Question

Reference : McDonald, R. (2011, December). Don't leave your hand in the cookie jar . IMA Educational Case Journal, 4 (4), ART. 2. QUESTIONS: 1)

Reference: McDonald, R. (2011, December). Don't leave your hand in the cookie jar . IMA Educational Case Journal, 4(4), ART. 2.

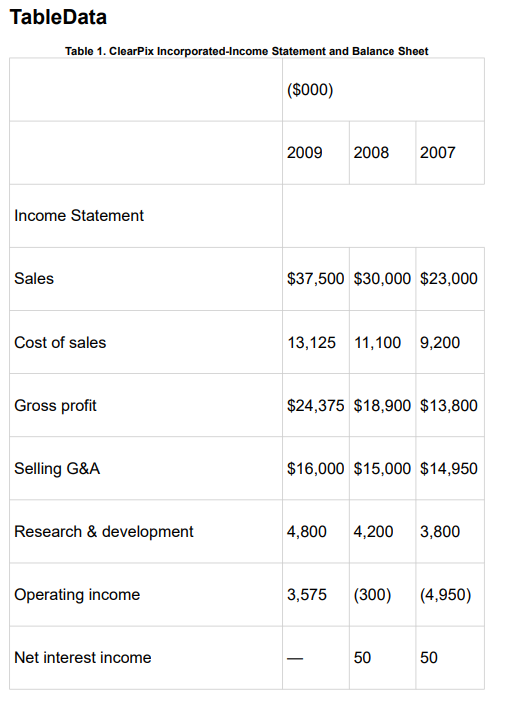

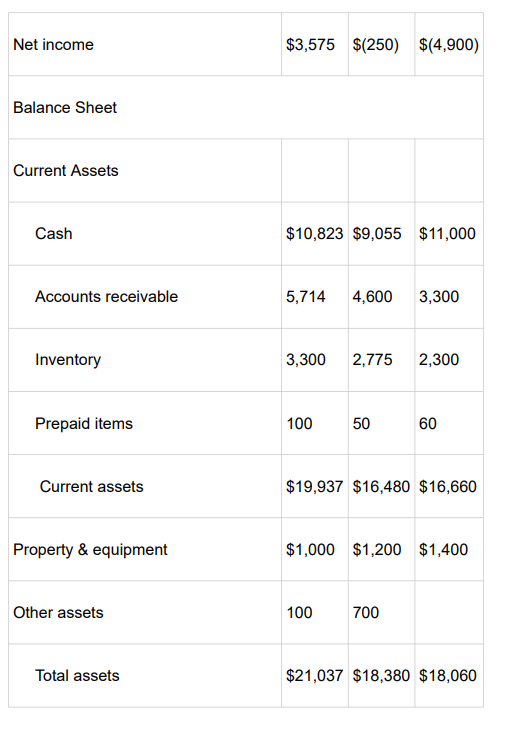

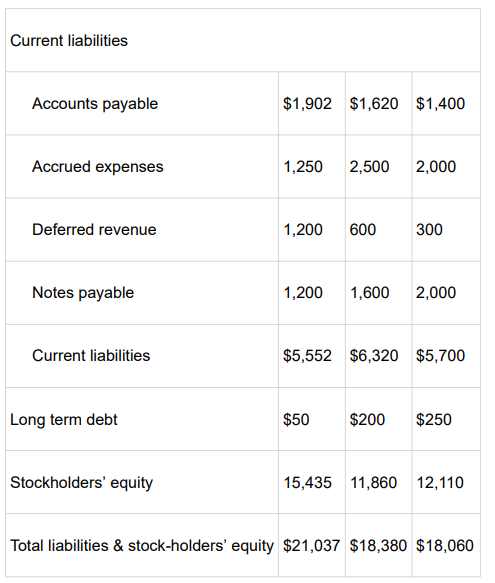

QUESTIONS: 1) See the attached data file and calculate the difference between Karl's and John's recommended adjustments for bad debt, product returns, and warranties. 2) Do you consider each individual difference material? 3) Is the combination of the three amounts material?

