Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to TJX Companies' Consolidated Financial Statements darr. The TJX Companies, Inc. CONSOLIDATED BALANCE SHEETS table [ [ Amounts in thousands except share amounts,Fiscal

Refer to TJX Companies' Consolidated Financial Statements darr. The TJX Companies, Inc. CONSOLIDATED BALANCE SHEETS

tableAmounts in thousands except share amounts,Fiscal Year EndedtabletableFebruary tabletableFebruary ASSETSCurrent assets:Cash and cash equivalents,$$Shortterm investments,,Accounts receivable, net,,Merchandise inventories,,Prepaid expenses and other current assets,,tableTotal current assets,,,,Net property at costNoncurrent deferred income taxes, net,,GoodwilltableOther assets,,TOTAL ASSETS,$$

LIABILITIES

tableCurrent liabilities:Accounts payable,$Accrued expenses and other current liabilities,,Federal state and foreign income taxes payable,,Total current liabilities,,tableOther longterm liabilities,,Noncurrent deferred income taxes, net,,tableLongterm debt,,

Commitments and contingencies See Note L and Note N

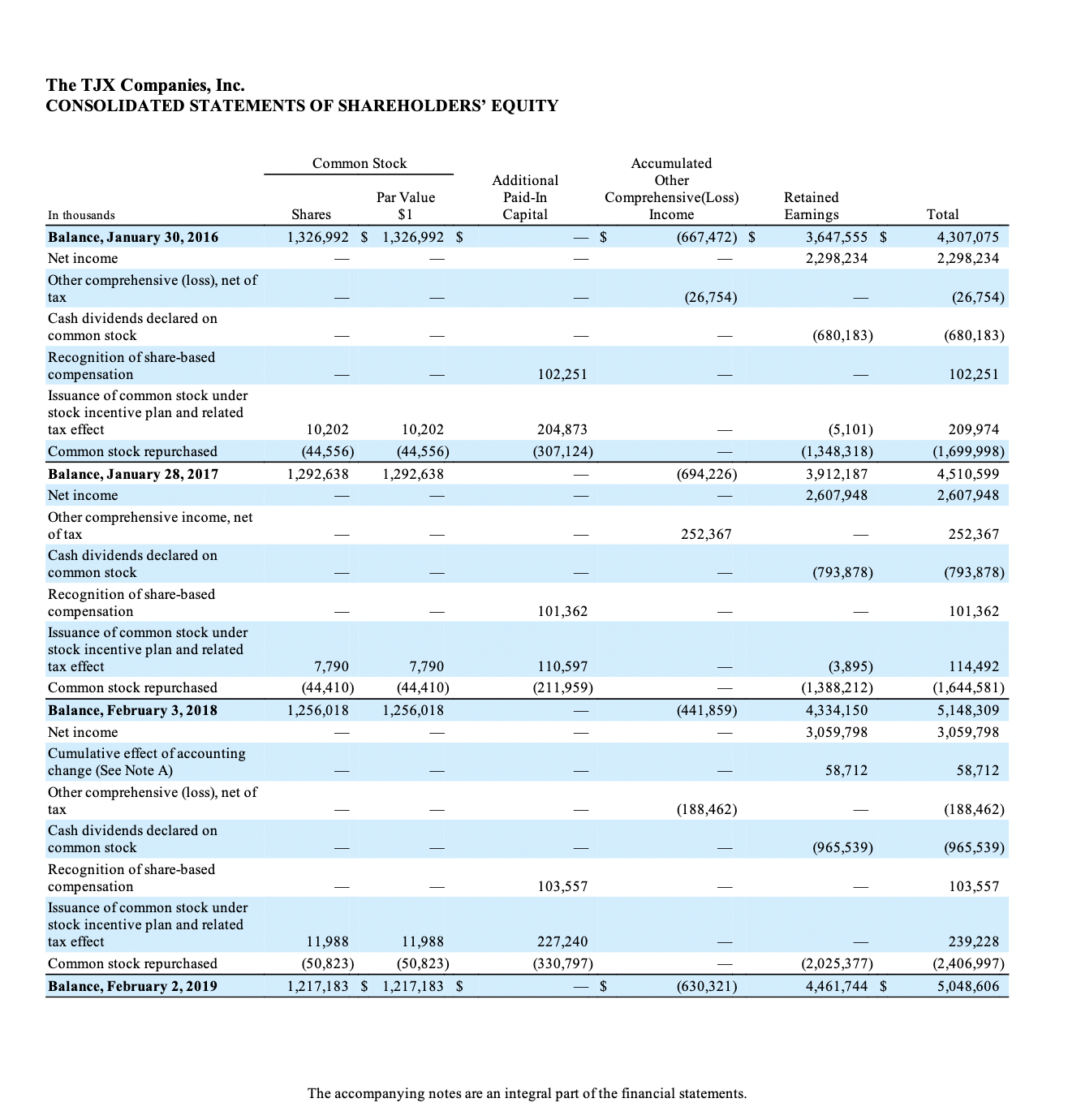

SHAREHOLDERS' EQUITYThe TJX Companies, Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Fiscal Year Ended

tableIn thousands,Fiscal Year EndedtabletableFebruary tabletableFebruary weekstableJanuary Net income,$$Additions to other comprehensive income:tableForeign currency translation adjustments, net of related tax benefit of $ in fiscal and provisions of $ and $ in fiscal and fiscal respectivelyGain on net investment hedges, net of related tax provision of $ in fiscal tableRecognition of net gainslosses on benefit obligations, net of related tax benefit of $in fiscal provision of $ in fiscal and benefit of $ in fiscal Reclassifications from other comprehensive income to net income:tablePension settlement charge, net of related tax provision of $ in fiscal and $in fiscal tableAmortization of loss on cash flow hedge, net of related tax provisions of $$ and$ in fiscal and respectivelytableAmortization of prior service cost and deferred gainslosses net of related tax provisions of$$ and $ in fiscal and respectivelyOther comprehensive loss income, net of tax,,Total comprehensive income,$$

Calculate TJXs Capital Acquisition Ratio for round to hundredths:

Question

Calculate TJXs Free Cash Flow for and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started