Answered step by step

Verified Expert Solution

Question

1 Approved Answer

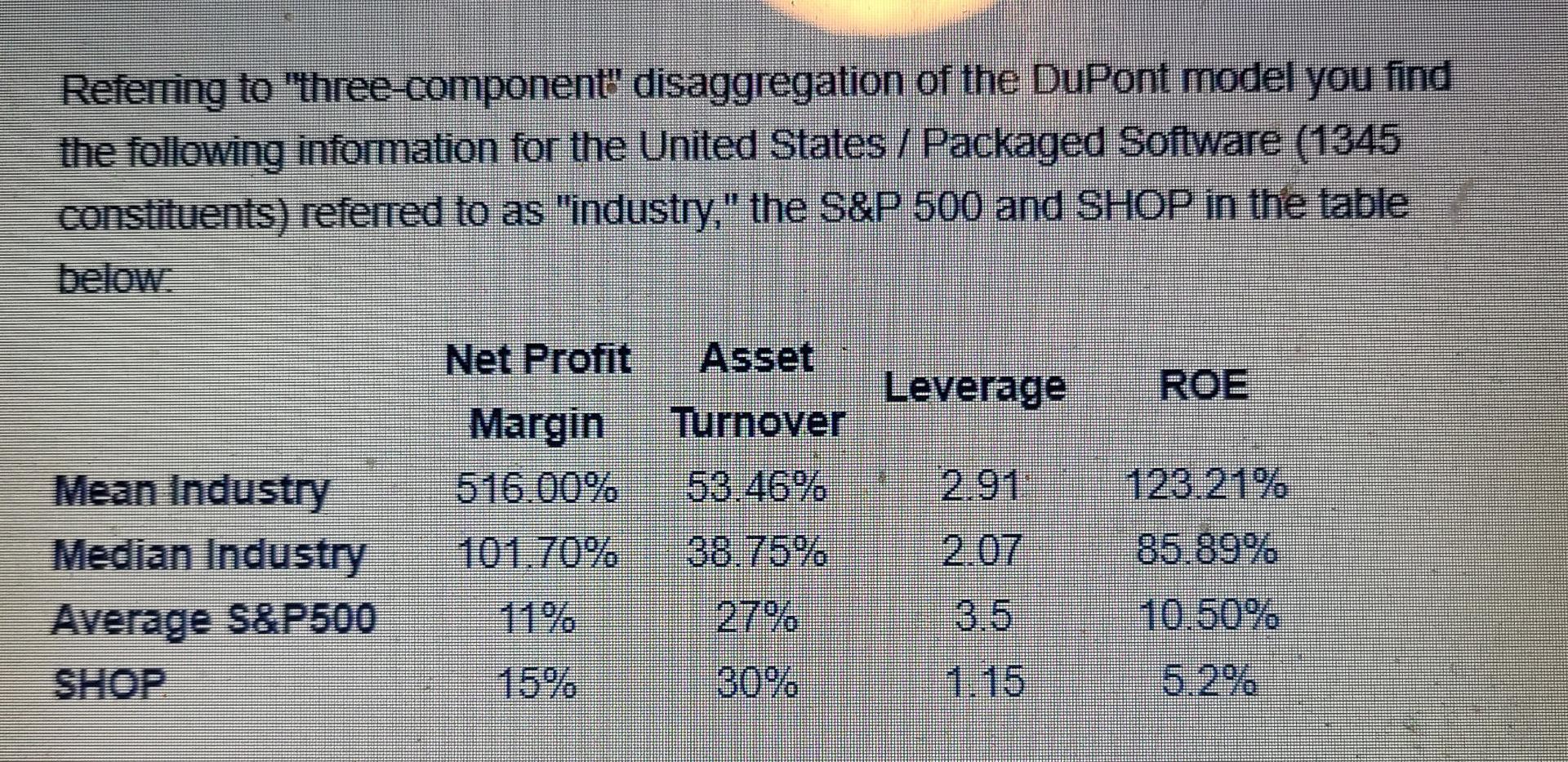

Referring to three-component disaggregation of the DuPont model you find the following information for the United States / Packaged Software (1345 constituents) referred to as

