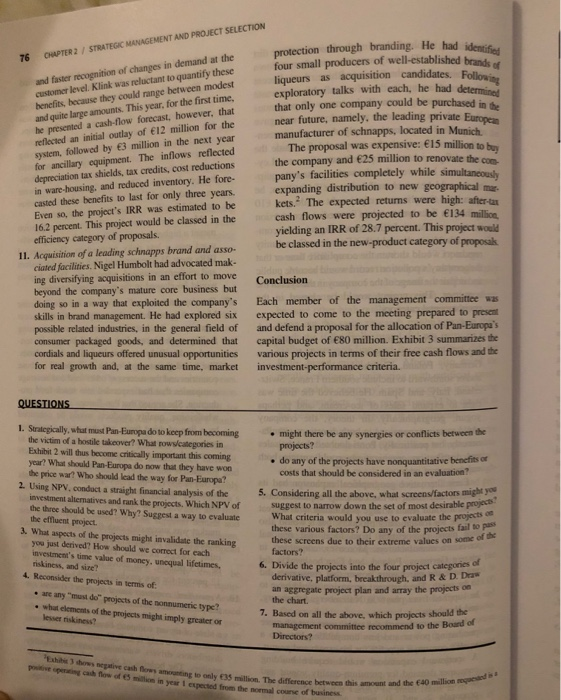

CASE 69 E PAN-EUROPA FOODS S.A. C. Opitz and R. F. Bruner It was early January, and the senior management com- mittee of Pan-Europa Foods was to meet to draw up the firm's capital budget for the new year. Up for considera- tion were Il major projects that totaled over 208 million (euros). Unfortunately, the board of directors had imposed a spending limit of only 80 million; even s, investment at that rate would represent a major increase in the firm's asset base of 656 million. Thus the challenge for the senior managers of Pan-Europa was to allocate funds among a range of compelling projects: new-product introduction, acquisition, market expan- sion, efficiency improvements, preventive maintenance, safety, and pollution control. content, large chunks of chocolate, fruit, nuts, and wide range of original flavors. Recently, Pan-Europa sales had been static (see Exhibit 2), which management attributed to low popula- tion growth in northern Europe and market saturation in some areas. Outside observers, however, faulted recent failures in new product introductions. Most members of management wanted to expand the company's market presence and introduce more new products to boost sales. These managers hoped that increased market presence and sales would improve the company's market value Pan-Europa's stock was currently at eight times earnings, just below book value. This price/earnings ratio was below the trading multiples of comparable companies, but it gave little value to the company's brands. Resource Allocation The Company Pan-Europa Foods, headquartered in Brussels, Belgium, was a multinational producer of high-quality ice-cream, yogurt, bottled water, and fruit juices. Its products were sold throughout Scandinavia, Britain, Belgium, the Netherlands, Luxembourg, western Germany, and north- em France. (See Exhibit 1 for a map of the company's marketing region.) The company was founded in 1924 by Theo Verdin, a Belgian farmer, as an offshoot of his dairy business. Through keen attention to product development, and shrewd marketing, the business grew steadily over the years. The company went public in 1979 and by 1993 Was listed for trading on the London, Frankfurt, and Brussels exchanges. Last year Pan-Europa had sales of Ice-cream accounted for 60 percent of the company's Tevenues; yogurt, which was introduced in 1982, con- tributed about 20 percent. The remaining 20 percent of wales was divided equally between bottled water and fruit Juices. Pan-Europa's flagship brand name was "Rolly." which was represented by a fat, dancing bear in farmers cong, le-cream, the company's leading product, had a loyal base of customers who sought out its high butterfall The capital budget at Pan-Europa was prepared annually by a committee of senior managers who then presented it for approval by the board of directors. The committee consisted of five managing directors, the prsident direc- teur gnral (PDG), and the finance director. Typically, the PDG solicited investment proposals from the manag- ing directors. The proposals included a brief project description, a financial analysis, and a discussion of strategic or other qualitative considerations. As a matter of policy, investment proposals at Pan-Europa were subjected to two financial tests, pay. back and internal rate of return (IRR). The tests, or hurdles, had been established by the management com- mittee and varied according to the type of project: most 1.1 billion Minimum Acceptable IRR Type of Project 1. New product or new markets 2. Product or market extension 3. Efficiency improvements 4. Safety or environmental 125 105 89 Maximum Acceptable Payback Years 6 years 5 years 4 years No test No test Show Charlottesville, Virginia Be with permission Copyright Darden Graduate Business promir 70 OWER2 / STRATEGIC MANAGEMENT AND PROJECT SELECTION Memb cento execut Mana Lond Bash bound share Land AI was 1 Europ relied years durin Now (led prog: prep: curre rema R th A Exhibit! Pan-Europa Foods S. A. Nations Where Pan-Europa Competed Note: The shaded area in this map reveals the principal distribution region of Pan-Europa's products. Important facilities are indicated by the following figures: 1. Headquarters, Brussels, Belgium 6. Plant, Copenhagen, Denmark 2. Plant. Antwerp, Belgium 7. Plant, Svald, Sweden 3. Plant, Strasbourg, France 8. Plant. Nelly-on-Mersey, England 4. Plant, Nuremberg, Germany 9. Plant, Caen, France 5. Plant, Hamburg, Germany 10. Plant, Melun, France Exhibit? Summary of Financial Results (all values in millions except per-share amounts) Fiscal Years Ending December 31 Pan mu all trac hac we car Previous Year The most recent estimated weighted average cost of capital (WACC) for Pan-Europa was 10.5 percent. describing the capital-budgeting process, the finance director, Trudi Lauf, said, "We use the sliding scale of IRR tests as a way of recognizing differences in risk among the various types of projects. Where the company test signals that we are not prepared to wait for long This Year Year 1,074 takes more risk, we should eam more return. The pays Gross sales Netcome Earnings per share Dividends Total acts Starcholders' equity 1,076 51 0.75 20 477 182 1.072 49 0.72 20 580 achieve that return." 37 0.54 20 656 235 ho tor LE ho Se in 206 Shareholders equity (marka 453 400 229 Ownership and the Sentiment of Creditors and Investors Pan-Europa's 12-member board of directors included three members of the Verdin family, four members of management, and five outside directors who was CASE 71 new shares of stock at this depressed price level is also unthinkable, as it would impose unacceptable dilution on your current shareholders. Your equity investors expect an improvement in performance If that improvement is not forthcoming, or worse, if investors' hopes are dashed, your shares might fall into the hands of raiders like Carlo de Benedetti or the Flick brothers.' At the conclusion of the most recent meeting of the directors, the board voted unanimously to limit capital spending in the next year to 80 million. prominent managers or public figures in northern Europe. Members of the Verdin family combined owned 20 per cent of Pan-Europa's shares outstanding, and company executives owned 10 percent of the shares. Venus Asset Management , a mutual fund management company in London, held 12 percent. Banque du