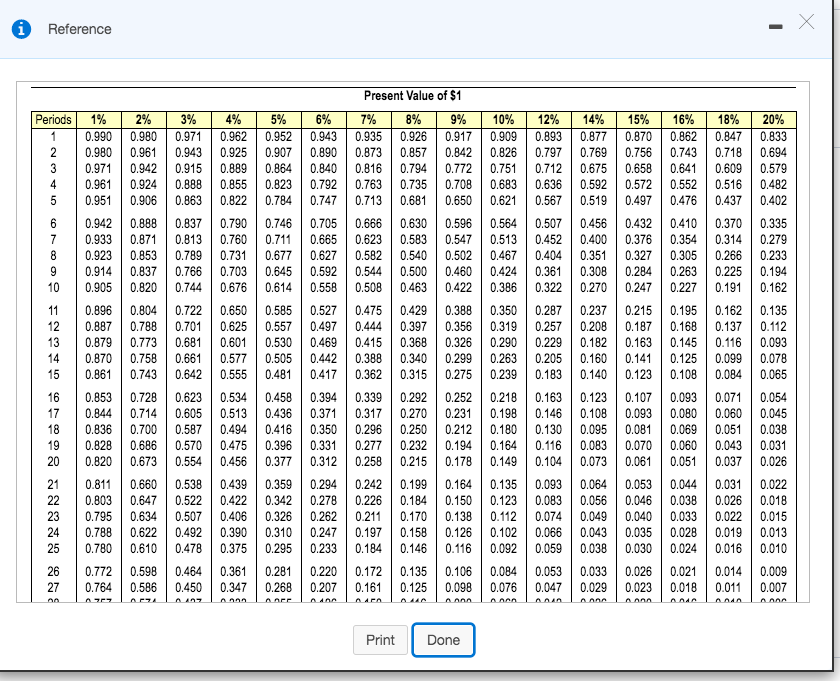

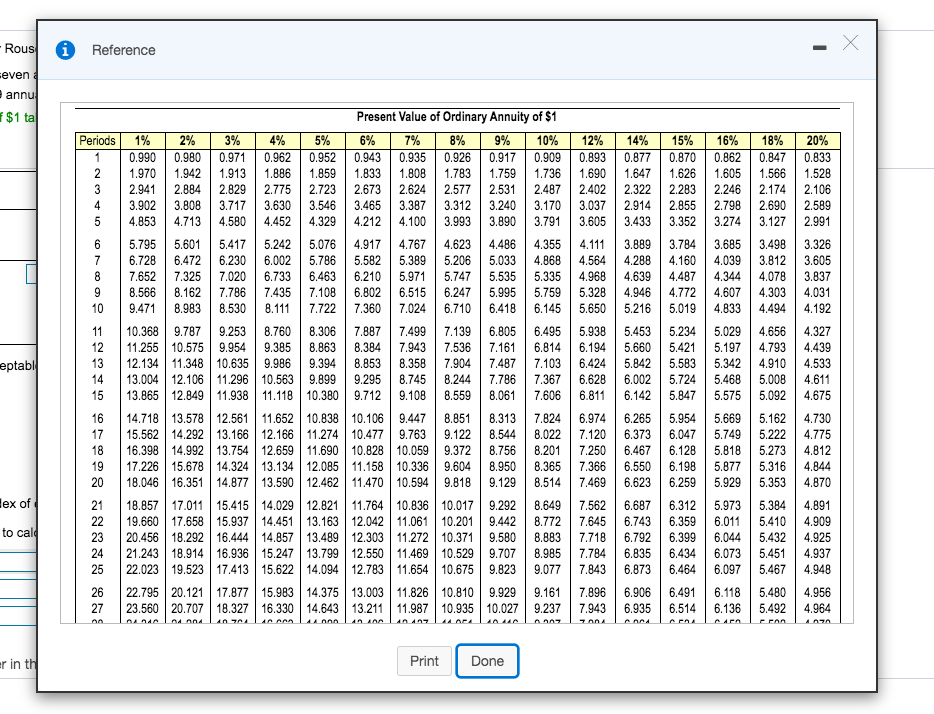

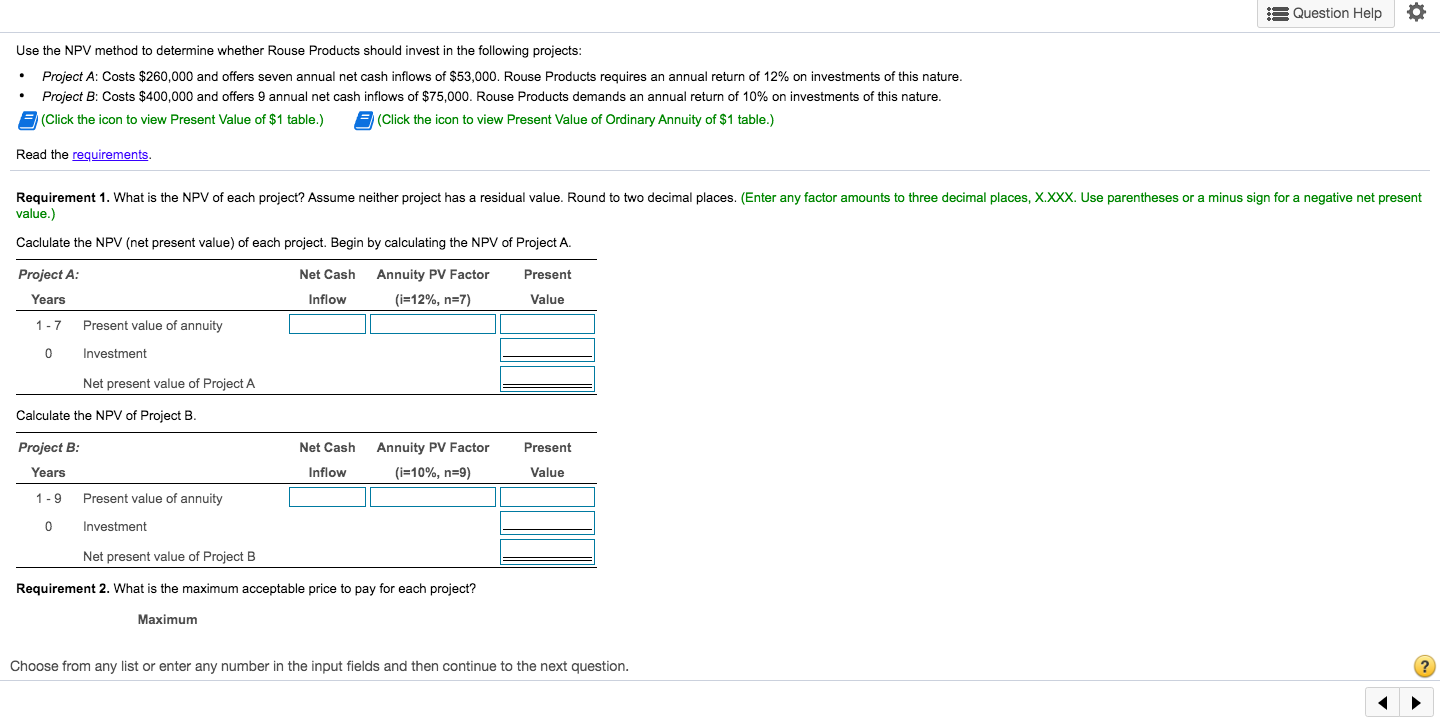

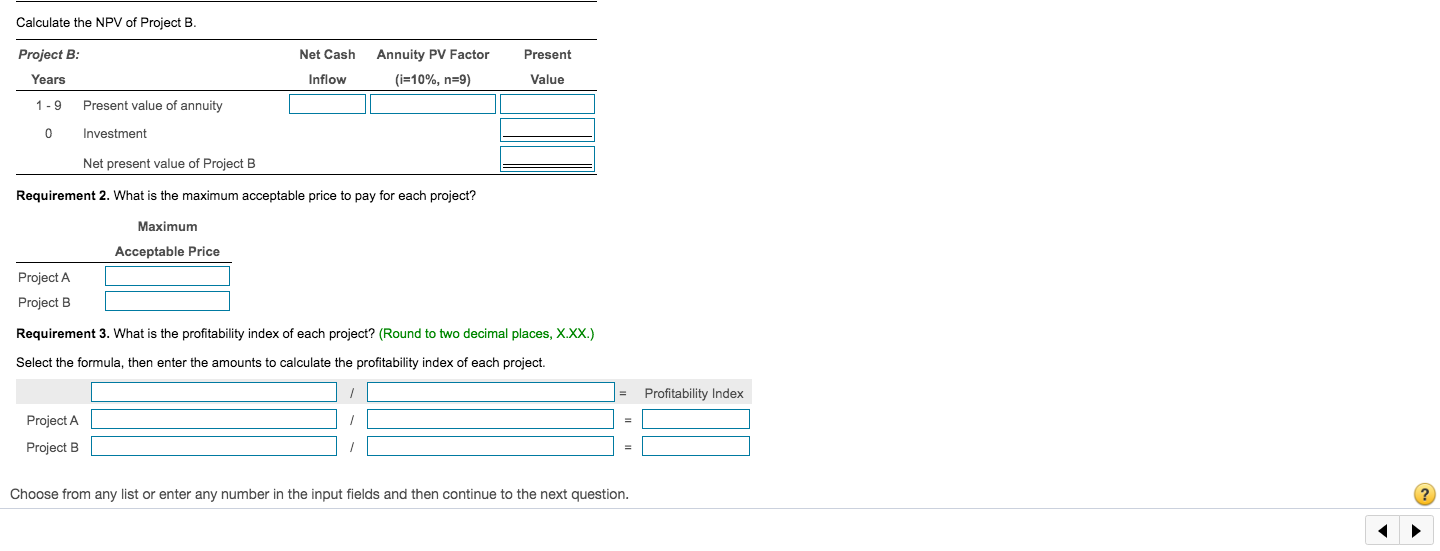

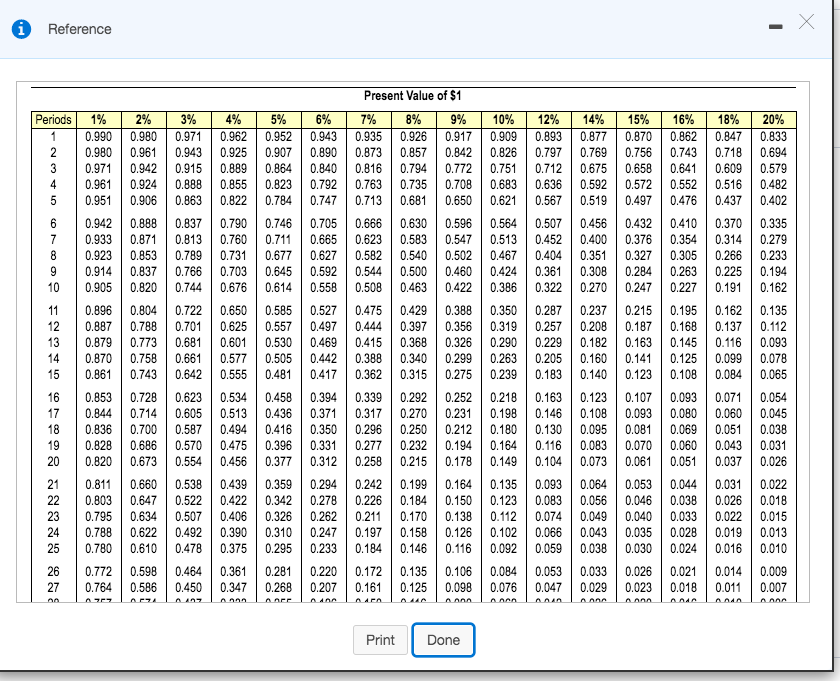

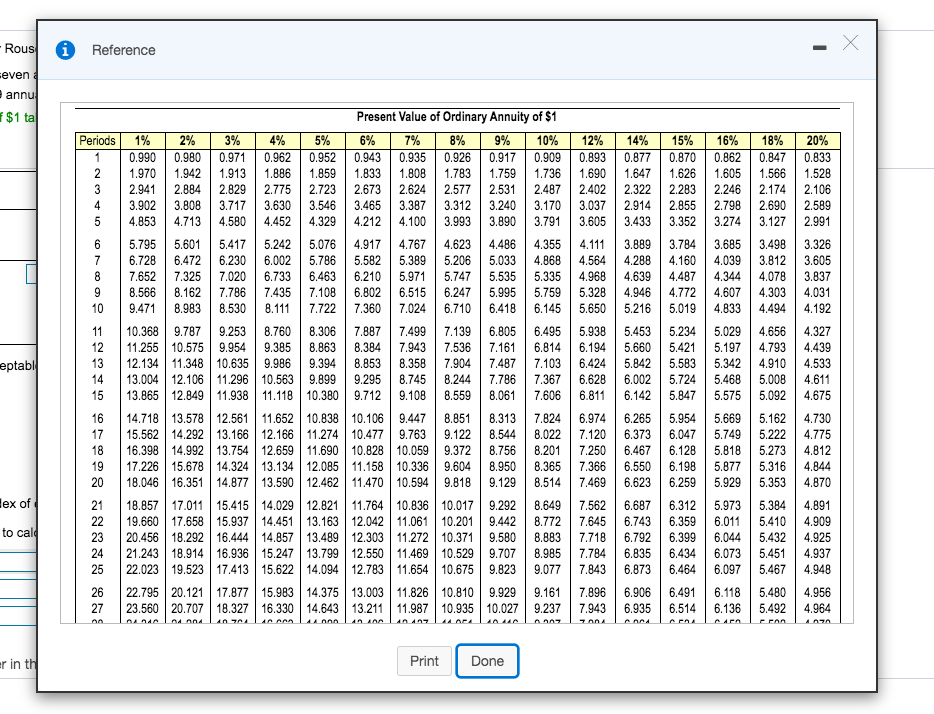

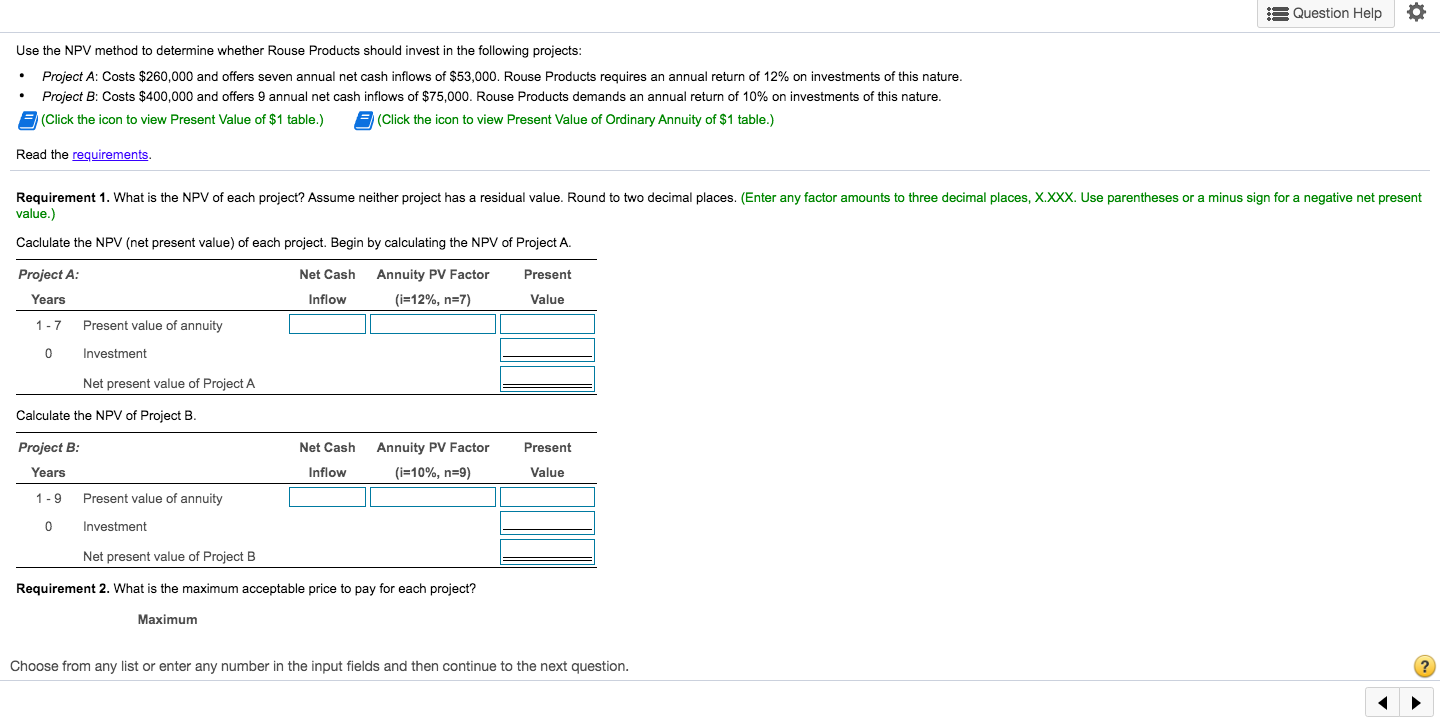

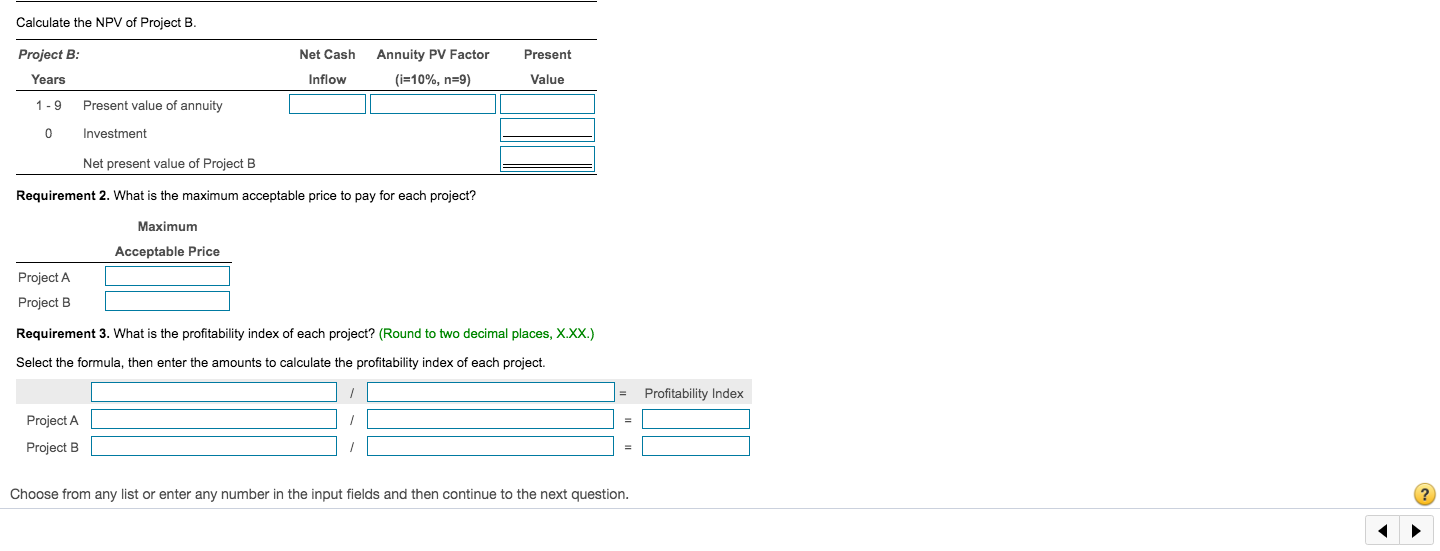

Reference Present Value of $1 Periods 1 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 2% 0.980 0.961 0.942 0.924 0.906 3% 0.971 0.943 0.915 0.888 0.863 4% 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.864 0.823 0.784 6% 0.943 0.890 0.840 0.792 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 9% 0.917 0.842 0.772 0.708 0.650 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 0.797 0.712 0.636 0.567 14% 0.877 0.769 0.675 0.592 0.519 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 18% 0.847 0.718 0.609 0.516 0.437 20% 0.833 0.694 0.579 0.482 0.402 7 0.942 0.933 0.923 0.914 0.905 8 9 10 0.888 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.746 