Question

Reference the Excel file containing financial information from footnote disclosures and substantive analytical procedures using data analytics from your instructor. PharmaCorp will be used as

Reference the Excel file containing financial information from footnote disclosures and substantive analytical procedures using data analytics from your instructor.

PharmaCorp will be usedas the main analytical procedure tasksyou will want to focus on for this assignment. The other companies, Novartell and AstraZoro, will be used as industry comparisons.

The opportunity exists in this case to perform planning and substantive analytical procedures for accounts in the revenue cycle. You may assume that the 2015 financial information is unaudited, but the information from 2014 has been audited. Consider the following trends and characteristics of the pharmaceutical industry and for PharmaCorp in particular as you work on this case:

- Following many years of dominant financial performance by companies in the United States, Europe and Canada, increased competition is arising from organizations in emerging economies such as Brazil, India, and China.

- Significant uncertainty exists in the industry due to regulation covering health-care and government reimbursements related to certain procedures and prescribed pharmaceuticals.

- Policy makers in the industry and governments increasingly:

- Mandate necessary prescripts for patients

- Focus on prevention instead of treatment regimes, thereby leading to changes in demand for some products

- Anticipated growth in the industry is expected to be 5% to 7% in 2016 compared with 4% to 5% in the prior year as stated by leading industry analysts.

- Pharmacorp started and executed a significant cost reduction initiative aimed at improving efficiency, reducing research and development costs, and eliminating corporate overhead in 2014.

- PharmaCorp's credit policies has remained the same over the past several years. Their credit policies are considered stringent in their industry, and they have been criticized on occasion for these policies in relation to their competitors.

- Two of the companies most popular pharmaceuticals, Sistosis and Vigarvox, are no longer patented as of the last quarter of 2015 and are now facing competition from generic alternatives.

Required:

Part I: Planning Analytical Procedures

- Step 1: Identify Proper Analytical Procedures. The senior auditor suggests you should use these ratios (on the financial statement level) for planning the analytical procedures as part of the revenue cycle at the company:

- Gross margin: (revenues-cost of sales)/revenues

- Turnover of receivables: (revenues/average accounts receivable); use the ending accounts receivable

- Receivables as a percentage of current assets: (accounts receivable/total current assets)

- Receivables as a percentage of total assets: (accounts receivable/total assets)

- Allowance for uncollectible accounts as a percentage of accounts receivable: (allowance/accounts receivable)

- Identify other relationships or trends that are relevant as part of the planning analytics. Discuss your reasons for your choices.

- Step 2: Evaluate the Data Reliability When Developing Expectations. The data you will use to develop expectations in the revenue cycle has been deemed reliable by the audit staff.

- Discuss the likely factors the audit team will consider when making this determination.

- Step 3: Develop expectations for accounts in the revenue cycle and for the ratios from Step # 1 that you deem as relevant. Since this is a planning analytical procedure, the expectations are not set at a high a high level of precision. Indicate if you expect a ratio to rise, fall, or remain the same, and explain the level of any anticipated rises or falls, or the range of the ratio. Pharma Corp's financial information is in the first tab of the Excel worksheet, while the information for Novartell and AstraZoro is available in the last two tabs of the file.

- Consider both historical trends of Pharmcorp and the industry on the whole.

- Step 4 and Step 5: Define and Identify Substantial Unanticipated Variances. Refer to the text for guidance on materiality.

- Apply those guidelines to Step 4 of planning the analytical procedures as part of the revenue cycle for Pharmacorp. Define the meaning of a significant difference. Discuss your reasons for these choices. Discuss the qualitative materiality considerations in relation to this case.

- Once you have determined the levels of difference you would consider noteworthy, calculate the Step 1 ratios (and any additional trend or ration analysis you deemed necessary), based on Pharmacorp's financial statement figures. Identify the ratios where you expect a significant difference.

- Step 6 and Step 7: Investigate Substantial Unanticipated Variances and Ensure Appropriate Documentation.

- Discuss the accounts or relationships you feel should be investigated further using substantive audit procedures. Discuss your reasons for these choices.

- Describe the information that should be a part of the auditor's report or files.

