Answered step by step

Verified Expert Solution

Question

1 Approved Answer

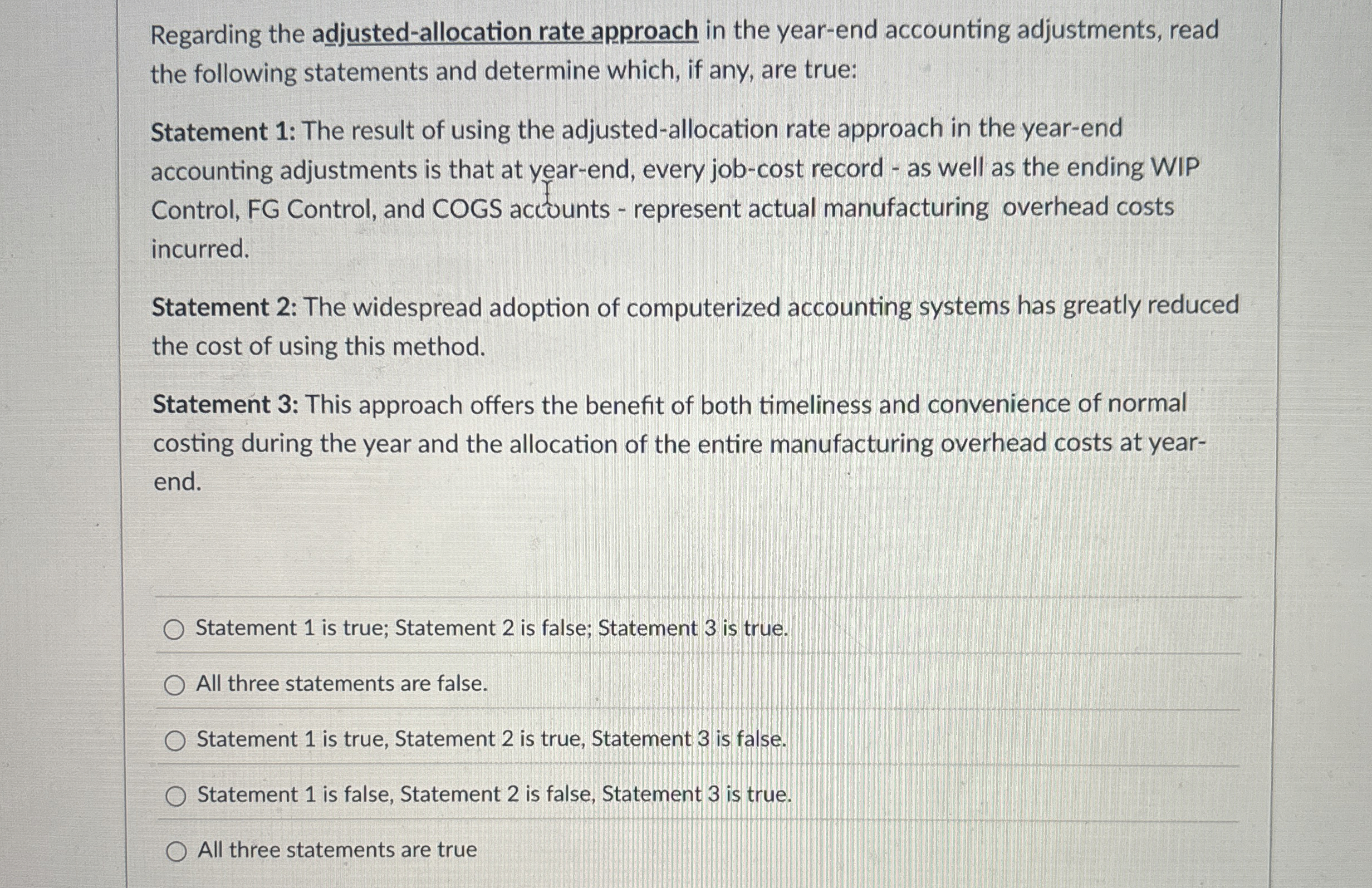

Regarding the adjusted - allocation rate approach in the year - end accounting adjustments, read the following statements and determine which, if any, are true:

Regarding the adjustedallocation rate approach in the yearend accounting adjustments, read the following statements and determine which, if any, are true:

Statement : The result of using the adjustedallocation rate approach in the yearend accounting adjustments is that at yearend, every jobcost record as well as the ending WIP Control, FG Control, and COGS accounts represent actual manufacturing overhead costs incurred.

Statement : The widespread adoption of computerized accounting systems has greatly reduced the cost of using this method.

Statement : This approach offers the benefit of both timeliness and convenience of normal costing during the year and the allocation of the entire manufacturing overhead costs at yearend.

Statement is true; Statement is false; Statement is true.

All three statements are false.

Statement is true, Statement is true, Statement is false.

Statement is false, Statement is false, Statement is true.

All three statements are true

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started