Answered step by step

Verified Expert Solution

Question

1 Approved Answer

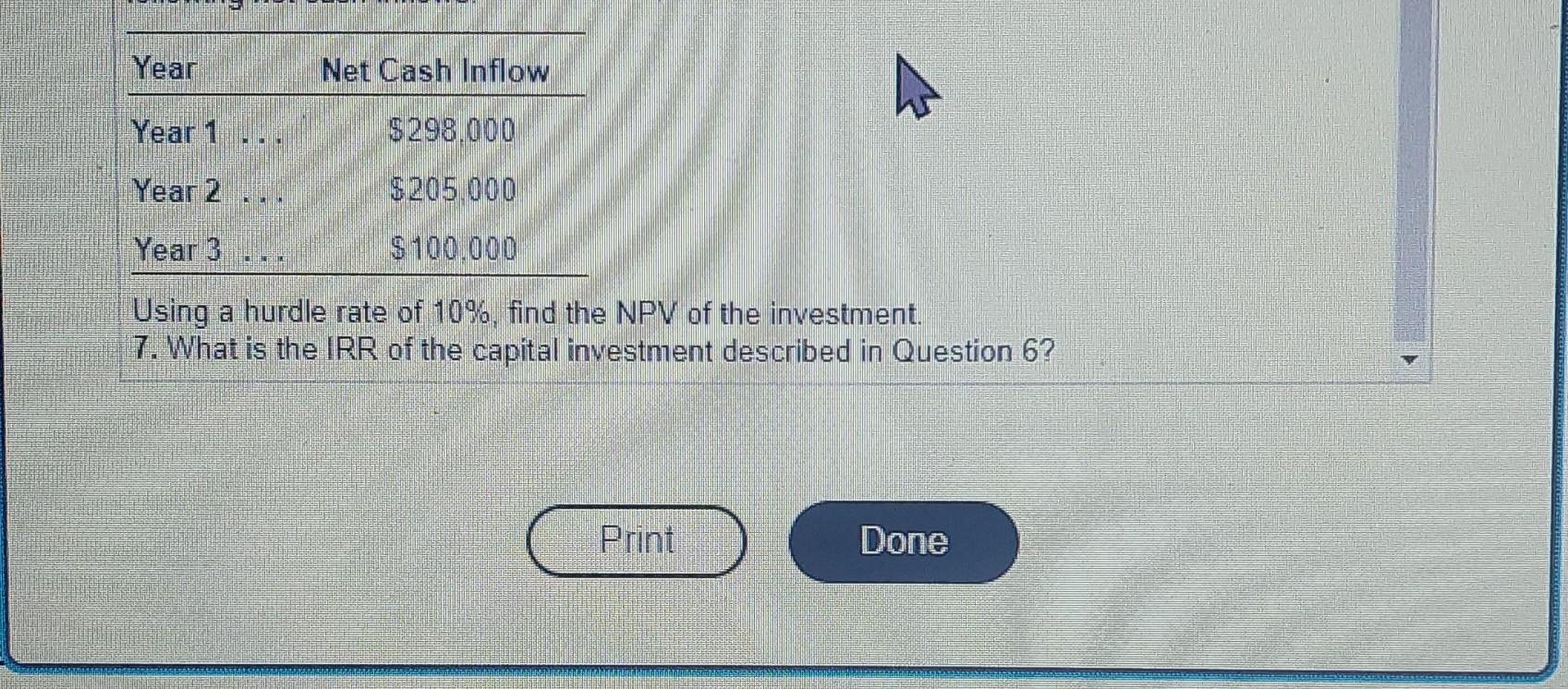

