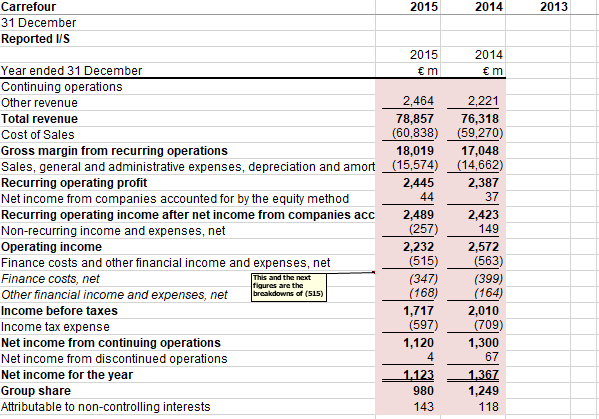

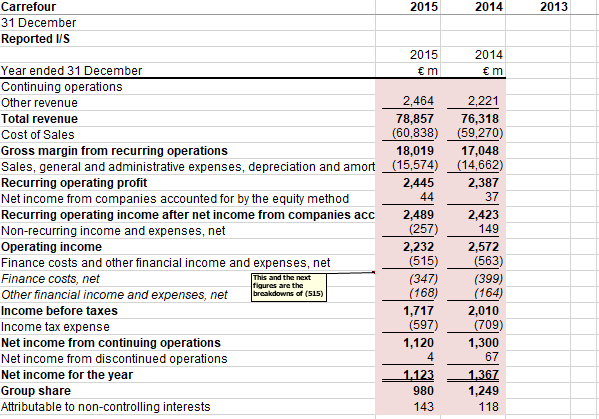

Reformulate Carrefours 2015 consolidated income statement (I/S),

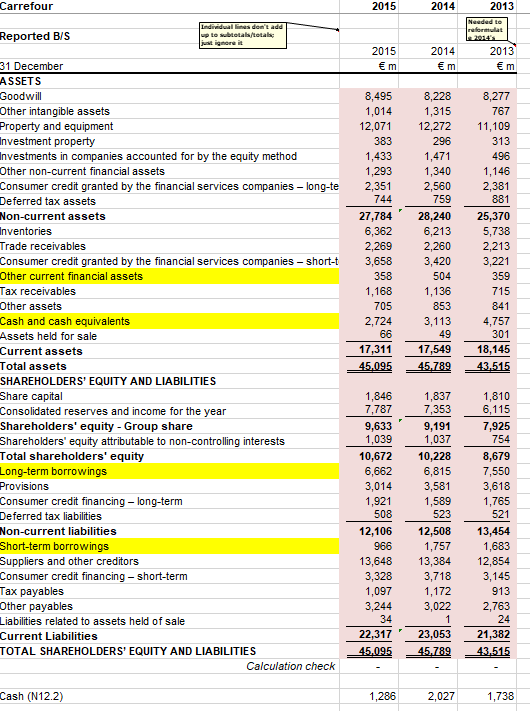

2014 and 2015 statements of financial positions (SFP; i.e., balance sheets),

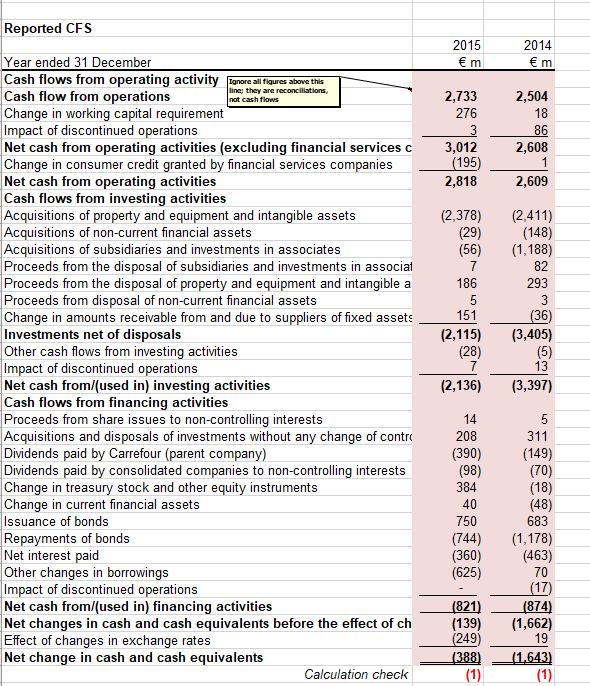

and 2015 statement of cash flows (SCF)

.

