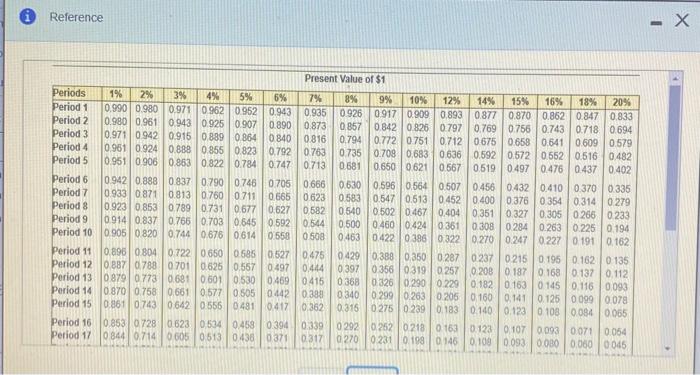

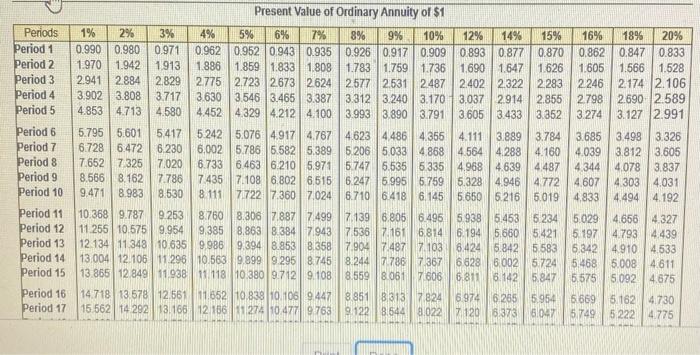

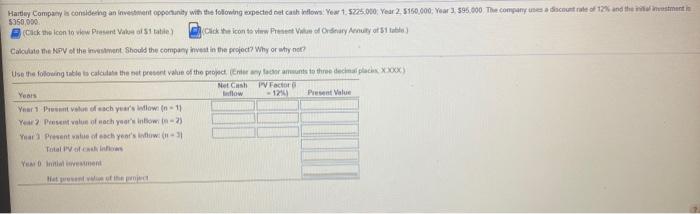

Reference - Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.9710.96209520.943 0.935 0.926 0917 0.909 0.893 0877 0.870 0.862 0.847 0.833 Period 2 0.980 0961 0943 0.925 0.9070.890 0.873 0.857 0.842 0.826 0797 0.769 0.756 0.7430.7180.694 Period 3 0.971 0 942 0.915 08890.8640 840 0.816 0.7940.772 0751 0.7120675 0,658 0.5410609 0.579 Period 4 09610924 0888 0.855 0.823 0.792 0763 0735 0.709 0,683 0 636 0.59205720552 0.516 0.482 Period 5 0.951 0 906 0.863 0.822 0.784 0.747 0713 0681 0.6500621 0.567 05190.497 0.476 0.437 0.402 Period 6 09420.888 0 837 0.790 0746 0705 0666 0630 0.596 0.564 0.507 0.456 0.432 0.410 03700335 Period 7 0933 0.8710.813 07600 711 0665 0.623 0.583 0.5470.51304520.400 0.37603540.3140 279 Period 8 10.923 0.853 0.789 0.731 0.677 0.6270582 0.540 0.502 04670.4040351 0.327 0.305 0 266 0233 Period 9 0.914 0.8370.766 0.703 06450.5920.544 0.500 0.460 0424 0.361 03080284 0.263 0.225 0.194 Period 10 0.905 0.820 0.7440.676 0.614 0.5580508 0463 042203860322 0270 0247 0.2270191 0162 Period 11 0.896 08040.722 06500685 0.527 0.475 0429 0.3880 350 0.287 02370215 0 196 0.162 0 135 Period 12 0887 07880701 0.625 0,5670497 0.444 0397 0356 031902570 2080187 0.168 0.1370.112 Period 13 0 879 0773 0681 0601 0.530 0469 0415 0368 0326 0.290 0.229 0.1820 1630145 0.116 0.093 Period 14 0.870 0.758 0661 0.577 0.505 0442 0.388 0340 0.299 0.263 0.206 0.1600.141 0.125 0099 0.078 Period 1508610 7430 64205560481 0.417 0.362 0.316 02750 239 0.183 0.140 0.123 0 10800840065 Period 16 0.853 072806230534 0.458 0.394 0339 0292 0252 02180163012301070093 0.071 0.064 Period 17 0 844 0.714060505130438 0371 0317 0270 0231 0.1990 146 0109 0093 0.000 0.0000045 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 1896 20% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0893 0.877 0.870 0.862 0.847 0.833 1.9701.942 1913 1.886 1.859 1.833 1808 1.783 1759 1.736 16901.647 1626 1.605 1.566 1.528 2.9412.884 2.829 2775 2.723 2673 2624 2577 2.531 2487 2.402 2322 2283 2246 2.174 2.106 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.865 2798 2.590 2.589 4.853 4.713 4.580 4.452 4329 4212 4.100 3.993 3.890 3.791 3.605 3.433 3.852 3.274 3.127 2.991 5.795 5.601 5.417 5.242 5.0764.917 4.767 4.623 4486 4366 4.111 3.8893.784 3.685 3.498 3.326 6.7286.472 6230 6.002 5.786 5.582 5.389 5.206 5033 4.868 45644288 4.160 4.039 3.812 3.605 7.652 7325 7.020 6.733 6.463 6.210 5.971 5.747 6.5355 335 4.968 4.6394487 4.344 4.078 3.837 8.566 | 8.162 7.786 7.435 7.108 6.802 6516 6 247 5 995 5.759 5.328 4.946 4.772 4.607 4303 4.031 9.471 8.983 8.530 8.111 74722 7,360 7.024 6.710 6.4186,145 5.6505.216 5.019 4.833 4.494 4.192 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.806 6.496 5938 5.453 5234 50294.656 4.327 11.255 10.575 9.954 9.385 8.863 8.384 7943 7.5367.166.814 6.194 5.560 5.421 5197 4.793 4439 12 134 11 348 10.635 9.986 9.394 8.853 8.358 7.9047.487 7.103 6.424 5.842 5583 6.342 4.910 4.533 13.004 12 106 11 296 10.563 9.899 9.295 8.745 8.24471786 7367 6.528 6.002 5.724 5.468 5.008 4.611 13.865 12.849 11.938 11 118 10 3809712 9.108 8.559 8 0517 606 6.8116.142 5.847 5.575 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.10694478 851 8.313 7.824 6.974 6.265 5.954 6.669 5.1624.730 15 562 14 292 13.166 12 106 11 274 10,477 9763 911228.544 8.022 7 120 5.373 6047 5.749 5:222 4.775 Hartley Company is considering an investment opportunity with the following expected at a low Yew 1$225.000 Year 2.5150.000 Year 3.595.000 The company este of 126 and the instantin $350,000 Click the icon to view Present of State Click the icon to view of Odry Annuity of 51 table Calculate the NPV of the investment should the company invest in the project? Why or why not? Use the following table to calculate the net presentatie of the project to as to the decimal xxxx) Neth PV Factor Years flow -12 Pre Value Year 1 we of each year's Wlow in 11 You Present value of each year's intown-> Yar Presentatie of each year's www. That of the Yen In