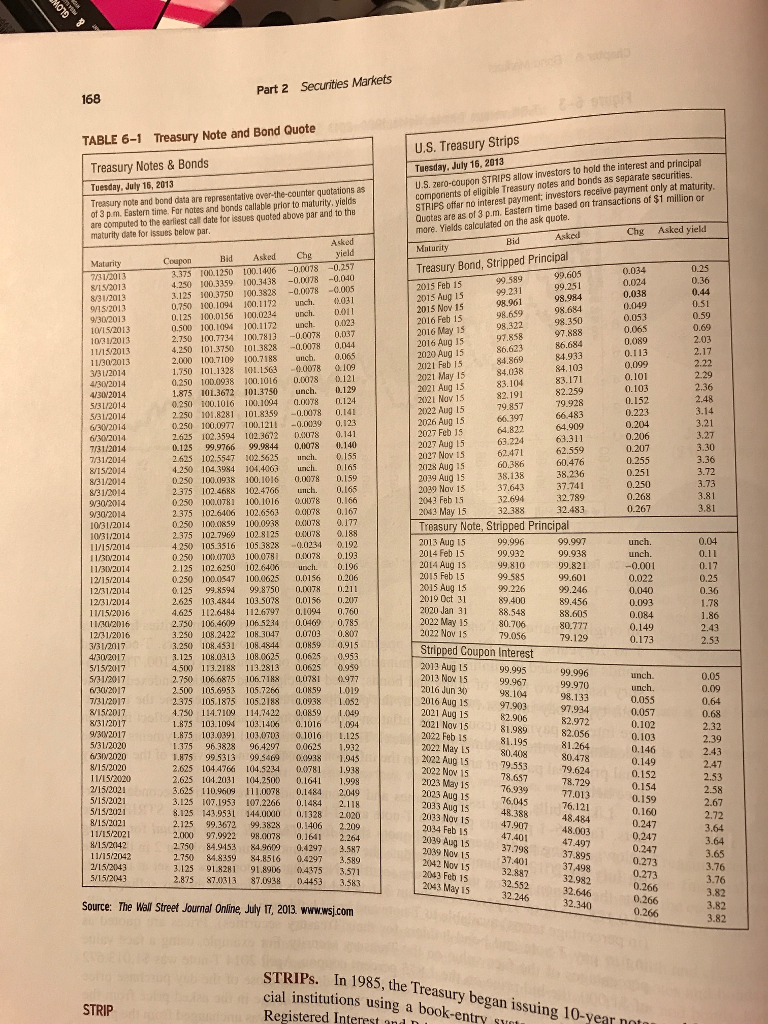

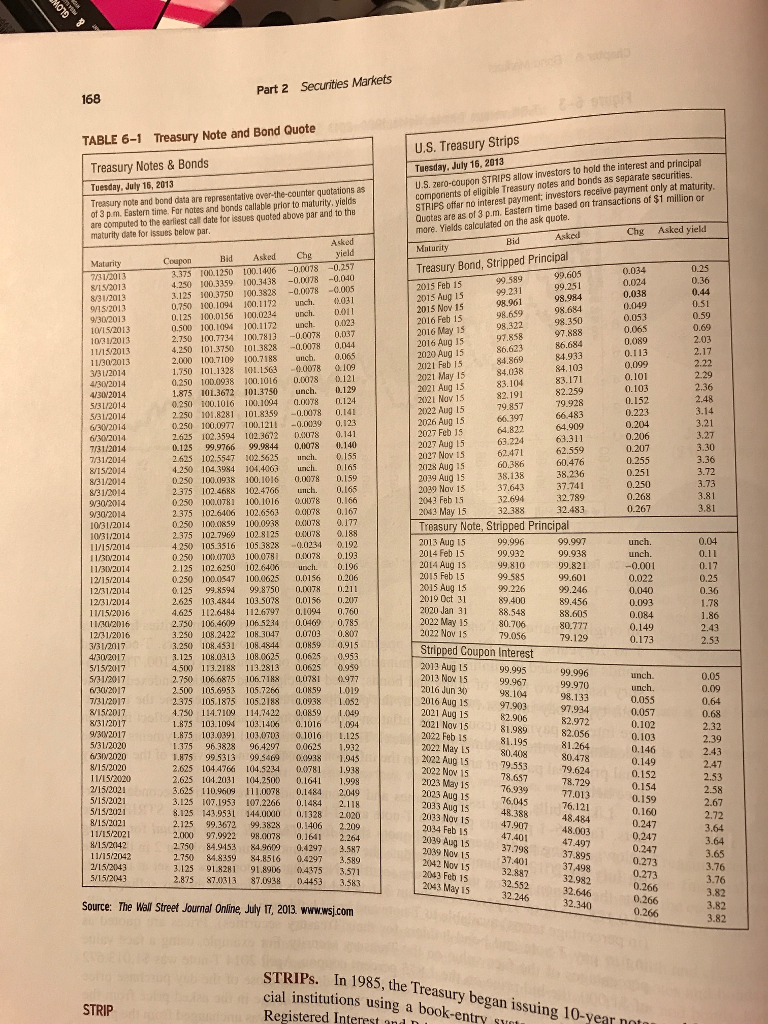

Refer to the T-note and T-bond quotes.

a.) What is the asking price on the 2.750 percent November 2042 T-bond if the face value of the bond is $10,000?

b.) What is the bid price on the 3.125 percent August 2013 T-note if the face value of the bond is $10,000?

