*Reference Case 2-1

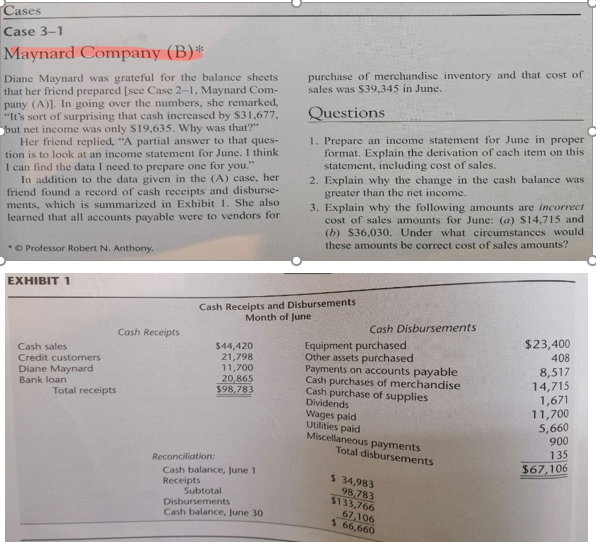

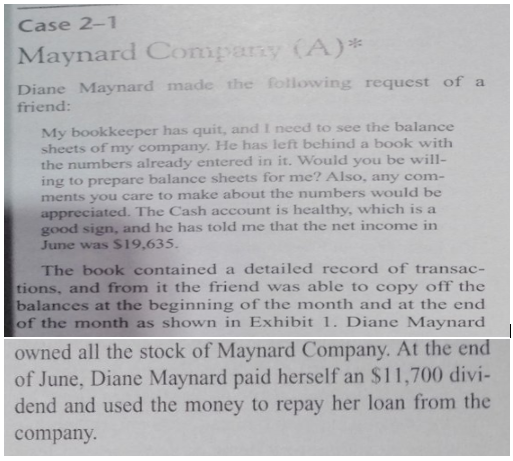

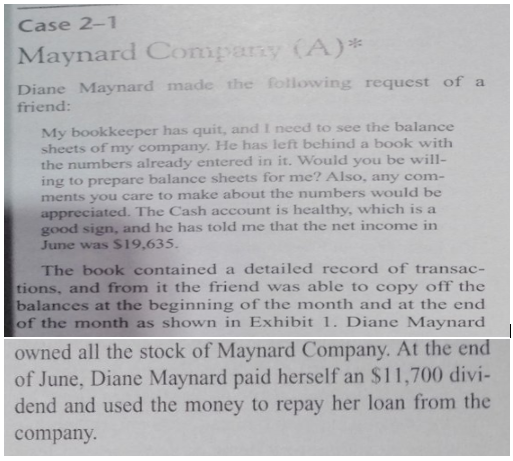

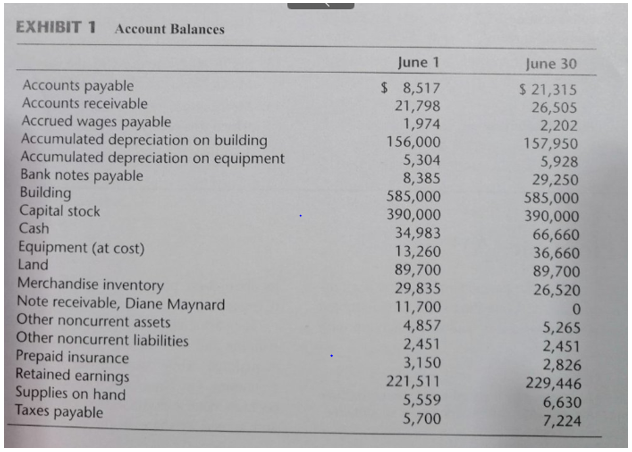

Cases Case 3-1 Maynard Company (B)* purchase of merchandise inventory and that cost of sales was $39,345 in June. Questions Diane Maynard was grateful for the balance sheets that her friend prepared [sce Case 2-1. Maynard Com- pany (A)]. In going over the numbers, she remarked. "It's sort of surprising that cash increased by S31.677. but net income was only $19,635. Why was that? Her friend replied, "A partial answer to that ques- tion is to look at an income statement for June. I think I can find the data I need to prepare one for you." In addition to the data given in the (A) case, her friend found a record of cash receipts and disburse- ments, which is summarized in Exhibit 1. She also learned that all accounts payable were to vendors for 1. Prepare an income statement for June in proper format. Explain the derivation of each item on this statement, including cost of sales. 2. Explain why the change in the cash balance was greater than the net income. 3. Explain why the following amounts are incorrect cost of sales amounts for June: (a) $14,715 and (5) S36,030. Under what circumstances would these amounts be correct cost of sales amounts? - Professor Robert N. Anthony EXHIBIT 1 Cash Receipts and Disbursements Month of June Cash Receipts Cash sales Credit customers Diane Maynard Bank loan Total receipts 544,420 21,798 11,700 20.865 598,783 Cash Disbursements Equipment purchased Other assets purchased Payments on accounts payable Cash purchases of merchandise Cash purchase of supplies Dividends Wages paid Utilities paid $23,400 408 8,517 14,715 1,671 11,700 5,660 900 135 $67,106 Miscellaneous payments Total disbursements $ 34,983 Reconciliation: Cash balance, June 1 Receipts Subtotal Disbursements Cash balance, June 30 98,783 5133,766 67 106 $ 66,660 Case 2-1 Maynard Compan(A) * Diane Maynard made the following request of a friend: My bookkeeper has quit, and I need to see the balance sheets of my company. He has left behind a book with the numbers already entered in it. Would you be will- ing to prepare balance sheets for me? Also, any com- ments you care to make about the numbers would be appreciated. The Cash account is healthy, which is a good sign, and he has told me that the net income in June was $19,635. The book contained a detailed record of transac- tions, and from it the friend was able to copy off the balances at the beginning of the month and at the end of the month as shown in Exhibit 1. Diane Maynard owned all the stock of Maynard Company. At the end of June, Diane Maynard paid herself an $11.700 divi- dend and used the money to repay her loan from the company. EXHIBIT 1 Account Balances Accounts payable Accounts receivable Accrued wages payable Accumulated depreciation on building Accumulated depreciation on equipment Bank notes payable Building Capital stock Cash Equipment (at cost) Land Merchandise inventory Note receivable, Diane Maynard Other noncurrent assets Other noncurrent liabilities Prepaid insurance Retained earnings Supplies on hand Taxes payable June 1 $ 8,517 21,798 1,974 156,000 5,304 8,385 585,000 390,000 34,983 13,260 89,700 29,835 11,700 4,857 2,451 3,150 221,511 5,559 5,700 June 30 $ 21,315 26,505 2,202 157,950 