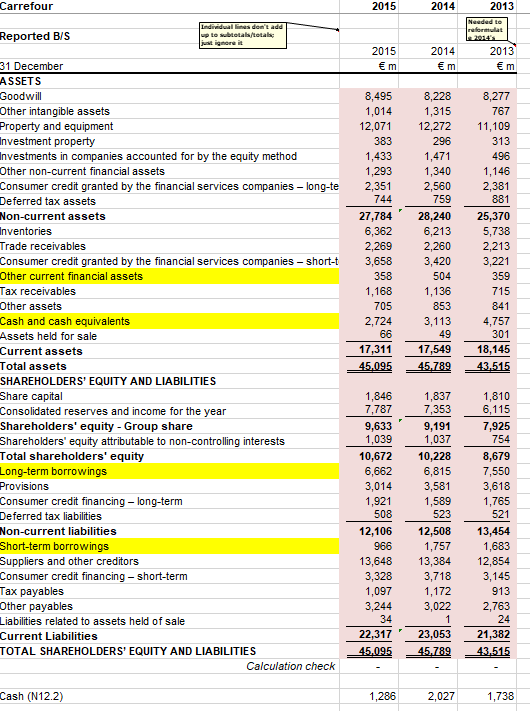

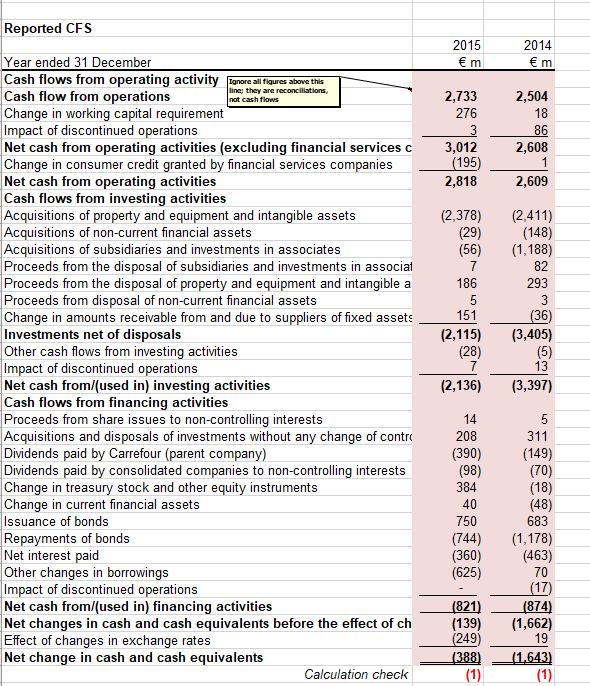

Carrefour 31 December Reported VS 2015 2014 2013 2015 2014 Year ended 31 December Continuing operations Other revenue Total revenue Cost of Sales Gross margin from recurring operations Sales, general and administrative expenses, depreciation and amort Recurring operating profit Net income from companies accounted for by the equity method Recurring operating income after net income from companies acc Non-recurring income and expenses, net Operating income Finance costs and other financial income and expenses, net Finance costs, nef Other financial income and expenses, net 0al downs of (515) Income before taxes Income tax expense Net income from continuing operations Net income from discontinued operations Net income for the year Group share Attributable to non-controlling interests 2,221 78,857 76,318 (60,838) (59,270) 18,019 17,048 (14,662) 2,445 2,387 37 2,423 149 2,232 2,572 (563) (399) 164) 1,717 2,010 597) (709) 1,120 1,300 67 2,464 (15,574) 2,489 (515) (347) are the 4 980 143 1,249 118 Carrefour 2015 2014 2013 Reported B/S 2015 31 December ASSETS Goodwill Other intangible assets Property and equipment Investment property Investments in companies accounted for by the equity method Other non-current financial assets Consumer credit granted by the financial services companies long-te 2,351 2,560 Deferred tax assets Non-current assets 8,495 8,228 8,277 1,315 12,071 12,272 11,109 1,471 496 1,293 2,381 881 27,784 28,240 25,370 5,738 2,269 2,260 2,213 3,420 3,221 744 6,362 Trade receivables Consumer credit granted by the financial services companies - short-t Other current financial assets Tax receivables Other assets Cash and cash equivalents Assets held for sale Current assets otal assets SHAREHOLDERS' EQUITY AND LIABILITIES Share capital Consolidated reserves and income for the yean Shareholders' equity Group share Shareholders' equity attributable to non-controlling interests Total shareholders' equity Long-term borrowings Provisions Consumer credit financing long-term Deferred tax liabilities Non-current liabilities Short-term borrowings Suppliers and other creditors Consumer credit financing short-term Tax payables Other payables Liabilities related to assets held of sale Current Liabilities OTAL SHAREHOLDERS' EQUITY AND LIABILITIES 3,658 2,724 3,113 4,757 17,311 17,549 18,14 1,846 7,787 9,633 1,039 1,837 7,353 9,191 1,037 7,925 10,672 10,228 8,67 7,550 9 6,662 5 1,921 521 12,106 12,508 13,454 1,757 13,648 13,384 12,854 3,328 3,718 3,145 1 1,097 3,244 3,022 2,763 22,317 23,05321,382 Calculation check Cash (N12.2) 1,286 2,027 1,738