Question

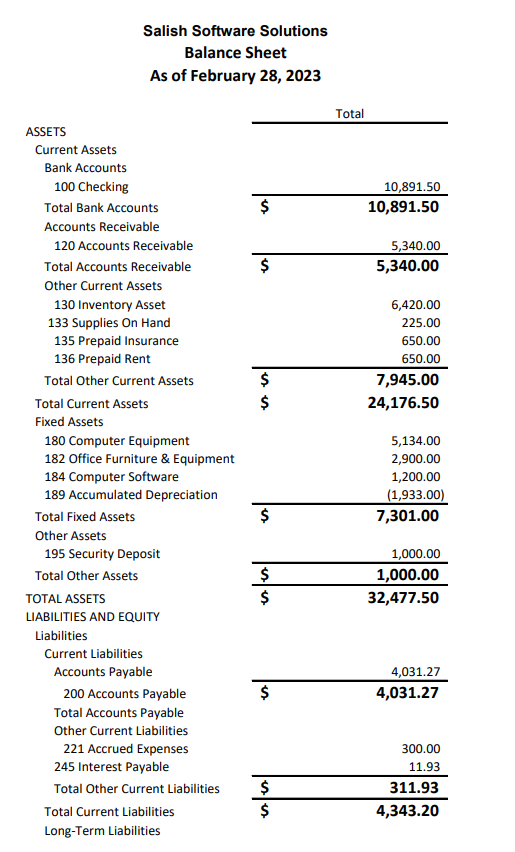

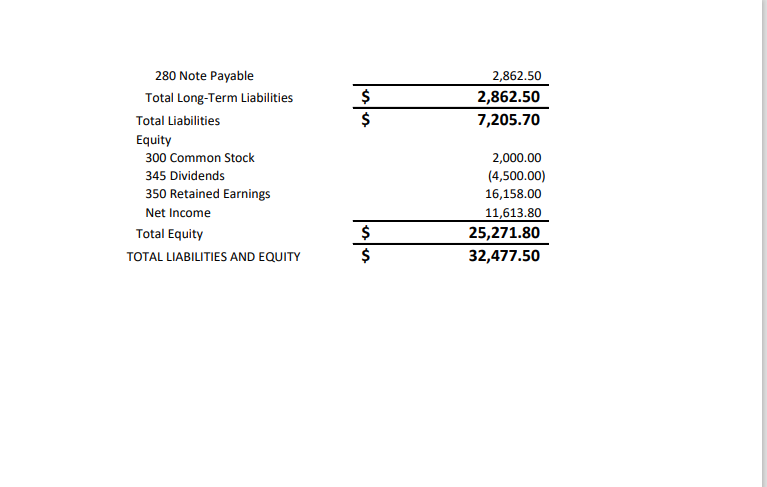

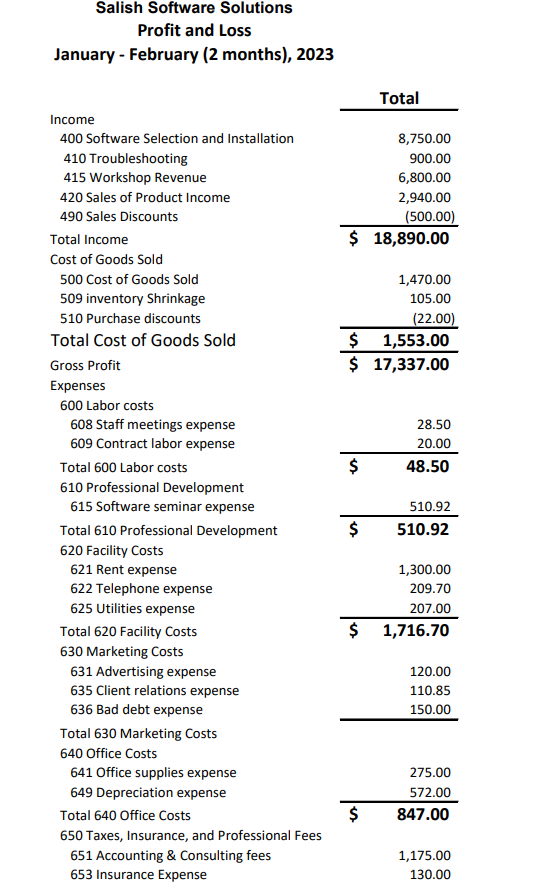

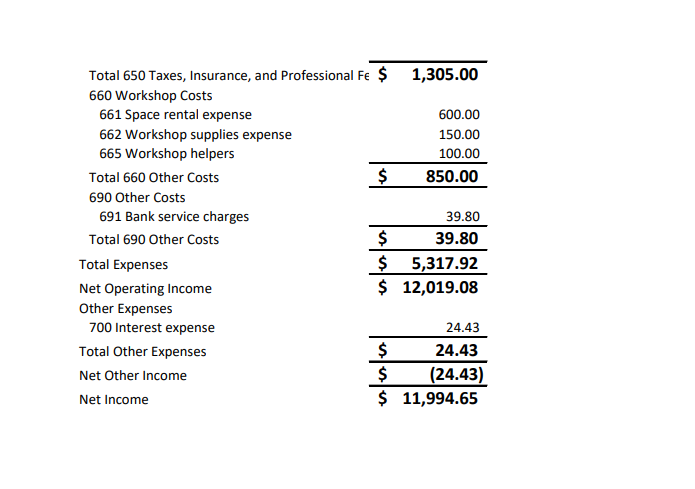

reference Salish Software Solutions Company profitability and solvency position based on February 28, 2023 Balance Sheet and Profit& Loss Reports used for financial ratios assignment

reference Salish Software Solutions Company profitability and solvency position based on February 28, 2023 Balance Sheet and Profit& Loss Reports used for financial ratios assignment this week.

Explain some of the financial ratios and future effects with possible business outcomes. Include your findings and conclusion about Salish Software Solutions and computer service industry. Needs to identify some of the companys strengths, weakness and future opportunities from the company financial reports and your web based search.

Answer at least two of the following questions in your initial discussion posting:

How successful do you think Salish Software Solutions will be?

What is the future of computer services businesses including some of your assignment analysis?

Identify how fluctuations in our economy effects a computer service business including information about Salish Software Solutions?

What are financial risks of operating Salish Software Solutions or a similar business?

this is information from financial analysis

A/R Turnover = 19.32

Current Ratio = 5.57

Days in A/R = 18.89

Days in Inventory = 1520.83

Debt to Assets Ratio = 22.2%

Debt to Equity Ratio = 28.5%

Gross Profit Margin = 47.2%

Inventory Turnover Ratio = 24.2%

Net Profit Margin = 63.5%

Quick Ratio = 3.74

Return on Equity = 47.5%

Working Capital = 19834.3

balance sheet and profit & loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started