Part II: Substantive Analytical Procedures

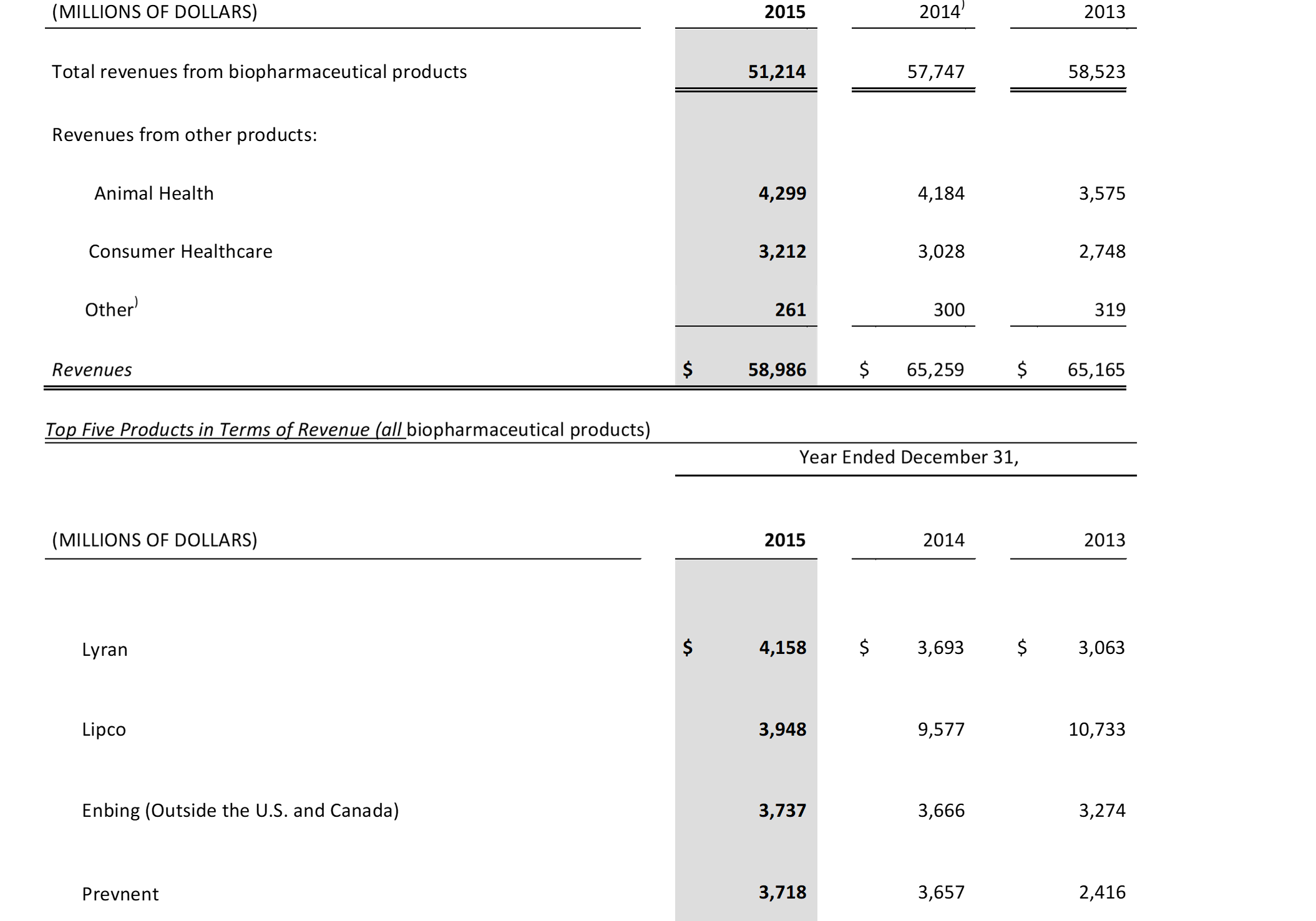

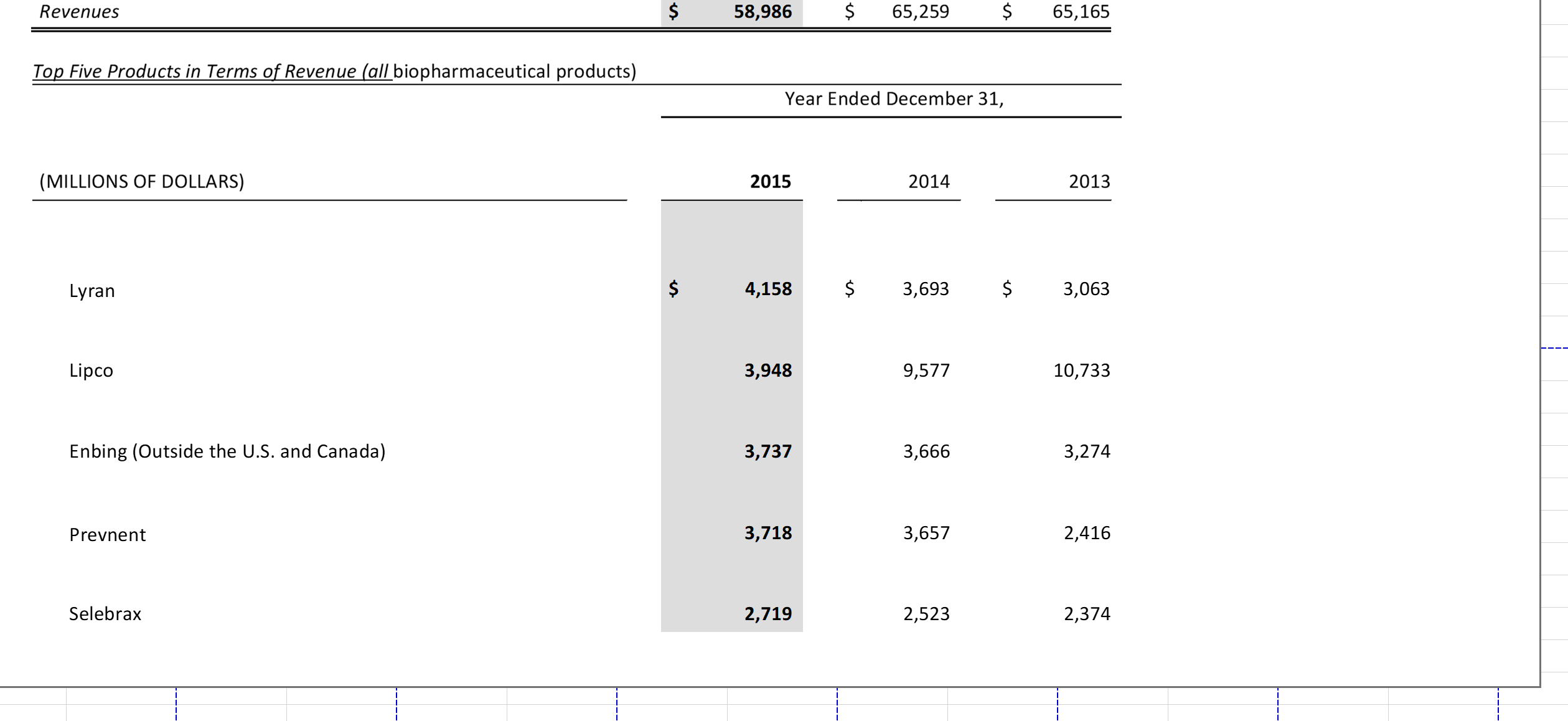

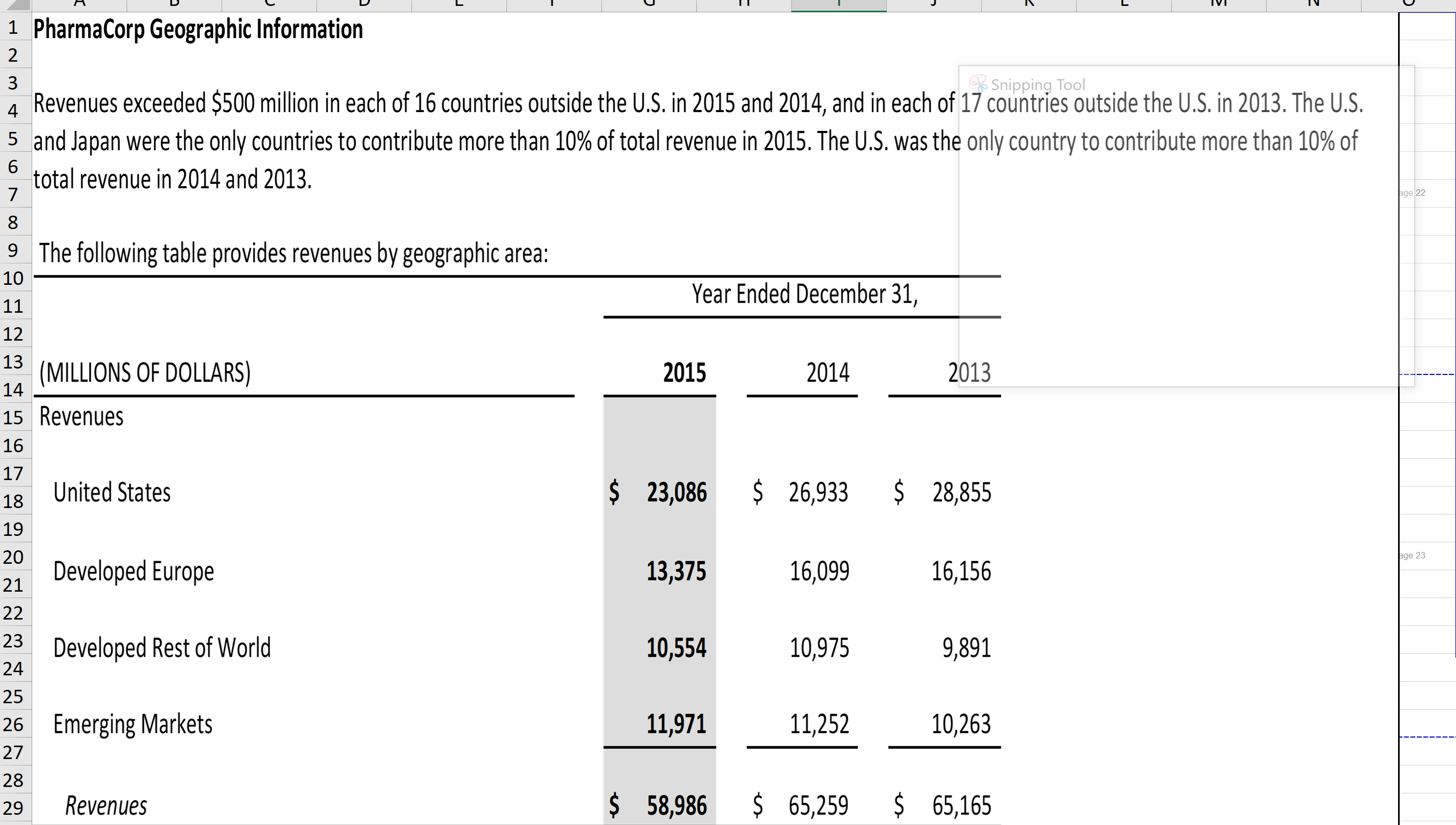

- You will see three tabs in the Excel file that should be reviewed: the Pharmacorp Segment Information, Pharmacorp's Geographic Information, and Pharmacorp's Other Revenue Information. These tabs display excerpts from Pharma Corp's footnote disclosures regarding segment, geographic, and other revenue information. Examine these disclosures and discuss the operating segments and geographic regions where the company does business.