Bruges et des Pays Bas held 9 percent and had one representative on the board of directors. The remaining 49 percent of the firm's shares were widely held. The firm's shares traded in London, Brussels, and Frankfurt At a debt-to-equity ratio of 125 percent, Pan-Europa was leveraged much more highly than its peers in the European consumer-foods industry. Management had relied on debt financing significantly in the past few years to sustain the firm's capital spending and dividends during a period of price wars initiated by Pan-Europa. Now, with the price wars finished, Pan-Europa's bankers (led by Banque du Bruges) strongly urged an aggressive program of debt reduction. In any event, they were not prepared to finance increases in leverage beyond the current level. The president of Banque du Bruges had remarked at a recent board meeting. Restoring some strength to the right-hand side of the balance sheet should now be a first priority. Any expansion of assets should be financed from the cash flow after debt amortization until the debt ratio returns to a more prudent level. If there are crucial investments that cannot be funded this way. then we should cut the dividend! Pa Europa common stock were priced below the average At a price-to-camnings ratio of eight times, shares of multiples of peer companies and the average multiples of inded. This was attributable to the recent price wars, which companies on the exchanges where Pan-Europa was bad suppressed the company's profitability, and to the well-known recent failure of the company to scire signifi- market share with a new product line of flavored mineral water. Since last year, all of the major securities houses had been issuing "sell recommendations to inves- to in Pan-Europa shares. Venus Asset Management in London bad quietly accumulated shares during this period. however, in the expectation of a turnaround in the firm's performance. At the most recent board meeting the Senior managing director of Venus gave a presentation Members of the Senior Management Committee The capital budget would be prepared by seven senior managers of Pan-Europa. For consideration, each project had to be sponsored by one of the managers present Usually the decision process included a period of discussion followed by a vote on two to four alternative capital budgets. The various executives were well known to each other Wilhelmina Verdin (Belgian), PDG, age 57. Grand- daughter of the founder and spokesperson on the board of directors for the Verdin family's interests. Worked for the company her entire career, with significant experience in brand management. Elected "European Marketer of the Year" in 1982 for success- fully introducing low-fat yogurt and ice-cream, the first major roll-out of this type of product. Eager to position the company for long-term growth but cau- tious in the wake of recent difficulties. Trudi Law (Swiss), finance director, age 51. Hired from Nestl to modernize financial controls and sys- tems. Had been a vocal proponent of reducing lever- age on the balance sheet. Also had voiced the concerns and frustrations of stockholders. Heinz Klink (German), managing director for Distri bution, age 49. Oversaw the transportation, warehous. ing, and order fulfillment activities in the company. Spoilage, transport costs, stock-outs, and control sys- tems were perennial challenges. Maarten Leyden (Dutch), managing director for Pro- duction and Purchasing, age 59. Managed production operations at the company's 14 plants. Engineer by training. Tough negotiator, especially with unions and c which he said. Cuming the dividend is al a lack of faith in your own future. Selling nkable, as it would 'De Benedetti of Milan and the Flick brothers of Munich were leaders of prominent hostile takeover attempts in recent years. 72 OMPTER 2 STRATEGIC MANAGEMENT AND PROJECT SELECTION The Expenditure Proposals The forthcoming meeting would entertain the following proposals (see summary table also): suppliers. A fanatie about production cost control Had voiced doubts about the sincerity of creditors and investors' commitment to the firm, Morro (Italianmanaging director for Sales, age 45. Oversaw the field sales force of 250 representatives and planned changes in geo- graphical sales coverage. The most vocal proponent of rapid expansion on the senior management com- minte. Sow several opportunities for ways to improve geographical positioning, Hired from Unilever to revitalize the sales organization, which he successfully accomplished. Fabienne Morin (French), managing director for Marketing, age 41. Responsible for marketing research, new product development, advertising, and, in general, brand management. The primary advocate of the recent price war, which, although financially difficult, realized solid gains in market share. Perceived a "window of opportunity" for product and market expansion and tended to support growth-oriented projects. Nigel Humboll (British), managing director for Stra- tegic Planning, age 47. Hired two years previously from a well-known consulting firm to set up a strategic planning staff for Pan-Europa. Known for asking difficult and challenging questions about Pan-Europa's core business, its maturity, and profit ability. Supported initiatives aimed at growth and market share. Had presented the most aggressive proposals in 1992, none of which were accepted. Becoming frustrated with what he perceived to be his lack of influence in the organization 1. Replacement and expansion of the track fleet. Hein Klink proposed to purchase 100 new refrigerated tractor trailer trucks, 50 this year and another 50 next year. By doing so, the company could sell 60 old, fully depreciated trucks over the two years for a total of 1.2 million. The purchase would expand the fleet by 40 trucks within two years. Each of the new trailers would be larger than the old trailers and afford a 15 percent increase in cubic meters of goods hauled on each trip. The new tractors would also be more fuel and maintenance efficient. The increase in number of trucks would permit more flexible scheduling and more efficient routing and servicing of the fleet than at present and would cut delivery times and therefore, pos- sibly inventories. It would also allow more fire quent deliveries to the company's major markets, which would reduce the loss of sales caused by stock-outs. Finally, expanding