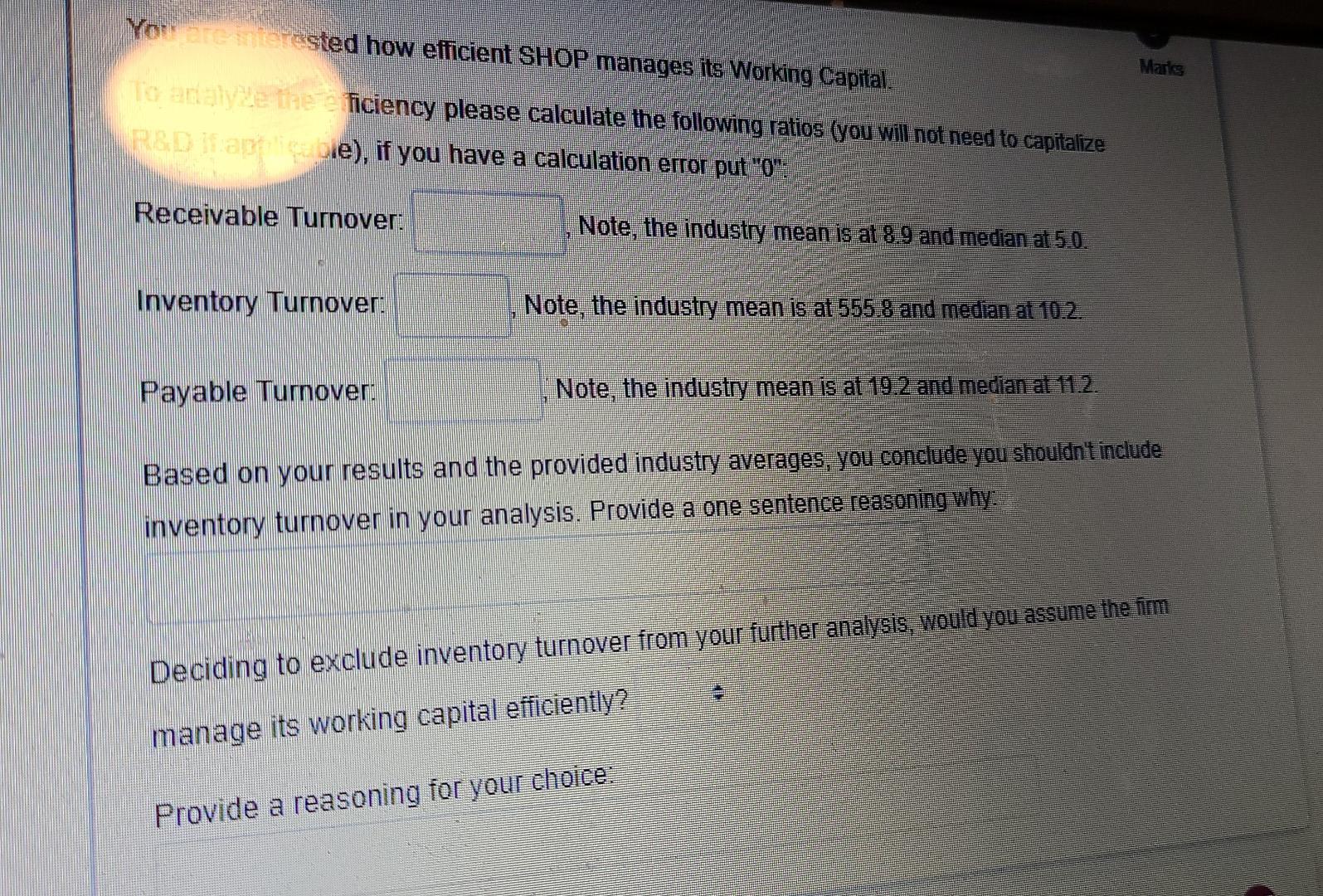

Referring to "three-component" disaggregation of the DuPont model you find the following information for the United States / Packaged Software (1345 constituents) referred to as "industry," the S&P 500 and SHOP in the table below Net Profit Asset Leverage ROE Turnover Margin 516.00 53 46% 2.91 123.21% 101.70% 38.75% 2.07 85,89% Mean Industry Median Industry Average S&P500 SHOP 10.50% 15% 30% 5.2% Youre sted how efficient SHOP manages its Working Capital. Marks To analyze the ficiency please calculate the following ratios (you will not need to capitalize R&D har i de), if you have a calculation error put "o": Receivable Turnover: Note, the industry mean is at 8.9 and median at 5.0. Inventory Turnover: Note, the industry mean is at 555.8 and median at 10.2. Payable Turnover: Note, the industry mean is at 19.2 and median at 11.2. Based on your results and the provided industry averages, you conclude you shouldn't include inventory turnover in your analysis. Provide a one sentence reasoning why: Deciding to exclude inventory turnover from your further analysis, would you assume the fim manage its working capital efficiently? Provide a reasoning for your choice Referring to "three-component" disaggregation of the DuPont model you find the following information for the United States / Packaged Software (1345 constituents) referred to as "industry," the S&P 500 and SHOP in the table below Net Profit Asset Leverage ROE Turnover Margin 516.00 53 46% 2.91 123.21% 101.70% 38.75% 2.07 85,89% Mean Industry Median Industry Average S&P500 SHOP 10.50% 15% 30% 5.2% Youre sted how efficient SHOP manages its Working Capital. Marks To analyze the ficiency please calculate the following ratios (you will not need to capitalize R&D har i de), if you have a calculation error put "o": Receivable Turnover: Note, the industry mean is at 8.9 and median at 5.0. Inventory Turnover: Note, the industry mean is at 555.8 and median at 10.2. Payable Turnover: Note, the industry mean is at 19.2 and median at 11.2. Based on your results and the provided industry averages, you conclude you shouldn't include inventory turnover in your analysis. Provide a one sentence reasoning why: Deciding to exclude inventory turnover from your further analysis, would you assume the fim manage its working capital efficiently? Provide a reasoning for your choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started