- Which operating segments generate the most revenue for the company and may be considered the most important? Which regions are the most important to the organization from geographic standpoint? List the three most important products manufactured by Pharmacorp? Discuss any trends you notice in relation to revenue generation for each of these different categories.

- Explain the different types of ratio analysis that could be conducted in substantive analytical procedures using the data from the segment, geographic, and other revenue information. An example would be the RD expenses as a percentage of revenues. How would these substantive analytics be different from the planning analytics? Discuss the trends and relationships that are relevant, and what are the implications in relation to further substantive testing?

here are graphs

20-F FILINGS AstraZoro Consolidated Balance Sheet at 31December 2015 2014 2013 (unaudited) (audited) (audited) $m $m $m Assets Non-current assets Property, plant and equipment 6,189 6,525 6,957 Goodwill 9,798 9,762 9,871 Intangible assets 16,348 10,880 12,158 Derivative financial instruments 489 442 324 Other investments 299 201 211 Other receivables 452 - - Deferred tax assets 1,111 1,514 1,475 34,486 29,324 30,996 Current assets Inventories 2,061 1,852 1,682 Trade and other receivables 7,629 8,754 7,847 Other investments 823 4,248 1,482 Derivative financial instruments 31 25 9 Income tax receivable 803 1,056 3,043 Cash and cash equivalents 7,701 7,571 11,068 19,048 23,506 25,131 Total assets 53,534 52,830 56,127 Liabilities Current liabilities Interest-bearing loans and borrowings -801 ) -1890 ) (125 ) Trade and other payables -9321 ) (8,975 ) (8,661 ) Derivative financial instruments (3 ) -109 ) (8 ) Provisions -816 ) (1,388 ) (1,095 ) Income tax payable (2,862 ) (3,390 ) (6,898 ) (13,903 ) (15,752 ) (16,787 ) Non-current liabilities Interest-bearing loans and borrowings -9309 ) -7438 ) (9,097 ) Deferred tax liabilities -2676 ) -2635 ) (3,145 ) Retirement benefit obligations -2165 ) (2,674 ) (2,472 ) Provisions -538 ) (474 ) (843 ) Other payables (1,001 ) (385 ) (373 ) (15,679 ) (13,606 ) (15,930 ) Total liabilities (29,582 ) (29,358 ) (32,717 ) Net assets 23,952 23,472 23,410 Equity Capital and reserves attributable to equity holders of the Company Share capital 302 423 352 Share premium account 3,604 2,978 2,672 Capital redemption reserve 253 239 107 Merger reserve 533 533 433 Other reserves 1,374 1,379 1,377 Retained earnings 17,961 17,894 18,272 23,737 23,246 23,213 Non-controlling interests 215 226 197 Total equity 23,952 23,472 23,410 AstraZoro Consolidated Statements of Income for the year ended 31December 2015 2014 2013 (unaudited) (audited) (audited) $m $m $m Revenue 27,963 33,581 33,269 Cost of sales -5383 ) -6016 ) (6,389 ) Gross profit 22,580 27,565 26,880 Distribution costs (320 ) (346 ) (335 ) Research and development expense -5233 ) -5533 ) (5,318 ) Selling, general and administrative costs -9849 ) -11061 ) (10,445 ) Profit on disposal of subsidiary - 1,483 - Other operating income and expense 970 777 712 Operating profit 8,148 12,795 11,494 Finance income 528 552 516 Finance expense (958 ) (980 ) (1,033 ) Profit before tax 7,718 12,367 10,977 Taxation (1,391 ) (2,351 ) (2,896 ) Profit for the period 6,327 10,016 8,081 Other comprehensive income: Foreign exchange arising on consolidation 106 (60 ) 26 Foreign exchange differences on borrowings designated