the fleet would support geographical expansion over the long term. As shown in Exhibit 3. the total net invest ment in trucks of 20 million and the increase in working capital to support added maintenance, fuel, payroll, and inventories of 2 million was expected to yield total cost savings and added sales potential of 7.7 million over the next seven yean The resulting IRR was estimated to be 7.8 percent, marginally below the minimum 8 percent required return on efficiency projects. Some of the manager Expenditure (e millions) 22 30 10 15 Project 1. Replacement and expansion of the truck fleet 2. A now plan 3. Expansion of a plant 4. Development and introduction of new tificially sweetened yogurt and ice cream 5. Pant automation and conveyor systems 6. Effluent water treatment at four plants 7. Market expansion eastward Market expansion southward 9. Development and roll-out of snack foods 10. Networked, computer-based inventory-control system for warehouses and field representatives 11. Acquisition of a leading schnapps brand and sociated facilities Sponsoring Manager Klink, Distribution Leyden, Production Leyden, Production Morin, Marketing 14 4 20 20 18 15 Leyden, Production Leyden, Production Ponti, Sales Ponti, Sales Morin, Marketing Klink, Distribution 40 Humbolt, Strategic Planning Free Cash Flows Analysis of raped Project (all values in millions) TO II Truck Automation and Cowreyer New Plan Expanded Plant Fastward Expansion Arfici Sweer Southwand Expansion (mode 5) Preiner Inventory Control System Snack Foods Strategie Aequo ( Code 6) Investment 25.00 5.00 10.00 15.00 3.00 15.00 Working Capital 2.00 30.00 10.00 Year 1 2 2.75 3.50 (11.40) (7.80) 3.00 3.50 4.00 4.50 3.00 7.00 (10.00) 1.25 150 1.75 2.00 2.25 2.50 1.50 15.00 14.00 20.00 20.00 EXPECTED FREE CASH FLOWS (note 4) (5.00) (14,00) (20.00) (20.00) (5.00) 2.75 3.50 3.00 (5.00) 4.00 3.00 2.75 4.50 400 3.00 2.75 5.00 4.50 4.00 2.75 5.50 5.00 4.50 2.75 6.00 5.50 5.00 2.75 6.50 6.00 5.50 7.00 6.50 6.00 7.50 7.00 6.50 8.00 7.30 (30.00) 2.00 5.00 5.50 6.00 6.25 6.50 6.75 5.00 5.25 5.50 (12.00) 5.50 5.50 5.00 4 5 6 7 8 9 10 (18.00) 3.00 4.00 4.50 5.00 5.00 3.00 5.00 5.00 5.00 5.00 (15.00) (2000) 5.00 9.00 11.00 1300 15.00 17.00 19.00 21.00 $9.00 1.50 1.50 1.50 7.70 23.75 7.25 6 4 6 5 Undiscounted Sum Payback (years) Maximum Payback Accepted IRR Minimum Accepted ROR Spread NPV at Corp. WACC (10.3%) NPV at Minimum ROR Equivalent Annuity (note 2) 5 11.35 100% 22 50 7 6 17.3% 12.05 37.50 5 6 21.45 12.05 9.45 5.25 6 4 8.75 80 0.75 -0.87 0.32 0.06 28.50 3 6 20:55 12.05 8.55 32.50 6 6 18.8% 12.05 6.85 9.00 7.08 1.25 8.0% -0.25 -1.92 -0.13 -0.02 1.34.00 5 6 28.7 12.09 167 47,97 4.00 3 1 16.25 8.05 8.25 1.16 1.78 0.69 100 1.25 0.28 0.55 0.09 5.3% 0.99 1.87 0.30 5.21 3.88 0.69 9.90 1.75 7.33 'The effluent treatment program is not included in this exhibit The equivalent annuity of a project is that level annual payment over 10 years that yields a net present value equal to the NPV at the minimum required rate of retum for that project. Annuity corrects for differences in duration among various projects. For instance, project Slasts only 7 years and has an NPV of 0.32 million, a 10-year stream of annual cash flows of 0.05 million, discounted at 8.0 percent (the required rate of return) also yields an NPV of 0.32 million. In ranking projects on the basis of equivalent annuity, bigger annuities create more investor wealth than smaller annuities. "This reflects Ell million spent both initially and at the end of year I. Free cash flow incremental profit or cost savings after taxes + depreciation - Investment in fixed assets and working capital Franchisees would gradually take over the burden of carrying receivables and inventory. E15 million would be spent in the first year, 20 million in the second, and 5 million in the third. 73 74 OWER STRATEGIC MANAGEMENT AND PROJECT SELECTION wondered if this project would be more properly classified as officiency expansion." 2.4 m plast Marten Leyden noted that Pan-Europe's yogurt and ice-cream sales in the southeastern region of the company's market were about to encoed the capacity of its Melun, France, manufacturing and packaging plant. At present, some of the demand was being met by shipments from the company's newest, most efficient facility. located in Strasbourg, France. Shipping costs over the distance were high, however, and some sales effort could not be supported by delivery. Leyden cialized production facilities, working capital, me artificial sweeteners were showing promise of nificant cost savings to food and beverage produce as well as stimulating growing demand for low calorie products. The challenge was to create the right flavor to complement or enhance the her ingredients. For ice-cream manufacturers, the diff culty lay in creating a balance that would result in the same flavor as was obtained when using nature sweeteners, artificial sweeteners might, of course create a superior taste. 15 million would be needed to commercializa yogurt line that had received promising results in were undoubtedly being lost when the marketing laboratory tests. This cost included acquiring spe- proposed that a new manufacturing and packaging the cost of the initial product introduction. The plant be built in Dijon, France, just at the current overall IRR was estimated to be 17.3 percent. southern edge of Pan-Europa's marketing region, to Morin stressed that the proposal, although highly take the burden off the Melun and Strasbourg plants. The cost of this plant would be 25 million and uncertain in terms of actual results, could be viewed would entail 5 million for working capital. The as a means of protecting present market share, E14 million worth of equipment would be amortized because other high-quality ice-cream producers ca- over seven years, and the plant over ten years. rying out the same research might introduce these Through an increase in sales and depreciation, and products, if the Rolly brand did not carry an artifi- the decrease in delivery costs, the plant was expected cially sweetened line and its competitors did, the to yield after-tax cash flows totaling 23.75 million Rolly brand might suffer. Morin also noted the and an IRR of 11.3 percent over the next ten years. parallels between innovating with artificial sweet- This project would be classified as a market extension eners and the company's