Answered step by step

Verified Expert Solution

Question

1 Approved Answer

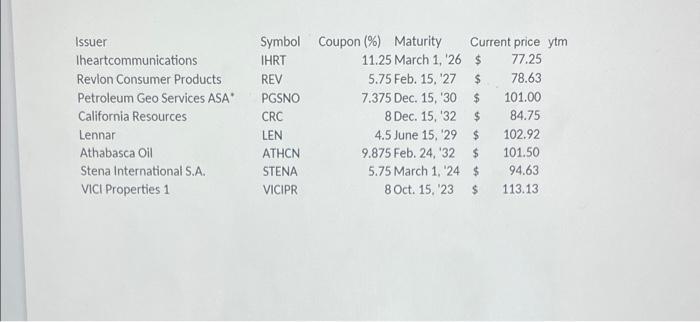

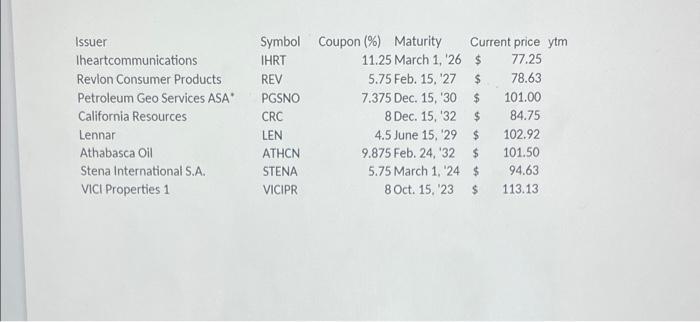

reference the first picture of bonds to the first part. please do on excel ! Issuer Theartcommunications Revlon Consumer Products Petroleum Geo Services ASA California

reference the first picture of bonds to the first part. please do on excel !