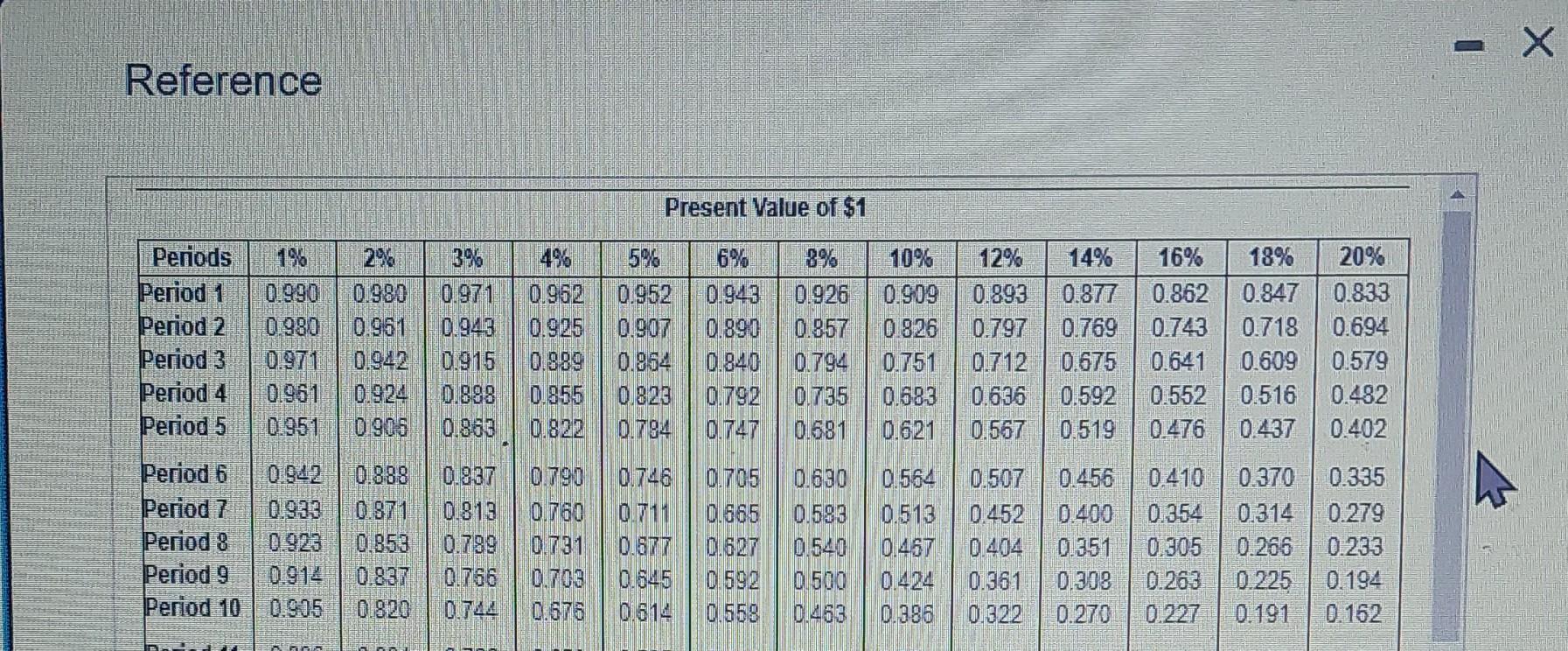

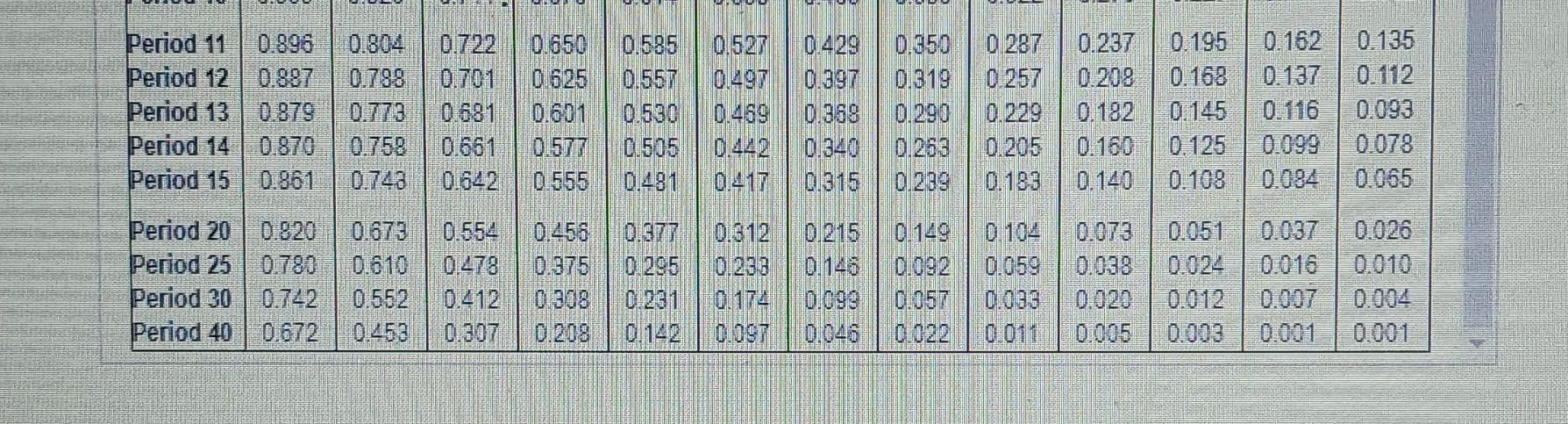

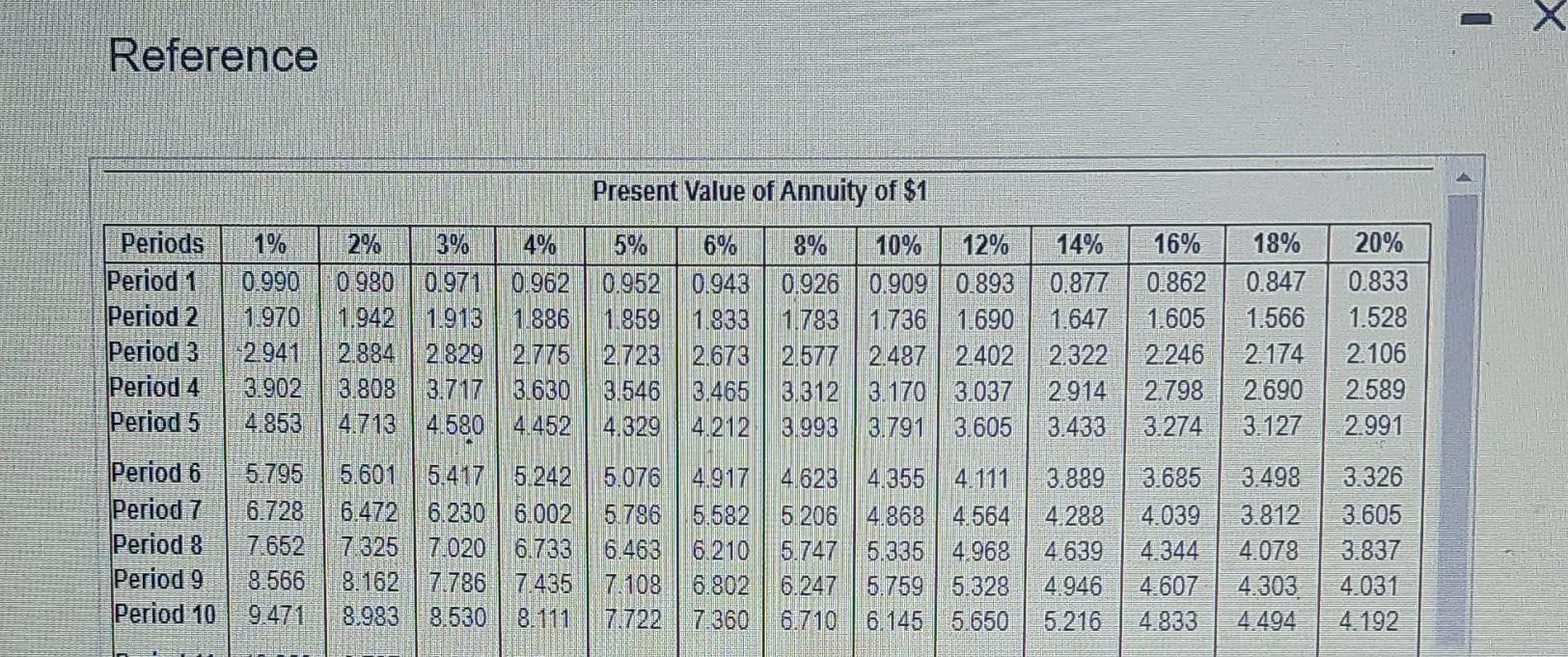