past success in introducing 3. Expansion of a plant. In addition to the need for low-fat products. This project would be classed in greater production capacity in Pan-Europa's south- the new product category of investments. eastem region, its Nuremberg, Germany. plant had 5. Plant automation and conveyor systems. Maarten reached full capacity. This situation made the sched. Leyden also requested 14 million to increase auto uling of routine equipment maintenance difficult, mation of the production lines at six of the company's which in turn, created production scheduling and older plants. The result would be improved through deadline problems. This plant was one of two highly automated facilities that produced Pan-Europa's put speed and reduced accidents, spillage, and pro entire line of bottled water, mineral water and fruit duction tie-ups. The last two plants the company juices. The Nuremberg plant supplied central and built included conveyer systems that eliminated the need for any heavy lifting by employees. The systems reduced the chance of injury to employees, at the sa markets.) older plants, the company had sustained an average of 75 missed worker-days per year per plant in the less two years because of muscle injuries sustained in heavy lifting. At an average hourly wage of 14.00 per hour, over 150.000 per year was thus lost, and the possibility always existed of more serious injuries and lawsuits. Overall cost savings and depreciation totaling 2.75 million per year for the project were expected to yield an IRR of 8.7 percent. This project would be classed in the efficiency category 6. Effluent water treatment of four plants. Pan-Europa preprocessed a variety of fresh fruits at its Meu and Strasbourg plants. One of the first stay western Europe. (The other plant, near Copenhagen, Denmark, supplied Pan-Europa's northern European The Nuremberg plant's capacity could be expanded by 20 percent for 10 million. The equip men (7 million) would be depreciated over seven years, and the plant over ten years. The increased capacity was expected to result in additional pro duction of up to 1.5 million per year. yielding an IRR of 11.2 percent. This project would be classified as a market extension 4. Development and introduction of new artificially weened yogurt and ice-cream. Fabienne Morin noted that recent developments in the synthesis of CHAPTER 2 / STRATEGIC MANAGEMENT AND PROJECT SELECTION 76 and faster recognition of changes in demand at the customer level. Klink was reluctant to quantify these benefits, because they could range between modest and quite large amounts. This year, for the first time, he presented a cash flow forecast, however, that reflected an initial outlay of 12 million for the system, followed by 3 million in the next year for ancillary equipment. The inflows reflected depreciation tax shields, tax credits, cost reductions in warehousing, and reduced inventory. He fore- casted these benefits to last for only three years. Even so, the project's IRR was estimated to be 16.2 percent. This project would be classed in the efficiency category of proposals. 11. Acquisition of a leading schnapps brand and asso. ciated facilities. Nigel Humbolt had advocated mak- protection through branding. He had identified four small producers of well-established brands of liqueurs as acquisition candidates. Following exploratory talks with each, he had determined that only one company could be purchased in the near future, namely, the leading private European manufacturer of schnapps, located in Munich The proposal was expensive: 15 million to buy the company and 25 million to renovate the com pany's facilities completely while simultaneously expanding distribution to new geographical mes kets. The expected returns were high: after-tax cash flows were projected to be 134 million yielding an IRR of 28.7 percent. This project would be classed in the new product category of proposak Conclusion ing diversifying acquisitions in an effort to move beyond the company's mature core business but doing so in a way that exploited the company's skills in brand management. He had explored six possible related industries, in the general field of consumer packaged goods, and determined that cordials and liqueurs offered unusual opportunities for real growth and, at the same time, market Each member of the management committee was expected to come to the meeting prepared to present and defend a proposal for the allocation of Pan-Europa's capital budget of 80 million. Exhibit 3 summarizes the various projects in terms of their free cash flows and the investment performance criteria. QUESTIONS 1. Strategically, what must Pan-Europa do to keep from becoming the victim of a hostile takeover? What rows/categories in Exhibit 2 will thus become critically important this coming year? What should Pan-Europa do now that they have won the price war? Who should lead the way for Pan-Europa! 2. Using NPV. conduct a straight financial analysis of the investment alternatives and rank the projects, Which NPV of the three should be used? Why? Suggest a way to evaluate the effluent project 3. What aspects of the projects might invalidate the ranking you just derived? How should we correct for each Investment's time value of money, unequal lifetimes. riskies, and sie 4. Reconsider the projects in terms of anys de projects of the nonnumeric type! What clements of the projects might imply greater or les sess? might there be any synergies or conflicts between the projects? do any of the projects have nonquantitative benefits or costs that should be considered in an evaluation? 5. Considering all the above, what screens/factors might you suggest to narrow down the set of most desirable projects What criteria would you use to evaluate the projects these various factors? Do any of the projects fail to pass these screens due to their extreme values on some of the factors? 6. Divide the projects into the four project categories of derivative, platform, breakthrough, and R&D. Draw an aggregate project plan and array the projects on the chart. 