Abstract: John Davies, assistant controller, was concerned about an upcoming meeting with his boss about year-end accounting adjustments. He had noticed over the past two years that the controller was adding to three reserve accounts: bad debt, product returns, and warranties. "Cookie jar" accounting came to mind as John thought through his arguments against the practice. Cookie-jar accounting sets aside reserves in good times to be dipped into in bad times when the firm needs a boost to earningsa classic example of earnings management. John knew the controller would cite conservatism in accounting, industry practice, and materiality in his defense of the added reserves. John was concerned that an ulterior motive for the controller was to present earnings growth to the venture capital firms that had funded the start-up firm. There still is a gray area that allows differing interpretations of what should be recorded for these estimates.

The Adjusting Entries/Reserves, Bad Debt

Karl: "I want to start our meeting off on a positive note. I realize last year our discussion was a bit strained, and well-meaning professionals can disagree. I would prefer to bring bad debt up to 3% of sales, because I really think an economic slowdown is coming and we should get ready for it. Our segment of the economy is still weak. Looking back at past history is like driving a car through the rear view mirror. I also think we have some new untested customers with the new Turbo product line, and there could be some bad debts lurking in that expanded business. But I know you were uneasy last year when we bumped up the bad debt adjustment to 2.75% from 2.5%. I will start with keeping the bad debt adjustment at 2.75% and not increase it to 3%. Even if we went to 3%, in relation to the size of the firm and in percentage terms, it would not be that excessive."

John: "Karl, we have had steady bad debt charge-offs at 2.5% for three years now. I still don't see the need for increasing bad debt allowances. We have steady, accurate numbers on bad debt, and we should stick with them. I don't think we should try to anticipate the future. Wait until something happens and then you have facts to record the events. I would wait at least six months, maybe nine months, to reflect what we think is a change in trend. Then we have year-end adjustments to play catch up."

Karl: "I have seen the high-tech business turn on a dime. You don't have six to nine months to figure out what is happening."

Karl believes in conservative accountingthat is, where there are several approaches to recording an amount and acceptable arguments can be made for each approach. Then the accountant should use the least favorable amountthe higher expense, the lower sale, or the lower asset.

Karl is also trying to show the venture capitalists that ClearPix has erred on the side of overstating expenses and understating profits. He wants the venture capitalists to feel at ease with ClearPix's accounting, knowing that there will be no unpleasant surprises, such as greater losses or less income. He is also looking further ahead for an eventual initial public offering. He wants the same impression about the firm's accounting standards when the firm goes through a strenuous "due diligence" audit from the accounting firm and the underwriter of the firm's stock.

Product Returns

Karl: "That Turbo product line was a generational change in our technology and I still think we will suffer additional returns when a product develops problems. I would rather anticipate problems than learn about them after one or two quarters of problems. Last year we used a 1% adjustment, and the reserve is relatively minor on our scale of business. As you CPAs say, it is immaterial."

John: "You are right, it is probably immaterial. But the Turbo line has been selling for a little over a year now, and if there were additional problems, we should have seen them in the beginning. For 15 months the actual returns are about .5% of sales. That figure also matches industry association data. We should start using the actual .5% on returns."

Karl: "That is not enough time for a new product to develop problems and disappoint our customers."

Product Warranties

Karl: "Last year we doubled the warranty period from six months to one year for parts and labor on the new Turbo line. I don't think you can use the first few months of sales to determine a long-term warranty problem. We should anticipate problems with the new line, and I would feel better if we used 1% of sales again in 2009 for a warranty adjustment and liability."

John: "Well said, Karl. We continue to experience .5% on warranty claims. That is the experience for about one year. We should have seen an uptick in warranty problems if there were problems. Remember, our chief technical officer stated the quality on Turbo was much improved, and he estimated any warranty claims would decrease after the first year."

Karl: "What do you expect the chief technical officer to say after we made a large investment in his operations? And, he made that statement before we starting shipping any product. Of course he will argue that quality is improved and our costs will decline."

At the end of their discussion about the three adjusting entries, Karl realized their positions had not improved that much since last year's meeting. He and John had opposing views on each adjustment, and he did not want the disagreement to worsen. Karl thought he would offer a solution to their different views: "Hey, don't sweat the small stuff. If in the future we have better information on our experience, and we determine that we need to reduce the allowances for bad debt, product returns, or warranties, it is no big deal to reduce those estimates. Remember, in your own accounting terms, each one is an immaterial amount.

Thank you for the tutoring help with this problem!