5,928 29,250 585,000 390,000 66,660 36,660 89,700 26,520 5,265 2,451 2,826 229,446 6,630 7,224 Cases Case 3-1 Maynard Company (B)* purchase of merchandise inventory and that cost of sales was $39,345 in June. Questions Diane Maynard was grateful for the balance sheets that her friend prepared [sce Case 2-1. Maynard Com- pany (A)]. In going over the numbers, she remarked. "It's sort of surprising that cash increased by S31.677. but net income was only $19,635. Why was that? Her friend replied, "A partial answer to that ques- tion is to look at an income statement for June. I think I can find the data I need to prepare one for you." In addition to the data given in the (A) case, her friend found a record of cash receipts and disburse- ments, which is summarized in Exhibit 1. She also learned that all accounts payable were to vendors for 1. Prepare an income statement for June in proper format. Explain the derivation of each item on this statement, including cost of sales. 2. Explain why the change in the cash balance was greater than the net income. 3. Explain why the following amounts are incorrect cost of sales amounts for June: (a) $14,715 and (5) S36,030. Under what circumstances would these amounts be correct cost of sales amounts? - Professor Robert N. Anthony EXHIBIT 1 Cash Receipts and Disbursements Month of June Cash Receipts Cash sales Credit customers Diane Maynard Bank loan Total receipts 544,420 21,798 11,700 20.865 598,783 Cash Disbursements Equipment purchased Other assets purchased Payments on accounts payable Cash purchases of merchandise Cash purchase of supplies Dividends Wages paid Utilities paid $23,400 408 8,517 14,715 1,671 11,700 5,660 900 135 $67,106 Miscellaneous payments Total disbursements $ 34,983 Reconciliation: Cash balance, June 1 Receipts Subtotal Disbursements Cash balance, June 30 98,783 5133,766 67 106 $ 66,660 Case 2-1 Maynard Compan(A) * Diane Maynard made the following request of a friend: My bookkeeper has quit, and I need to see the balance sheets of my company. He has left behind a book with the numbers already entered in it. Would you be will- ing to prepare balance sheets for me? Also, any com- ments you care to make about the numbers would be appreciated. The Cash account is healthy, which is a good sign, and he has told me that the net income in June was $19,635. The book contained a detailed record of transac- tions, and from it the friend was able to copy off the balances at the beginning of the month and at the end of the month as shown in Exhibit 1. Diane Maynard owned all the stock of Maynard Company. At the end of June, Diane Maynard paid herself an $11.700 divi- dend and used the money to repay her loan from the company. EXHIBIT 1 Account Balances Accounts payable Accounts receivable Accrued wages payable Accumulated depreciation on building Accumulated depreciation on equipment Bank notes payable Building Capital stock Cash Equipment (at cost) Land Merchandise inventory Note receivable, Diane Maynard Other noncurrent assets Other noncurrent liabilities Prepaid insurance Retained earnings Supplies on hand Taxes payable June 1 $ 8,517 21,798 1,974 156,000 5,304 8,385 585,000 390,000 34,983 13,260 89,700 29,835 11,700 4,857 2,451 3,150 221,511 5,559 5,700 June 30 $ 21,315 26,505 2,202 157,950 5,928 29,250 585,000 390,000 66,660 36,660 89,700 26,520 5,265 2,451 2,826 229,446 6,630 7,224