Show work if you have any please.

Part 2 Securities Markets 168 Treasury Note and Bond Quote U.S. Treasury Strips Tuesday, July 16, 2013 TABLE 6-1 U.S. zero-coupon STRIPS allow investors to hold the interest and principal components of eligible Treasury notes and bonds as separate securitias. STRIPS offar no interest payment; investors receive payment only at maturity. Quates are as of 3 p.m. Eastern time based on transactions of $1 million or more. Yields calculated on the ask quote. Treasury Notes & Bonds Tuesday, July 16, 2013 Treasury note and bond data are representative over-the-counter quotations as of 3 p.m. Eastern time. Far nates and bonds callable prior to maturity, yields are computed to the earliest call date for issuss quated above par and to the maturity date for issues below par 3,375 ION1250 100.1406-0.0078 0.257 4.250 I0.3359 100.3438 -0.0178-0040 3.125 100.3750 100.3828 -00078 C.005 0.750 100.1094 100.1172 2031 0,125 100.0156 100.0234 unch. 0.011 0.500 100.1094 100.1172 unch 0.4023 2.750 100.7734 1007813 -0.008 0,037 4.250 101.3750 1013828 -0.0078 0,044 2.000 100.7109 100.7188 unch. 0.065 1.750 101.1328 101.1563-40078109 0.250 100.0938 100.1016 0.0078 0121 1.875 101.3672 101.3750 unch. 0129 0.250 100.1016 100.104 0.08 0.124 2.250 101.8281 101.8359 0.0078 0.141 0.250 100.0977 100.1211 0.0039 0.123 2625 102.3594 102.3672 078 0.141 0.125 99.9766 99.9844 0.0078 .140 2.625 102554 02.5625 0.155 4.250 104.3984 104.4003 u 0.165 0.250 100.0938 100.1016 0.08 0,159 2.375 102.4688 102.4766 uh0.165 0250 100.0781 100.1016 0.0078 0.166 2.375 1026406 102.6563 0008 0.167 0.250100.(1859 100.0938 1078 0.177 2.37510279691028125 2078 0.188 4.250 1053516 105.3828 .0234 0.192 0250 10T 100.0781 0108 0.193 2.125 1026250 102.6406 unc0.196 0.250 1000547 100.0625 0.0156 0.206 0.125 99.8594 99.8750 0.07 0.21 2.625 103.4844 103 5078 0,0156 0.207 4.625 112.6484 112679 0.1094 0.760 2.350 106.4609 106 5234 0.04690.785 3.250 108.2422 108.304 0.0703 0.807 3.250 108.4531 108.4844 0.0859 0.915 3.125 108.0313 108.0025 0.0625 0953 4.500 113.2188 113.2813 0.0625 0959 2.750 106.6875 106.7188 0.0781 977 2500 105.6953 105.726 (O859 1019 2.375 105.1875 105.2188 0.0938 1052 4.730 114.7109 114.7422 0.0859 19 1.875 103.1094 10314 0.1016 04 1.B75 1030391 10303 06 1.125 1.335 96.3828 964297 00623 1.932 1.875 995313 99.3469 00938 1.945 2.625 104.4766 104.5234 081 1.938 2.625 101.2031 104,250 0.161 1.998 3.625 110.9609 11.0078 0.1484 2049 3.125 07.1953 107.2266 0.1484 2.118 8.125 143.9531 144.0000 0.1328 2.020 2.125 99.3672 99.3828 0.1406 2.209 2.000 .9922 98.0078 0.1641 2.264 2.750 84.9153 849609 0.4297 3.587 2.750 84.8359 84.8516 0.4297 3.589 3.125 91.8281 91.8906 04375 3.571 2.875 870313 87.09384453 3.583 Treasury Bond, Stripped Principal 31/2013 8/31/2013 0.065 10V31/2013 3/3142014 2.36 2.48 41302014 79.857 79.928 0.223 5/3112014 14. 713112014 7/31/2014 15/2014 831/2014 831/2014 2027 Now 15 2028 Aug 15 2039 Aug 15 2039 Nov 13 1031/2014 Treasury Note, Stripped Principal 14. 99.821 -0.001 0.022 12/15/2014 12/31/2014 1231/2014 11/152016 1231/2016 3/31/2017 Stripped Coupon Interest 5152017 5312017 2013 Aug 15 2013 NoN 15 0.055 /31/2017 815/2017 1s 2.32 931V2017 2022 May L5 80.40 79.553 78.657 2022 Nov 15 15 2.58 2033 Nav 15 2034 Feb 1S 2039 Aug 15 2039 Nov 15 2042 Nov 15 2043 Feb 15 2043 May 15 11/15/2021 8/15/20143 2/15/2043 SV15/2043 32.883 0.266 Source: The Well Street Journal Online July T, 2013. www.wsjcom 3.82 STRIPs. In 198 cial institutions using a book-entrys Registered Interest and D 5, the Treasury began issuing 10-yeartn STRIP