0.711 0.677 0.645 0.614 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.547 0.502 0.460 0.422 0.564 0.513 0.467 0.424 0.386 0.507 0.452 0.404 0.361 0.322 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.456 0.400 0.351 0.308 0.270 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.370 0.314 0.266 0.225 0.191 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.722 0.701 0.681 0.661 0.642 0.585 0.557 0.530 0.505 0.481 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.388 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0.208 0.182 0.160 0.140 0.195 0.168 0.145 0.125 0.108 0.162 0.137 0.116 0.099 0.084 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 16 17 18 19 20 0.853 0.844 0.836 0.828 0.820 0.623 0.605 0.587 0.570 0.554 0.534 0.513 0.494 0.475 0.456 0.458 0.436 0.416 0.396 0.377 0.339 0.317 0.296 0.277 0.258 0.292 0.270 0.250 0.232 0.215 0.252 0.231 0.212 0.194 0.178 0.218 0.198 0.180 0.164 0.149 0.163 0.146 0.130 0.116 0.104 0.107 0.093 0.081 0.070 0.061 0.093 0.080 0.069 0.060 0.051 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 0.031 0.026 0.123 0.108 0.095 0.083 0.073 0.064 0.056 0.049 0.043 0.038 21 22 23 24 25 0.811 0.803 0.795 0.788 0.780 0.660 0.647 0.634 0.622 0.610 0.538 0.522 0.507 0.492 0.478 0.439 0.422 0.406 0.390 0.375 0.359 0.342 0.326 0.310 0.295 0.281 0.268 0.294 0.278 0.262 0.247 0.233 0.220 0.207 0.242 0.226 0.211 0.197 0.184 0.199 0.184 0.170 0.158 0.146 0.164 0.150 0.138 0.126 0.116 0.135 0.123 0.112 0.102 0.092 0.093 0.083 0.074 0.066 0.059 0.053 0.046 0.040 0.035 0.030 0.044 0.038 0.033 0.028 0.024 0.021 0.018 0.031 0.026 0.022 0.019 0.016 0.014 0.011 0.022 0.018 0.015 0.013 0.010 0.009 0.007 26 27 0.772 0.764 0.598 0.586 0.464 0.450 0.361 0.347 0.172 0.161 0.135 0.125 0.106 0.098 0.084 0.076 0.053 0.047 0.033 0.029 0.026 0.023 An A Print Done Rous Reference even annu $1 ta Periods 1% 2% 7% 14% 2 3 4 5 12% 0.893 1.690 2.402 3.037 3.605 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 6 