in net investment hedges -56 ) 24 101 Fair value movements on derivatives designated in net investment hedges 86 - - Amortisation of loss on cash flow hedge 1 2 1 Net available for sale gains taken to equity 72 31 4 Actuarial loss for the period (85 ) (741 ) (46 ) Income tax relating to components of other comprehensive income (46 ) 198 (61 ) Other comprehensive income for the period, net of tax 78 (546 ) 25 Total comprehensive income for the period 6,405 9,470 8,106 Profit attributable to: Owners of the Parent 6,297 9,983 8,053 Non-controlling interests 30 33 28 Total comprehensive income attributable to: Owners of the Parent 6,395 9,428 8,058 Non-controlling interests 10 42 48 Basic earnings per $0.25 Ordinary Share $4.99 $7.33 $5.60 Diluted earnings per $0.25 Ordinary Share $4.98 $7.30 $5.57 Weighted average number of Ordinary Shares in issue (millions) 1,261 1,361 1,438 Diluted weighted average number of Ordinary Shares in issue (millions) 1,264 1,367 1,446 Dividends declared and paid in the period 3,619 3,752 3,494 All activities were in respect of continuing operations. $m means millions of US dollars. AstraZoro Consolidated Statements of Cash Flows for the year ended 31December 2015 2014 2013 (unaudited) (audited) (audited) $m $m $m Cash flows from operating activities Profit before tax 7,718 12,367 10,977 Finance income and expense 530 528 517 Depreciation, amortisation and impairment 2,528 2,650 2,741 Decrease/(increase) in trade and other receivables 765 (1,108 ) 10 (Increase)/decrease in inventories -160 ) (256 ) 88 (Decrease)/increase in trade and other payables and provisions (1,311 ) 467 (16 ) Profit on disposal of subsidiary - (1,483 ) - Non-cash and other movements (424 ) (597 ) (463 ) Cash generated from operations 9,536 12,368 13,854 Interest paid (545 ) (548 ) (641 ) Tax paid (2,043 ) (3,999 ) (2,533 ) Net cash inflow from operating activities 6,948 7,821 10,680 Cash flows from investing activities Acquisitions of business operations (1,187 ) - (348 ) Movement in short-term investments and fixed deposits 3,719 -2843 ) (125 ) Purchase of property, plant and equipment (672 ) -739 ) (791 ) Disposal of property, plant and equipment 99 102 83 Purchase of intangible assets (3,947 ) (458 ) (1,390 ) Disposal of intangible assets - - 210 Purchase of non-current asset investments (46 ) (11 ) (34 ) Disposal of non-current asset investments 43 - 5 Net cash received on disposal of subsidiary - 1,772 - Dividends received 7 - - Interest received 145 171 174 Payments made by subsidiaries to non-controlling interests (20 ) (16 ) (10 ) Net cash outflow from investing activities (1,859 ) (2,022 ) (2,226 ) Net cash inflow before financing activities 5,089 5,799 8,454 Cash flows from financing activities Proceeds from issue of share capital 429 409 494 Repurchase of shares (2,635 ) (6,015 ) (2,604 ) Repayment of obligations under finance leases (17 ) - - Issue of loans 1,980 - - Repayment of loans (1,750 ) - (1,741 ) Dividends paid (3,665 ) (3,764 ) (3,361 ) Hedge contracts relating to dividend payments 48 3 (114 ) Movement in short-term borrowings 687 46 (8 ) Net cash outflow from financing activities (4,923 ) (9,321 ) (7,334 ) Net increase/(decrease) in cash and cash equivalents in the period 166 (3,522 ) 1,120 Cash and cash equivalents at the beginning of the period 7,434 10,981 9,828 Exchange rate effects (4 ) (25 ) 33 Cash and cash equivalents at the end of the period 7,596 7,434 10,981