7. Based on all the above, which projects should the management committee recommend to the Board of Directors? Showie cash as among only 35 million. The difference between this amount and the fillon med in operating cah flow of million in year I expected from the normal course of business CASE 69 E PAN-EUROPA FOODS S.A. C. Opitz and R. F. Bruner It was early January, and the senior management com- mittee of Pan-Europa Foods was to meet to draw up the firm's capital budget for the new year. Up for considera- tion were Il major projects that totaled over 208 million (euros). Unfortunately, the board of directors had imposed a spending limit of only 80 million; even s, investment at that rate would represent a major increase in the firm's asset base of 656 million. Thus the challenge for the senior managers of Pan-Europa was to allocate funds among a range of compelling projects: new-product introduction, acquisition, market expan- sion, efficiency improvements, preventive maintenance, safety, and pollution control. content, large chunks of chocolate, fruit, nuts, and wide range of original flavors. Recently, Pan-Europa sales had been static (see Exhibit 2), which management attributed to low popula- tion growth in northern Europe and market saturation in some areas. Outside observers, however, faulted recent failures in new product introductions. Most members of management wanted to expand the company's market presence and introduce more new products to boost sales. These managers hoped that increased market presence and sales would improve the company's market value Pan-Europa's stock was currently at eight times earnings, just below book value. This price/earnings ratio was below the trading multiples of comparable companies, but it gave little value to the company's brands. Resource Allocation The Company Pan-Europa Foods, headquartered in Brussels, Belgium, was a multinational producer of high-quality ice-cream, yogurt, bottled water, and fruit juices. Its products were sold throughout Scandinavia, Britain, Belgium, the Netherlands, Luxembourg, western Germany, and north- em France. (See Exhibit 1 for a map of the company's marketing region.) The company was founded in 1924 by Theo Verdin, a Belgian farmer, as an offshoot of his dairy business. Through keen attention to product development, and shrewd marketing, the business grew steadily over the years. The company went public in 1979 and by 1993 Was listed for trading on the London, Frankfurt, and Brussels exchanges. Last year Pan-Europa had sales of Ice-cream accounted for 60 percent of the company's Tevenues; yogurt, which was introduced in 1982, con- tributed about 20 percent. The remaining 20 percent of wales was divided equally between bottled water and fruit Juices. Pan-Europa's flagship brand name was "Rolly." which was represented by a fat, dancing bear in farmers cong, le-cream, the company's leading product, had a loyal base of customers who sought out its high butterfall The capital budget at Pan-Europa was prepared annually by a committee of senior managers who then presented it for approval by the board of directors. The committee consisted of five managing directors, the prsident direc- teur gnral (PDG), and the finance director. Typically, the PDG solicited investment proposals from the manag- ing directors. The proposals included a brief project description, a financial analysis, and a discussion of strategic or other qualitative considerations. As a matter of policy, investment proposals at Pan-Europa were subjected to two financial tests, pay. back and internal rate of return (IRR). The tests, or hurdles, had been established by the management com- mittee and varied according to the type of project: most 1.1 billion Minimum Acceptable IRR Type of Project 1. New product or new markets 2. Product or market extension 3. Efficiency improvements 4. Safety or environmental 125 105 89 Maximum Acceptable Payback Years 6 years 5 years 4 years No test No test Show Charlottesville, Virginia Be with permission Copyright Darden Graduate Business promir 70 OWER2 / STRATEGIC MANAGEMENT AND PROJECT SELECTION Memb cento execut Mana Lond Bash bound share Land AI was 1 Europ relied years durin Now (led prog: prep: curre rema R th A Exhibit! Pan-Europa Foods S. A. Nations Where Pan-Europa Competed Note: The shaded area in this map reveals the principal distribution region of Pan-Europa's products. Important facilities are indicated by the following figures: 1. Headquarters, Brussels, Belgium 6. Plant, Copenhagen, Denmark 2. Plant. Antwerp, Belgium 7. Plant, Svald, Sweden 3. Plant, Strasbourg, France 8. Plant. Nelly-on-Mersey, England 4. Plant, Nuremberg, Germany 9. Plant, Caen, France 5. Plant, Hamburg, Germany 10. Plant, Melun, France Exhibit? Summary of Financial Results (all values in millions except per-share amounts) Fiscal Years Ending December 31 Pan mu all trac hac we car Previous Year The most recent estimated weighted average cost of capital (WACC) for Pan-Europa was 10.5 percent. describing the capital-budgeting process, the finance director, Trudi Lauf, said, "We use the sliding scale of IRR tests as a way of recognizing differences in risk among the various types of projects. Where the company test signals that we are not prepared to wait for long This Year Year 1,074 takes more risk, we should eam more return. The pays Gross sales Netcome Earnings per share Dividends Total acts Starcholders' equity 1,076 51 0.75 20 477 182 1.072 49 0.72 20 580 achieve that return." 37 0.54 20 656 235 ho tor LE ho Se in 206 Shareholders equity (marka 453 400 229 Ownership and the Sentiment of Creditors and Investors Pan-Europa's 12-member board of directors included three members of the Verdin family, four members of management, and five outside directors who was CASE 71 new shares of stock at this depressed price level is also unthinkable, as it would impose unacceptable dilution on your current shareholders. Your equity investors expect an improvement in performance If that improvement is not forthcoming, or worse, if investors' hopes are dashed, your shares might fall into the hands of raiders like Carlo de Benedetti or the Flick brothers.' At the conclusion of the most recent meeting of the directors, the board voted unanimously to limit capital spending in the next year to 80 million. prominent managers or public figures in northern Europe. Members of the Verdin family combined owned 20 per cent of Pan-Europa's shares outstanding, and company executives owned 10 percent of the shares. Venus Asset Management , a mutual fund management company in London, held 12 percent. Banque du Bruges et des Pays Bas held 9 percent and had one