7 4.111 4.564 4.968 5.328 5.650 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 9 10 eptabil 11 12 13 14 15 Present Value of Ordinary Annuity of $1 3% 4% 5% 6% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 13.004 12.106 11.296 | 10.563 9.899 9.295 8.745 8.244 7.786 7.367 13.865 12.849 11.938 11.118 | 10.380 9.712 9.108 8.559 8.061 7.606 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 16.398 14.992 13.754 | 12.659 11.690 10.828 10.059 9.372 8.756 8.201 17.226 15.678 14.324 13.134 | 12.085 11.158 10.336 9.604 8.950 8.365 18.046 16.351 14.877 13.590 12.462 | 11.470 10.594 9.818 9.129 8.514 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 8.772 20.456 18.292 16.444 14.857 13.489 12.303 | 11.272 10.371 9.580 8.883 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 22.795 20.121 | 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 DARIA 197 5.938 6.194 6.424 6.628 6.811 5.453 5.660 5.842 6.002 6.142 5.234 5.421 5.583 5.724 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 16 17 18 19 20 6.974 7.120 7.250 7.366 7.469 6.265 6.373 6.467 6.550 6.623 5.954 6.047 6.128 6.198 6.259 5.669 5.749 5.818 5.877 5.929 5.162 5.222 5.273 5.316 5.353 4.730 4.775 4.812 4.844 4.870 dex of to cald 21 22 23 24 25 7.562 7.645 7.718 7.784 7.843 6.687 6.743 6.792 6.835 6.873 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 5.384 5.410 5.432 5.451 5.467 4,891 4.909 4.925 4.937 4.948 26 27 7.896 7.943 6.906 6.935 6.491 6.514 6.118 6.136 5.480 5.492 4.956 4.964 A APA er in the Print Done Question Help O Use the NPV method to determine whether Rouse Products should invest in the following projects: Project A: Costs $260,000 and offers seven annual net cash inflows of $53,000. Rouse Products requires an annual return of 12% on investments of this nature. Project B: Costs $400,000 and offers 9 annual net cash inflows of $75,000. Rouse Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Net Cash Annuity PV Factor Present Project A: Years Inflow (i=12%, n=7) Value 1 - 7 Present value of annuity 0 Investment Net present value of Project A Calculate the NPV of Project B. Net Cash Present Project B: Years 1-9 Present value of annuity Annuity PV Factor (i=10%, n=9) Inflow Value 0 Investment Net present value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? Maximum Choose from any list or enter any number in the input fields and then continue to the next question. ? Calculate the NPV of Project B. Project B: Net Cash Present Annuity PV Factor (i=10%, n=9) Years Inflow Value 1-9 Present value of annuity 0 Investment Net present value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? Maximum Acceptable Price Project A Project B Requirement 3. What is the profitability index of each project? (Round to two decimal places, X.XX.) Select the formula, then enter the amounts to calculate the profitability index of each project. Profitability Index Project A Project B Choose from any list or enter any number in the input fields and then continue to the next