Graph 2

NOVARTELL GROUP CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED BALANCE SHEETS (At December31, 2015 and 2014) 2015 2014 (unaudited) (audited) $ m $ m Assets Non-current assets Property, plant& equipment 16,839 15,727 Goodwill 31,190 29,843 Intangible assets other than goodwill 30,431 31,869 Investments in associated companies 8,940 8,722 Deferred tax assets 7,190 5,957 Financial assets 1,117 938 Other non-current assets 505 456 Total non-current assets 96,212 93,412 Current assets Inventories 6,844 5,830 Trade receivables 10,051 10,432 Marketable securities and derivative financial instruments 2,667 1,466 Cash and cash equivalents 5,652 3,609 Other current assets 2,990 2,756 Total current assets 28,004 24,084 Total assets 124,216 117,496 Equity and liabilities Equity Share capital 1,001 1,016 Treasury shares (92) (121) Reserves 68,184 64,949 Issued share capital and reserves attributable to novartell AG shareholders 69,093 65,844 Non-controlling interests 126 96 Total equity 69,219 65,940 Liabilities Non-current liabilities Financial debt 13,881 13,955 Deferred tax liabilities 7,186 6,861 Provisions and other non-current liabilities 9,879 7,792 Total non-current liabilities 30,946 28,408 Current liabilities Trade payables 5,693 4,898 Financial debt and derivative financial instruments 5,845 6,274 Current income tax liabilities 2,070 1,706 Provisions and other current liabilities 10,443 10,079 Total current liabilities 24,051 23,148 Total liabilities 54,997 51,556 Total equity and liabilities 124,216 117,496 NOVARTELL GROUP CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED INCOME STATEMENTS (For the years ended December31, 2015, 2014 and 2013) 2015 2014 2013 (unaudited) (audited) (audited) $ m $ m $ m Net sales 56,773 58,666 50,724 Other revenues 988 909 837 Cost of goods sold (18,756) 18,983 (14,488) Gross profit 38,805 40,392 37,073 Marketing& Sales (14,353) (15,179) (13,416) Research& Development (9,432) (9,483) (8,970) General& Administration (2,837) (2,870) (2,481) Other income 1,287 1,254 1,234 Other expense (1,959) (3,116) (1,914) Operating income 11,511 10,998 11,526 Income from associated companies 652 628 904 Interest expense -824 ) -851 -792 Other financial income and expense (96 ) (2 64 Income before taxes 11,243 10,773 11,702 Taxes (1,625 ) (1,528 (1,733 Net income 9,618 9,245 9,969 Attributable to: Shareholders of novartell AG 9,505 9,113 9,794 Non-controlling interests 113 132 175 Basic earnings per share ($) 3.93 3.83 4.28 Diluted earnings per share ($) 3.89 3.78 4.26 NOVARTELLGROUP CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED CASH FLOW STATEMENTS (For the years ended December31, 2015, 2014 and 2013) 2015 2014 2013 (unaudited) (audited) (audited) $ m $ m $ m Net income 9,618 9,245 9,969 Reversal of non-cash items 7,938 9,200 6,262 Dividends received from associated companies and others 326 304 471 Interest received 149 66 180 Interest paid (594 ) (640 ) -535 ) Other financial receipts 114 Other financial payments (22 ) (47 ) (145 ) Taxes paid (2,022 ) (2,435 ) (2,616 ) Cash flows before working capital and provision changes 15,507 15,893 13,586 Restructuring payments and other cash payments from provisions (1,173 ) (1,471 ) (1,281 ) Change in net current assets and other operating cash flow items (140 ) (113 ) 1,762 Cash flows from operating activities 14,194 14,309 14,067 Purchase of property, plant& equipment (2,698 ) (2,167 ) (1,678 ) Proceeds from sales of property, plant& equipment 92 161 46 Purchase of intangible assets (370 ) (220 ) (554 ) Proceeds from sales of intangible assets 263 543 535 Purchase of financial assets (180 ) (139 ) (124 ) Proceeds from sales of financial assets 121 49 66 Purchase of other non-current assets -157 ) (48 ) -25 ) Proceeds from sales of other non-current assets 118 15 13 Acquisitions of interests in associated companies (12 ) Acquisitions and divestments of businesses (1,741 ) (569 ) (26,666 ) Purchase of marketable securities (1,639 ) (1,750 ) (40,569 ) Proceeds from sales of marketable securities 516 3,345 53,200 Cash flows used in investing activities (5,675 ) (792 ) (15,756 ) Acquisition of treasury shares (505 ) (3,628 ) (311 ) Disposal of treasury shares 514 59 811 Increase in non-current financial debt 1,879 381 5,574 Repayment of non-current financial debt (704 ) (28 ) (5 ) Change in current financial debt (1,737 ) (3,054 ) 2,610 Proceeds from issuance of share capital to third parties 4 19 Acquisition of non-controlling interests (6 ) (3,187 ) (32 ) Dividends paid to non-controlling interests and other financing cash flows (86 ) (203 ) (64 ) Dividends paid to shareholders of novartell AG (6,030 ) (5,368 ) (4,486 ) Cash flows used in financing activities (6,675 ) (15,024 ) 4,116 Net effect of currency translation on cash and cash equivalents (1 ) (103 ) (2 ) Net change in cash and cash equivalents 1,843 (1,610 ) 2,425 Cash and cash equivalents at January1 3,709 5,319 2,894 Cash and cash equivalents at December31 5,552 3,709 5,319