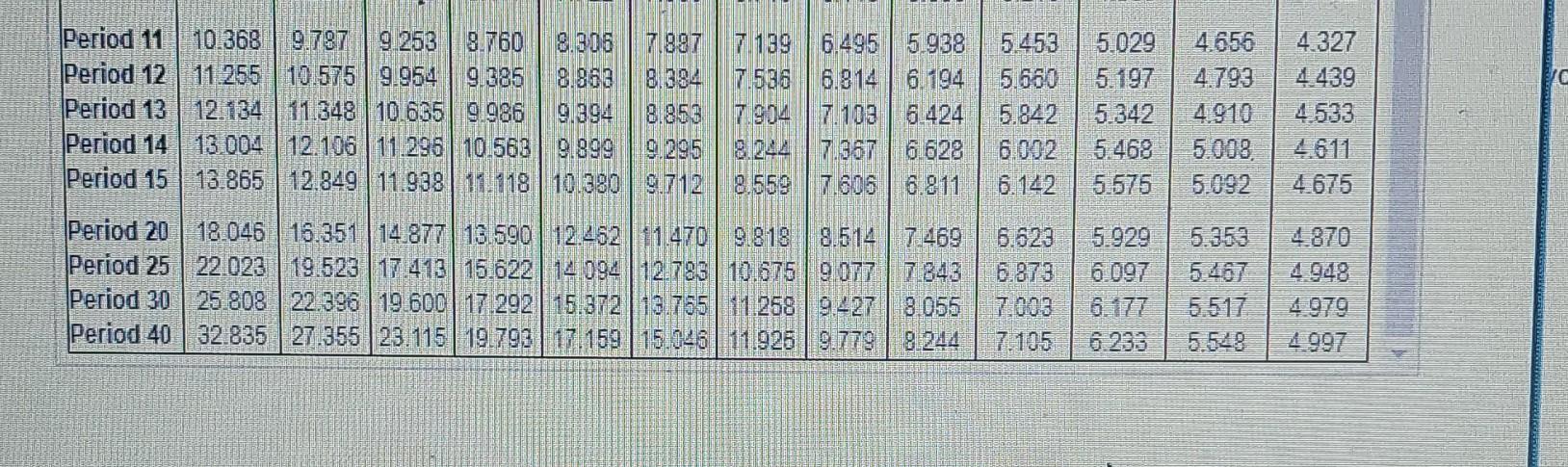

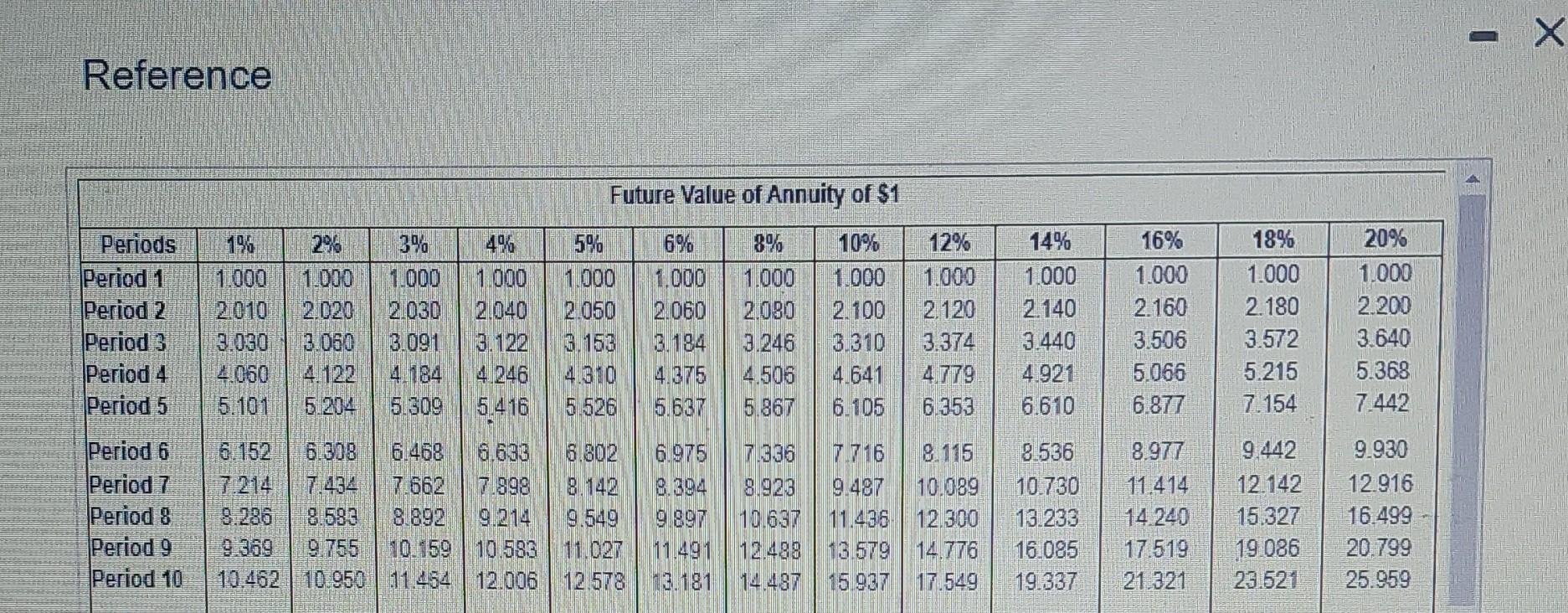

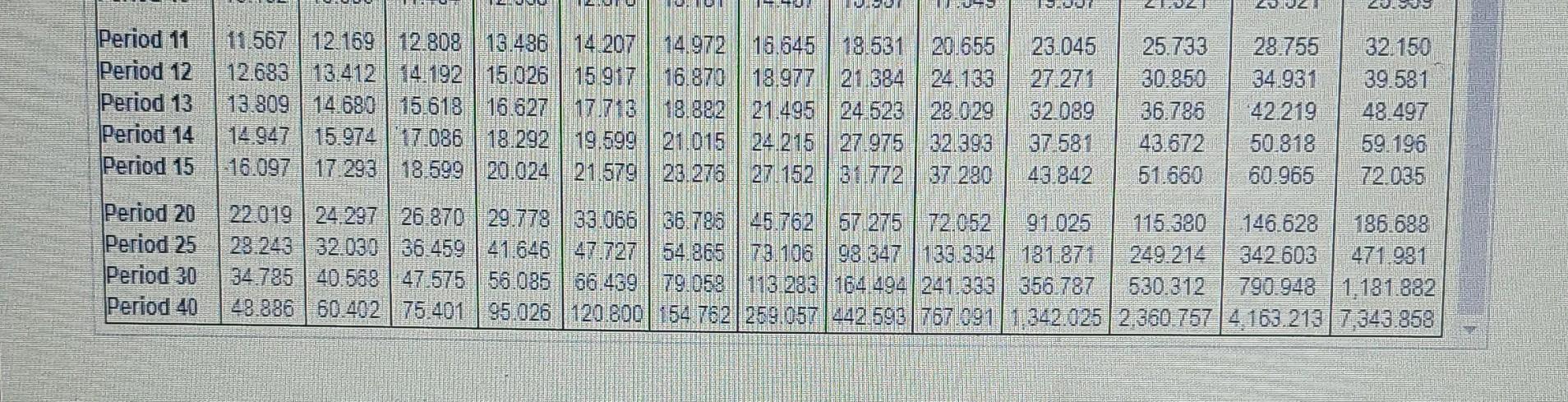

Reference Reference Dracant Vali of Annuitu nf $1 Using a hurdle rate of 10%, find the NPV of the investment. 7. What is the IRR