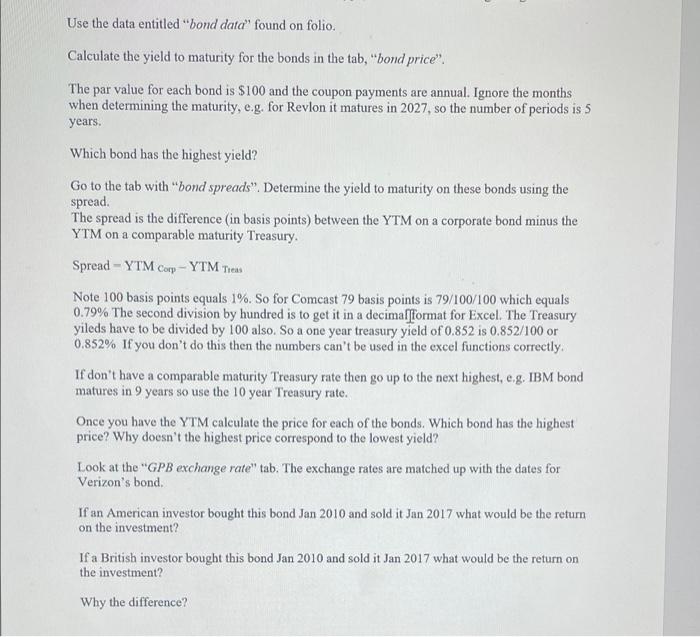

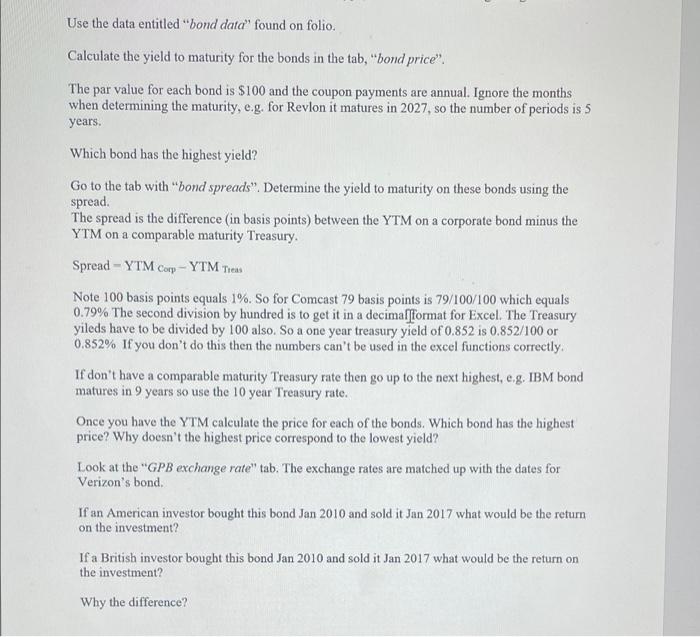

Issuer Theartcommunications Revlon Consumer Products Petroleum Geo Services ASA California Resources Lennar Athabasca Oil Stena International S.A. VICI Properties 1 Symbol Coupon (%) Maturity Current price ytm IHRT 11.25 March 1, 26 $ 77.25 REV 5.75 Feb. 15. 27 $ 78.63 PGSNO 7.375 Dec. 15, 30 $ 101.00 CRC 8 Dec. 15, 32 $ 84.75 LEN 4.5 June 15, 29 $ 102.92 ATHCN 9.875 Feb. 24. 32 101.50 STENA 5.75 March 1, 24 $ 94.63 VICIPR 8 Oct. 15. 23 $ 113.13 Use the data entitled "bond data" found on folio. Calculate the yield to maturity for the bonds in the tab, "bond price". The par value for each bond is $100 and the coupon payments are annual. Ignore the months when determining the maturity, e.g. for Revlon it matures in 2027, so the number of periods is 5 years. Which bond has the highest yield? Go to the tab with "bond spreads". Determine the yield to maturity on these bonds using the spread. The spread is the difference (in basis points) between the YTM on a corporate bond minus the YTM on a comparable maturity Treasury. Spread - YTM Corp - YTM Treas Note 100 basis points equals 1%. So for Comcast 79 basis points is 79/100/100 which equals 0.79% The second division by hundred is to get it in a decimalformat for Excel. The Treasury yileds have to be divided by 100 also. So a one year treasury yield of 0.852 is 0.852/100 or 0.852% If you don't do this then the numbers can't be used in the excel functions correctly If don't have a comparable maturity Treasury rate then go up to the next highest, eg. IBM bond matures in 9 years so use the 10 year Treasury rate. Once you have the YTM calculate the price for each of the bonds. Which bond has the highest price? Why doesn't the highest price correspond to the lowest yield? Look at the "GPB exchange rate" tab. The exchange rates are matched up with the dates for Verizon's bond If an American investor bought this bond Jan 2010 and sold it Jan 2017 what would be the return on the investment? If a British investor bought this bond Jan 2010 and sold it Jan 2017 what would be the return on the investment? Why the difference? Issuer Theartcommunications Revlon Consumer Products Petroleum Geo Services ASA California Resources Lennar Athabasca Oil Stena International S.A. VICI Properties 1 Symbol Coupon (%) Maturity Current price ytm IHRT 11.25 March 1, 26 $ 77.25 REV 5.75 Feb. 15. 27 $ 78.63 PGSNO 7.375 Dec. 15, 30 $ 101.00 CRC 8 Dec. 15, 32 $ 84.75 LEN 4.5 June 15, 29 $ 102.92 ATHCN 9.875 Feb. 24. 32 101.50 STENA 5.75 March 1, 24 $ 94.63 VICIPR 8 Oct. 15. 23 $ 113.13 Use the data entitled "bond data" found on folio. Calculate the yield to maturity for the bonds in the tab, "bond price". The par value for each bond is $100 and the coupon payments are annual. Ignore the months when determining the maturity, e.g. for Revlon it matures in 2027, so the number of periods is 5 years. Which bond has the highest yield? Go to the tab with "bond spreads". Determine the yield to maturity on these bonds using the spread. The spread is the difference (in basis points) between the YTM on a corporate bond minus the YTM on a comparable maturity Treasury. Spread - YTM Corp - YTM Treas Note 100 basis points equals 1%. So for Comcast 79 basis points is 79/100/100 which equals 0.79% The second division by hundred is to get it in a decimalformat for Excel. The Treasury yileds have to be divided by 100 also. So a one year treasury yield of 0.852 is 0.852/100 or 0.852% If you don't do this then the numbers can't be used in the excel functions correctly If don't have a comparable maturity Treasury rate then go up to the next highest, eg. IBM bond matures in 9 years so use the 10 year Treasury rate. Once you have the YTM calculate the price for each of the bonds. Which bond has the highest price? Why doesn't the highest price correspond to the lowest yield? Look at the "GPB exchange rate" tab. The exchange rates are matched up with the dates for Verizon's bond If an American investor bought this bond Jan 2010 and sold it Jan 2017 what would be the return on the investment? If a British investor bought this bond Jan 2010 and sold it Jan 2017 what would be the return on the investment? Why the difference

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started