graph 3

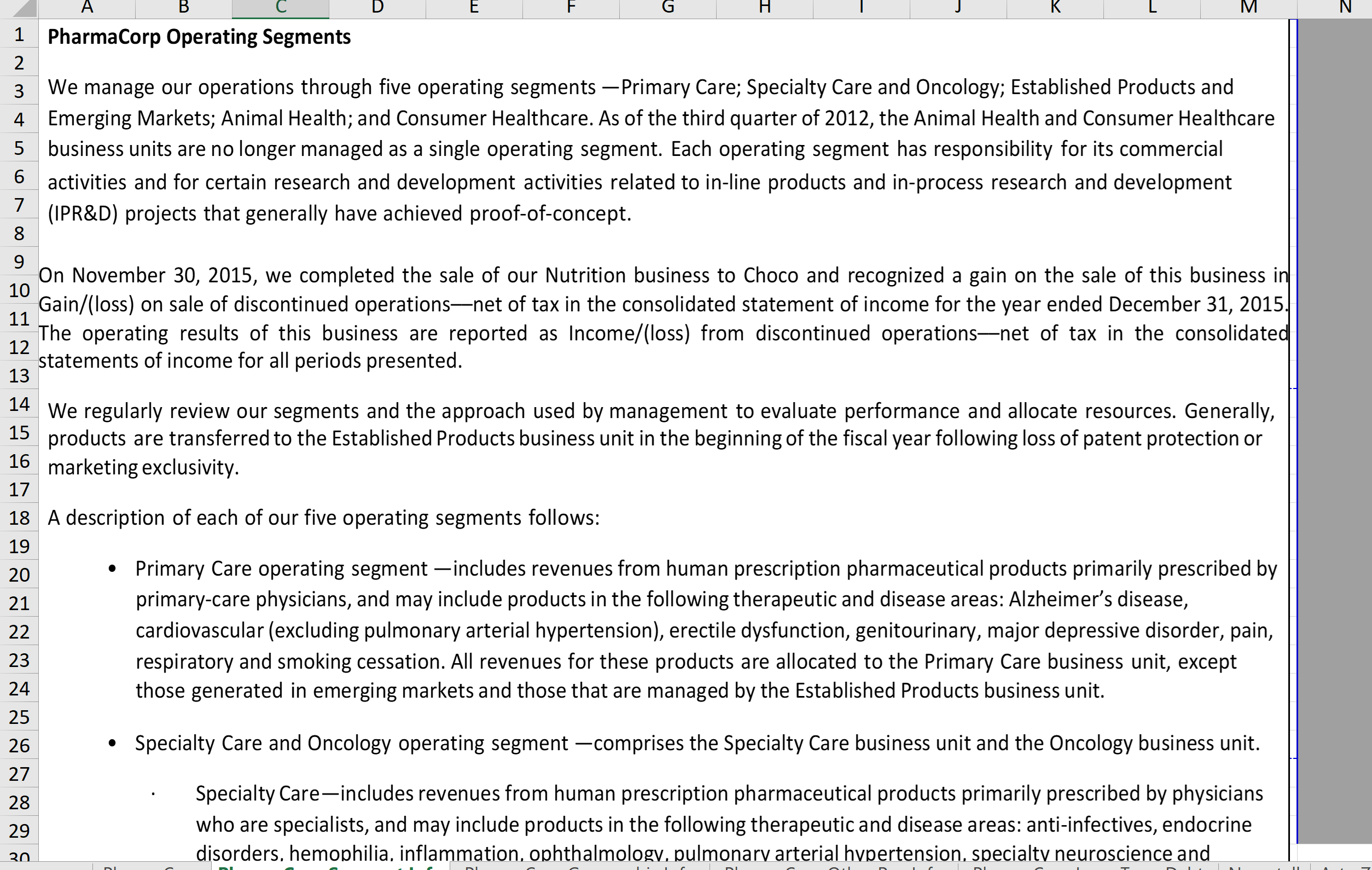

PharmaCorp. Long-Term Debt The following table provides the components of senior unsecured long-term debt: As of December 31, Maturity Date 2015 2014 6.20% March2022 $ 3,427 $ 3,348 5.35% Mar-18 2,965 2,969 7.20% Mar-42 2,803 2,848 4.75% Jun-19 2,738 2,683 5.75% Jun-24 2,734 2,581 3.625% (At December 31, 2015, the note has been reclassified to Current portion of long-term debt.) Jun-16 ? 2,392 6.50% Jun-41 2,307 2,206 5.95% Apr-40 2,086 2,188 5.50% February2017 1,832 1,893 5.50%(At December31, 2015, the note had been called and is no longer outstanding.) Mar-16 ? 1,564 4.55% May-20 1,394 1,425 4.75% December2017 1,274 1,166 5.50% Feb-19 1,048 1,061 6.51% 2028 3,403 3,345 5.28% 2019 2,254 2,402 2.48% 2018 771 865 Long-term debt $ 31,036 $ 34,926

