Answered step by step

Verified Expert Solution

Question

1 Approved Answer

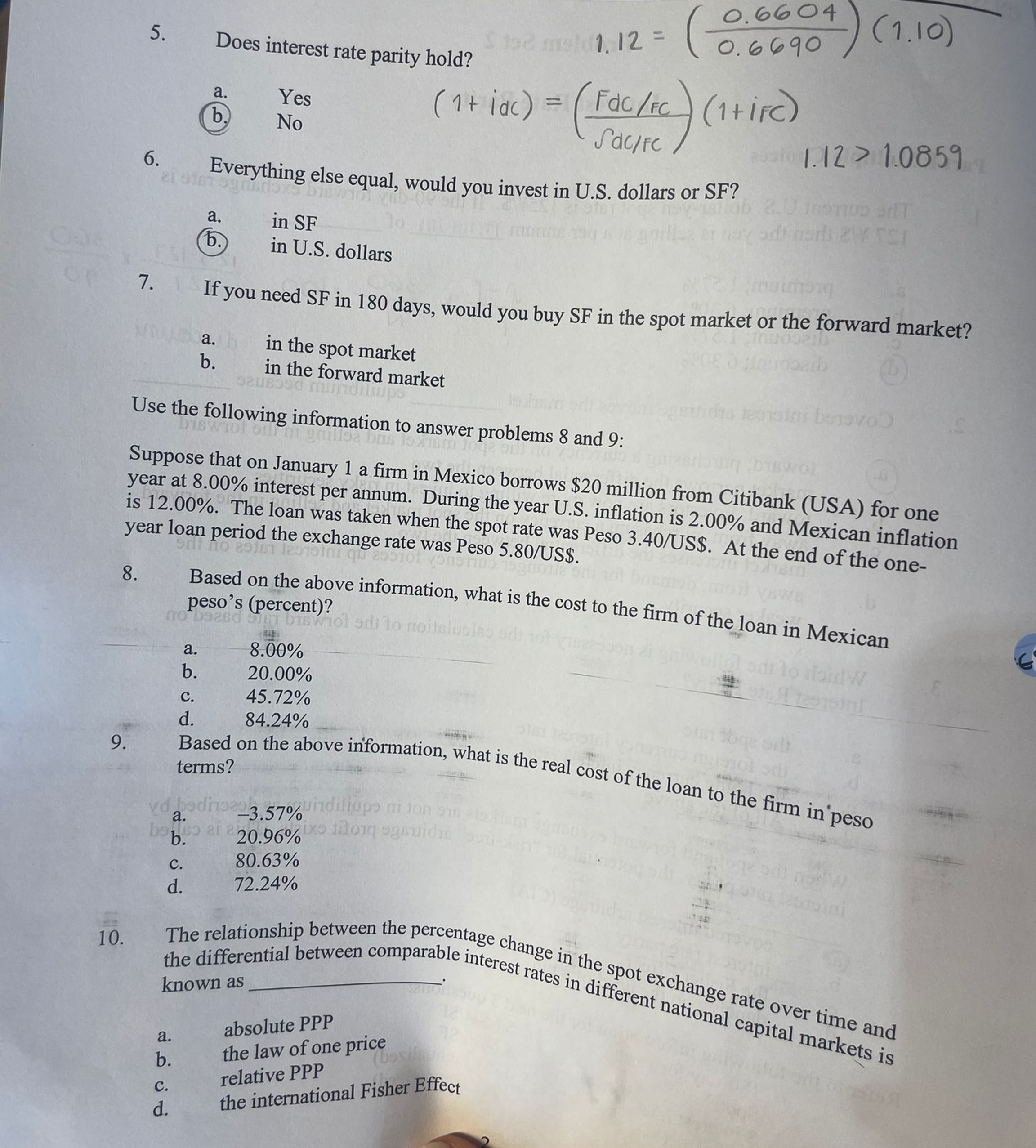

ReferRefer to the following information for the next 3 questions: 1 8 0 - day forward: Spot: $ interest rate: SF interest rate: $ .

ReferRefer to the following information for the next questions:

day forward:

Spot:

$ interest rate:

SF interest rate:

$

$SF

annualized

annualizedDoes interest rate parity hold?

a Yes

b No

idciFC

Everything else equal, would you invest in US dollars or SF

a in SF

b in US dollars

If you need SF in days, would you buy SF in the spot market or the forward market?

a in the spot market

b in the forward market

Use the following information to answer problems and :

Suppose that on January a firm in Mexico borrows $ million from Citibank USA for one

year at interest per annum. During the year US inflation is and Mexican inflation

is The loan was taken when the spot rate was Peso US$ At the end of the one

year loan period the exchange rate was Peso US$

Based on the above information, what is the cost to the firm of the loan in Mexican

peso's percent

a

b

c

d

Based on the above information, what is the real cost of the loan to the firm in'peso

terms?

a

a

b

c

d

The relationship between the percentage change in the spot exchange rate over time and

the differential between comparable intere

known as

a absolute PPP

b the law of one price

c relative PPP

d the international Fisher Effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started