Answered step by step

Verified Expert Solution

Question

1 Approved Answer

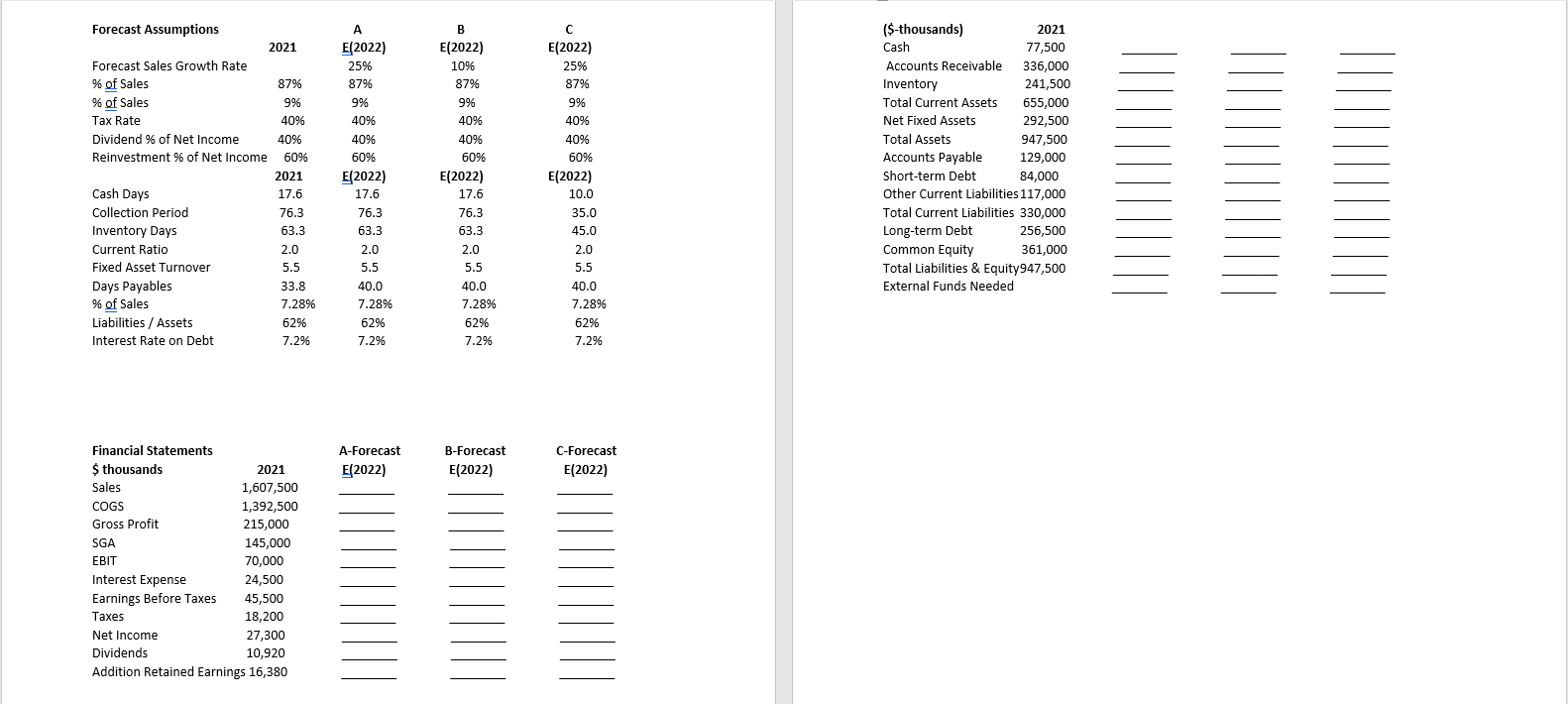

Referring to the forecast assumptions in the column labeled A, build the 2022 proforma financial statements and compute EFN in the column labeled there will

- Referring to the forecast assumptions in the column labeled A, build the 2022 proforma financial statements and compute EFN in the column labeled there will be no change in ST and LT debt.

- Repeat your forecast, but this time using the assumptions in column B, and building your profomas and compute EFN in the column B-Forecast. Assume no change in ST and LT debt.

- Repeat your forecast, but this time using the assumptions in column C, and building your profomas and compute EFN in the column C-Forecast. Assume no change in ST and LT debt.

- In your A-Forecast, you should have an EFN>0. Briefly describe what this means for the firm, and how the firm might resolve this with ST and LT debt.

- In your C-Forecast you should have an EFN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started