Graph 4

10-K FILINGS PharmaCorp Consolidated Balance Sheets (USD $) Dec. 31, 2015 Dec. 31, 2014 In Millions, except Share data, unless otherwise specified (unaudited) (audited) ASSETS Cash and cash equivalents $10,489 $3,282 Short-term investments 22,219 23,170 Accounts receivable, less allowance for doubtful accounts, 2015?$374; 2014?$226 12,478 13,158 Inventories 6,963 6,510 Taxes and other current assets 9,196 9,480 Assets of discontinued operations and other assets held for sale 70 5,217 Total current assets 61,415 60,917 Long-term investments 14,249 9,914 Property, plant and equipment, less accumulated depreciation 14,361 15,921 Goodwill 44,572 44,669 Identifiable intangible assets, less accumulated amortization 46,113 51,284 Taxes and other noncurrent assets 5,088 5,697 Total assets 185,798 188,002 LIABILITIES AND EQUITIES Short-term borrowings, including current portion of long-term debt: 2015?$2,449; 2014?$6 6,524 4,116 Accounts payable 4,164 3,578 Dividends payable 1,834 1,896 Income taxes payable 910 909 Accrued compensation and related items 2,146 2,220 Other current liabilities 13,041 15,066 Liabilities of discontinued operations 0 1,124 Total current liabilities 28,719 28,909 Long-term debt 30,936 34,826 Pension benefit obligations 7,930 6,455 Postretirement benefit obligations 3,393 3,244 Noncurrent deferred tax liabilities 21,593 18,861 Other taxes payable 6,610 6,886 Other noncurrent liabilities 4,939 6,100 Total liabilities 104,120 105,381 Preferred stock, without par value, at stated value; 27 shares authorized; issued: 2015?967; 2014?1,112 39 45 Common stock, $0.05 par value; 12,000 shares authorized; issued: 2015?8,956; 2014?8,902 448 445 Additional paid-in capital 72,608 71,423 Employee benefit trusts -1 -3 Treasury stock, shares at cost: 2015?1,680; 2014?1,327 -40,121 -31,801 Retained earnings 54,240 46,210 Accumulated other comprehensive loss -5,953 -4,129 Total shareholders' equity 81,260 82,190 Equity attributable to noncontrolling interests 418 431 Total equity 81,678 82,621 Total liabilities and equity 185,798 188,002 PharmaCorp Consolidated Statements of Income (USD $) In Millions, except Per Share data, unless otherwise specified Dec. 31, 2015 Dec. 31, 2014 Dec. 31, 2013 Revenues $58,886 $65,159 $65,065 Costs and expenses: Cost of sales 11,234 14,176 14,888 Selling, informational and administrative expenses 16,516 18,632 18,873 Research and development expenses 7,770 9,074 9,583 Amortization of intangible assets 5,275 5,644 5,264 Restructuring charges and certain acquisition-related costs 1,880 2,830 3,245 Other deductions--net 4,031 2,499 3,841 Income from continuing operations before provision for taxes on income 12,080 12,304 9,571 Provision for taxes on income 2,462 3,809 1,153 Income from continuing operations 9,618 8,495 8,318 Discontinued operations: Income/(loss) from discontinued operations--net of tax 197 250 -19 Gain/(loss) on sale of discontinued operations--net of tax 4,873 1,404 -11 Discontinued operations--net of tax 5,080 1,654 -30 Net income before allocation to noncontrolling interests 14,598 10,049 8,288 Less: Net income attributable to noncontrolling interests 28 40 31 Net income attributable to PharmaCorp Inc. $14,570 $10,009 $8,257 Earnings per common share--basic: Income from continuing operations attributable to PharmaCorp Inc. common shareholders $1.27 $1.07 $1.03 Discontinued operations--net of tax $0.68 $0.21 $0.00 Net income attributable to PharmaCorp Inc. common shareholders $1.96 $1.28 $1.03 Earnings per common share--diluted: Income from continuing operations attributable to PharmaCorp Inc. common shareholders $1.26 $1.06 $1.03 Discontinued operations--net of tax $0.68 $0.21 $0.00 Net income attributable to PharmaCorp Inc. common shareholders $1.94 $1.27 $1.02 Weighted-average shares--basic 7,442 7,817 8,036 Weighted-average shares--diluted 7,508 7,870 8,074 Cash dividends paid per common share $0.88 $0.80 $0.72 PharmaCorp Consolidated Statements of Cash Flows (USD $) In Millions, unless otherwise specified Dec. 31, 2015 Dec. 31, 2014 Dec. 31, 2013 Operating Activities (unaudited) (audited) (audited) Net income before allocation to noncontrolling interests $14,598 $10,049 $8,288 Adjustments to reconcile net income before allocation to noncontrolling interests to net cash provided by operating activities: Depreciation and amortization 7,711 8,809 8,299 Share-based compensation expense 381 519 505 Asset write-offs and impairment charges 1,199 1,298 3,386 (Gain)/loss on sale of discontinued operations -7,123 -1,688 111 Deferred taxes from continuing operations 839 207 2,109 Deferred taxes from discontinued operations 1,459 147 -156 Benefit plan contributions (in excess of)/less than expense 135 -1,769 -677 Other non-cash adjustments, net -203 -172 -49 Other changes in assets and liabilities, net of acquisitions and divestitures: Accounts receivable 375 -66 -708 Inventories -731 1,184 2,917 Other assets 93 801 -718 Accounts payable 569 -367 -401 Other liabilities -3,438 1,498 1,214 Other tax accounts, net 1,190 -8 -12,666 Net cash provided by operating activities 17,054 20,240 11,454 Investing Activities Purchases of property, plant and equipment -1,327 -1,660 -1,513 Purchases of short-term investments -24,018 -18,447 -11,082 Proceeds from redemptions and sales of short-term investments 25,302 14,176 5,699 Net proceeds from redemptions and sales of short-term investments with original maturities of 90 days or less 1,459 10,874 5,950 Purchases of long-term investments -11,145 -4,620 -4,128 Proceeds from redemptions and sales of long-term investments 4,990 2,147 4,737 Acquisitions, net of cash acquired -1,050 -3,282 -273 Proceeds from sale of businesses 11,850 2,376 0 Other investing activities 93 279 118 Net cash provided by/(used in) investing activities 6,154 1,843 -492 Financing Activities Proceeds from short-term borrowings 7,985 12,910 6,500 Principal payments on short-term borrowings 7 -3,926 -9,349 Net payments on short-term borrowings with original maturities of 90 days or less -8,304 -7,540 -1,197 Principal payments on long-term debt -1,413 -6,896 -106 Purchases of common stock -8,228 -9,100 -1,000 Cash dividends paid -6,534 -6,134 -6,088 Other financing activities 488 169 66 Net cash used in financing activities -15,999 -20,607 -11,174 Effect of exchange-rate changes on cash and cash equivalents -2 -29 -31 Net increase/(decrease) in cash and cash equivalents 7,207 1,447 -243 Cash and cash equivalents, beginning 3,182 1,735 1,978 Cash and cash equivalents, ending 10,389 3,182 1,735 Cash paid during the period for: Income taxes 2,430 2,938 11,775 Interest $1,873 $2,085 $2,155

the rest of the graphs are uploaded as images.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started