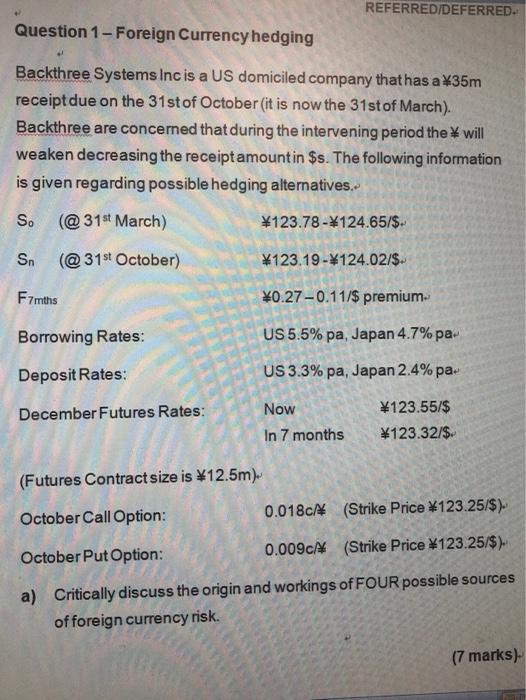

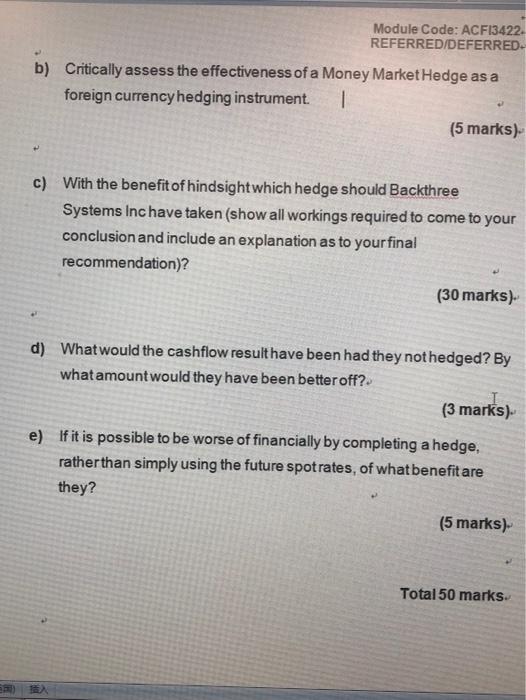

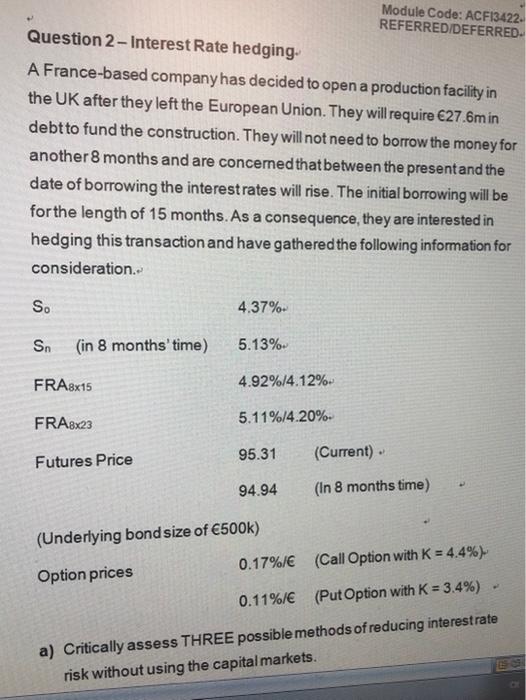

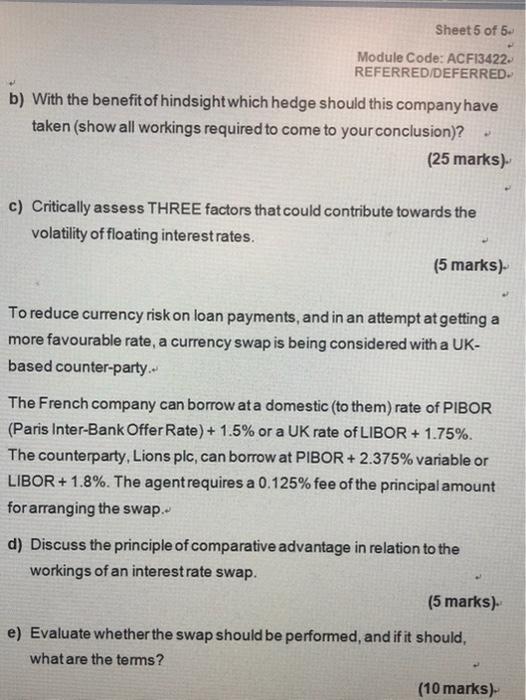

REFERRED/DEFERRED. Question 1 - Foreign Currency hedging Backthree Systems Inc is a US domiciled company that has a 35m receipt due on the 31st of October (it is now the 31st of March). Backthree are concerned that during the intervening period the will weaken decreasing the receipt amount in $s. The following information is given regarding possible hedging alternatives. S. (@31st March) 123.78 - 124.65/$. Sn (@31st October) 123.19-124.02/$. F7mths 0.27 -0.11/$ premium- Borrowing Rates: US 5.5% pa, Japan 4.7% pa Deposit Rates: US 3.3% pa, Japan 2.4% pa. December Futures Rates: Now In 7 months 123.55/$ 123.32/$. (Futures Contract size is $12.5m). October Call Option: 0.0184 (Strike Price $123.25/$). October Put Option: 0.009c/ (Strike Price $123.25/$). a) Critically discuss the origin and workings of FOUR possible sources of foreign currency risk. (7 marks) Module Code: ACF13422 REFERRED/DEFERRED b) Critically assess the effectiveness of a Money Market Hedge as a foreign currency hedging instrument. 1 (5 marks) c) With the benefit of hindsight which hedge should Backthree Systems Inc have taken (show all workings required to come to your conclusion and include an explanation as to your final recommendation)? (30 marks). d) What would the cashflow result have been had they not hedged? By what amount would they have been better off? (3 marks). e) If it is possible to be worse of financially by completing a hedge, rather than simply using the future spotrates, of what benefit are they? (5 marks) Total 50 marks Module Code: ACF13422. REFERRED/DEFERRED. Question 2 - Interest Rate hedging. A France-based company has decided to open