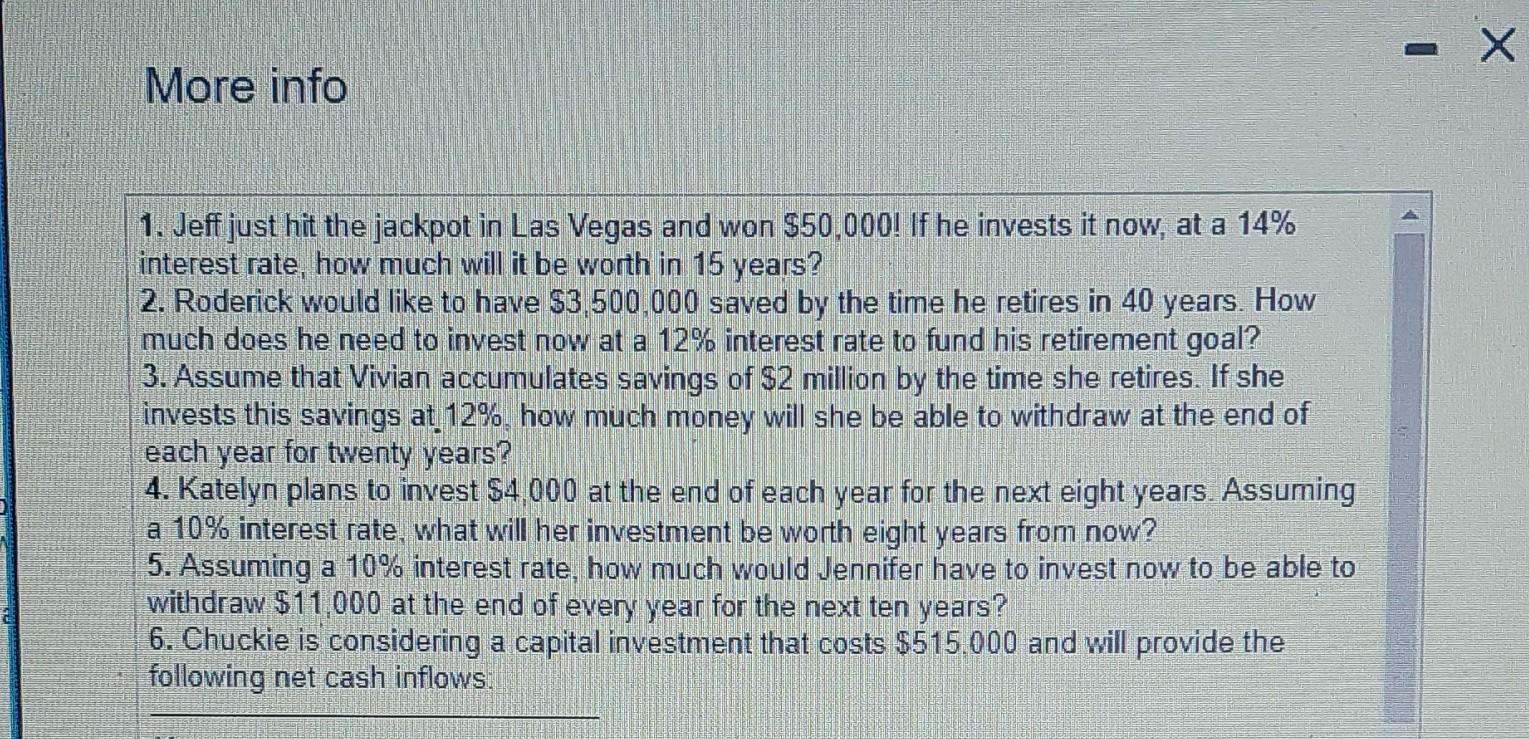

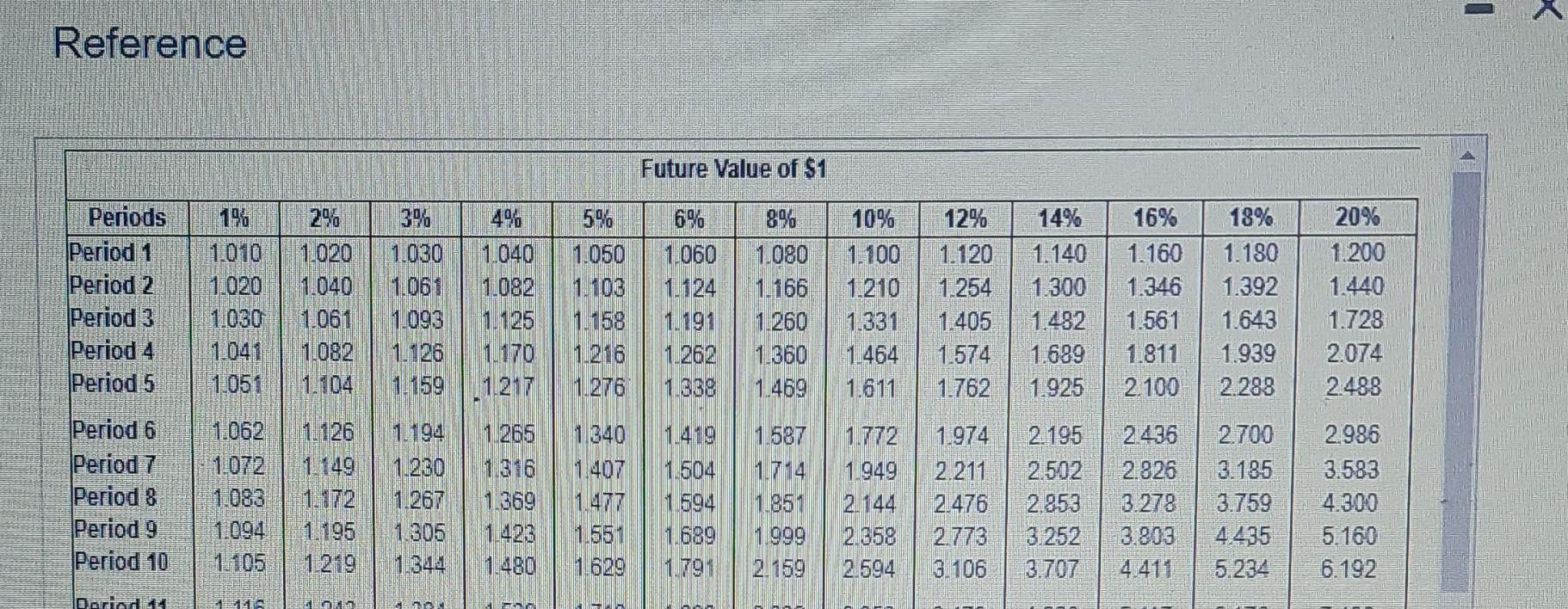

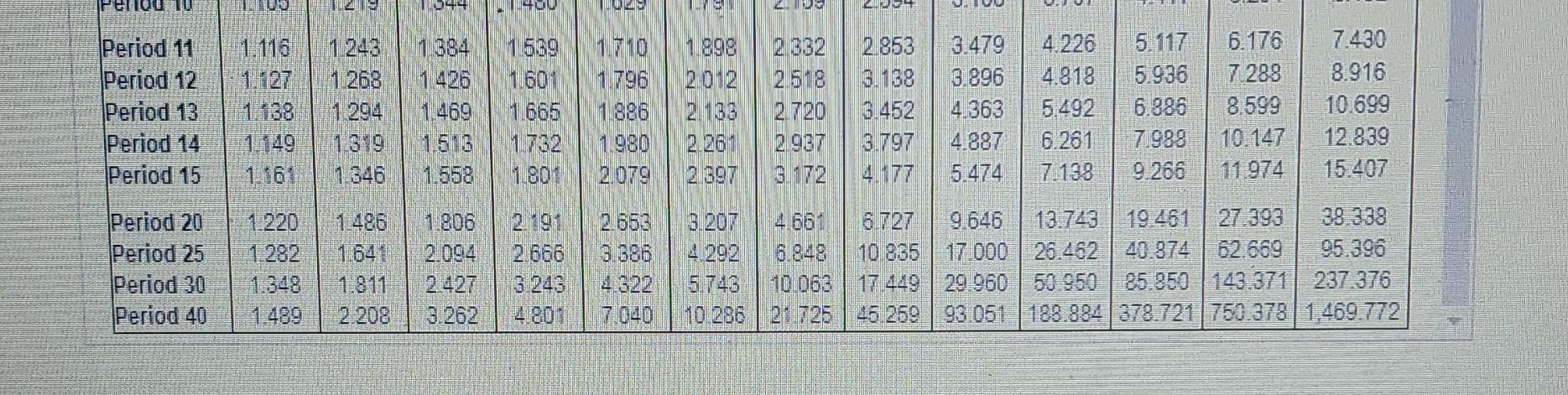

Reference Reference Dracant Vali of Annuitu nf $1 Using a hurdle rate of 10%, find the NPV of the investment. 7. What is the IRR of the capital investment described in Question 6? Reference Reference \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|} Period 11 & 1.116 & 1.243 & 1.384 & 1.539 & 1.710 & 1.898 & 2.332 & 2.853 & 3.479 & 4.226 & 5.117 & 6.176 & 7.430 \\ Period 12 & 1.127 & 1.268 & 1.426 & 1.601 & 1.796 & 2.012 & 2.518 & 3.138 & 3.896 & 4.818 & 5.936 & 7.288 & 8.916 \\ Period 13 & 1.138 & 1.294 & 1.469 & 1.665 & 1.886 & 2.133 & 2.720 & 3.452 & 4.363 & 5.492 & 6.886 & 8.599 & 10.699 \\ Period 14 & 1.149 & 1.319 & 1.513 & 1.732 & 1.980 & 2.261 & 2.937 & 3.797 & 4.887 & 6.261 & 7.988 & 10.147 & 12.839 \\ Period 15 & 1.161 & 1.346 & 1.558 & 1.801 & 2.079 & 2.397 & 3.172 & 4.177 & 5.474 & 7.138 & 9.266 & 11.974 & 15.407 \\ Period 20 & 1.220 & 1.486 & 1.806 & 2.191 & 2.653 & 3.207 & 4.661 & 6.727 & 9.646 & 13.743 & 19.481 & 27.393 & 38.338 \\ Period 25 & 1.282 & 1.641 & 2.094 & 2.666 & 3.386 & 4.292 & 6.848 & 10.835 & 17.000 & 26.462 & 40.374 & 62.669 & 95.396 \\ Period 30 & 1.348 & 1.811 & 2.427 & 3.243 & 4.322 & 5.743 & 10.063 & 17.449 & 29.960 & 50.950 & 85.850 & 143.371 & 237.376 \\ Period 40 & 1.489 & 2.208 & 3.262 & 4.801 & 7.040 & 10.286 & 21.725 & 45.259 & 93.051 & 188.884 & 378.721 & 750.378 & 1,469.772 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|l|} Period 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.429 & 0.350 & 0.287 & 0.237 & 0.195 & 0.162 & 0.135 \\ Period 