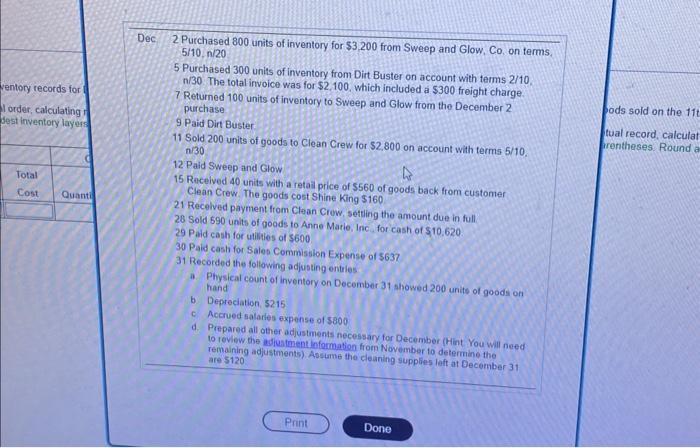

Reference Dec 2Purchased 800 units of inventory for $3.200 from Sweep and Glow, Co, on terms, 5/10,n/20 5 Purchased 300 units of inventory from Dirt Buster on account with terms 2/10. n/30. The total invoice was for $2,100. which included a $300 freight charge. 7 Returned 100 units of inventory to Sweep and Glow from the December 2 purchase 9 Paid Dirt Buster. 11 Sold 200 units of goods to Clean Crew for $2,800 on account with terms 5/10. n/30 12 Paid Sweep and Glow. 15 Raceived 40 units with a retal price of $560 of goods back from customer Clean Crew. The goods cost Shine King $160 21 Recelved payment from Clean Crow, setting the amount due in full. 28 Sold 590 units of goods to Anne Marie, Inc. for cash of $10.620. 29 Paid cash for utilities of $600 30 Paid cash for Sales Commission Expense of $637 31 Recorded the following adjusting entries a. Physical count of inventory on December 31 showed 200 units of goods on hand b. Depreciation, 5215 c. Accrued salaries expense of $800 d. Prepared all other adjustments necessary for December (Hint You will need to review the adiluatment information from Nowember to determine the remaining adjustments) Aosume the cleaning supplies left at December 31 are 5120 Reference Dec 2Purchased 800 units of inventory for $3.200 from Sweep and Glow, Co, on terms, 5/10,n/20 5 Purchased 300 units of inventory from Dirt Buster on account with terms 2/10. n/30. The total invoice was for $2,100. which included a $300 freight charge. 7 Returned 100 units of inventory to Sweep and Glow from the December 2 purchase 9 Paid Dirt Buster. 11 Sold 200 units of goods to Clean Crew for $2,800 on account with terms 5/10. n/30 12 Paid Sweep and Glow. 15 Raceived 40 units with a retal price of $560 of goods back from customer Clean Crew. The goods cost Shine King $160 21 Recelved payment from Clean Crow, setting the amount due in full. 28 Sold 590 units of goods to Anne Marie, Inc. for cash of $10.620. 29 Paid cash for utilities of $600 30 Paid cash for Sales Commission Expense of $637 31 Recorded the following adjusting entries a. Physical count of inventory on December 31 showed 200 units of goods on hand b. Depreciation, 5215 c. Accrued salaries expense of $800 d. Prepared all other adjustments necessary for December (Hint You will need to review the adiluatment information from Nowember to determine the remaining adjustments) Aosume the cleaning supplies left at December 31 are 5120