representative on the board of directors. The remaining 49 percent of the firm's shares were widely held. The firm's shares traded in London, Brussels, and Frankfurt At a debt-to-equity ratio of 125 percent, Pan-Europa was leveraged much more highly than its peers in the European consumer-foods industry. Management had relied on debt financing significantly in the past few years to sustain the firm's capital spending and dividends during a period of price wars initiated by Pan-Europa. Now, with the price wars finished, Pan-Europa's bankers (led by Banque du Bruges) strongly urged an aggressive program of debt reduction. In any event, they were not prepared to finance increases in leverage beyond the current level. The president of Banque du Bruges had remarked at a recent board meeting. Restoring some strength to the right-hand side of the balance sheet should now be a first priority. Any expansion of assets should be financed from the cash flow after debt amortization until the debt ratio returns to a more prudent level. If there are crucial investments that cannot be funded this way. then we should cut the dividend! Pa Europa common stock were priced below the average At a price-to-camnings ratio of eight times, shares of multiples of peer companies and the average multiples of inded. This was attributable to the recent price wars, which companies on the exchanges where Pan-Europa was bad suppressed the company's profitability, and to the well-known recent failure of the company to scire signifi- market share with a new product line of flavored mineral water. Since last year, all of the major securities houses had been issuing "sell recommendations to inves- to in Pan-Europa shares. Venus Asset Management in London bad quietly accumulated shares during this period. however, in the expectation of a turnaround in the firm's performance. At the most recent board meeting the Senior managing director of Venus gave a presentation Members of the Senior Management Committee The capital budget would be prepared by seven senior managers of Pan-Europa. For consideration, each project had to be sponsored by one of the managers present Usually the decision process included a period of discussion followed by a vote on two to four alternative capital budgets. The various executives were well known to each other Wilhelmina Verdin (Belgian), PDG, age 57. Grand- daughter of the founder and spokesperson on the board of directors for the Verdin family's interests. Worked for the company her entire career, with significant experience in brand management. Elected "European Marketer of the Year" in 1982 for success- fully introducing low-fat yogurt and ice-cream, the first major roll-out of this type of product. Eager to position the company for long-term growth but cau- tious in the wake of recent difficulties. Trudi Law (Swiss), finance director, age 51. Hired from Nestl to modernize financial controls and sys- tems. Had been a vocal proponent of reducing lever- age on the balance sheet. Also had voiced the concerns and frustrations of stockholders. Heinz Klink (German), managing director for Distri bution, age 49. Oversaw the transportation, warehous. ing, and order fulfillment activities in the company. Spoilage, transport costs, stock-outs, and control sys- tems were perennial challenges. Maarten Leyden (Dutch), managing director for Pro- duction and Purchasing, age 59. Managed production operations at the company's 14 plants. Engineer by training. Tough negotiator, especially with unions and c which he said. Cuming the dividend is al a lack of faith in your own future. Selling nkable, as it would 'De Benedetti of Milan and the Flick brothers of Munich were leaders of prominent hostile takeover attempts in recent years. 72 OMPTER 2 STRATEGIC MANAGEMENT AND PROJECT SELECTION The Expenditure Proposals The forthcoming meeting would entertain the following proposals (see summary table also): suppliers. A fanatie about production cost control Had voiced doubts about the sincerity of creditors and investors' commitment to the firm, Morro (Italianmanaging director for Sales, age 45. Oversaw the field sales force of 250 representatives and planned changes in geo- graphical sales coverage. The most vocal proponent of rapid expansion on the senior management com- minte. Sow several opportunities for ways to improve geographical positioning, Hired from Unilever to revitalize the sales organization, which he successfully accomplished. Fabienne Morin (French), managing director for Marketing, age 41. Responsible for marketing research, new product development, advertising, and, in general, brand management. The primary advocate of the recent price war, which, although financially difficult, realized solid gains in market share. Perceived a "window of opportunity" for product and market expansion and tended to support growth-oriented projects. Nigel Humboll (British), managing director for Stra- tegic Planning, age 47. Hired two years previously from a well-known consulting firm to set up a strategic planning staff for Pan-Europa. Known for asking difficult and challenging questions about Pan-Europa's core business, its maturity, and profit ability. Supported initiatives aimed at growth and market share. Had presented the most aggressive proposals in 1992, none of which were accepted. Becoming frustrated with what he perceived to be his lack of influence in the organization 1. Replacement and expansion of the track fleet. Hein Klink proposed to purchase 100 new refrigerated tractor trailer trucks, 50 this year and another 50 next year. By doing so, the company could sell 60 old, fully depreciated trucks over the two years for a total of 1.2 million. The purchase would expand the fleet by 40 trucks within two years. Each of the new trailers would be larger than the old trailers and afford a 15 percent increase in cubic meters of goods hauled on each trip. The new tractors would also be more fuel and maintenance efficient. The increase in number of trucks would permit more flexible scheduling and more efficient routing and servicing of the fleet than at present and would cut delivery times and therefore, pos- sibly inventories. It would also allow more fire quent deliveries to the company's major markets, which would reduce the loss of sales caused by stock-outs. Finally, expanding the fleet would support geographical expansion