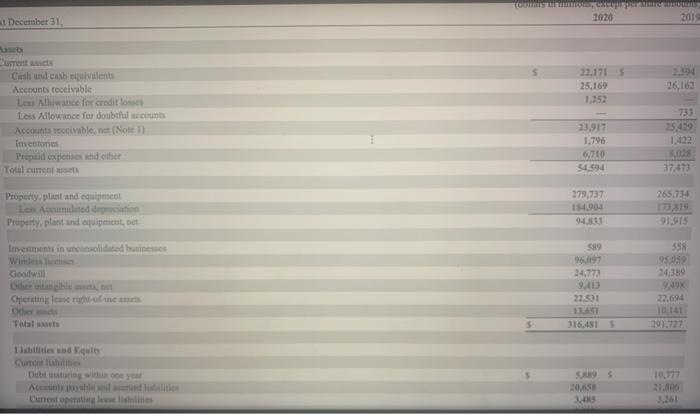

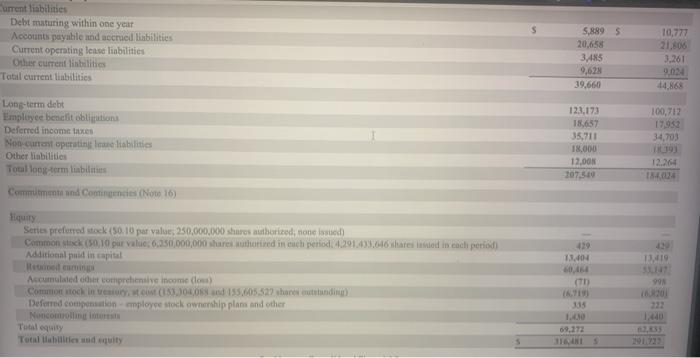

refer to the VZ financial statements and calculate the following ratios; (5 points each) 7. Current ratio 8. Debt equity ratio 9. Times interest earned I 10. Inventory turnover ratio 2020 2013 At December 31 5 21,171 25,169 1,352 26,162 Currentes Cish und enth equivalents Accounts receivable Less Allowance for credit losses Lets Allowance for doubtful accounts Accounts rooivable net (Note 1) Inventores Prepaid expenses hd other Total current 733 15439 33,917 6,710 54.594 279,737 Property, plant and equipment La Accumulated depiction Property, plant and equipment, bet 265,734 13,319 91.915 Investments in consolidated businesses 358 589 9609 9503 Goodwill Operating lese right out 22.301 22.694 10141 Tout Lisbildes ud quity SS 20,65 SEKS 10.177 21. Accueil Cum pertinentes S urrent liabilities Debt maturing within one year Accounts payable and accrued abilities Current operating lese liabilities Other current libilities Tatal current liabilities 5,8895 20.658 3,485 9,628 39,660 10,777 21,806 3.261 0.024 44.868 100,712 17.952 Long-term debit Employee benefit obligations Deferred income taxes Non-cunes operating sibilities Other liabilities Total long term liabilities Commitment and Continentes (Noto 16) 123,173 18,657 35,711 18,000 12.000 07.10 12.264 429 13,404 13.419 Series preferred stock (50.10 par value, 250,000,000 shares thered one foto Common stick 0.10 pur value: 600.000,000 share thored in each period: 4291.433.646 shares wedi cacl period Additional paid in capital Helmi Accumulated our comprehensive income dow) Common stock in 2000 155.605,327 shansetetundin Deferred companion mployee stock ownership plans and other Noncomitent Totally Total tables and equity PA 120 (A. 13 1.440 09.172 SOS refer to the VZ financial statements and calculate the following ratios; (5 points each) 7. Current ratio 8. Debt equity ratio 9. Times interest earned I 10. Inventory turnover ratio 2020 2013 At December 31 5 21,171 25,169 1,352 26,162 Currentes Cish und enth equivalents Accounts receivable Less Allowance for credit losses Lets Allowance for doubtful accounts Accounts rooivable net (Note 1) Inventores Prepaid expenses hd other Total current 733 15439 33,917 6,710 54.594 279,737 Property, plant and equipment La Accumulated depiction Property, plant and equipment, bet 265,734 13,319 91.915 Investments in consolidated businesses 358 589 9609 9503 Goodwill Operating lese right out 22.301 22.694 10141 Tout Lisbildes ud quity SS 20,65 SEKS 10.177 21. Accueil Cum pertinentes S urrent liabilities Debt maturing within one year Accounts payable and accrued abilities Current operating lese liabilities Other current libilities Tatal current liabilities 5,8895 20.658 3,485 9,628 39,660 10,777 21,806 3.261 0.024 44.868 100,712 17.952 Long-term debit Employee benefit obligations Deferred income taxes Non-cunes operating sibilities Other liabilities Total long term liabilities Commitment and Continentes (Noto 16) 123,173 18,657 35,711 18,000 12.000 07.10 12.264 429 13,404 13.419 Series preferred stock (50.10 par value, 250,000,000 shares thered one foto Common stick 0.10 pur value: 600.000,000 share thored in each period: 4291.433.646 shares wedi cacl period Additional paid in capital Helmi Accumulated our comprehensive income dow) Common stock in 2000 155.605,327 shansetetundin Deferred companion mployee stock ownership plans and other Noncomitent Totally Total tables and equity PA 120 (A. 13 1.440 09.172 SOS