TableData Table 1. ClearPix Incorporated-Income Statement and Balance Sheet \begin{tabular}{|l|l|l|l|} \hline & ($000) & \\ \hline Table 1. ClearPix Incorporated-Income Statement and Balance Sheet \\ \hline & 2009 & 2008 & 2007 \\ \hline \end{tabular} Income Statement \begin{tabular}{|l|l|l|l|} \hline Sales & $37,500 & $30,000 & $23,000 \\ \hline Cost of sales & 13,125 & 11,100 & 9,200 \\ \hline Gross profit & $24,375 & $18,900 & $13,800 \\ \hline Selling G\&A & $16,000 & $15,000 & $14,950 \\ \hline Research \& development & 4,800 & 4,200 & 3,800 \\ \hline Operating income & 3,575 & (300) & (4,950) \\ \hline Net interest income & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Net income & $3,575 & $(250) & $(4,900) \\ \hline Balance Sheet & $10,823 & $9,055 & $11,000 \\ \hline Current Assets & $,714 & 4,600 & 3,300 \\ \hline Cash & 3,300 & 2,775 & 2,300 \\ \hline Accounts receivable & $21,037 & $18,380 & $18,060 \\ \hline Other assets & 100 & 50 & 60 \\ \hline Inventory & $19,937 & $16,480 & $16,660 \\ \hline Total assets & $1,000 & $1,200 & $1,400 \\ \hline Prepaid items & & \\ \hline & & \\ \hline Current assets & & \\ \hline \end{tabular} Current liabilities \begin{tabular}{|c|c|c|c|} \hline Accounts payable & $1,902 & $1,620 & $1,400 \\ \hline Accrued expenses & 1,250 & 2,500 & 2,000 \\ \hline Deferred revenue & 1,200 & 600 & 300 \\ \hline Notes payable & 1,200 & 1,600 & 2,000 \\ \hline Current liabilities & $5,552 & $6,320 & $5,700 \\ \hline Long term debt & $50 & $200 & $250 \\ \hline Stockholders' equity & 15,435 & 11,860 & 12,110 \\ \hline \end{tabular} Total liabilities \& stock-holders' equity $21,037$18,380$18,060 TableData Table 1. ClearPix Incorporated-Income Statement and Balance Sheet \begin{tabular}{|l|l|l|l|} \hline & ($000) & \\ \hline Table 1. ClearPix Incorporated-Income Statement and Balance Sheet \\ \hline & 2009 & 2008 & 2007 \\ \hline \end{tabular} Income Statement \begin{tabular}{|l|l|l|l|} \hline Sales & $37,500 & $30,000 & $23,000 \\ \hline Cost of sales & 13,125 & 11,100 & 9,200 \\ \hline Gross profit & $24,375 & $18,900 & $13,800 \\ \hline Selling G\&A & $16,000 & $15,000 & $14,950 \\ \hline Research \& development & 4,800 & 4,200 & 3,800 \\ \hline Operating income & 3,575 & (300) & (4,950) \\ \hline Net interest income & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Net income & $3,575 & $(250) & $(4,900) \\ \hline Balance Sheet & $10,823 & $9,055 & $11,000 \\ \hline Current Assets & $,714 & 4,600 & 3,300 \\ \hline Cash & 3,300 & 2,775 & 2,300 \\ \hline Accounts receivable & $21,037 & $18,380 & $18,060 \\ \hline Other assets & 100 & 50 & 60 \\ \hline Inventory & $19,937 & $16,480 & $16,660 \\ \hline Total assets & $1,000 & $1,200 & $1,400 \\ \hline Prepaid items & & \\ \hline & & \\ \hline Current assets & & \\ \hline \end{tabular} Current liabilities \begin{tabular}{|c|c|c|c|} \hline Accounts payable & $1,902 & $1,620 & $1,400 \\ \hline Accrued expenses & 1,250 & 2,500 & 2,000 \\ \hline Deferred revenue & 1,200 & 600 & 300 \\ \hline Notes payable & 1,200 & 1,600 & 2,000 \\ \hline Current liabilities & $5,552 & $6,320 & $5,700 \\ \hline Long term debt & $50 & $200 & $250 \\ \hline Stockholders' equity & 15,435 & 11,860 & 12,110 \\ \hline \end{tabular} Total liabilities \& stock-holders' equity $21,037$18,380$18,060Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started