Question

Regarding the United States' current Economic outlook, there are currently two main sources of uncertainty: (1) the Federal Reserve (FED) Interest rate increases and (2)

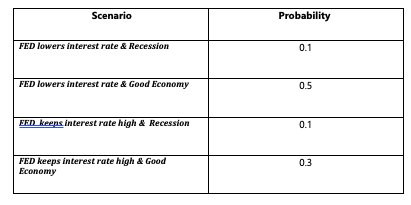

Regarding the United States' current Economic outlook, there are currently two main sources of uncertainty: (1) the Federal Reserve (FED) Interest rate increases and (2) the looming possibility of a recession. Assume that you are making decisions regarding business investment in this environment. Based on information in the news/government reports, we have the following probability of each of the four possible scenarios.

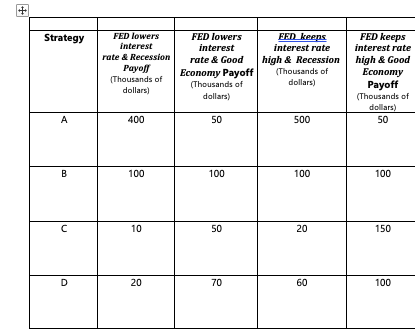

You are considering four possible investment strategies, and the payoff of the investment depends on how well the economy is doing. Some investments are more sensitive to economic conditions (e.g., recessions) than others. The following table shows the payoffs of the four investments:

Assume you only care about the expected payoff and possibly the variance of each strategy. [Make sure to include the tables and the calculations below in your document

- Using a spreadsheet, determine the expected value and variance for each strategy.

- Which strategy would be chosen if you were a risk-neutral investor? What about if you were a risk-preferring investor?

- Can we rule out any strategies if we know only that you are a risk-averse investor?

- Now assume that your utility is U(X) = 10X0.5. Which strategy will you choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started