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.397 & 0.319 & 0.257 & 0.208 & 0.168 & 0.137 & 0.112 \\ Period 13 & 0.879 & 0.773 & 0.681 & 0.601 & 0.530 & 0.469 & 0.368 & 0.290 & 0.229 & 0.182 & 0.145 & 0.116 & 0.093 \\ Period 14 & 0.870 & 0.758 & 0.661 & 0.577 & 0.505 & 0.442 & 0.340 & 0.263 & 0.205 & 0.160 & 0.125 & 0.099 & 0.078 \\ Period 15 & 0.861 & 0.743 & 0.642 & 0.555 & 0.481 & 0.417 & 0.315 & 0.239 & 0.183 & 0.140 & 0.108 & 0.084 & 0.065 \\ Period 20 & 0.820 & 0.673 & 0.554 & 0.456 & 0.377 & 0.312 & 0.215 & 0.149 & 0.104 & 0.073 & 0.051 & 0.037 & 0.026 \\ Period 25 & 0.780 & 0.610 & 0.478 & 0.375 & 0.295 & 0.233 & 0.146 & 0.092 & 0.059 & 0.038 & 0.024 & 0.016 & 0.010 \\ Period 30 & 0.742 & 0.562 & 0.412 & 0.308 & 0.231 & 0.174 & 0.099 & 0.057 & 0.033 & 0.020 & 0.012 & 0.007 & 0.004 \\ Period 40 & 0.672 & 0.453 & 0.307 & 0.208 & 0.142 & 0.097 & 0.046 & 0.022 & 0.011 & 0.005 & 0.003 & 0.001 & 0.001 \\ \hline \end{tabular} Solve various time value of money scenarios. (Click the icon to view the scenarios.) (Click the icon to view the present value of \$1 table (Click the icon to view the present value of annuity of $1 table.) (Click the icon to view the future value of $1 table. (Click the icon to view the future value of annuity of $1 table.) Scenario 1. Jeff just hit the jackpot in Las Vegas and won $50,000 ! If he invests it now, at a 14% interest rate, how much will it be worth in 15 years? (Round your answer to the nearest whole dollar:) Future value = \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} Period 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7.139 & 6.495 & 5.938 & 5.453 & 5.029 & 4.656 & 