Answered step by step

Verified Expert Solution

Question

1 Approved Answer

References: Frank Wood's business accounting : an introduction to financial accounting, 2021, 15th ed., Pearson (Chapter 27) Tutorial 2 Partnerships vs Joint Ventures Question 4

References: Frank Wood's business accounting : an introduction to financial accounting, 2021, 15th ed., Pearson (Chapter 27)

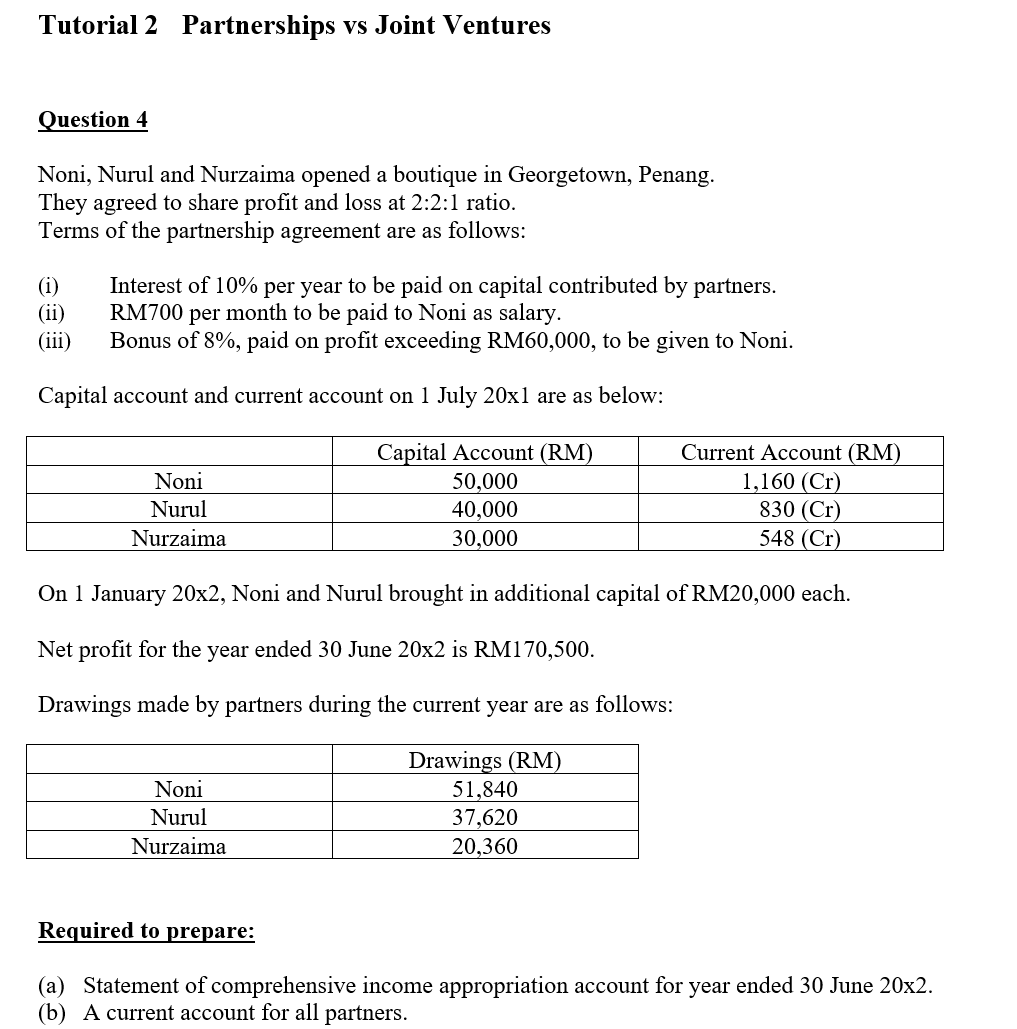

Tutorial 2 Partnerships vs Joint Ventures Question 4 Noni, Nurul and Nurzaima opened a boutique in Georgetown, Penang. They agreed to share profit and loss at 2:2:1 ratio. Terms of the partnership agreement are as follows: (i) Interest of 10% per year to be paid on capital contributed by partners. (ii) RM700 per month to be paid to Noni as salary. (iii) Bonus of 8%, paid on profit exceeding RM60,000, to be given to Noni. Capital account and current account on 1 July 201 are as below: On 1 January 20x2, Noni and Nurul brought in additional capital of RM20,000 each. Net profit for the year ended 30 June 20x2 is RM170,500. Drawings made by partners during the current year are as follows: Required to prepare: (a) Statement of comprehensive income appropriation account for year ended 30 June 20x2. (b) A current account for all partners

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started