over the long term. As shown in Exhibit 3. the total net invest ment in trucks of 20 million and the increase in working capital to support added maintenance, fuel, payroll, and inventories of 2 million was expected to yield total cost savings and added sales potential of 7.7 million over the next seven yean The resulting IRR was estimated to be 7.8 percent, marginally below the minimum 8 percent required return on efficiency projects. Some of the manager Expenditure (e millions) 22 30 10 15 Project 1. Replacement and expansion of the truck fleet 2. A now plan 3. Expansion of a plant 4. Development and introduction of new tificially sweetened yogurt and ice cream 5. Pant automation and conveyor systems 6. Effluent water treatment at four plants 7. Market expansion eastward Market expansion southward 9. Development and roll-out of snack foods 10. Networked, computer-based inventory-control system for warehouses and field representatives 11. Acquisition of a leading schnapps brand and sociated facilities Sponsoring Manager Klink, Distribution Leyden, Production Leyden, Production Morin, Marketing 14 4 20 20 18 15 Leyden, Production Leyden, Production Ponti, Sales Ponti, Sales Morin, Marketing Klink, Distribution 40 Humbolt, Strategic Planning Free Cash Flows Analysis of raped Project (all values in millions) TO II Truck Automation and Cowreyer New Plan Expanded Plant Fastward Expansion Arfici Sweer Southwand Expansion (mode 5) Preiner Inventory Control System Snack Foods Strategie Aequo ( Code 6) Investment 25.00 5.00 10.00 15.00 3.00 15.00 Working Capital 2.00 30.00 10.00 Year 1 2 2.75 3.50 (11.40) (7.80) 3.00 3.50 4.00 4.50 3.00 7.00 (10.00) 1.25 150 1.75 2.00 2.25 2.50 1.50 15.00 14.00 20.00 20.00 EXPECTED FREE CASH FLOWS (note 4) (5.00) (14,00) (20.00) (20.00) (5.00) 2.75 3.50 3.00 (5.00) 4.00 3.00 2.75 4.50 400 3.00 2.75 5.00 4.50 4.00 2.75 5.50 5.00 4.50 2.75 6.00 5.50 5.00 2.75 6.50 6.00 5.50 7.00 6.50 6.00 7.50 7.00 6.50 8.00 7.30 (30.00) 2.00 5.00 5.50 6.00 6.25 6.50 6.75 5.00 5.25 5.50 (12.00) 5.50 5.50 5.00 4 5 6 7 8 9 10 (18.00) 3.00 4.00 4.50 5.00 5.00 3.00 5.00 5.00 5.00 5.00 (15.00) (2000) 5.00 9.00 11.00 1300 15.00 17.00 19.00 21.00 $9.00 1.50 1.50 1.50 7.70 23.75 7.25 6 4 6 5 Undiscounted Sum Payback (years) Maximum Payback Accepted IRR Minimum Accepted ROR Spread NPV at Corp. WACC (10.3%) NPV at Minimum ROR Equivalent Annuity (note 2) 5 11.35 100% 22 50 7 6 17.3% 12.05 37.50 5 6 21.45 12.05 9.45 5.25 6 4 8.75 80 0.75 -0.87 0.32 0.06 28.50 3 6 20:55 12.05 8.55 32.50 6 6 18.8% 12.05 6.85 9.00 7.08 1.25 8.0% -0.25 -1.92 -0.13 -0.02 1.34.00 5 6 28.7 12.09 167 47,97 4.00 3 1 16.25 8.05 8.25 1.16 1.78 0.69 100 1.25 0.28 0.55 0.09 5.3% 0.99 1.87 0.30 5.21 3.88 0.69 9.90 1.75 7.33 'The effluent treatment program is not included in this exhibit The equivalent annuity of a project is that level annual payment over 10 years that yields a net present value equal to the NPV at the minimum required rate of retum for that project. Annuity corrects for differences in duration among various projects. For instance, project Slasts only 7 years and has an NPV of 0.32 million, a 10-year stream of annual cash flows of 0.05 million, discounted at 8.0 percent (the required rate of return) also yields an NPV of 0.32 million. In ranking projects on the basis of equivalent annuity, bigger annuities create more investor wealth than smaller annuities. "This reflects Ell million spent both initially and at the end of year I. Free cash flow incremental profit or cost savings after taxes + depreciation - Investment in fixed assets and working capital Franchisees would gradually take over the burden of carrying receivables and inventory. E15 million would be spent in the first year, 20 million in the second, and 5 million in the third. 73 74 OWER STRATEGIC MANAGEMENT AND PROJECT SELECTION wondered if this project would be more properly classified as officiency expansion." 2.4 m plast Marten Leyden noted that Pan-Europe's yogurt and ice-cream sales in the southeastern region of the company's market were about to encoed the capacity of its Melun, France, manufacturing and packaging plant. At present, some of the demand was being met by shipments from the company's newest, most efficient facility. located in Strasbourg, France. Shipping costs over the distance were high, however, and some sales effort could not be supported by delivery. Leyden cialized production facilities, working capital, me artificial sweeteners were showing promise of nificant cost savings to food and beverage produce as well as stimulating growing demand for low calorie products. The challenge was to create the right flavor to complement or enhance the her ingredients. For ice-cream manufacturers, the diff culty lay in creating a balance that would result in the same flavor as was obtained when using nature sweeteners, artificial sweeteners might, of course create a superior taste. 15 million would be needed to commercializa yogurt line that had received promising results in were undoubtedly being lost when the marketing laboratory tests. This cost included acquiring spe- proposed that a new manufacturing and packaging the cost of the initial product introduction. The plant be built in Dijon, France, just at the current overall IRR was estimated to be 17.3 percent. southern edge of Pan-Europa's marketing region, to Morin stressed that the proposal, although highly take the burden off the Melun and Strasbourg plants. The cost of this plant would be 25 million and uncertain in terms of actual results, could be viewed would entail 5 million for working capital. The as a means of protecting present market share, E14 million worth of equipment would be amortized because other high-quality ice-cream producers ca- over seven years, and the plant over ten years. rying out the same research might introduce these Through an increase in sales and depreciation, and products, if the Rolly brand did not carry an artifi- the decrease in delivery costs, the plant was expected cially sweetened line and its competitors did, the to yield after-tax cash flows totaling 23.75 million Rolly brand might suffer. Morin also noted the and an IRR of 11.3 percent over the next ten years. parallels between innovating with artificial sweet- This project would be classified as a market extension eners and the company's past success in introducing 3. Expansion of a