a production facility in the UK after they left the European Union. They will require 27.6min debt to fund the construction. They will not need to borrow the money for another 8 months and are concerned that between the presentand the date of borrowing the interest rates will rise. The initial borrowing will be for the length of 15 months. As a consequence, they are interested in hedging this transaction and have gathered the following information for consideration. S. 4.37% Sn (in 8 months' time) 5.13%. FRA8x15 4.92%/4.12% FRA8x23 5.11%/4.20% 95.31 Futures Price (Current) - 94.94 (In 8 months time) (Underlying bond size of 500k) 0.17%/ (Call Option with K = 4.4%) Option prices 0.11%/ (PutOption with K = 3.4%) a) Critically assess THREE possible methods of reducing interest rate risk without using the capital markets. Sheet 5 of 5 Module Code: ACF13422. REFERRED/DEFERRED. b) With the benefit of hindsight which hedge should this company have taken (show all workings required to come to your conclusion)? (25 marks). c) Critically assess THREE factors that could contribute towards the volatility of floating interest rates. (5 marks) To reduce currency risk on loan payments, and in an attempt at getting a more favourable rate, a currency swap is being considered with a UK- based counter-party.. The French company can borrow ata domestic (to them) rate of PIBOR (Paris Inter-Bank Offer Rate) + 1.5% or a UK rate of LIBOR + 1.75%. The counterparty, Lions plc, can borrow at PIBOR +2.375% variable or LIBOR + 1.8%. The agent requires a 0.125% fee of the principal amount for arranging the swap. d) Discuss the principle of comparative advantage in relation to the workings of an interest rate swap. (5 marks). e) Evaluate whether the swap should be performed, and if it should, what are the terms? (10 marks)