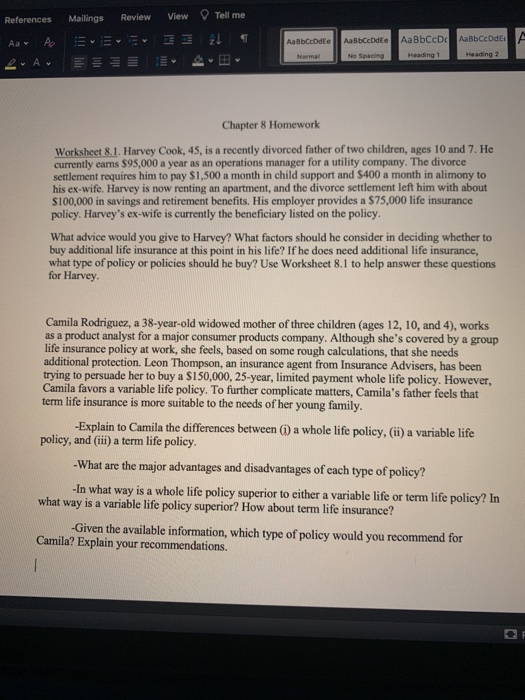

References Mailings Review View Tell me A t AaBbcode Aa Bbc dee No Spacing AaBbCcDc AaBbCcDdE A Heading 1 Heading 2 Normal A. Chapter 8 Homework Worksheet 8.1. Harvey Cook, 45, is a recently divorced father of two children, ages 10 and 7. He currently earns $95,000 a year as an operations manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support and $400 a month in alimony to his ex-wife. Harvey is now renting an apartment, and the divorce settlement left him with about S100,000 in savings and retirement benefits. His employer provides a $75,000 life insurance policy. Harvey's ex-wife is currently the beneficiary listed on the policy. What advice would you give to Harvey? What factors should he consider in deciding whether to buy additional life insurance at this point in his life? If he does need additional life insurance, what type of policy or policies should he buy? Use Worksheet 8.1 to help answer these questions for Harvey Camila Rodriguez, a 38-year-old widowed mother of three children (ages 12, 10, and 4), works as a product analyst for a major consumer products company. Although she's covered by a group life insurance policy at work, she feels, based on some rough calculations, that she needs additional protection. Leon Thompson, an insurance agent from Insurance Advisers, has been trying to persuade her to buy a $150,000, 25-year, limited payment whole life policy. However, Camila favors a variable life policy. To further complicate matters, Camila's father feels that term life insurance is more suitable to the needs of her young family. -Explain to Camila the differences between (1) a whole life policy, (ii) a variable life policy, and (iii) a term life policy. -What are the major advantages and disadvantages of each type of policy? -In what way is a whole life policy superior to either a variable life or term life policy? In what way is a variable life policy superior? How about term life insurance? -Given the available information, which type of policy would you recommend for Camila? Explain your recommendations