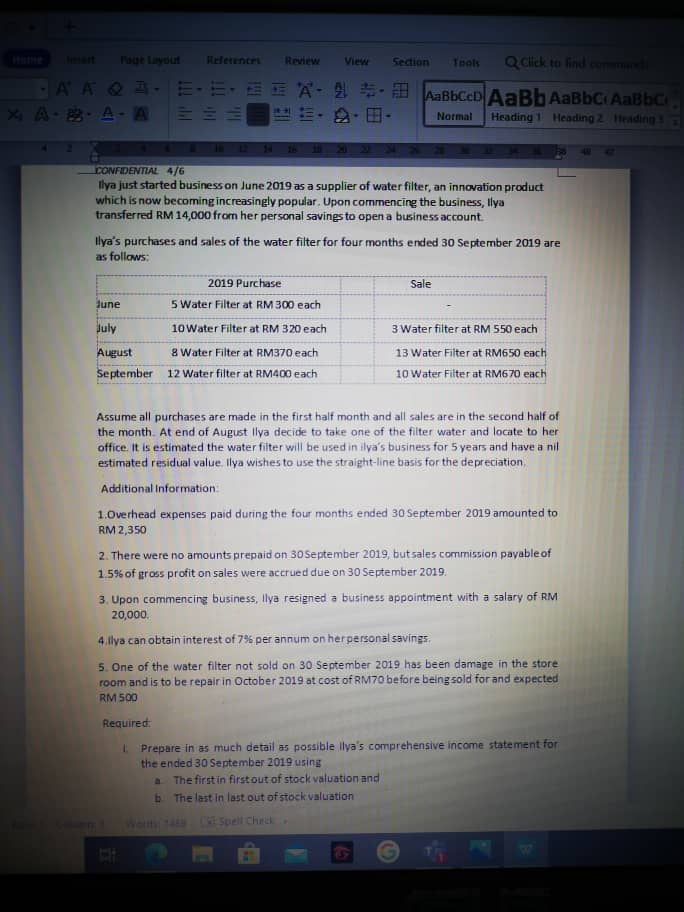

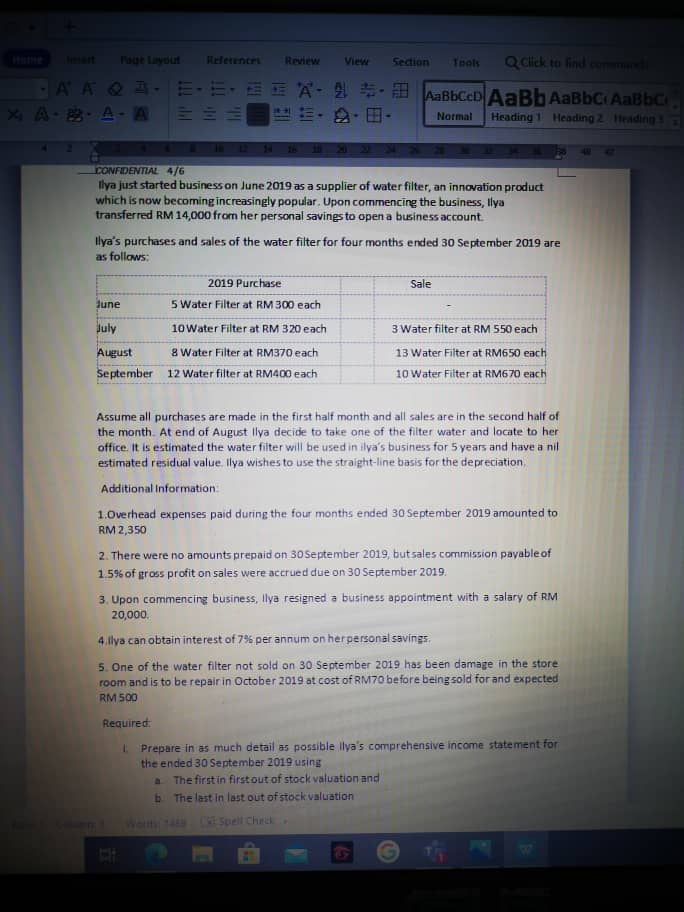

Referentni View Sedion trage Layout Tools Q Click to find JAA@1 EEEA-AaBbced AaBb AaBbci AaBbc XA AA Heading 1 Heading 2 Heading Normal CONFIDENTIAL 4/6 llya just started businesson lune 2019 as a supplier of water filter, an innovation product which is now becoming increasingly popular. Upon commencing the business, llya transferred RM 14,000 from her personal savings to open a business account Ilya's purchases and sales of the water filter for four months ended 30 September 2019 are as follows: 2019 Purchase Sale June 5 Water Filter at RM 300 each July 10 Water Filter at RM 320 each 3 Water filter at RM 550 each August 8 Water Filter at RM370 each 13 Water Filter at RM650 each September 12 Water filter at RM400 each 10 Water Filter at RM670 each Assume all purchases are made in the first half month and all sales are in the second half of the month At end of August Ilya decide to take one of the filter water and locate to her office. It is estimated the water filter will be used in ilva's business for 5 years and have a nil estimated residual value. Ilya wishes to use the straight-line basis for the depreciation, Additional Information 1.Overhead expenses paid during the four months ended 30 September 2019 amounted to RM 2,350 2. There were no amounts prepaid on 30 September 2019, but sales commission payable of 15% of gross profit on sales were accrued due on 30 September 2019. 3. Upon commencing business, Ilya resigned a business appointment with a salary of RM 20,000 4 Ilya can obtain interest of 7% per annum on her personal savings. 5. One of the water filter not sold on 30 September 2019 has been damage in the store room and is to be repair in October 2019 at cost of RM70 before being sold for and expected RM 500 Required: Prepare in as much detail as possible lla's comprehensive income statement for the ended 30 September 2019 using The first in first out of stock valuation and The last in last out of stock valuation Referentni View Sedion trage Layout Tools Q Click to find JAA@1 EEEA-AaBbced AaBb AaBbci AaBbc XA AA Heading 1 Heading 2 Heading Normal CONFIDENTIAL 4/6 llya just started businesson lune 2019 as a supplier of water filter, an innovation product which is now becoming increasingly popular. Upon commencing the business, llya transferred RM 14,000 from her personal savings to open a business account Ilya's purchases and sales of the water filter for four months ended 30 September 2019 are as follows: 2019 Purchase Sale June 5 Water Filter at RM 300 each July 10 Water Filter at RM 320 each 3 Water filter at RM 550 each August 8 Water Filter at RM370 each 13 Water Filter at RM650 each September 12 Water filter at RM400 each 10 Water Filter at RM670 each Assume all purchases are made in the first half month and all sales are in the second half of the month At end of August Ilya decide to take one of the filter water and locate to her office. It is estimated the water filter will be used in ilva's business for 5 years and have a nil estimated residual value. Ilya wishes to use the straight-line basis for the depreciation, Additional Information 1.Overhead expenses paid during the four months ended 30 September 2019 amounted to RM 2,350 2. There were no amounts prepaid on 30 September 2019, but sales commission payable of 15% of gross profit on sales were accrued due on 30 September 2019. 3. Upon commencing business, Ilya resigned a business appointment with a salary of RM 20,000 4 Ilya can obtain interest of 7% per annum on her personal savings. 5. One of the water filter not sold on 30 September 2019 has been damage in the store room and is to be repair in October 2019 at cost of RM70 before being sold for and expected RM 500 Required: Prepare in as much detail as possible lla's comprehensive income statement for the ended 30 September 2019 using The first in first out of stock valuation and The last in last out of stock valuation