plant. In addition to the need for low-fat products. This project would be classed in greater production capacity in Pan-Europa's south- the new product category of investments. eastem region, its Nuremberg, Germany. plant had 5. Plant automation and conveyor systems. Maarten reached full capacity. This situation made the sched. Leyden also requested 14 million to increase auto uling of routine equipment maintenance difficult, mation of the production lines at six of the company's which in turn, created production scheduling and older plants. The result would be improved through deadline problems. This plant was one of two highly automated facilities that produced Pan-Europa's put speed and reduced accidents, spillage, and pro entire line of bottled water, mineral water and fruit duction tie-ups. The last two plants the company juices. The Nuremberg plant supplied central and built included conveyer systems that eliminated the need for any heavy lifting by employees. The systems reduced the chance of injury to employees, at the sa markets.) older plants, the company had sustained an average of 75 missed worker-days per year per plant in the less two years because of muscle injuries sustained in heavy lifting. At an average hourly wage of 14.00 per hour, over 150.000 per year was thus lost, and the possibility always existed of more serious injuries and lawsuits. Overall cost savings and depreciation totaling 2.75 million per year for the project were expected to yield an IRR of 8.7 percent. This project would be classed in the efficiency category 6. Effluent water treatment of four plants. Pan-Europa preprocessed a variety of fresh fruits at its Meu and Strasbourg plants. One of the first stay western Europe. (The other plant, near Copenhagen, Denmark, supplied Pan-Europa's northern European The Nuremberg plant's capacity could be expanded by 20 percent for 10 million. The equip men (7 million) would be depreciated over seven years, and the plant over ten years. The increased capacity was expected to result in additional pro duction of up to 1.5 million per year. yielding an IRR of 11.2 percent. This project would be classified as a market extension 4. Development and introduction of new artificially weened yogurt and ice-cream. Fabienne Morin noted that recent developments in the synthesis of CHAPTER 2 / STRATEGIC MANAGEMENT AND PROJECT SELECTION 76 and faster recognition of changes in demand at the customer level. Klink was reluctant to quantify these benefits, because they could range between modest and quite large amounts. This year, for the first time, he presented a cash flow forecast, however, that reflected an initial outlay of 12 million for the system, followed by 3 million in the next year for ancillary equipment. The inflows reflected depreciation tax shields, tax credits, cost reductions in warehousing, and reduced inventory. He fore- casted these benefits to last for only three years. Even so, the project's IRR was estimated to be 16.2 percent. This project would be classed in the efficiency category of proposals. 11. Acquisition of a leading schnapps brand and asso. ciated facilities. Nigel Humbolt had advocated mak- protection through branding. He had identified four small producers of well-established brands of liqueurs as acquisition candidates. Following exploratory talks with each, he had determined that only one company could be purchased in the near future, namely, the leading private European manufacturer of schnapps, located in Munich The proposal was expensive: 15 million to buy the company and 25 million to renovate the com pany's facilities completely while simultaneously expanding distribution to new geographical mes kets. The expected returns were high: after-tax cash flows were projected to be 134 million yielding an IRR of 28.7 percent. This project would be classed in the new product category of proposak Conclusion ing diversifying acquisitions in an effort to move beyond the company's mature core business but doing so in a way that exploited the company's skills in brand management. He had explored six possible related industries, in the general field of consumer packaged goods, and determined that cordials and liqueurs offered unusual opportunities for real growth and, at the same time, market Each member of the management committee was expected to come to the meeting prepared to present and defend a proposal for the allocation of Pan-Europa's capital budget of 80 million. Exhibit 3 summarizes the various projects in terms of their free cash flows and the investment performance criteria. QUESTIONS 1. Strategically, what must Pan-Europa do to keep from becoming the victim of a hostile takeover? What rows/categories in Exhibit 2 will thus become critically important this coming year? What should Pan-Europa do now that they have won the price war? Who should lead the way for Pan-Europa! 2. Using NPV. conduct a straight financial analysis of the investment alternatives and rank the projects, Which NPV of the three should be used? Why? Suggest a way to evaluate the effluent project 3. What aspects of the projects might invalidate the ranking you just derived? How should we correct for each Investment's time value of money, unequal lifetimes. riskies, and sie 4. Reconsider the projects in terms of anys de projects of the nonnumeric type! What clements of the projects might imply greater or les sess? might there be any synergies or conflicts between the projects? do any of the projects have nonquantitative benefits or costs that should be considered in an evaluation? 5. Considering all the above, what screens/factors might you suggest to narrow down the set of most desirable projects What criteria would you use to evaluate the projects these various factors? Do any of the projects fail to pass these screens due to their extreme values on some of the factors? 6. Divide the projects into the four project categories of derivative, platform, breakthrough, and R&D. Draw an aggregate project plan and array the projects on the chart. 7. Based on all the above, which projects should the management committee recommend to the Board of Directors? Showie cash as among only 35 million. The difference between this amount and the fillon med in operating cah flow of million in year I expected from the normal course of businessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started