4.327 \\ Period 12 & 11.255 & 10.575 & 9.954 & 9.385 & 8.863 & 8.384 & 7.536 & 6.814 & 6.194 & 5.660 & 5.197 & 4.793 & 4.439 \\ Period 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.853 & 7.904 & 7.103 & 6.424 & 5.842 & 5.342 & 4.910 & 4.533 \\ Period 14 & 13.004 & 12.106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.244 & 7.367 & 6.628 & 6.002 & 5.468 & 5.008 & 4.611 \\ Period 15 & 13.865 & 12.849 & 11.938 & 11.118 & 10.380 & 9.712 & 8.559 & 7.606 & 6.811 & 6.142 & 5.575 & 5.092 & 4.675 \\ Period 20 & 18.046 & 15.351 & 14.877 & 13.590 & 12.462 & 11.470 & 9.818 & 8.514 & 7.469 & 6.623 & 5.929 & 5.353 & 4.870 \\ Period 25 & 22.023 & 19.523 & 17.413 & 15.622 & 14.094 & 12.783 & 10.675 & 9.077 & 7.84 .3 & 6.873 & 6.097 & 5.467 & 4.948 \\ Period 30 & 25.808 & 22.396 & 19.600 & 17.292 & 15.372 & 13.755 & 11.258 & 9.427 & 8.055 & 7.003 & 6.177 & 5.517 & 4.979 \\ Period 40 & 32.835 & 27.355 & 23.115 & 19.793 & 17.159 & 15.046 & 11.925 & 9.779 & 8.244 & 7.105 & 6.233 & 5.548 & 4.997 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} Period 11 & 11.567 & 12.169 & 12.808 & 13.486 & 14.207 & 14.972 & 16.545 & 18.531 & 20.655 & 23.045 & 25.733 & 28.755 & 32.150 \\ Period 12 & 12.683 & 13.412 & 14.192 & 15.026 & 15.917 & 16.870 & 18.977 & 21.384 & 24.133 & 27.271 & 30.850 & 34.931 & 39.581 \\ Period 13 & 13.809 & 14.680 & 15.618 & 16.627 & 17.713 & 18.882 & 21.495 & 24.523 & 28.029 & 32.089 & 36.786 & 42.219 & 48.497 \\ Period 14 & 14.947 & 15.974 & 17.086 & 18.292 & 19.599 & 21.015 & 24.215 & 27.975 & 32.39 .3 & 37.581 & 43.672 & 50.818 & 59.196 \\ Period 15 & 16.097 & 17.293 & 18.599 & 20.024 & 21.579 & 23.276 & 27.152 & 31.772 & 37.280 & 43.842 & 51.660 & 60.965 & 72.035 \\ Period 20 & 22.019 & 24.297 & 26.870 & 29.778 & 33.066 & 36.785 & 45.762 & 67.275 & 72.052 & 91.025 & 115.380 & 146.628 & 186.688 \\ Period 25 & 28.243 & 32.030 & 36.459 & 41.646 & 47.727 & 54.065 & 73.106 & 98.347 & 133.334 & 181.871 & 249.214 & 342.603 & 471.981 \\ Period 30 & 34.785 & 40.568 & 47.575 & 56.085 & 66.439 & 79.058 & 113.283 & 164.494 & 241.393 & 356.787 & 530.312 & 790.948 & 1,181.882 \\ Period 40 & 48.886 & 60.402 & 75.401 & 95.026 & 120.800 & 154.762 & 259.057 & 442.593 & 767.091 & 1,342.025 & 2,360.757 & 4,163.213 & 7,343.858 \\ \hline \end{tabular} More info 1. Jeff just hit the jackpot in Las Vegas and won $50,000 ! If he invests it now, at a 14% interest rate, how much will it be worth in 15 years? 2. Roderick would like to have $3,500,000 saved by the time he retires in 40 years. How much does he need to invest now at a 12% interest rate to fund his retirement goal? 3. Assume that Vivian accumulates savings of $2 million by the time she retires. If she invests this savings at 12%, how much money will she be able to withdraw at the end of each year for twenty years? 4. Katelyn plans to invest $4,000 at the end of each year for the next eight years. Assuming a 10% interest rate, what will her investment be worth eight years from now? 5. Assuming a 10% interest rate, how much would Jennifer have to invest now to be able to withdraw $11,000 at the end of every year for the next ten years? 6. Chuckie is considering a capital investment that costs $515.000 and will provide the following net cash inflows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started